Chapter 17 The Global Economy: Trade

advertisement

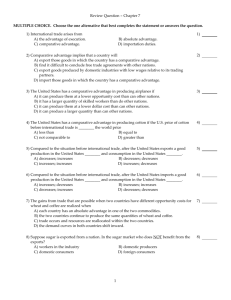

Chapter 17 The Global Economy: Trade What's in This Chapter and Why This chapter treats U.S. involvement in world trade. U.S. exports and imports are increasing both absolutely and relatively. After describing U.S. participation, the principles of absolute and comparative advantage are discussed. A two country–two good example are used to illustrate those principles. Gains and losses from international trade to consumers and producers are separated and it is shown that the net gain to the society is positive. Three impediments to international trade--tariffs, quotas, and voluntary export restraintsare discussed. The cases for and against free trade are then presented. Finally, the global and regional approaches to reducing trade barriers are discussed. Instructional Objectives After completing this chapter, your students should know: 1. That U.S. participation in the world economy is increasing. 2. That trade among nations is based on comparative, not absolute, advantage. 3. That international trade is advantageous in that it allows countries to specialize in the production of goods in which they have a comparative advantage and exchange those goods for goods in which they have a comparative disadvantage. 4. That the increase in consumer surplus is greater than the decline in producer surplus and there are positive net gains from international trade. 5. That tariffs, quotas, and voluntary export restraints serve as impediments to international trade. 6. That society as a whole benefits from free trade, but some individuals are worse off. Key Terms These terms are introduced in this chapter: Trade deficit Comparative advantage Comparative disadvantage Absolute advantage Absolute disadvantage Consumers’ surplus Producers’ surplus Tariff Quota Voluntary export restraints (VERs) Suggestions for Teaching In view of increased U.S. participation in the world economy and the importance of the issues, it is strongly recommended that this chapter be covered. It will take two or three sessions to cover it. In covering absolute and comparative advantage, some instructors may wish to use a graphical approach. In covering the net gains from international trade, concepts of consumer and producer surplus should be reviewed, and a graphical approach may be more effective. With regard to reducing international trade barriers, it may be desirable to discuss the World Trade Organization (WTO) and the future prospects for trade liberalization, both global and regional. Additional References In addition to the references in the text, instructors may wish to read or assign one or more of the following: 1. Robert E. Baldwin, "Are Economists' Traditional Trade Policy Views Still Valid?" Journal of Economic Literature 30 (June 1992), pp. 804-829. 2. Jagdish Bhagwati and Marvin H. Kosters (eds.), Trade and Wages: Leveling Wages Down? (Washington, D.C.: The AEI Press, 1994). 3. Cletus C. Coughlin, K. Alec Chrystal, and Geoffrey E. Wood, "Protectionist Trade Policies: A Survey of Theory, Evidence and Rationale," Federal Reserve Bank of St. Louis, Review 70 (January/February 1988), pp. 12-29. 4. Robert C. Feenstra, "How Costly is Protectionism?" Journal of Economic Perspectives 6 (Summer 1992), pp. 159-178. 5. David M. Gould, “Has NAFTA Changed North American Trade?” Federal Reserve Bank of Dallas, Economic Review (Q 1, 1998), pp. 12-23. 6. “Multilateral Trade Negotiations: Issues for the Millennium Round,” Federal Reserve Bank of St. Louis, Review 82, (July/August 2000), pp. 3-129. 7. John Mutti, Rachelle Sampson, and Bernard Yeung, “The Effects of the Uruguay Round: Empirical Evidence from U.S. Industry,” Contemporary Economic Policy 18, (January 2000), pp. 59-69. 8. Overbeek, Johannes, ed. Free Trade Versus Protectionism: A Source Book of Essays and Readings (Cheltenham, U.K. and Northhampton, Mass.: Elgar, 1999). 9. Andrew Schmitz, Garth Coffin, and Kenneth A. Rosaasen, Regulation and Protectionism Under GATT: Case Studies in North American Agriculture (Boulder: HarperCollins, 1996). 10. “Symposia: Income Inequality and Trade,” Journal of Economic Perspectives 9 (Summer 1995), pp. 15-80. Outline I. U.S. PARTICIPATION IN WORLD TRADE A. Increased Participation 1. During the last few decades, U.S. imports and exports have increased significantly. II. COMPARATIVE ADVANTAGE AND INTERNATIONAL TRADE A. Comparative and Absolute Advantage 1. A country has a comparative advantage in a good or service if it can produce the good or service at a lower opportunity cost than its trading partner. 2. A country has an absolute advantage if it can produce a good or service with fewer resources than its trading partner. 3. Countries gain by producing goods and services for which they have a comparative advantage and exchanging them for goods and services for which they have a comparative disadvantage. III. NET GAINS FROM INTERNATIONAL TRADE A. Importing goods at lower prices than the equilibrium domestic prices increases the consumer surplus more than it decreasing the producer surplus. The net gains from international trade is therefore positive. IV. BARRIERS TO INTERNATIONAL TRADE A. Tariffs 1. A tariff is a tax levied upon a good when it crosses a nation's border. 