Diluted Earnings per Share

advertisement

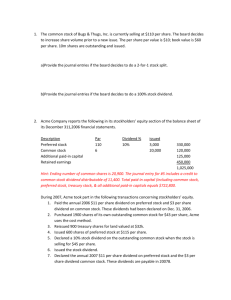

StIce | StIce |Skousen Earnings Per Share Chapter 18 Intermediate Accounting 16E Prepared by: Sarita Sheth | Santa Monica College COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Learning Objectives 1. 2. 3. 4. Know the difference between a simple and a complex capital structure, and understand how dilutive securities affect earnings per share computations. Compute basic earnings per share, taking into account the sale and repurchase of stock during the period as well as the effects of stock splits and stock dividends. Use the treasury stock method to compute diluted earnings per share when a firm has outstanding stock options, warrants, and rights. Use the if-converted method to compute diluted earnings per share when a company has convertible preferred stock or convertible bond outstanding. Learning Objectives 5. 6. 7. 8. Factor into the diluted EPS computations the effect of actual conversion of convertible securities or the exercise or options, warrants, or rights during the period, and understand the anti-dilutive effect of potential common shares when a firm reports a loss from continuing operations. Determine the order in which multiple potentially dilutive securities should be considered in computing diluted EPS. Understand the disclosure requirements associated with basic and diluted EPS computations. Make complex EPS computations involving multiple potentially dilutive securities. Simple and Complex Capital Structures • Dilutive Securities- Securities whose assumed exercise or conversion results in a reduction in earnings per share. • Antidilutive Securities:- Securities whose assumed conversion or exercise results in an increase in earnings per share. Simple and Complex Capital Structures Basic Considers only common shares issued and outstanding. Simple and Complex Capital Structures Basic Considers only common shares issued and outstanding. Diluted Reflects the maximum potential dilution from all possible stock conversions that would have decreased EPS. Capital Structures Simple Capital Structure- The corporation has only common and nonconvertible preferred stock and has no convertible securities, stock options, warrants, or other rights outstanding. Complex Capital Structure- The corporation has one or more instruments outstanding that could result in issuance of additional common shares. For example, a firm with potential for per share dilution. Basic Earnings Per Share The Basic Equation: Net Income – Preferred Dividend Weighted-Average Common Shares Outstanding The Complications: – Issuance or reacquisition of common stock – Stock dividends or stock splits Basic Earnings Per Share Weighted-Average Number of Shares –Shares Outstanding January 1: –New Shares Issued May 1: –Shares Repurchased November 1: 10,000 5,000 2,000 Jan. 1 to May 1 10,000 x 4/12 = 3,333 May 1 to Nov. 1 15,000 x 6/12 = 7,500 Nov. 1 to Dec. 31 13,000 x 2/12 = 2,167 Dec. 31 Weighted-average shares 13,000 Stock Dividends and Stock Splits –Shares outstanding January 1…….. 2,600 –Shares issued for exercise of options on February 1…………. 400 –Shares issued for 10% stock dividend on May 1………………….. 300 –Shares sold for cash on September 1.. 1,200 –Shares repurchased on November 1… 400 –Shares issued for 3-for-1 stock split on December 15……………………… 8,200 Stock Dividends and Stock Splits Date 1/1 to 2/1 2/1 Option 2/1 to 5/1 No. of Stock Stock Shares Dividend Split 2,600 400 3,000 Portion of Year Weighted Average Stock Dividends and Stock Splits No. of Stock Stock Shares Dividend Split Date 1/1 2/1 2/1 5/1 5/1 to 2/1 Option to 5/1 Dividend to 9/1 2,600 400 3,000 300 3,300 x 1.10 x 1.10 Portion of Year Weighted Average Stock Dividends and Stock Splits No. of Stock Stock Shares Dividend Split Date 1/1 2/1 2/1 5/1 5/1 9/1 9/1 to 2/1 Option to 5/1 Dividend to 9/1 Sale to 11/1 2,600 400 3,000 300 