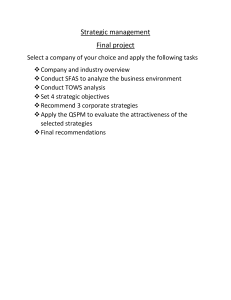

Strategic Management Outline

advertisement

OUTLINE OF THE STRATEGIC PLANNING A SCANNING ENVIRONMENT [SWOT ANALYSIS] A.1. Internal Environment [SW – Analysis] A.1.1. Current Situation ALK A. Financial Ratio Analysis 1) 1.Liquidity (3 types of ratio) 2.Leverage (3 types of ratio) 3.Activity / Efficiency (5 types of ratio) 4.Profitability (4 types of ratio) 5.Valuation (2 types of ratio) B. Other Financial Measurement 1.Market Value Added 2) 2.Economic Value Added 3) A.1.1.2. Strategic Posture: - Current Vision & Mission - Current Objectives - Current Strategies - Current Policies A.1.2. Corporate Governance, Business Ethics & CSR A.1.2.1. Corporate Governance (Board of Directors & Top Mgt) A.1.2.2. Business Ethics & Code of Conduct A.1.2.3. CSR A.1.3. Corporate Resources [IFAS Table] –> ALI A.1.3.1. Marketing (STP, Marketing Mix) A.1.3.2. Finance (Obtaining, Allocating & Dividend Policy) A.1.3.3. Research & Development A.1.3.4. Operations & Logistics A.1.3.5. Human Resources A.1.3.6. Information System A.1.3.7. Other organizational function A.1.4. Corporate Resources [Value Chain Analysis] A.1.4.1. Primary Activities A.1.4.2. Support Activities A.1.5. Tangible & Intangible Resources Analysis [TIRA] A.2. External Environment [OT – Analysis] A.2.1. Remote Environment [EFAS Table] A.2.1.1. Politic & Regulations A.2.1.2. Economy A.2.1.3. Social & Culture A.2.1.4. Technology A.2.1.5. Ecology A.2.1.6. Other factors A.2.2. Task Environment A.2.2.1. Consumer (Market) Analysis Strategic Management Seminar – Course Syllabi – 25 August 2014 11 A.2.2.2. Competitors & Industry Analysis A.2.2.3. Supply Chain Analysis A.2.2.4. Industry Value Chain Analysis A.2.2.5. Key Success Factor Analysis (Industry Matrix) A.2.2.6. Strategic Groups A.3. Analysis of Strategic Factors [SFAS Table] A.3.1. Key Internal and External Strategic Factors (SFAS Table) A.3.2. Review of Mission and Objective B STRATEGY FORMULATION B.1. Mapping of the Implemented Strategy B.1.1. Corporate Strategy B.1.1. Growth / Expansion Strategy B.1.2. Delay / Stability Strategy B.1.3. Retrenchment Strategy B.1.2. Business Strategy B.1.1. Review of the Strategic Business Unit(s) B.1.2. Review of the Porter’s Strategy B.1.2.1. Competitive Strategy (Porter) a. Timing tactics b. Market location tactics B.1.2.2. Cooperative Strategy (Review the application of strategic alliance, joint venture, FDI, etc) B.1.3. Functional Strategy B.3.1. Marketing Strategy B.3.2. Finance Strategy B.3.3. Operation Strategy B.3.4. Human Resource Strategy B.3.5. Other Functional Strategy B.2. Strategy alternative mapping B.2.1. TOWS Matrix B.2.2. GE Matrix B.2.3. TOWS Matrix B.3. Strategic Alternatives—pro and contra B.4. Ranking of Selected Strategy B.5. Strategi integration to financial aspects* Strategic Management Seminar – Course Syllabi – 25 August 2014 12 B.5. Strategi integration to financial aspects* Indicator (REALISASI 2012) 2013 (FORECAST 10% dari 2009)* harus ada asumsi missal growth perekonomian 2013 (TARGET) Operational strategy (program) Strategic planning (lihat B.4) LIQUIDITY RATIO Current Ratio Quick Ratio (acid Test Ratio0 Cash Ratio Cash Turn Over Inventory to Net Working Capital LEVERAGE RATIO Debt to Asset Ratio Debt to Equity Ratio Long-term debt to Equity Ratio Times Interest Earned Fix Charge Coverage ACTIVITY RATIO Receivable Turn Over Inventory Turn Over Working Capital Turn Over Fix Assets Turn Over Total Assets Turn Over PROFITABILITY RATIO Gross Profit Margin Return on Investment Return on Equity Earnings per share Net profit margin MARKET RATIO Price/earnings ratio Market/book ratio Strategic Management Seminar – Course Syllabi – 25 August 2014 13 C STRATEGY IMPLEMENTATION (Program, People, Procedure & Budget) C.1. Organization for implanting the project C.1.1. Organization Chart C.1.2. Job description C.1.6. Types of cross functional team C.2. Scheduling of the selected program to be implemented C.4.1. Programs to be implemented C.4.2. People (department) responsible to implement programs C.4.3. Budget (proposed budget for each program) C.4.4. Procedures (standard of procedure of implemented program) D STRATEGY CONTROL & EVALUATION D.1.BALANCE SCORE CARD D.1.1. Company’s Perspective (Financial Perspectives) D.1.2. Internal Perspective (Internal Business Process) D.1.3. External Perspective (Customer Perspectives) D.1.4. Learning & Growth D.2. QUANTITATIVE MEASUREMENT D.2.1. Marketing Performance (indicators) D.2.1. HRM Performance (indicators) D.2.1. Operation Management Performance (indicators) D.2.1. Financial Management Performance (indicators) D.3. QUALITATIVE MEASUREMENT D.3.1. Customer Satisfaction Survey D.3.2. Employee Satisfaction Survey D.3.3. Other surveys/ studies APPENDICES I. Introduction 1.1. Industry coverage where the company operates, 1.2. Problems and challenges in the company 1.3. Aims of the strategic planning II. Research Object (the selected company) 2.1. History, products / services, market segment 2.2. Research Method 2.2.1. Case study 2.2.2. Data collection method (observation, interview, questionnaire) III. Annual Report of the Company (attach 2 years consecutively) IV. Prove of Letter from the company that students have done the study