2. Because a tariff increases the domestic price of a good, consumers are worse off and domestic producers are better off. 3. Because a tariff redirects resources from industries that have a comparative advantage to those that have a comparative disadvantage, society is made worse off. B. Quotas 1. An import quota specifies the maximum amount of a good that may be imported during a time period. 2. The effects of a quota are similar to the effects of a tariff. a. One difference is the fact that a tariff generates revenue for the federal government; a quota does not. b. Another difference is the fact that a quota may result in a higher price than a tariff because imports cannot respond to an increase in demand. C. Voluntary Export Restraints 1. A voluntary export restraint (VER) is an agreement between importing and exporting countries whereby exporting nations agree to limit the amount of a good shipped to importing nations. 2. Like a tariff and quota, a VER increases the price of a good and redirects resources from industries that have a comparative advantage to those that have a comparative disadvantage. V. THE CASE FOR FREE TRADE A. Decreasing Costs 1. International trade allows some industries to increase output and take advantage of the lower average production costs that occur at higher levels of output. B. Increased Competition 1. In some industries, competition from foreign firms is the only way to keep a market from being dominated by one or a few domestic firms. C. Diversity of Products 1. International trade increases the diversity of products available to consumers. VI. THE CASE FOR PROTECTION A. Infant Industry 1. Some argue that initially a new industry may be unable to compete with corresponding mature industries in other countries and should be protected. 2. This view is not particularly relevant for mature industrial economies like the United States. B. National Defense 1. Some argue that industries producing goods vital to national security should be protected. C. Save American Jobs 1. Some argue that some form of protection should be maintained because foreign competition can reduce employment in import-competing industries. 2. The solution to unemployment in import-competing industries is pursuing policies that will provide for full employment and policies that will help those workers who become structurally unemployed. D. Cheap Foreign Labor 1. Some argue that some form of protection should be maintained because high wages in the United States keep many industries from being competitive in world markets. 2. If wages are high because productivity is high (as in the United States), then high wages do not necessarily imply high costs. VII. REDUCING TRADE BARRIERS A. The Global Approach 1. Under the auspices of the General Agreement on Tariffs and Trade (GATT) there have been eight round of international trade negotiations in the post-World War II era. a. These negotiations have resulted in reductions in tariff rates. B. The Regional Approach 1. Many countries have formed regional trading blocs. a. These blocs reduce or eliminate trade barriers among members while maintaining barriers against countries who are not a part of the bloc. 2. The North American Free Trade Agreement (NAFTA) established a free-trade area for the United States, Canada, and Mexico. 3. The European Union has 15 members. It has eliminated most trade barriers between member countries. Answers to Review Questions 1. Describe the relationship between U.S. exports and imports since 1960. U.S. exports and imports have increased significantly over the past four decades. Exports rose from $25 billion in 1960 to $1,034 billion in 2001, and imports increased from $23 billion to $1,383 billion. The U.S. economy also grew rapidly over the same time period. GDP was $527 billion in 1960 and $10,082 billion in 2001. The growth of international trade outpaced GDP, however. The U.S. economy has become increasingly internationalized. Measured by exports, foreign trade increased from almost 5 percent of GDP in 1960 to nearly 12 percent in 1997, then fell back to about 10 percent of GDP by 2001. Measured by imports, international trade grew from a little over 4 percent of GDP in 1960 to a peak of 15 percent of GDP in 2000, then fell back to about 14 percent of GDP in 2001. 2. Describe the behavior of the trade deficit since 1976. What is the political significance of this trend? From 1960 to 1976, U.S. exports closely matched U.S. imports. Since then, the U.S. has had a trade deficit (imports greater than exports). The trade deficit reached a record level of more than $350 billion - 3.5 percent - of GDP in 2000. Many people see exports as a source of jobs, and imports as a loss of jobs - in the sense that imported goods and services would have provided jobs in the U.S. if they had been produced here. They view the rising trend in U.S. trade deficit as evidence that foreign trade destroys more jobs than it creates and push for various restrictions on trade as a means of protecting U.S. workers. 3. Distinguish between absolute and comparative advantage. An absolute advantage refers to a country's ability to produce a commodity with fewer resources than another country. A comparative advantage refers to a country's ability to produce a commodity at a lower opportunity cost than another country. 