3,300 1,200 4,500 x 1.10 x 1.10 Portion of Year Weighted Average Stock Dividends and Stock Splits Date No. of Stock Stock Shares Dividend Split 1/1 to 2/1 2/1 Option 2/1 to 5/1 5/1 Dividend 5/1 to 9/1 9/1 Sale 9/1 to 11/1 11/1 Purchase 11/1 to 12/1 2,600 400 3,000 300 3,300 1,200 4,500 (400) 4,100 x 1.10 x 1.10 Portion of Year Weighted Average Stock Dividends and Stock Splits Date No. of Stock Stock Shares Dividend Split 1/1 to 2/1 2/1 Option 2/1 to 5/1 5/1 Dividend 5/1 to 9/1 9/1 Sale 9/1 to 11/1 11/1 Purchase 11/1 to 12/1 12/1 Split 12/1 to 12/31 2,600 x 1.10 400 3,000 x 1.10 300 3,300 1,200 4,500 (400) 4,100 8,200 12,300 Portion of Year Weighted Average Stock Dividends and Stock Splits Date No. of Stock Stock Shares Dividend Split 1/1 to 2/1 2,600 x 1.10 x 3.0 2/1 Option 400 2/1 to 5/1 3,000 x 1.10 x 3.0 5/1 Dividend 300 5/1 to 9/1 3,300 x 3.0 9/1 Sale 1,200 9/1 to 11/1 4,500 x 3.0 x 11/1 Purchase (400) 11/1 to 12/1 4,100 x 3.0 12/1 Split 8,200 12/1 to 12/31 12,300 Weighted-average number of shares Portion of Year Weighted Average x 1/12 = 715 x 3/12 = 2,475 x 4/12 = 3,300 2/12= 2,250 x 1/12= 1,025 x 1/12 = 1,025 10,790 Stock Dividends and Stock Splits • All stock splits and stock dividends must be incorporated into the computation of weighted average shares outstanding. • This must done for all periods presented in the financial statements. • Current EPS figures may have to be changed in the future as a result of stock splits or dividends. Stop and Think Why must basic EPS associated with prior periods be adjusted for stock splits or stock dividends that occurred in the current period? Preferred Stock Included in Capital Structure • Basic EPS reflects only income available to common stockholders; it does not include preferred stock. • Dividends on preferred stock should be deducted from income before extraordinary or other special items from net income for EPS, if preferred stock is in the capital structure. Preferred Stock Included in Capital Structure To illustrate a simple capital structure for two years, assume the following data: •On December 31, 2006, the firm had 10,000 shares of preferred stock and 200,000 shares of common stock outstanding. • On June 30, 2007, issued 100,000 shares of common stock. Preferred Stock Included in Capital Structure Date No. of Shares 1/1 to 6/30 200,000 Stock Dividend Portion of Year Weighted Average x 6/12 100,000 Preferred Stock Included in Capital Structure • On June 30, 2007 the firm paid: – An 8% dividend on preferred stock ($80,000) – A $0.30 per share dividend on common stock (300,000 shares x $0.30 = 90,000). • No additional stocks were issued during 2007. • These cash dividends would not affect the weighted-average number of shares of common stock. • However, Retained Earnings would decrease by $170,000. Preferred Stock Included in Capital Structure Date No. of Shares 1/1 to 6/30 7/1 to 12/31 200,000 300,000 Stock Dividend Portion of Year Weighted Average x 6/12 x 6/12 100,000 150,000 250,000 There are 250,000 weighted-average shares outstanding in 2007 On May 1, 2008, the firm issued a 50% stock dividend on common stock. Preferred Stock Included in Capital Structure 2007 Date No. of Shares 1/1 to 6/30 7/1 to 12/31 Stock Portion of Dividend Year Weighted Average 200,000 300,000 x 6/12 x 6/12 100,000 150,000 250,000 300,000 x 4/12 100,000 2008 1/1 to 4/30 The weight-average before considering the stock dividend. The stock dividend was the only stock transaction for 2008. Preferred Stock Included in Capital Structure 2007 Date 1/1 to 6/30 7/1 to 12/31 No. of Shares Stock Portion of Dividend Year Weighted Average 200,000 300,000 x 6/12 x 6/12 100,000 150,000 250,000 300,000 450,000 x 4/12 x 8/12 100,000 300,000 2008 1/1 to 4/30 5/1 to 12/31 WAIT! We are not finished. The stock dividend 300,000 x 1.5 must be “rolled back” for all years displayed. Preferred Stock Included in Capital Structure 2007 Date 1/1 to 