Cost of Doing Business in India - Chartered Accountant New Delhi

advertisement

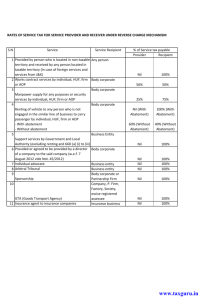

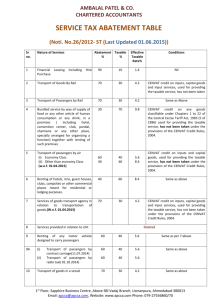

OVERVIEW OF COMPOSITION, SERVICE TAX & ABATEMENT E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com A. VALUATION OF SERVICE 1. VALUE OF SERVICE FOR PAYMENT OF SERVICE TAX a. Gross amount charged by service provider for service provided or to be provided – section 67. b. Value of taxable service + service tax = Gross amount charged. c. If service tax not charged separately, the gross amount charged should be taken as inclusive of service tax and then back calculations should be made to arrive at value of service and service tax payable thereon. d. Amount may be received before, during or after provision of service. e. Any specific service not defined w.e.f. 1-7-2012. Hence, scope of service can be determined by mutual agreement between service provider and service receiver. 2. NO TAX ON VALUE OF GOODS a. Price of goods cannot be included in value of services – Bharat Sanchar Nigam Ltd. v. UOI (2006) 3 SCC 1 = 152 Taxman 135 = 3 STT 245 (SC 3 member bench). b. In Imagic Creative Pvt. Ltd v. CCT (2008) 2 SCC 614 = 12 STT 392 (SC), it has been held that service tax and Vat (sales tax) are mutually exclusive. In case of a composite contract, Vat cannot be imposed on portion relating to value of service. As an obvious corollary, service tax cannot be imposed on value of material. c. Section 67 – Service tax only on ‘gross amount charged by service provider for such taxable services provided or to be provided’. d. Section 66B – service tax on value of service (i.e. not on value of goods) 3. ISSUES RELATING TO SOME SERVICES a. Spare parts used while repairs –not taxable if billed separately – It is not works contract service. b. The reason is that the definition of ‘deemed sale’ in Article 366(29A) does not say that the definition is only for purpose of sales tax. Thus, that definition will be applicable to all contracts executed in India after 1983. c. Photography paper or Xerox paper – my view – It is ‘works contract service’ as per definition revised w.e.f. 1-7-2012 d. Cleaning material used while providing cleaning services – in my view – includible as it gets consumed and its property is not transferred to the customer (service receiver). E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com 4. CONSIDERATION OTHER THAN MONEY a. Consideration for service – partly money partly other than money – then value of such consideration to be added. b. Valuation will be on basis of ‘amount equivalent to consideration’ as provided in section 67(1)(ii) [faulty drafting]. 5. FUEL SUPPLIED TO SERVICE PROVIDER a. Fuel supplied to service provider (e.g. for construction equipment, rented vehicle) b. In my view if scope of service specifically excludes such supply, its value is not includible c. The reason is that w.e.f. 1-7-2012, any specific service has not been defined – thus, scope of service can be decided by mutual agreement 6. Valuation Rules a. b. c. d. Valuation Rules apply subject to section 67 Gross amount charged for similar services [rule 3(a)] Equivalent money value of consideration which shall not be less than cost [rule 3(b)] Distinction between cost and value 7. Charges which are not part of value of service a. Some expense incurred by service provider for administrative convenience and then recovered from service receiver. b. Reimbursements of expenses incurred by service receiver which are not part of value of service are not includible. c. This is the basic concept of ‘pure agent’ contained in Service Tax Valuation Rules. 8. Gross Amount charged for service a. Service tax is not payable on any other amount charged and/or recovered from service receiver if it is not part of value of taxable service b. Examples – Advertisement Agent collecting advertisement charges plus his commission, Air Travel Agent collecting air fare plus his commission, Customs House Agent paying for various expenses incurred by him at Port on behalf of customer and then recovering the same plus his charges c. In aforesaid cases, the advertisement charges, air ticket charges or expenses incurred by CHA in port are not part of value of service and hence not includible in value for service tax. E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com 9. Cost and Expenditure relating to service is includible a. Travelling Expenses, hotel expenses incurred by CA, Maintenance Engineer or Management Consultant in the course of providing his service b. Out of pocket expenses incurred while providing taxable service – these are includible as service cannot be provided without incurring these expenses. c. Now the issue arguable under new provisions w.e.f. 1-7-2012, as any specific service is not defined – thus it can be argued that scope of service can be fixed by mutual agreement. 