BSP - UST3FM3

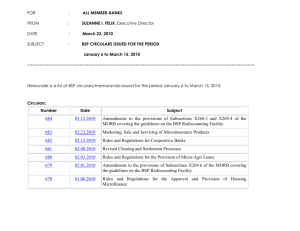

advertisement

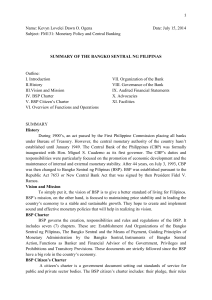

established on 3 July 1993 pursuant to the provisions of the 1987 Philippine Constitution and the New Central Bank Act of 1993 BSP enjoys fiscal and administrative autonomy from the National Government in the pursuit of its mandated responsibilities. Maintain price stability conducive to a balanced and sustainable economic growth. Promote and preserve monetary stability and the convertibility of the national currency. The BSP provides policy directions in the areas of money, banking and credit. It supervises operations of banks and exercises regulatory powers over nonbank financial institutions with quasibanking functions. Liquidity Management Currency issue Lender of last resort Financial Supervision Management of foreign currency reserves Determination of exchange rate policy Other activities 1. Issue rules and regulations it considers necessary for the effective discharge of the responsibilities and exercise of the powers vested in it; 2. Direct the management, operations, and administration of Bangko Sentral, 3.Establish a human resource management system which governs the selection, hiring, appointment, transfer, promotion, or dismissal of all personnel; 4.Adopt an annual budget for and authorize such expenditures by Bangko Sentral 5. Indemnify its members and other officials of Bangko Sentral, against all costs and expenses reasonably incurred BSP Initiatives on Microfinance To provide the enabling policy and regulatory environment, To increase the capacity of banking sector on microfinance operations To advocate the development of sound and sustainable microfinance operations. Anti-Money Laundering Financial Literacy Economic Information › enhance public awareness on the role of the BSP in the Philippine economy, and help manage inflation expectations and reputational risks. › The BSP initiatives to improve the Overseas Filipinos’ (OFs) remittance environment Improving access to financial services Encouraging OFs and their families to increase savings and investment Promoting financial learning among OFs and their beneficiaries The primary objective of BSP's monetary policy is to promote a low and stable inflation conducive to a balanced and sustainable economic growth. The adoption of inflation targeting framework for monetary policy aimed at achieving this objective. 1. Open Market Operations 2. Acceptance of fixed-term deposits 3. Standing Facilities 4. Reserve requirements › regular or statutory reserves › liquidity reserves The Monetary Board decided to keep the BSP’s key policy interest rates steady at 4 percent for the overnight borrowing or reverse repurchase (RRP) facility and 6 percent for the overnight lending or repurchase (RP) facility. The interest rates on term RRPs, RPs, and special deposit accounts (SDAs) were also left unchanged. The Inflation Target › is an approach to monetary policy that involves the use of a publicly announced inflation target set by the Government, which the BSP commits to achieve over a two-year horizon Rediscounting Overnight Clearing Line Emergency Loans Lending Rates Credit Information System (CRIS) Electronic Rediscounting System Credit Surety Fund Program