THE PHILIPPNE FINANCIAL SYSTEM

advertisement

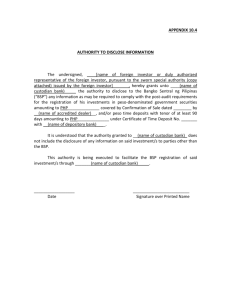

THE PHILIPPNE FINANCIAL SYSTEM: Overview A. THE STRUCTURE OF THE PHILIPPNE FINANCIAL SYSTEM FNANCIAL SYSTEM – a network that generates, circulates, and controls money and credit. SURPLUS INCOME – refers to the excess incomes of an individual. OBRAS PIAS – the first credit institution in the Philippines; started by Fr. Juan Fernandez de Leon in 1754 and ended in 1820. BANCO ESPAÑOL – Filipino de Isabella II the First Philippine Bank establish in 1851 FIRST AGRICULTURAL BANK OF THE PHILIPPINES – established in 1906 and in 1916 all of its asset and liabilities were transferred to the newly organized PNB. FINANCIAL MARKET – are physical locations or electronic forums that facilitate the flow of funds among investors, businesses and governments. It provides the mechanism for allocating financial resources of funds from savers to borrowers. ROLES OF THE FNANCIAL MARKET: 1 . Mon e y mar ket o per at i on 2. Expedites the transaction of financial claims 3. Serves as a mean of bringing the forces of demand and supply of financial claims 4. Facilitates the flow of funds among investors, business, and governments 5. Provides the mechanisms for allocating financial resources or funds from savers to borrowers. 6. Raises money by selling shares to investors and its e xisting share can be bought or sold. 7. Where lenders and their agents can meet borrowers. 8. Convenes many interested sellers in one place. 9. Provides the place where many commodities are traded. 10. Used to match those who want capital to who have it. 11. Facilitates: •The raising capital in capital markets •The transfer of risk in the derivatives market •International trade in the currency market1942 – PNB closes its doors because of the coming of the Japanese imperial Forces. Rehabilitation Finance Corporation – formed in 1946 to provide credit facilities for the rehabilitation of agricultural, commerce and industry reconstruction of war-damaged properties and later became the Development Bank of the Philippines. Offshore Banking Units – any branch, subsidiary of affiliate of Foreign Banking Corporation that conduct banking transactions in foreign currencies. BANGKO SENTRAL NG PILIPINAS AND ITS ROLE IN THE DEPOSIT EXPANSION AND MONEY SUPPLY CENTRAL BANK – a financial institution vested by the State with the function of regulating the supply, cost and use of money with a view to promoting national and international economic stability and welfare. DEVELOPMENT OF THE BANGKO SENTRALNG PILIPNAS The central bank of countries within the region of Southeast Asia are comparatively young having been established mostly only after the end of the Second World War. The Philippines, a young nation, is not an exception. It established its central bank only on January 3, 1949, The concept of a central bank was developed in 1933 by Miguel Cuaderno, the first governor of the Central Bank of the Philippines. The Central Bank of t h e P hi l i p pi n es w as pat t er ne d a f t er si mi l ar ce nt r al ban ks e st abl i she d i n Paraguay and Guatemala, two countries which, like the Philippines have the s a m e e x p o r t e c o n o m i e s . T h e C e n t r a l B a n k o f t h e P h i l i p p i n e s c a m e t o existence as a result of the approval by the former President Elpidio Quirino of Republic Act No. 265, otherwise known as the “Central Bank Act” on June 15,1948. However, actual operations did not commence until January 3, 1949when the bank open its doors for business in the old Intendencia Building located at Intramuros, Manila. With the accumulation of losses incurred by the Central Bank, P317B as of December 1992, there emerged the CMA bill to transform the Central Bank into Central Monetary Authority. This CMA bill is also in response to a call of the International monetary Bank and World Bank to ease the foreign debt burden and strengthen the credit standing of the Philippines. And then when the CMA law also known as “The New Central Bank Act” took effect on June14, 1993 there is established an independent Central Monetary Authority which is known as the “Bangko Sentral ng Pilipinas” and has a capital of P50billion. THE FUNCTION OF THE BANGKO SENTRAL NG PILIPNAS 1. Liquidity Management 2. Currency Issue 3. Lender of Last Resort 4. Financial Supervision 5. Management of Foreign Currency Reserves 6. Determination of Exchange Rate Policy 7. Other Activities (Functions as the banker, financial advisor and official depository of the Government) OBJECTIVES OF BSP 1. To maintain price stability conducive to a balanced and sustainable growth of the economy 2. To promote and maintain monetary stability and convertibility of the Philippine peso THE BSP ON MONEY SUPPLY AND DEPOSIT EXPANSION MONEY SUPPLY – the sum of notes and coins in the circulation and peso demand deposits subject to withdrawal by check DEPOSIT EXPANSION – the change in money supply as a result of an increase in bank reserve MONETARY BOARD – policy making body of the BSP; exercise the powers and functions of the BSP THE MAIN FUNCTONS OF THE MONETARY BOARD 1. Issues rules and regulations it considers necessary for the effective discharge of the responsibilities and exercise the powers vested upon it. 2. Direct the management, operations and administration of the BSP 3. Establish a human resource management system 4. Adopt an annual budget for and authorize such expenditures by Bangko Sentral 5. Indemnify its members and other officials of Bangko Sentral THE BSP MONETARY BOARD Chairman: Armando M. Tetangco, Jr.Members: Juanito D. AmatongAlfredo C. AntonioRaul A. BoncanIgnacio R. BunyePeter FavilaNelly F. Villafuerte MONETARY POLICY AND ITS OBJECTIVES MONETARY POLICY – the management of the expansion and contraction of the volume of money in circulation for the explicit purpose for attaining a specific objective CENTRAL BANK OF THE PHILIPPINES – responsible for executing the monetary policy; gives primary and immediate importance to the maintenance of monetary stability CONFIDENCE OF MONEY – basis for all economic activities in a society based uponcredit ADVANTAGES 1.Impersonal 2 . Fl e xi bl e i n o per at i o n 3. Operates for the most part free from the weight of political pressures DISADVANTAGES 1. Attempts to change available money supply through the banking system 2. Results to high-priced goods and services QUANTITATIVE AND SELECTIVE INSTRUMENTS 1. QUANTITATIVE (Open Market Operations) – used to regulate total quality of money available for all purposes 2. SELECTIVE – employed to limit the amount of money available for certain specific purposes RELATION OF INTEREST RATES TO SAVINGS AND INVESTMENTINVESTMENT – induce a significant increase when the depressions of driving interest rates down SAVINGS – it is contended when there is an increase in interest rate TIGHT MONEY POLICY AND EASY MONEY POLICY TIGHT MONEY SUPPLY – contraction of money supply EASY MONEY POLICY – expansion of money supply FINANCIAL STABILITY SSUES AND CHALLENGES KEY FACTORS THAT AFFECTS THE FINANCIAL SYSTEM: 1 . Fi n anci al Re sou r ces 2.Banking System 3. Non-Bank Financial institution ISSUES ARISING 1 . Fi n anci al St a bi l i t y 2 . In t e gr at e d Re gul a t o r ( s ) 3. Financial Transparency 4. Deregulation of Financial Market 5. Rapid Financial Innovation 6 . Sp ace A ge T ech nol o gy CHALLENGES ENCOUNTERED 1 . Imp r o vi n g Ass et Qu al i t y 2 . Mana gi n g Ri s k Ex po sur e 3. Developing the Domestic Capital Market