The Debasement of the Riskless Rate

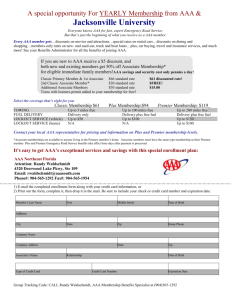

advertisement

16 February 2012 The Debasement of the Riskless Rate Structural causes and effects on world macroeconomics 1 Finance and the Riskless Rate • What is Finance? – The business of borrowing and lending money in the free capital markets • What is the Riskless Rate? – Or risk-free rate of return, is the interest an investor would expect from a theoretically risk-free investment over a specific period of time • Why Does the Riskless Rate Matter to Global Macroeconomics? – By representing the certainty or near-certainty of principal repayment, both short-term (CB Repos/Deposits; Treasury Bills; AAA CPs) and longer-term (AAA Treasury and Corporate Bonds) risk-free rates work to anchor the credit risk (insolvency) hierarchy; crucial prerequisite to an optimal allocation of capital 2 When the Riskless Is at Risk • During Normal Times Financing and Investment Anchored by Risk-Free Rate – Traditional foundation is high-grade sovereign (e.g. US, Germany, UK) – Extends across the maturity spectrum – from o/n deposits at CBs’ to long-term bonds • Underlying Source or Cause of Risk– Debt that Cannot be Repaid – Insolvency or the prospect of insolvency • • • Responses – A Typology of Sovereign Risk The Good – Growth, Taxes, and Re-payment The Bad and the ugly – Nominal Default • Simplest and most obvious – as in Russia 1998 , Argentina 2001, Ecuador 2008, Greece 2012? Actually pretty common over history – Inflation • Moderate to High Unexpected Inflation – as in most Latin American countries over past 70 years, but also Europe and the US in the 1970s. Devalues the debt – Financial Repression • • Restrictions on nominal rates or other financial activities Current example – US – low rates, negative real rates devalues the debt** – Currency Revaluation • For foreign-denominated debt – equivalent to nominal default ** Expected Positive Real Interest Rate – The Anchor to Economic Growth and Investing - Key price for decisions on consumption today vs. tomorrow, investing, growth 3 Credit Risk Distorted • Problems Start when Credit Risk (Insolvency Hierarchy) is Distorted • It is Bad Policies, not Financial Markets, that Produce Long-Term Credit Risk Distortions – Fed’s monetary policy 1994-2007* • The Productivity Miracle • The Y2K • The “Great Moderation” – US Congress housing policies: ’00s mortgage democratisation* • “One mortgage for every American” • Fanny Mae and Freddy Mac’s balance sheet leverage • Government implied guaranty on GSEs’ MBS * See Appendix 4 Current State of Affairs - Riskless Rate Debasement • Current Disarray – “Financial Repression” and Negative Real Rates – Past four years has seen explosion of sovereign debt and increasing sovereign risk – Shows up in places as explicit default risk – pretty obvious (e.g. Greece) – More important – although harder to see and far more damaging – is the effect of financial repression and negative real rates – default by a thousand cuts • Global Quantitative Easing Distorts Real Rates and Credit Risk Hierarchy – US, Eurozone, and UK CB short-term funding to banking system provides emergency liquidity – But banking system hoarding reserves in anticipation of further funding difficulties and investors losing confidence in extending credit to indebted governments – The creeping sovereign risk of financial repression distorts traditional risk-free benchmarks • This Leaves Global Markets Looking for “True” AAA Assets – Borrowers and investors looking for transparency, liquidity, and stable credit hierarchy 5 Current State of Affairs (cont.) • Only few Surviving “True” AAA Lenders and Borrowers Globally – Low sovereign risk requires good growth prospects, low debt, good fiscal management – China, Germany, Canada, Norway, Australia,….? • China, Currently Pursuing the “Bilateral” Way i.e. Investment + Currency Bilateral Agreement vs Strategic Collateral – Bilateral convertibility • Opens to bilateral finance and trading • By-passes traditional capital markets – Crucially, China has no Borrowing Needs so no AAA Bond Issuance • Germany, Trapped in Captive Political Environment, Trading Funds vs Political/Fiscal Conditionality; Too Small to Fill “True” AAA Assets-Global Savings Gap • IMF and EMU’s (EFSF, ESM) Rescue Funds Creating Unprecedented Credit Seniority Debasement – Crucially, No IMF Issuance; EMU’s not a AAA • US, Backed by China’s Captive AAA Investor Status, Precariously Extending Role of Global AAA Liquid Asset Provider 6 Current State of Affairs (cont.) • Financial Markets Pressing for Credit Standing Differentiation While Policy Makers and Rating Agencies Catching up with Reality • New Ranking of “True” AAA Lenders/Issuers Emerging • “True” AAA Lenders/Borrowers Unwilling to Offer Funds Without Strict Conditionality • China and Germany’s “Bilateral” Approach Inadequate to Solve Global Credit Anchoring Vacuum 7 AAA Debasement: Macroeconomic Impact • Global Business Confidence Likely to Remain Low as Businesses and Individuals Perceive Their Savings as Unsecured • CBs Short-Term Lending Provision and QE Likely to Increase Confusion Between Liquidity and Solvency Risk Leading to Misallocation of Capital, Next Financial/Asset Bubble • Lack of Credit Hierarchy Anchoring and Credit Differentiation Hampering Private and Public Sector Financing/Re-financing Activity 8 Desirable Outcomes • “True” AAA Lender/Borrowers (China, Germany, Canada, etc.) and C/A Surplus Countries (Russia, Brazil, India, etc.) to Establish Voluntary Global AAA Fund Which Lends to Countries and Banks Against Streamlined, Market-Based Conditionality • Global AAA Fund Resources to be Provided Through Up-front Cash + Issuance of a Global AAA Bond • “True” Global Longer-Term AAA Lending, Coupled with AAA Issuance to Provide Credible Anchor to Global Credit Hierarchy • Struggling European Countries to Re-acquire Credit Standing Differentiation • “Implied” Chinese Capital Market as a By-product of AAA-GlobalBond Issuance Sets off Additional Global Reserve Currency • US to Compete for Global Savings; Budget Deficit to Be Tackled by Congress Sooner Rather than Later 9 Greenspan’s Expansionary Mon. Policy Excess Liquidity Excessive Leverage + US Congress Housing Policies AAA Pool Expansion GSEs’ AAA Implied Rating Rating Agencies’ Modelling Error AAA MBS and AAA CDOs Proliferation Sub Prime Lending Expansion - Real Estate Bubble Generalised Capital Misallocation - Real Estate, Financial Assets, Commodities Real Estate Bubble Burst - Sub Prime Derivatives Default Banking Insolvency Risk Re-pricing Government Insolvency Risk Re-pricing AAA Poll Contraction 10