10. Pure Agent a. Various charges recovered by service provider from service receiver and paid to concerned third party are not includible in value if these expenses which is not part of service. b. Liability of service receiver, but expenses incurred by service provider for administrative convenience and recovered from customer. c. These are not part of value of taxable service and not includible (even if all requirements of pure agent not satisfied). 11. Requirement of pure agent a. b. c. d. Payment to third party on behalf of service provider under authority Amount to be separately indicated in Invoice Only actual amount should be recovered Title in goods and services not held by pure agent 12. Illustrations of pure agent a. Octroi/Entry tax paid by Agent b. Customs duty, transport, warehousing charges paid by Custom House Agent (CHA). c. Parking fees, toll naka charges by person renting motor vehicle for transport of passengers (rent-a-cab operator). d. Air fare/rail fare paid by Agent e. Distinction between ‘bundled service’ and service as ‘pure agent’ – Bundled service means all expenses incurred or sub-services provided are part of main service, while in case of ‘pure agent’, the expenses incurred are not part of the service. E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com 13. Illustration when payment not as Pure Agent a. Rent, telephones, transport expenses incurred by C&F Agent\ b. Travelling expenses of Auditor, Consulting Engineer, Maintenance Engineer, Management Consultant (now issue arguable) c. Charges of salary of labour by Labour Contractor (though in my view, issue is debatable since the service of labour contractor is only to bring labour to the Principal Employer). 14. Service provider padding the amounts to be recovered from customer a. As per the definition of ‘pure agent’, the amount recovered from customer is not includible if it is recovered on actual basis. b. In many cases (e.g. CHA, goods transport, freight forwarder etc.), the expenses are padded and higher amounts are charged in the Bill. c. In Bax Global India v. CST (2008) 13 STT 263 (CESTAT), it was held that if the service provider earns profit on these activities, it is not includible in value of his services – relying on Baroda Electric Meters Ltd. v. CCE 1997 (94) ELT 13 (SC 3 member). d. However, surely the issue is litigation prone. 15. Other provisions in service tax valuation a. b. c. d. e. f. Service tax is payable on net amount excluding Vat, if payable on that transaction. Vat payable on service tax amount if State Law definition covers such amount. Service tax is payable on gross amount including TDS. No service tax on (really) free services Service tax, excise duty and customs duty are independent duties. Rate of customs duty is relevant for valuation in case of export and import of services. In such cases, rate of exchange as notified in Customs Notification is relevant and not RBI reference rate of rates notified by FEDAI or rate at which the amount is credited or debited by the Bank to account of service provider/service receiver. 16. Composition Schemes a. In some cases, finding of value of service is not easy e.g. sale or purchase of foreign exchange, air travel agent – in such cases, optional composition schemes provide b. In case of composite contracts, e.g. construction, finding value of service is difficult. In such cases, optional composition schemes are available 17. Abatement schemes a. In case of some services, abatement is available i.e. part of tax is exempted – e.g. 40% in case of air travel, 25% in case of GTA service b. Restrictions on Cenvat Credit E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com B. ABATEMENTS AND COMPOSITION UNDER SERVICE TAX 1. Composition Schemes a. In some cases, finding of value of service is not easy e.g. sale or purchase of foreign exchange, air travel agent – in such cases, optional composition schemes provided. b. In case of composite contracts, e.g. construction, finding value of service is difficult. In such cases, optional composition schemes are available. c. Each contract is a different contract and can be valued on different basis. 