6/30 7/1 to 12/31 No. of Shares Stock Portion of Dividend Year Weighted Average 200,000 300,000 x 1.5 x 1.5 x 6/12 x 6/12 150,000 225,000 375,000 300,000 450,000 x 1.5 x 4/12 x 8/12 150,000 300,000 450,000 2008 1/1 to 4/30 5/1 to 12/31 Preferred Stock Included in Capital Structure Assume that in 2007 the firm made a net income, including a $75,000 extraordinary gain, of $380,000. Basic EPS (common), continuing operations (2007): Net income $305,000 $80,000 Dividends after EI –– Preferred Weighted-average 375,000 shares shares of of common stock outstanding Earnings per share from continuing operations = $0.60 Preferred Stock Included in Capital Structure Basic EPS (common), extraordinary gain (2007): Extraordinary $75,000 gain Weighted-average 375,000 sharesshares of of common stock outstanding Earnings per share from extraordinary gain = $0.20 Preferred Stock Included in Capital Structure Basic EPS (common): net income per share (2007): Net income after EI – Preferred Dividend $380,000 – $80,000 Weighted-average 375,000 sharesshares of of common stock outstanding Earnings per share from extraordinary gain = $0.80 Preferred Stock Included in Capital Structure Assume that in 2008 the firm had a net loss of $55,000 and that there were no extraordinary items. Basic EPS (common), continuing operations (2005): Net$55,000 loss + Preferred + $80,000 Dividends Weighted-average 450,000 sharesshares of of common stockdividends Preferred Note that a outstanding included even loss isare added . though they were not declared. Basic loss per share = $(0.30) Diluted Earnings per ShareOptions, Warrants, and Rights • Dilution occurs if inclusion of a potentially dilutive security reduces the basic EPS or increases the basic loss per share. • Proceeds from conversion are assumed to be used for purchase of treasury stock at current market price. • Treasury stock is assumed to be reissued to option or warrant holders. • Any additional shares issued, over treasury stock, are added to “weighted- average shares outstanding.” • Exercise is assumed to occur on the first day of the year unless issue date is later. Diluted Earnings per ShareOptions, Warrants, and Rights • Number of shares of common stock made available to employees • Average market price of stock per share during the year • Exercise price per share on options 5,000 Number of shares sold Proceeds from sale (5,000 x $40) = $200,000 Number of shares that could be purchased with the proceeds ($200,000 ÷ $50) Number of shares used for diluted EPS $50 $40 5,000 4,000 1,000 Diluted Earnings per ShareOptions, Warrants, and Rights •Rasband Corporation had net income for the year of $92,800. •There were 100,000 shares of common stock outstanding all year. •There are 20,000 options outstanding to $92,800 purchase shares. 100,000 = $0.93 Basic EPS = •The exercise price per share is $6 and the average market price during the year was $10. •The firm had a net income of $92,800 and there were 100,000 shares outstanding throughout the year. Diluted Earnings per ShareOptions, Warrants, and Rights Proceeds from assumed exercise of options outstanding (20,000 x $6) $120,000 Number of outstanding shares assumed to be repurchased with proceeds from options ($120,000 ÷ $10) 12,000 Number of Shares to be Used in Computing Diluted EPS Actual number of shares outstanding 100,000 Issued on assumed exercise of options 20,000 Less assumed options repurchased 12,000 8,000 Total 108,000 Diluted Earnings per ShareOptions, Warrants, and Rights Diluted Earnings per Share: $92,800 108,000 The diluted = $0.86 EPS is less than the basic COMPARED TO— EPS, so it is acceptable. Basic Earnings per Share: $92,800 100,000 = $0.93 Diluted Earnings per ShareConvertible Securities • Convertible securities- potential new shares of common stock that can become actual common shares. • There is no need for approval from existing common shareholders. • Conversion