4. Suppose that a worker in the United States is able to produce more beef and more steel than a worker in Japan. Does this mean that Japan will be unable to trade with the United States? Defend your answer. Just because the American worker can produce more of both goods does not imply that Japan will be unable to trade with the United States. Trade is not based on absolute advantage, but on comparative advantage. So long as the United States and Japan have different opportunity costs in the production of goods, there is a basis for trade. 5. Use the information in the table to answer parts a, b, and c. Country United States France Car Production per Day 6 1 Wine Production per Day 2 1 a. Which country has the absolute advantage in cars? In wine? b. Which country has the comparative advantage in cars? In wine? c. Is there a basis for trade between the two countries? Explain in detail why or why not. a. The United States has the absolute advantage in the production of both cars and wine. It can produce more of both goods. b. In the United States, 1/3 unit of wine must be given up to produce an additional car. In France, 1 unit of wine must be given up in order to produce an additional car. This means that the Unites States has a comparative advantage in the production of cars. In the United States, 3 cars must be given up to produce a unit of wine. In France, 1 car must be given up to produce a unit of wine. This means that France has a comparative advantage in the production of wine. c. There is a basis for trade between these countries. The United States would be willing to trade for wine if it could get more than 1/3 unit of wine for each car. France would be willing to trade for cars if it could get more than 1 car for each unit of wine. Suppose the countries agree to trade at the rate of 2 cars for 1 unit of wine. In this case, the United States will get 1/2 unit of wine for each car it trades to France. It is better off than if it tried to produce wine. For each unit of wine it gives to the United States, France gets 2 cars. It is also better off as a result of trade. Thus, so long as the opportunity costs of production differ between the countries, trade can improve their welfare. 6. International trade affects consumers, producers, and workers. Illustrate and explain why economists normally conclude that free international trade is a good thing for society, on balance, referring to the effects of international trade on each of these parties. Price of Cloth U.S. Supply A Pb B D Pa U.K. Price C U.S. Demand Imports 0 Qd Qb Qc Quantity of Cloth Consumers, producers and workers are effected differently from international trade. Le us use the following example to illustrate these effects. Suppose that U.S. imports textile from U.K. We know that the U.S. can produce cloth, so if textiles are imported from the U.K., U.S. firms will suffer from losses in sales and some textile workers will lose their jobs. This is true, as far as it goes, but it is only part of the story. Textiles will not be imported in the real world unless U.S. consumers value them more highly relative to their price than domestically-produced textiles. So, although textile imports create losses for workers and producers, they also create gains for consumers. It turns out, moreover, that gains to consumers exceed losses to workers and producers. This result can be demonstrated using supply and demand analysis and some of the measures related to that analysis that we have used previously. The figure below shows the domestic market for cloth. In the absence of supply from the U.K. the market would clear at Qb (the quantity before international trade) and Pb (the price before international trade). Given that the U.K. has a comparative advantage in cloth production, however, its opportunity cost of cloth production is generally lower than in the U.S. This means it can offer its cloth on the U.S. market at a price below that of most U.S. cloth producers. This is indicated in the figure by a U.K. price (Pa - the price after trade) that is below the U.S. price of Pb. Given the lower U.K. price, U.S. consumers will buy Qd from domestic producers, some of whom are more efficient than their U.K. counterparts. They will consume Qc, however, importing Qc-Qd from lower-cost producers in the U.K. With no imports the market would clear at Qb and Pb, producing net gains to consumers (consumers' surplus) equal to area A and net gains to producers (producers' surplus) equal to area B+C. With trade, the price will fall to Pa, and consumers will buy Qc; Qd from domestic producers and Qc-Qd from U.K. producers. Trade will increase the net gains of consumers by the area B+D and reduce the net gains of producers by area B, leaving a net gain from trade of area D. Before the U.K. cloth is available, consumers reap net benefits in this market equal to the difference between what they would pay for the cloth they buy, their demand price, and the price they must pay, Pb. Their net benefit, or consumers' surplus, is equal to area A. Before the U.K. cloth is available, U.S. producers enjoy net benefits equal to the difference between the price they receive, Pb, and what they must receive to cover costs, i.e., their supply price. Their net benefit, or producers' surplus, is equal to area B+C. After cloth is imported from the U.K., consumers gain additional consumers' surplus of B+D and producers lose producers' surplus of B. The gain in consumers' surplus is larger than the loss in producers' surplus by the area D. Area D represents the net gains from trade for cloth with the U.K. U.S. production will fall from Qb to Qd, however. Because of this, some U.S. workers will lose their jobs. There is a net loss to workers, however, only to the degree that they are unable to find alternative employment. Under normal conditions, an economy at or close to full employment, they will find other jobs and net losses to workers will be small. 