1.A Services Under Composition Schemes i. Air Travel Agent – 0.6% (domestic travel) – 1.2% (international booking) of basic fare – Rates specified in Rule 6(7) ii. Sale and Purchase of Foreign Currency – Rates specified in Rule 6(7B) iii. Life Insurance Service – Rates specified in rule 6(7A) iv. Lottery Ticket Promotion – Rates specified in Rule 6(7C) 1.B Composition Scheme (Continued) i. Restaurant service – On 40% amount excluding Vat ii. Works Contract Service – On 40%/60%/70% value – Rules 2A of Valuation Rules iii. 25% Abatement Scheme if gross amount includes value of land E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com B. ABATEMENTS AND COMPOSITION UNDER SERVICE TAX 2. Abatement schemes a. Notification No. 26/2012-ST dated 20-6-2012 provides for abatement. b. In case of some services, abatement is available i.e. part of tax is exempted – e.g. 40% in case of air travel, 25% in case of GTA service, 40% in case of renting or hire of motor vehicle to carry passengers. c. Restrictions on Cenvat Credit d. In some cases, abatement scheme is used as composition scheme 2.A 2.B 2.C Abatements i. Mandap, Shamiana or convention along with food – 70% of amount ii. Chit Related Services – 70% – No Cenvat iii. Financial leasing and hire purchase – Management fee, processing fees plus 10% of interest iv. Renting of motor vehicle – 40% – No Cenvat [reverse charge in some cases] v. Renting of hotels, guest houses, clubs – 60% vi. Tour Operator – Package Tour – 25%, mere booking of hotel (including room rent charges) – 10%, Other cases – 40% vii. Rail Transport of goods and AC/First class passengers – 10% w.e.f. 1-102012 [if not further extended] viii. GTA – 25% – No Cenvat ix. Passenger transport by air – 40% – Cenvat of only input services allowable Valuation under rule 6 Some abatements and compositions are subject to condition of nonavailment of Cenvat ii. In such cases, if Cenvat credit is taken, valuation for purpose of rule 6 of Cenvat Credit Rules (for payment of 6% ‘amount’ or reversal of Cenvat) as per provisions in those Rules i. Abatement and Exemption Schemes at a glance E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com 2.C Abatement and Exemption Schemes at a glance TAXABLE SERVICES Accommodation booking service by tour operator PARTIAL ABATEMENT/ COMPOSITION SCHEMES CONDITIONS 10% of amount charged (Abatement Scheme, though really it is composition scheme) No Cenvat Credit. Invoice should be inclusive of cost of accommodation RELEVANT NOTIFICATION / RULE Sr. No. 11(ii) of Notification No. 26/2012ST dated 20-6-2012. Air Travel Agent Option to pay service tax at flat rate on ‘basic fare’ @ 0.6% in case of domestic booking and 1.2% in case of international booking – plus education cess (Composition Scheme) No restriction on availment of Cenvat credit Rule 6(7) of Service Tax Rules Bundled service by way of supply of food or any other article of human consumption or any drink, in a premises ( including hotel, convention center, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises Tax on 70% of amount charged including fair value of goods and services supplied by service receiver (to service provider) under same or different contract (Composition Scheme) Cenvat credit of input services and capital goods is available. Cenvat credit on food items (covered under Chapters 1 to 22 of CETA) not available. Cenvat credit of other inputs is available. Sr. No. 4 of Notification No. 26/2012-ST dated 206-2012 Chit related services Tax on 70% of amount charged (Abatement Scheme) No Cenvat Credit allowed Sr. No. 8 of Notification No. 26/2012-ST dated 206-2012. Financial leasing and hire purchase Tax on lease management fee, processing fee, documentation charges and administrative fee plus 10% of interest No restriction on availment of Cenvat Credit Sr. No. 1 of Notification No. 26/2012-ST dated 206-2012 E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly, if value of land is included in the amount charged from the service receiver Tax on 25% of amount charged including fair market value of all goods and services supplied by recipient (termed as Abatement Scheme – actually it is composition scheme) Cenvat credit of input services and capital goods can be taken but not of input goods Sr No. 12 of Notification No. 26/2012-ST dated 206-2012 Foreign Currency – sale and purchase At slab rates prescribed under rule 6(7B)on total gross amount of currency exchanged (Optional Composition Scheme) No restriction on availment of Cenvat Credit Rule 6(7B) of Service Tax Rules Foreign Currency – sale and purchase Value is difference between buying or selling rate and RBI reference rate (Normal Scheme of valuation) No restriction on availment of Cenvat Credit Rule 2B of Service Tax (Determination of Value) Rules Life Insurance 3% of net premium (excluding investment or savings part, if such amount is informed to policy holder) – If not so informed, 3% in first year and 1.5% in subsequent years(Composition Scheme) No restriction on availment of Cenvat Credit Rule 6(7A) of Service Tax Rules Lottery ticket promotion ` 7,000 or ` 11,000 per ` 10 lakhs of tickets printed by State lottery (Composition Scheme) No restriction on availment of Cenvat Credit Rule 6(7C) of Service Tax Rules Tax on 60% amount excluding State Vat (Composition Scheme) (Till 1-7-2012, it was 50%) Cenvat credit of input services and capital goods is available. Cenvat credit on food items (covered under