Service Tax Abatement Rate wef 01.04.2015

advertisement

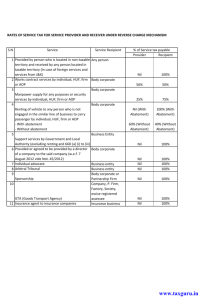

Service Tax Abatement Rate wef 01.04.2015 Abatement Rate Chart under Service Tax updated 01.04.2015 Sr No. 1 1 Abatemen t 3 90 Taxable Conditions 4 10 5 Nil. 70 70 30 30 Nil. Nil. 30 70 (i) CENVAT credit on any goods classifiable under Chapters 1 to 22 of the Central Excise Tariff Act, 1985 (5 of 1986) used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. Transport of passengers by air, with or without accompanied belongings (Only for Economy class wef 01.04.2015) Other than Economy Class (means business class /First class) wef 01.04.2015) 60 40 40 60 CENVAT credit on inputs and capital goods, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. 6 Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes. 40 60 Same as above. 7 Services of goods transport agency in relation to transportation of goods. wef 01.04.2015 75 25 70 30 Services provided in relation to chit wef 01.04.2015 Renting of any motor vehicle designed to carry passengers Transport of goods in a vessel wef 01.04.2015 30 0 60 70 100 40 CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. Same as above. Same as above. Same as above. 60 70 40 30 Same as above. Same as above. 2 3 4 5 8 9 10 Description of taxable service 2 Services in relation to financial leasing including hire purchase Transport of goods by rail Transport of passengers, with or without accompanied belongings by rail Bundled service by way of supply of food or any other article of human consumption or any drink, in a premises ( including hotel, convention center, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises Abatement Rate Chart under Service Tax updated 01.04.2015 BY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 Sr No. 11 Abatement Taxable Conditions Services by a tour operator in relation to,- (i) a package tour 75 25 (i) CENVAT :Same as above (ii) The bill issued for this purpose indicates that it is inclusive of charges for such a tour. (ii) a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour 90 10 (i) CENVAT :Same as above (ii) The invoice, bill or challan issued indicates that it is towards the charges for such accommodation. Description of taxable service (iii) This exemption shall not apply in such cases where the invoice, bill or challan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation. (iii) any services other specified at (i) and (ii) above. 12 than 60 40 Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly except where entire consideration is received after issuance of completion certificate by the competent authority a. Residential properties having a carpet area above 2000 sq ft and where amount charged is equal to or more than Rs. 1 crore, b. Commercial properties.wef 01.03.13 75 25 70 30 Brief description of amendment in Budget-2015 BY : www.simpletaxindia.net (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii)The bill issued indicates that the amount charged in the bill is the gross amount charged for such a tour. (i) CENVAT credit on inputs used for providing the taxable service has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii)The value of land is included in the amount charged from the service receiver. (Notification No. 02/2013-ST dated 1st March, 2013 applicable wef 01.03.13 Service Tax Abatement Rate wef 01.04.2015 Uniform Abatement for transport by rail, road and vessel: A uniform abatement of 70% has been prescribed for transport by rail, road and vessel to bring parity in these sectors. Service tax shall be payable on 30% of the value of such service subject to a uniform condition of non-availment of Cenvat credit on Inputs, Capital goods and Input services. Presently, Service tax is payable on 30% (in case of rail transport)/ 25% (in case of road transport)/ 40% (in case of transport by vessels). Further, there is no condition for availment of Cenvat credit on Inputs, Capital goods and Input services in case of transport by rail, which is now withdrawn. · Reduction in abatement for classes other than economy class: The abatement for classes other than economy class (i.e. business/ first class) has been reduced from 60% to 40%. Accordingly, Service tax would be payable on 60% of the value of such higher classes. At present, Service tax is payable on 40% of the value of transport of passenger by air for economy as well as higher classes (i.e. business/ first class). · Abatement in relation to Chit fund withdrawn: Abatement for the services provided in relation to Chit fund stands withdrawn. Consequently, Service tax shall be paid by on full consideration received by the foremen of Chit fund. BY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 [TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)] Government of India Ministry of Finance (Department of Revenue) Notification No. 26/2012- Service Tax New Delhi, the 20th June, 2012 G.S.R….. (E). - In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994) (hereinafter referred to as the said Act), and in supersession of notification number 13/2012- Service Tax, dated the 17 th March, 2012, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 211 (E), dated the 17 th March, 2012, the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service of the description specified in column (2) of the Table below, from so much of the service tax leviable thereon under section 66B of the said Act, as is in excess of the service tax calculated on a value which is equivalent to a percentage