Stockholders' Equity PPT

advertisement

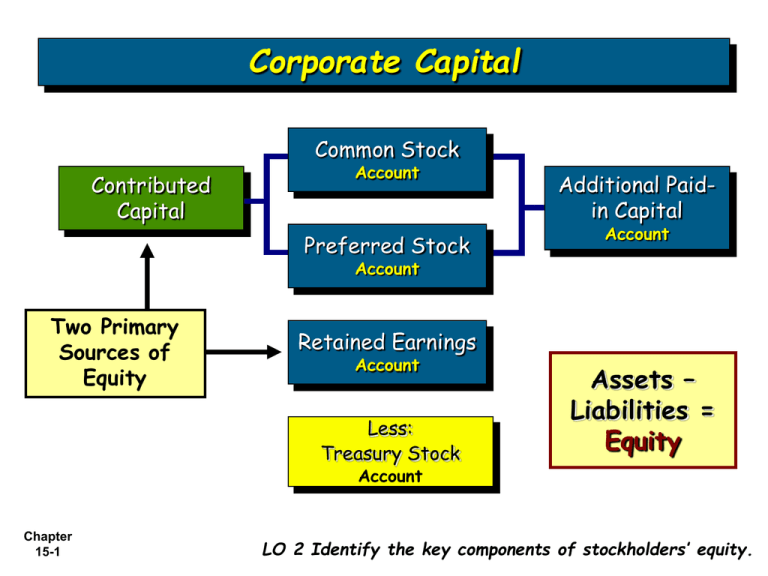

Corporate Capital Common Stock Contributed Capital Account Preferred Stock Additional Paidin Capital Account Account Two Primary Sources of Equity Retained Earnings Account Less: Treasury Stock Assets – Liabilities = Equity Account Chapter 15-1 LO 2 Identify the key components of stockholders’ equity. The Corporate Form of Organization Authorized Shares – Maximum number of shares to be issued per the charter. Selling more than Authorized amount requires a vote by the Board of Directors. Unissued Shares – Total number of shares that have never been issued. Issued Shares – Total number of shares that have been Issued [Outstanding Shares and Treasury Shares]. Outstanding Shares – Total shares of stock owned by stockholders on a given date. Treasury Shares – Stock that has once been issued and since purchased back by the company. Treasury stock is considered issued stock that is currently inactive. Chapter 15-2 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Authorized Shares = Issued Shares + Unissued Shares Outstanding + Treasury Shares Chapter 15-3 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Assume XYZ Co. is authorized to sell 600,000 shares. At December 31, 2014, XYZ Co. had total issued shares of 250,000. They are holding 30,000 shares in Treasury. How many shares are Outstanding (in the hands of shareholders)? Chapter 15-4 The Corporate Form of Organization Issued Shares = Outstanding Shares + Treasury Shares 250,000 = X + 30,000 X = Chapter 15-5 220,000 Outstanding Shares Issuing Common Stock Ex) Assume Busby Inc. issues 10,000 shares of $10 par value Common Stock for $32 per share, prepare the necessary journal entry. DR 320,000 Cash Common Stock Paid In Capital – CS Chapter 15-6 CR 100,000 220,000 Treasury Stock Chapter 15-7 Treasury Stock Treasury Shares Treasury stock is considered inactive Issued Stock The Treasury stock account is a Contra Equity account reducing the overall value of equity Equity: Common Stock ($1 Par 100,000 shares issued 98,000 shares OS) Additional PIC Retained Earnings Treasury Stock (2,000 shares) Total Equity: Chapter 15-8 $100,000 264,000 411,000 (75,000) $700,000 LO 4 Describe the accounting for treasury stock. Purchasing Treasury Stock Assume Busby Inc. purchases 2,000 of its $10 par value common stock outstanding, paying $15 per share. Prepare the necessary journal entry. Treasury Stock Cash Chapter 15-9 Dr 30,000 Cr 30,000 Busby Inc. Equity Common Stock [$10 par value, 500,000 shares authorized] [? shares issued, ? shares OS] $100,000 Paid in Capital - Common Stock $220,000 Retained Earnings $500,000 Treasury Stock [2,000 shares] ($30,000) Total Stockholders' Equity $790,000 How many Common Stock shares are issued? $100,000/$10 p/s = 10,000 shares issued How many Common Stock shares are outstanding? 