here

advertisement

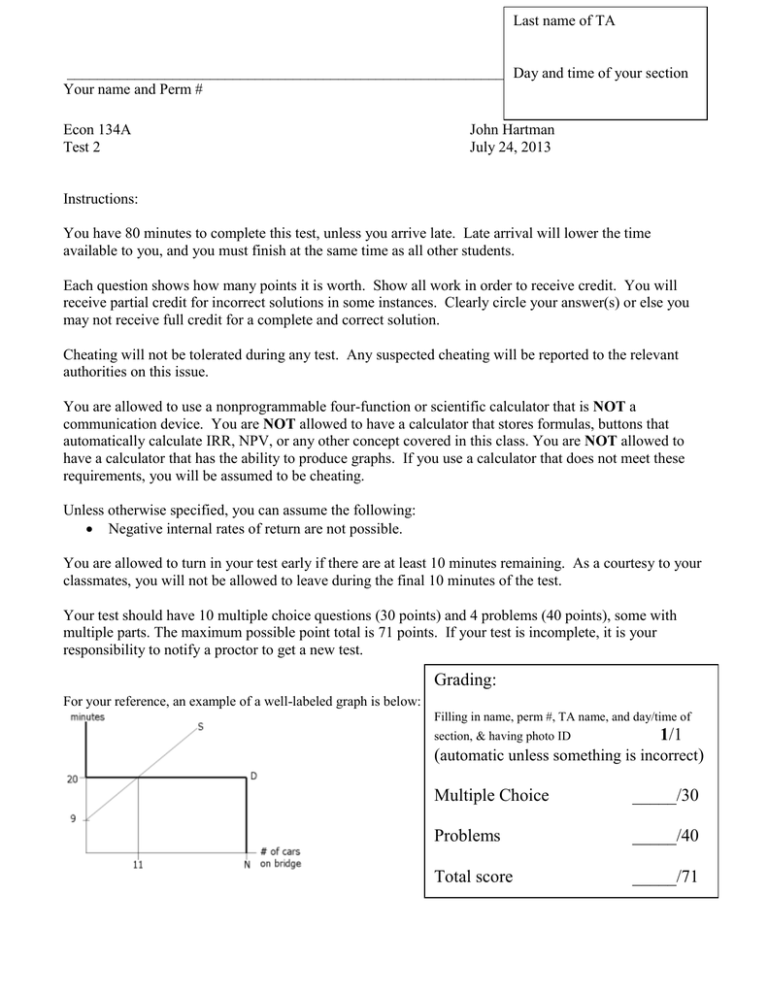

Last name of TA ________________________________________________________________ Day and time of your section Your name and Perm # Econ 134A Test 2 John Hartman July 24, 2013 Instructions: You have 80 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students. Each question shows how many points it is worth. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution. Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue. You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating. Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible. You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test. Your test should have 10 multiple choice questions (30 points) and 4 problems (40 points), some with multiple parts. The maximum possible point total is 71 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test. Grading: For your reference, an example of a well-labeled graph is below: Filling in name, perm #, TA name, and day/time of section, & having photo ID 1/1 (automatic unless something is incorrect) Multiple Choice _____/30 Problems _____/40 Total score _____/71 MULTIPLE CHOICE: Answer the following questions by circling your answer on this test. Each correct answer is worth 3 points. All incorrect or blank answers are worth 0 points. If there is an answer that does not exactly match the correct answer, choose the closest answer. 1. A stock is expected to pay its first dividend five years from today, with subsequent dividends to be paid yearly forever into the future. The first dividend that will be paid will be $5. Each subsequent dividend will be 4% higher. What is the present value of the stock if the relevant effective annual discount rate is 10%? A. $50 B. $57 C. $65 D. $69 E. $83 2. The Daily Dividend Newspaper, Inc., has a very unusual dividend policy. This company pays daily dividends. The next dividend will be later today, at $0.15. Each subsequent dividend will also be $0.15, and will be made forever. What is the present value of this stock if the stated annual discount rate is 9.125%, compounded daily? (Assume that there are 365 days this year.) A. $627.05 B. $626.90 C. $600.15 D. $600 E. $599.85 3. Motor City Chopper Motorcycles will pay a $6 dividend one year from today. Each subsequent dividend will be paid one year after the previous dividend, and will be 5% less than the previous dividend. What is the present value of this stock if the effective annual discount rate is 6% and dividends are paid forever? A. $606 B. $600 C. $594 D. $61 E. $55 4. Jack the Joker’s Fool Magic Supplies, Inc., is currently scheduled to pay a $10 dividend (per share) every year forever, starting one year from today, and has an effective annual discount rate is 10%. This information is used to determine the current value of the company. Later in the day, it is discovered that the company can invest $5 per share today into a project that will earn 15% over the next year. This is a one-time investment that cannot be repeated in later years. How much will the value of each share go up by today? A. $50 B. $33.33 C. $5 D. $0.75 E. $0.25 5. First Order Conditioning Services (FOCS) issues bonds today, which sell at a face value of $1000 each. This bond has a 10% coupon that will be paid next year, and will also mature one year from today. After the bonds are issued, it is suddenly realized today that a