Marginal Costing Answers

advertisement

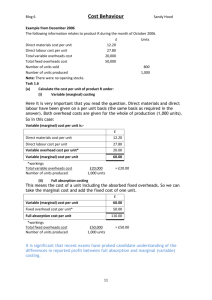

Activity 1 – Swifts Ltd a) Calculate the absorption cost of producing each set: Total costs per week: £ Direct materials 30000 Direct labour 20000 Production overheads 5000 Total cost 55000 The absorption cost of producing one set is: Total cost = 55000 = £1100 per unit Units of output 50 b) Calculate the total profit each week £ Selling price (£1750 x 50) 87500 Less Total cost 55000 equals Profit for the week 32500 Activity 2 - Voles Vending a) Calculate the absorption cost per coffee machine. Absorption cost per coffee machine: £ Direct materials 375 Direct labour 125 Fixed production overheads (160000/5000) = 32 Absorption Cost 532 b) Prepare a statement of profit or loss (Income Statement) to show the profit or loss is 5000 coffee machines are sold. £ £ Sales revenue (5000 x 640) 3200000 Direct materials (5000 x 375) 1875000 Direct labour (5000 x 125) 625000 Fixed production overheads 160000 Total Cost 2660000 Profit 540000 Activity 3 - Wyvern Bike Company a) Absorption cost of producing one bike: Direct Materials 40 Direct Labour 50 Production o/heads (£5000/100 bikes) 50 Absorption cost per bike 140 b) Statement of profit or loss for 100 bikes: £ Sales (£200 per bike) Less: Direct Materials (£40 per bike) Direct labour (£50 per bike) Production overheads £ 20,000 4,000 5,000 5,000 Production overheads Profit Activity 4 – A Factory Cost per unit: a) Absorption costing: Direct Materials 4.50 Direct Labour 7.85 Variable o/heads 1.60 Fixed o/heads (420,000/105,000) x 2 ½ hrs 10.00 Absorption cost per unit 23.95 Activity 5 - Voles Vending Using the data from Question 1 page 4, you are required to calculate: a) The marginal cost of producing one coffee machine The marginal cost of producing an item/unit, is the sum of the variable costs per item/unit. £ Direct materials 375 Direct labour 125 Marginal cost of one coffee machine 500 b) The contribution per coffee machine Contribution is calculated by: Selling price per unit – variable costs per unit (marginal costs) Selling price Variable costs Contribution £640 £500 £140 per coffee machine c) Prepare the profit statement using marginal costing for the proposed year’s production and sales of coffee machines. £ Sales £ 5000 x 640 = 3200000 Less Variable costs: Direct materials Direct labour 375 x 5000 = 1875000 125 x 5000 =625000 2500000 Contribution 700000 Less Fixed Costs 160000 Profit 540000 Activity 6 – Wyvern Bike Company a) The Marginal Cost of producing one bike: £ Direct Materials 40 Direct Labour Marginal cost per unit 50 90 (variable costs) b) The Contribution per bike: Selling Price per bike Less variable costs 200 90 Contribution c) The weekly profit statement (using Marginal costing) for 100 bikes is: £ £ Sales (£200 per bike) Less: Direct Materials (£40 per bike) Direct labour (£50 per bike) 20,000 4,000 5,000 9,000 Contribution 11,000 Less Fixed Costs (production o/heads) 5,000 Profit 6,000 Activity 7 - Return to activity 4 b) Marginal costing Direct Materials £4.50 Direct Labour Variable o/heads £7.85 £1.60 Marginal cost per unit Activity 8 - Chairs Limited Chairs Limited Profit Statement for the year ended 30 April 2014 Sales at £110 each Variable costs Direct Materials at £30 each Direct labour at £40 each Less Closing Stock (marginal cost) 500 chairs at £70 each (30 + 40) Fixed production overheads Less Closing stock (absorption costing) (500 chairs x £90) Less Cost of goods sold PROFIT £13.95 (b) Reconciliation of profit April 2014 Absorption costing profit 90,000 *Increase in stocks x Fixed Costs per unit (10,000) Marginal costing profit 80,000 *Increase in stock figure calculated by: Opening stock 0 Units produced 5000 Less units sold (4500) Increase in stocks 500 x £20 Fixed Costs = £10,000 Fixed costs are calculated by: £100,000 FC / 5,000 chairs produced = £20 per chair Notes: Closing stock is always calculated on the basis of this year’s costs: Marginal costing: Variable costs only i.e. £30 + £40 = £70 per chair Absorption