specified in the corresponding entry in column (3) of the said Table, of the amount charged by such service provider for providing the said taxable service, unless specified otherwise, subject to the relevant conditions specified in the corresponding entry in column (4) of the said Table, namely;Table Sl. Description of taxable PercentConditions No. service age (1) (2) (3) (4) 1 Services in relation to financial 10 Nil. leasing including hire purchase 2 Transport of goods by rail 30 Nil. 3 Transport of passengers, with or 30 Nil. without accompanied belongings by rail 4 Bundled service by way of 70 (i) CENVAT credit on any goods supply of food or any other classifiable under Chapters 1 to 22 of the article of human consumption or Central Excise Tariff Act, 1985 (5 of 1986) any drink, in a premises used for providing the taxable service, has ( including hotel, convention not been taken under the provisions of the center, club, pandal, shamianaor CENVAT Credit Rules, 2004. any other place, specially arranged for organizing a function) together with renting of such premises 5 Transport of passengers by air, 40 CENVAT credit on inputs and capital goods, with or without accompanied used for providing the taxable service, has belongings not been taken under the provisions of the CENVAT Credit Rules, 2004. 6 Renting of hotels, inns, guest 60 Same as above. houses, clubs, campsites or other commercial places meant for BY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 7 residential or lodging purposes. Services of goods transport agency in relation to transportation of goods. 8 Services provided in relation to chit 9 Renting of any motor vehicle designed to carry passengers 10 Transport of goods in a vessel 11 Services by a tour operator in 25 CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. 70 Same as above. 40 Same as above. 50 25 Same as above. (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The bill issued for this purpose indicates that it is inclusive of charges for such a tour. 10 (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. relation to,(i) a package tour (ii) a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour (ii) The invoice, bill or challan issued indicates that it is towards the charges for such accommodation. (iii) any services other than specified at (i) and (ii) above. BY : www.simpletaxindia.net 40 (iii) This exemption shall not apply in such cases where the invoice, bill orchallan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation. (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii)The bill issued indicates that the amount charged in the bill is the gross amount charged for such a tour. Service Tax Abatement Rate wef 01.04.2015 12. Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly except where entire consideration is received after issuance of completion certificate by the competent authority 25 (i) CENVAT credit on inputs used for providing the taxable service has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii)The value of land is included in the amount charged from the service receiver. Explanation. – A. For the purposes of exemption at Serial number 1 (i) The amount charged shall be an amount, forming or representing as interest, i.e. the difference between the installments paid towards repayment of the lease amount and the principal amount contained in such installments; (ii) the exemption shall not apply to an amount, other than an amount forming or representing as interest, charged by the service provider such as lease management fee, processing fee, documentation charges and administrative fee, which shall be added to the amount calculated in terms of (i) above. B. For the purposes of exemption at Serial number 4 The amount charged shall be the sum total of the gross amount charged and the fair market value of all goods and services supplied in or in relation to the supply of food or any other article of human consumption or any drink (whether or not intoxicating) and whether or not supplied under the same contract or any other contract, after deducting(i) the amount charged for such goods or services supplied to the service provider, if any; and (ii) the value added tax or sales tax, if any, levied thereon: Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted accounting principles. C. For the purposes of exemption at Serial number 12 – The amount charged shall be the sum total of the amount charged for the service including the fair market value of all goods and services supplied by the recipient(s) in or in relation to the service, whether or not supplied under the same contract or any other contract, after deductingBY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 (i) the amount charged for such goods or services supplied to the service provider, if any; and (ii) the value added tax or sales tax, if any, levied thereon: Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted accounting principles. 