competitor is closing, which changes the effective annual discount rate for FOCS bonds to 8%. How much does the value of each bond change by the end of the day? A. Down by $18 B. Down by $10 C. No change D. Up by $10 E. Up by $18 6. A zero-coupon bond is currently selling for $600. The bond will pay out $1000 in 3½ years. What is the stated annual interest rate if interest is compounded every six months? A. 14.9% B. 15.1% C. 15.3% D. 15.5% E. 15.7% 7. Stock A has an expected return of 5% and a variance of 0.01. Stock B has an expected return of 8% and a variance of 0.04. The correlation between these two stocks is strictly greater than –1 and strictly less than 1. Which of the following could NOT be the standard deviation at the minimum variance point of a portfolio consisting only of Stock A and/or Stock B? A. 0% B. 1% C. 2% D. 4% E. 8% 8. From 2005-2010, the annual rate of return for long-term government bonds for each year was 10.35%, 0.28%, 10.85%, 19.24%, – 5.61%, and 7.73%. What is the geometric average rate of return during this period? A. 6.8% B. 7.1% C. 7.8% D. 9.3% E. 11.3% 9. Two stocks, A and B, have a covariance of zero. Suppose you invest in a portfolio of 60% of your money in stock A and 40% of your money in stock B. What is the standard deviation of this portfolio if the standard deviation of stock A’s return is 10% and the standard deviation of stock B’s return is 15%? A. 8.5% B. 10% C. 12% D. 12.5% E. 13% 10. Chen’s Churros is expected to pay out dividends as follows: A $C dividend will be paid one year from today. Each subsequent dividend will be paid yearly, and grow by 5% per year. The final dividend will be paid 20 years from today. After the final dividend is paid, the company will go out of business and never pay out anything to stock holders again. Find C if the effective annual discount rate is 10% and the current stock value is $50 per share. A. $1 B. $2 C. $3 D. $4 E. $5 For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution. 1. (12 points) A sample of stocks has rates of return of 6%, 12%, and X%. The standard deviation of the sample is 5%. The average rate of return for the sample is at least 9%. What is X? 2. (8 points) A bond with face value of $500 pays a $50 coupon twice, 6 months from today and 12 months from today. The bond matures 12 months from today. The bond currently sells for $500. What is the effective annual interest rate for this bond? 3. Black Beluga Investments is soliciting money to finance a new movie “Creature from the Black Beluga Lagoon.” If you invest $5,000, you can assume that you will receive $15,000 two years from now with probability 0.4 and nothing with probability 0.6. Assume that the effective annual discount rate for the movie project is 10% If you do not invest in the movie, you will invest the $5,000 in Project X that will earn 5% effective annual interest for each of the next two years, and this project has an effective annual discount rate of 5%. (a) (3 points) What is the expected net present value of the movie? (b) (3 points) What is the expected net present value of Project X? (c) (7 points) Draw a decision tree showing the situation described above. Which project should be invested in? Why? 4. (9 points) Pink Hills Elephant Trunks will pay dividends of $4 every 4 months, starting 3 months from now. What is the present value of this stock assuming an effective annual discount rate of 14%?