CST/MGT ACCT: AFIN 210 SCHOOL OF BUSINESS AND

advertisement

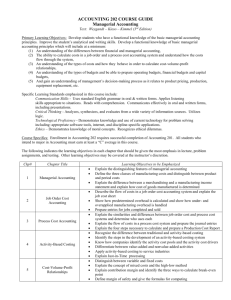

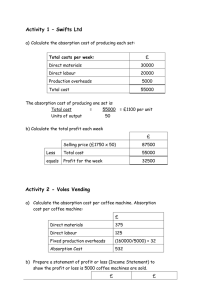

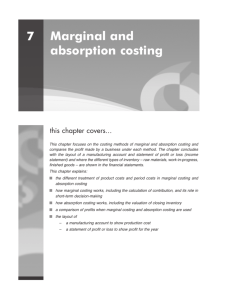

CST/MGT ACCT: AFIN 210 SCHOOL OF BUSINESS AND MANAGEMENT [FT/PT/DST] UNDERGRADUATE PROGRAMMES COURSE SYLLABUS COURSE NAME: COST AND MANAGEMENT ACCOUNTING COURSE CODE: AFIN 210 ______________________________________________________________________________ Course Objectives: The course combines two areas of accounting that are important. Cost Accounting and Management Accounting. The objectives of the course are to: i. Enable candidates understanding the relationship between of Cost Accounting, Management Accounting and Financial Accounting and the importance of this Accounting information. ii. Understand the various Concepts, Principles and Techniques Applied in Cost and Management Accounting. iii. Develop analytical skills and abilities for solving practical business problems using Cost and Management Accounting knowledge. Learning Outcomes: Upon completion of this course students should be able to: i. ii. iii. iv. Demonstrate a clear understanding of the value or importance of Cost and Management Accounting information in any business. Compute Costs/Prices and other Information for Decision making using Cost and Management Accounting Techniques/Methods. Prepare Cost and Management Accounting Reports for relevant use in an organization. Analyze business transactions and reports and provide advice for organizational decisions. 1 CST/MGT ACCT: AFIN 210 COURSE STRUCTURE: UNIT 1: Introduction i. Definition, Nature and Purpose of Cost and Management Accounting ii. Costing, Management and Financial Accounting relationship and differences UNIT 2: Cost Concepts, Classification, Behavior and Cost Determination i. Concept of Costs; Recording Costs; Analysis of Costs and Reporting; Cost Objects, Units; Cost Centers, ii. Costs Elements: Material, Labour, Other Expenses. iii. Cost Classification: Nature/Purpose/Function Direct and Indirect/Overhead Costs/ Period Costs. iv. Cost Behavior: Variable/Semi Variable and Fixed Costs v. Cost accumulation: Unit Cost, Prime Costs, Total costs. vi. Cost determination: High- Low method UNIT 3: Costing for Materials, Labour and Overheads i. Valuation/Inventory Management ii. Labour: Remuneration/incentive schemes/Turnover iii. Overhead Costs: Nature iv. Absorption Costing [Allocation, Apportionment Absorption, Under/Over Absorption, Reconciliation]. v. Marginal Costing vi. Absorption vs. Marginal Costing vii. Activity Based Costing(ABC) UNIT 4: Cost Accounting Techniques/Systems i. Job and Batch Costing ii. Process Costing/Joint/By-Products iii. Contract Costing iv. Service Costing UNIT 5: Cost-Volume-Profit Analyses (CVP) i. Contribution, Breakeven (B.E) point; margin of safety; contribution, graphical representations of B.E. ii. Terminology: Relevant/Avoidable/Sunk/Opportunity/Incremental/Marginal Costs iii. Decision Making: Make or Buy, Divestment, Limiting Factors Decisions. UNIT 6: Standard Costing and Variance Analysis i. Establishment of Standards and types of standards ii. Variance Analysis: Material,Labour,Overhead, Sales and Volume Variances 2 CST/MGT ACCT: AFIN 210 UNIT 7: i. ii. iii. iv. v. Management Control Systems Organizational Controls Types of Control Advantages and Disadvantages of Controls Responsibility Centers: Cost,Revenue,Pofit,Investment Controllability principal UNIT 8: Budgeting Process i. ii. iii. iv. Nature of budgets and the budgetary process, types of budgets; role of budgets; benefits and limitations of budgets. Preparation of Sales,Materials,Labour,Overheads and Master Budget; Preparation of Cash budget and Flexible Budgets. The Characteristics of Activity Based Budgets (ABB), Zero Base Budget (ZBB). Assessment Criteria: FT/PT Students Test and Assignments: Mid Semester Examination Final Examination: Total Marks: DST Students Test and Assignments: Final Examination: Total Marks: Reference Materials: 1. 2. 3. 4. 5. 20% 20% 60% 100% 40% 60% 100% Costing Terry Lucey DPP (7th ) edition. ZICA T2 Costing Text Management and Cost Accounting C. Drury (7th ) edition Management Accounting Terry Lucey (5th) edition [special edition] Managerial Accounting for business decisions Ray Proctor 3