Chapters 1 to 22 of CETA) not available. Cenvat credit of other inputs is available. Rule 2C of Service Tax (Determination of Value) Rules Outdoor caterer E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com Tax payable on 40% of amount charged (Abatement Scheme) No Cenvat credit available Sr. No. 9 of Notification No. 26/2012-ST dated 206-2012 Restaurant service Tax on 40% amount excluding State Vat (Composition Scheme) (Till 1-7-2012, it was 30%) Cenvat credit of input services and capital goods is available. Cenvat credit of excise duty on food items (covered under Chapters 1 to 22 of CETA) not available. Cenvat credit of other inputs is available. Rule 2C of Service Tax (Determination of Value) Rules Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes Tax payable on 60% of amount charged (Abatement Scheme) (Till 1-7-2012, the tax payable was on 50% amount). Cenvat Credit of input services allowable but no Cenvat credit of inputs and capital goods Sr. No. 6 of Notification No. 26/2012-ST dated 206-2012 Tour operator – Package tours (“package tour” means a tour wherein transportation, accommodation for stay, food, tourist guide, entry to monuments and other similar services in relation to tour are provided by the tour operator as part of the package tour to the person undertaking the tour). Tax is payable on 25% of gross amount charged (Abatement Scheme) No Cenvat credit available. Bill to be inclusive of all charges for the tour. Sr. No. 11(i) of Notification No. 26/2012ST dated 20-6-2012 Tour operator – providing services solely of arranging or booking accommodation for any person in relation to a tour (If Bill includes cost of accommodation) Tax is payable on 10% of amount charged (Abatement Scheme) No Cenvat credit available. Bill to be inclusive of charges for such accommodation Sr. No. 11(ii) of Notification No. 26/2012ST dated 20-6-2012 Renting of motor vehicle designed to carry passengers E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com Tour operator – Other than package tours and other than service of booking accommodation where Bill includes cost of accommodation Tax is payable on 40% of amount charged (Abatement Scheme) No Cenvat credit available. Bill to be inclusive of all charges for the tour Sr. No. 11(iii) of Notification No. 26/2012ST dated 20-6-2012 Transport of goods by rail Tax payable on 30% of amount charged (Abatement Scheme) No restriction on availment of Cenvat Credit Sr. No. 2 of Notification No. 26/2012-ST dated 206-2012 Transport of goods by road by Goods Transport Agency (GTA) Tax payable on 25% of amount charged (Abatement Scheme) No Cenvat Credit available (Certificate should be taken from the GTA that he has not availed Cenvat credit, as tax is payable by service receiver under reverse charge – this headache was not there earlier) Sr. No. 7 of Notification No. 26/2012-ST dated 206-2012 Transport of goods in a vessel from one port in India to another Tax payable on 50% of amount charged (Abatement Scheme) No Cenvat Credit available) Sr. No. 10 of Notification No. 26/2012-ST dated 206-2012 Transport of passengers by air Tax payable on 40% of amount charged (Abatement Scheme) Cenvat Credit of input services allowable but no Cenvat credit of inputs and capital goods Sr. No. 5 of Notification No. 26/2012-ST dated 206-2012 Transport of passengers by rail Tax payable on 30% of amount charged (Abatement Scheme) No restriction on availment of Cenvat Credit Sr. No. 3 of Notification No. 26/2012-ST dated 206-2012 Works Contract Service Tax on value of service calculated as per rule 2A(i) or Tax on 25%/40%/60% of gross amount charged as specified in rule 2A(ii) (Composition Scheme) Tax on 25% of amount charged including fair market value of all goods and services supplied by recipient (termed as Abatement Scheme – actually it is composition scheme) Cenvat credit of input services and capital goods is available. Cenvat credit of excise duty on goods, the property of which is transferred is not available. Cenvat credit of other inputs (like consumables) is available Rule 2A of Service Tax (Determination of Value) Rules E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 | Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com E-10A, Kailash Colony, Greater Kailash – 1, New Delhi – 110048 Telefax: 011-46664600, 29245500/5522/5533 Email: akg@akgindia.in www.akgindia.in | www.charteredaccountantnewdelhi.com DISCLAIMER: The information contained in this document is for information purposes only and does not constitute a legal advice from AKG or solicitation or an offer to sell any products or services. Reasonable efforts are being made to provide correct and updated information by us, however, users are advised to use their own prudence and seek independent professional advise before taking any decision based on this document.