7. Compare and contrast the different restrictions that the United States might place on steel imports. There are several different restrictions that might be placed on steel imports. First, the United States might place a tariff on steel imports. In this case, a tax would be levied on all steel that enters the country. The effect of the tariff would be to increase the domestic price of steel. As price increased, domestic steel producers would be made better off. The price increase would make consumers worse off. Government would be made better off because it would gain some revenue from the imposition of the tariff. Finally, society as a whole would be worse off. This occurs because the tariff would redirect resources from those industries that have a comparative advantage to those that have a comparative disadvantage. Instead of a tariff, the United States might place a quota on steel imports. The quota would specify the maximum amount of steel that could enter the country. Like the tariff, this would drive up the price of steel making domestic producers better off and consumers worse off. Society would also be worse off because resources would be redirected to industries that have a comparative disadvantage. Unlike the tariff, a quota would generate no revenue for the government. Further, it is possible that prices would increase more under the quota. If demand for steel increased, imports could not respond (as they might under a tariff), and the price increase would be greater. Finally, the United States could negotiate a voluntary export restraint (VER) with countries exporting steel into the country. A voluntary export restraint is an agreement between importing and exporting countries under which exporting nations agree to limit the amounts that they ship to importing nations. The effects of a voluntary export restraint are like those of quotas. The domestic price of steel would rise. Domestic producers would be better off and domestic consumers worse off. Society's welfare would fall because resources would be directed to industries having a comparative disadvantage. No governmental revenue would be generated. The basic difference between a VER and a quota is the fact that the VER is voluntary. The United States and other countries would reach a mutual agreement limiting imports. A quota is not voluntary. The United States simply imposes a restriction limiting imports. 8. How is each of the following affected by a tariff? An import quota? a. consumers b. domestic producers A tariff is a tax levied on a good when it crosses a nation’s borders. This causes the domestic price of the good to rise. The consumer is worse off because of the tariff because they are forced to pay a higher price for the good. The domestic producer is better off. They receive a higher price for the product, but are not subject to the tax. This also allows them to increase production. A quota specifies the maximum amount of a good that may be imported during any time period. The limitation of quantity causes domestic price to rise. Therefore, the consumer is worse off because of the quota. Domestic producers, again, are better off because they receive a higher price for their product and can increase output. 9. What is the infant industry argument? Is it likely to be valid for a mature economy like that of the United States? If valid, what would be a better solution than imposing trade restrictions? Some claim that certain emerging industries should be protected (as one would protect a small child) because, once they are established, they will have a comparative advantage. Initially, however, they will be unable to compete with industries already established in other countries. According to this argument, the protection is temporary. It would be eliminated as the industry becomes competitive in world markets. This argument is not particularly valid for a mature economy like the United States, although the automobile industry has successfully used this argument to receive protection from foreign competition. They claimed to need some time to modernize in order to become more competitive. Unfortunately, modernization tends to come more quickly in the face of competition. Economists tend to agree that tariffs and quotas are not the best methods to help emerging industries become competitive. Instead, direct subsidies would be a better approach. Subsidies have several advantages: prices remain low, it is clear what industries are being helped and to what extent, and subsidies are easier to eliminate. 