of these securities can potentially impact the earnings that will flow to the existing shareholders. • To make them aware of the magnitude of potential dilution use the if-converted method for the EPS calculation. Diluted Earnings per ShareConvertible Securities Assume the following: •Net income………………………$10,000 •10% convertible bonds issued 1/1/08………………..5,000 •15% convertible bonds issued 7/1/08………………..2,000 •Common shares outstanding (no changes during year)…10,000 •Tax rate……………………………….40% Conversion terms: •10% Bonds: 15 common shares per $100 bond •15% Bonds: 20 common shares per $100 bond Diluted Earnings per ShareConvertible Securities Net income – Preferred dividend Basic EPS = Weighted-average common shares outstanding $10,000 Basic EPS = 10,000 Basic EPS = $1.00 Diluted Earnings per ShareConvertible Securities Net income Interest savings 10% bond 15% bond Less: tax effect Adjusted net income $10,000 $ 500 150 (260) 390 $10,390 Actual shares outstanding 10,000 Incremental Shares: 10% bond ($5,000/$100 x 15) 750 15% bond ($2,000/$100 x 20 x 1/2) 200 950 Total shares assumed issued 10,950 Diluted Earnings per ShareConvertible Securities Diluted = EPS Adjusted Net Income – Preferred Dividend Total Shares Assumed Issued Diluted EPS = $10,390 10,950 Diluted EPS = $0.95 Diluted Earnings per ShareConvertible Securities • Continually remind yourself that the events you are considering when computing diluted EPS did not occur. • Bonds were not converted, options were not exercised, etc. • Diluted EPS is providing information as if these events occurred. Effect of Actual Exercise or Conversion Net Income…………...…………………….$2,300,000 Common shares outstanding at the beginning of the year………………..400,000 Options outstanding at the beginning of the year to purchase equivalent shares....100,000 Proceeds from actual exercise or options on 10/1 of current year…..…………………900,000 Market price of common stock at exercise date 10/1…………………….……$15.00 Effect of Actual Exercise or Conversion Basic EPS $2,300,000 425,000 ? = $5.41 Actual number of shares outstanding for full year 400,000 Weighted-average shares issued on October 1 (100,000 x 3/12) 25,000 Weighted-average number of shares for basic EPS 425,000 Effect of Actual Exercise or Conversion Diluted EPS $2,300,000 = $5.05 455,000 ? Weighted-average number of shares for basic EPS 425,000 Issued (assumed) exercise of options100,000 Less: assumed repurchase of shares with proceeds ($900,000 ÷ $15) 60,000 Incremental shares 40,000 Weighted-average (40,000 x 9/12) 30,000 Weighted-average 455,000 Stop and Think In the case of securities actually converted during the year, why must we assume conversion occurred at the beginning of the period in the computation of diluted EPS when we know it did not? Multiple Potentially Dilutive Securities • Remember that preferred dividends were initially subtracted from income to arrive at income available to common shareholders. • When we assume conversion of the preferred stock, those dividends must be added back. • When we assume conversion of the preferred stock, those dividends must be added back. Multiple Potentially Dilutive Securities Financial Statement Presentation • Firms are also required to provide the following disclosure items in the notes to the financial statements: 1. A reconciliation of both the numerators and the denominators of the basic and diluted EPS computations for income from continuing operations. 2. The effect that preferred dividends have on the EPS computations. Financial Statement Presentation 3. Securities (antidilutive for the current year) that could potentially dilute basic EPS in the future that were not included in comparative diluted EPS this period. 4. Transactions that occurred after the period ended but prior to the issuance of financial statements that would have materially affected the number of common shares outstanding or potentially outstanding.