2. For the purposes of this notification, unless the context otherwise requires,a. “chit” means a transaction whether called chit, chit fund, chitty, kuri, or by whatever name by or under which a person enters into an agreement with a specified number of persons that every one of them shall subscribe a certain sum of money (or a certain quantity of grain instead) by way of periodical installments over a definite period and that each subscriber shall, in his turn, as determined by lot or by auction or by tender or in such other manner as may be specified in the chit agreement, be entitled to a prize amount, b. "package tour" means a tour wherein transportation, accommodation for stay, food, tourist guide, entry to monuments and other similar services in relation to tour are provided by the tour operator as part of the package tour to the person undertaking the tour, c. “tour operator” means any person engaged in the business of planning, scheduling, organizing, arranging tours (which may include arrangements for accommodation, sightseeing or other similar services) by any mode of transport, and includes any person engaged in the business of operating tours, 3. This notification shall come into force on the 1st day of July, 2012. [F.No. 334 /1/ 2012-TRU] (Rajkumar Digvijay) Under Secretary to the Government of India [TO BE PUBLISHED IN THE GAZETTE OF INDIA, (EXTRAORDINARY), PART II, SECTION 3, SUBSECTION (i)] BY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 Government of India Ministry of Finance (Department of Revenue) Notification New Delhi, the 1st March, 2013 No.2 /2013 - Service Tax G.S.R....(E)In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following amendment in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.26/2012-Service Tax, dated the 20th June, 2012, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 468 (E), dated the 20th June, 2012, namely:In the said notification, in the TABLE, for serial number 12 and the entries relating thereto, the following serial number and the entries shall be substituted, namely:- 12 Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly except where entire consideration is received after issuance of completion certificate by the competent authority (i)for residential unit having carpet area upto 2000 square feet or where the amount charged is less than rupees one crore; (ii) for other than the (i) above. (i) CENVAT credit on inputs used for providing the taxable service has not been taken under the provisions of the CENVAT Credit Rules, 2004. 25 (ii)The value of land is included in the amount charged from the service receiver. 30% 3. The notification shall come in to force on the 1st day of March, 2013. [F.No. 334 /3/ 2013-TRU] (Raj Kumar Digvijay) Under Secretary to the Government of India Note.- The principal notification was published in the Gazette of India, Extraordinary, vide notification No. 26/2012 - Service Tax, dated 20th June, 2012, vide number G.S.R. 468 (E), dated the 20th June, 2012 and this notification has not been amended so far. Changes in Service Tax in Budget 2015 & Its Impact BY : www.simpletaxindia.net Service Tax Abatement Rate wef 01.04.2015 1. Effective From March 1, 2015 2. Effective From April 1, 2015 3. From Date To Be Notified After The Enactment Of Finance Bill, 2015 Articles Impact of Changes in Service tax liability structure from Partial Reverse Charge to Full Reverse Charge on Manpower supply and Security services in transition period Hike in Rate of Service tax – Open Issues Taxability of newly made ‘Taxable Services’ Changes in Cenvat Credit in Budget 2015 Discussion Forum – Articles 1. Increase in time limit for availing Cenvat credit on Input services and Inputs – Whether applicable on invoices issued prior to March 1, 2015? 2. Interest on Wrong availment of Cenvat Credit but not utilised – a tale of never ending litigation and interpretational issues 3. Aftermath of non-excisable goods being equated to exempted goods/ final products for the purpose of Rule 6 of the Cenvat Credit Rules, 2004 4. Doubtful fate of refund on Deemed exports List of Service Covered Under Reverse Charge updated 01.04.2015 TDS-TCS Rates Chart Fy 2015-16 with due date Charts BY : www.simpletaxindia.net [TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)] GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT OF REVENUE) New Delhi, the 1st March, 2015 NOTIFICATION No. 8/2015-Service Tax, G.S.R. ---(E).- In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.26/2012Service Tax, dated the 20th June, 2012, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 468 (E), dated the 20th June, 2012, namely:1. In the said notification, in the Table,(i) against Sl. No. 2, in column (4), for the entry, the following entry shall be substituted, namely:"CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004."; (ii) against Sl. No. 3, in column (4), for the entry “ Nil”, the entry “Same as above” shall be substituted; (iii) for Sl. No. 5 and the entries relating thereto, the following serial number and entries shall be substituted, namely:(1) (2) (3) “5 Transport of passengers by air, with or without accompanied belongings in (i) economy class 40 (ii) other than economy class 60 (4) CENVAT credit on inputs and capital goods, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004.”; (iv) against Sl. No. 7, in column (3), for the entry “25”, the entry “30” shall be substituted; (v) Sl. No. 8 and entries relating thereto shall be omitted; (vi) against Sl. No. 10, in column (3), for the entry “40”, the entry “30” shall be substituted. 2. This notification shall come into force on the 1st day of April, 2015. [F.No. 334/5/2015 - TRU] (Akshay Joshi) Under Secretary to the Government of India Note:-The principal notification No. 26/2012 - Service Tax, dated 20th June, 2012, was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-Section (i) vide number G.S.R. 468 (E), dated the 20th June, 2012 and was last amended by notification No.08/2014Service Tax, dated the 11th July, 2014 vide G.S.R. 477 (E), dated the 11th July, 2014.