10. "If we allow free trade in the automobile industry, some automobile workers will lose their jobs. This unemployment will make society worse off." What advantage of free trade does this argument overlook? How might the unemployment be alleviated? The basic advantage of free trade ignored by this argument is the fact that free trade is based on the principle of comparative advantage. If free trade prevails, countries will produce those goods in which resources are used most efficiently. If restrictions are imposed, jobs may be saved in some industries; however, jobs in other industries will be lost as resources are redirected. Further, the jobs saved will be in those industries that are less efficient. Hence, resources are directed away from efficient industries to inefficient industries. To maintain full employment, policymakers could use fiscal and monetary policy. Also, because it may be difficult for some workers to relocate due to skill obsolescence, policymakers may need to implement programs to retrain and relocate workers. 11. Suppose U.S. wage rates are higher than those abroad. Is there a basis for trade between the United States and the rest of the world? Defend your answer. U.S. wage rates probably are higher than in most foreign countries; however, there is good reason for this. U.S. workers are well trained and work with relatively large amounts of capital. It is not surprising that they are very productive and earn high wages as a result. Thus, it is not safe to say that high wages in America imply high costs. Even if high wages did give the U.S. an absolute disadvantage in the world market, other countries would still find it advantageous to trade with the U.S. Remember, trade is based on comparative advantage, not absolute advantage. 12. Despite the fact that society is generally better off with free trade, governments often impose trade barriers. Explain why government might take such action. Often, restrictions are imposed because of the political pressure of special interest groups. The political process may cause a bias in favor of the programs of special interest groups. These programs tend to bestow a large amount of benefits upon a few individuals (those that compose the special interest group). As a result of these large benefits, special interest groups may be willing to commit large quantities of resources to politicians to ensure passage of the desired program. These resources are beneficial to the politician because they can be used in political campaigns to ensure re-election. These same programs may generate large aggregate costs; however, because the costs are spread over all members of society, only a small cost upon may be imposed upon each individual. Because of this small individual cost, the majority may have no interest in devoting resources to ensure that the politician is not re-elected because of his or her support for inefficient programs. 13. Compare and contrast the global and regional approaches to reducing barriers to international trade. Both the global and regional approaches to reducing barriers to international trade are designed to enhance international trade. The global approach has been a series of international trade negotiations conducted under the auspices of the General Agreement on Tariffs and Trade (GATT). There have been eight rounds of negotiations in the post-World War II era. Each round has resulted in reductions in tariff rates. Under the regional approach, countries form regional trading blocs. Barriers to trade are reduced or eliminated for members of the bloc. Barriers are maintained against countries outside the bloc. The North American Free Trade Area and the European Union are two examples of such blocs. 14. What is the World Trade Organization (WTO)? Why are environmentalists and other groups disappointed in the WTO? Formed in 1995, the WTO is comprised of approximately 120 nations, including the United States. The organization was formed as a successor to the General Agreement on Tariffs and Trade (GATT). The WTO provides a framework for multilateral trade negotiations, issues ground rules for the conduct of international trade, and helps to resolve trade disputes. Most criticisms of the WTO date back to GATT, but environmentalists, in particular, have not been happy with GATT/WTO. Environmentalist groups disagreed with GATT in 1991 when GATT ruled against the United States’ embargo on tuna caught by foreign fleets (which endangered dolphins). In 1998, environmentalists were again upset with WTO when they ruled against U.S. restrictions on imports of shrimp caught in nets without adequate means to protect sea turtles. 15. Trade negotiations are complex and lengthy. Explain why they may be even more complex and time consuming in the future. Trade negotiations promise to become more complex in the future as some parties attempt to link the negotiations to labor and environmental standards. Those who favor this argue that less developed countries have poor working conditions and less stringent environmental standards than the U.S. Trade agreements offer an opportunity to raise those standards.

![Quiz About [Your Topic]](http://s3.studylib.net/store/data/009237721_1-467865351cf76015d6a722694bb95331-300x300.png)