10,000 issued – 2,000 Treasury = 8,000 shares outstanding Chapter 15-10 What is the average market price per share of Issued Common Stock? ($100,000 + $220,000)/10,000 = $32 p/s New Example Common Stock [$5 par value, 500,000 shares authorized] [? shares issued, ? shares OS] $100,000 Paid in Capital - Common Stock $400,000 Retained Earnings $500,000 Treasury Stock [2,000 shares] ($36,000) Total Stockholders' Equity $964,000 How many Common Stock shares are issued? $100,000/$5 p/s = 20,000 shares issued How many Common Stock shares are outstanding? 20,000 issued – 2,000 Treasury = 18,000 shares outstanding Chapter 15-11 What is the average market price per share of Issued Common Stock? ($100,000 + $400,000)/20,000 = $25 p/s Stock Dividends Chapter 15-12 Cash Dividends Dividends are direct withdrawals from earnings by owners. Example: Nelson Inc.’s Board of Directors announced, on March 5, 2014, they would pay $100,000 in dividends to stockholders. Prepare the journal entry required on the Date of Declaration. March 5, 2014 DR Retained Earnings Dividends Payable Chapter 15-13 CR 100,000 100,000 Cash Dividends Assume On April 10, 2014, Nelson Inc. Paid the Dividends. Prepare a journal entry for the Date of Payment. April 10, 2014 DR Dividends Payable Cash Chapter 15-14 CR 100,000 100,000 Preferred Stock Chapter 15-15 Preferred Stock Preferred Stock is a special class of stock with features of both equity and debt. Preferred Stock has a fixed dividend rate that must be paid in any year dividends are declared. Preferred shareholders get their fixed dividend distribution first, Common shareholders get the remaining portion. Example of Fixed Dividend Rate on Preferred Stock: If a company has $500,000 of 6% Preferred Stock outstanding, the Fixed Dividend Rate is: $500,000 * .06 = $30,000 per year Chapter 15-16 Preferred Stock Cumulative preferred stock – requires that if a corporation fails to pay dividends to stockholders in any year, the fixed dividend obligation to cumulative preferred shareholders will accumulate until paid in a following year. Noncumulative preferred stock – if a corporation fails to pay a dividend to shareholders in any year, dividend obligations to preferred stockholders will not accumulate. Noncumulative preferred stock rights to receive dividends are forfeited in any year that dividends are not declared. Chapter 15-17 Preferred Stock Back to Nelson Inc. Nelson Inc. distributed $100,000 of dividends on April 10, 2014. Assume Nelson Inc. has $400,000 par, 6% shares of Cumulative Preferred Stock outstanding on record. Assume Nelson Inc. did not pay dividends in year 2013 (the prior year). How will the dividends be distributed between Nelson’s Cumulative Preferred Stockholders and its Common Stockholders? Chapter 15-18 Dividend Distributions between Preferred and Common Shares Nelson’s Cumulative Preferred Stock Fixed Dividend Rate is $400,000 * .06 = $24,000 per year Nelson did not pay dividends in the prior year, so the dividend obligation from last year has accumulated and rolled forward to this year. Nelson owes their Cumulative Preferred Stockholder’s the fixed dividend for 2013 and 2014. 2014 Dividend allocation: $24,000 $24,000 $52,000 $100,000 Chapter 15-19 2013 Fixed Dividend to Preferred 2014 Fixed Dividend to Preferred 2014 Dividends to Common Shareholders Total Dividends