costing: Variable and Fixed Costs i.e. £450,000 / 5,000 chairs = £90 OAR per chairs – remember that fixed production overheads are absorbed using this costing method!! The difference in the profit figures is caused only by the closing stock figures: Closing stock £35,000 under marginal costing [VC (DM £30 + DL £40) x 500 chairs = £35,000] Closing stock £45,000 under absorption costing [(VC (DM £30 + DL £40) + FC (£20)) x 500 chairs = £45,000] The same costs have been used, but fixed production overheads have been treated differently. o With marginal costing, the full amount of the fixed production overheads has been charged in this year’s profit statement (£100,000); o With absorption costing, part of the fixed production overheads (£20 OAR x 500 chairs = £10,000) has been carried forward in the stock valuation Activity 9 - MAXXA Limited MAXXA Limited Sales 3,000 units at £8 each Variable costs: Direct Materials at £1.25 each Direct labour at £2.25 each Less Closing Stock (marginal cost) 1,000 units at £3.50 each Fixed production overheads Less Closing stock (absorption cost) 1,000 units at £5 each Less Cost of goods sold PROFIT Marginal Costing Absorption Costing £ £ £ 24,000 5,000 9,000 14,000 5,000 9,000 3,500 10,500 6,000 6,000 20,000 5,000 16,500 7,500 Profit Statement for the month ended 31 May 2014 £ 24,000 15,000 9,000 Reconciliation of profit 31 May 2014 Absorption costing profit 9,000 *Increase in stocks x Fixed Costs per unit (1,500) Marginal costing profit 7,500 *Increase in stock figure calculated by: Opening stock 0 Units produced 4,000 Less units sold (3,000) Increase in stocks 1,000 x £1.50 Fixed Costs = £1,500 Fixed costs are calculated by: £6,000 FC / 4,000 units produced = £1.50 per unit Notes: Closing stock is calculated on the basis of this year’s costs: Marginal costing: Variable costs only i.e. £1.25 + £2.25 = £3.50 per unit Absorption costing: Variable and fixed costs i.e. £20,000 / 4,000 units = £5 per unit The difference in the profit is caused only by the closing stock figures: £3,500 under marginal costing, and £5,000 under absorption costing. With marginal costing, the full amount of the fixed production overheads has been charged in this year’s profit statement; by contrast, with absorption costing, part of the fixed production overheads has been carried forward in the stock valuation. Activity 10 - Product M Cost per unit: a) Absorption costing: £ Direct materials 12.20 Direct labour 8.00 Variable overhead 1.25 Prime cost 21.45 Plus fixed overheads (126000/60000 =OAR x 3hrs) 6.30 Absorption cost 27.75 b) Marginal costing: £ Direct materials 12.20 Direct labour 8.00 Variable overhead 1.25 Prime cost or marginal cost 21.45 Activity 11 - Product P Cost per unit: a) Absorption costing: £ Direct materials 16.00 Direct labour 21.00 Variable overhead 4.20 Prime cost 41.20 Plus fixed overheads (184275/81900 =OAR x 2hrs) 4.50 Absorption cost 45.70 b) Marginal costing: £ Direct materials 16.00 Direct labour 21.00 Variable overhead 4.20 Prime cost or marginal cost 41.20 Activity 12 - Product J First you need to calculate the marginal and absorption cost per unit, as you need these figures to calculate inventory figures.: £ Direct materials 8.50 Direct labour 30.00 Variable overhead (96000/(3x20000)) x 3hrs 4.80 Prime cost or marginal cost per unit 43.30 Plus fixed overheads (210000/60000)= 3.50 OAR x 3hrs) 10.50 Absorption cost per unit 53.80 Prepare the budgeted statement of profit or loss for November using: a) Absorption costing £ Sales £ £110 x 18000 units = 1980000 Less cost of sales: Opening inventory Production cost 1500 units x £53.80 = 80700 20000 units x £53.80 = 1076000 1156700 Less closing inventory 1500+20000-18000 = 3500 units x £53.80 = (188300) (968400) Profit 1011600 b) Marginal costing £ Sales £ 1980000 Less cost of sales: Opening inventory 1500 units x £43.30 = 64950 Production cost 20000 units x £43.30 = 866000 930950 Less closing inventory 3500 units x £43.30 = (151550) (779400) Contribution 1200600 Less Fixed overheads (210000) Profit 990600