Blog 6 Cost Behaviour Sandy Hood Example from December 2006 The

advertisement

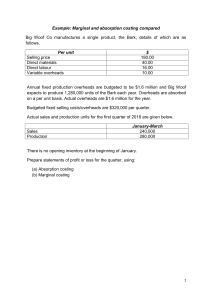

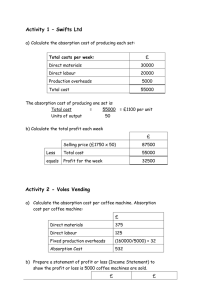

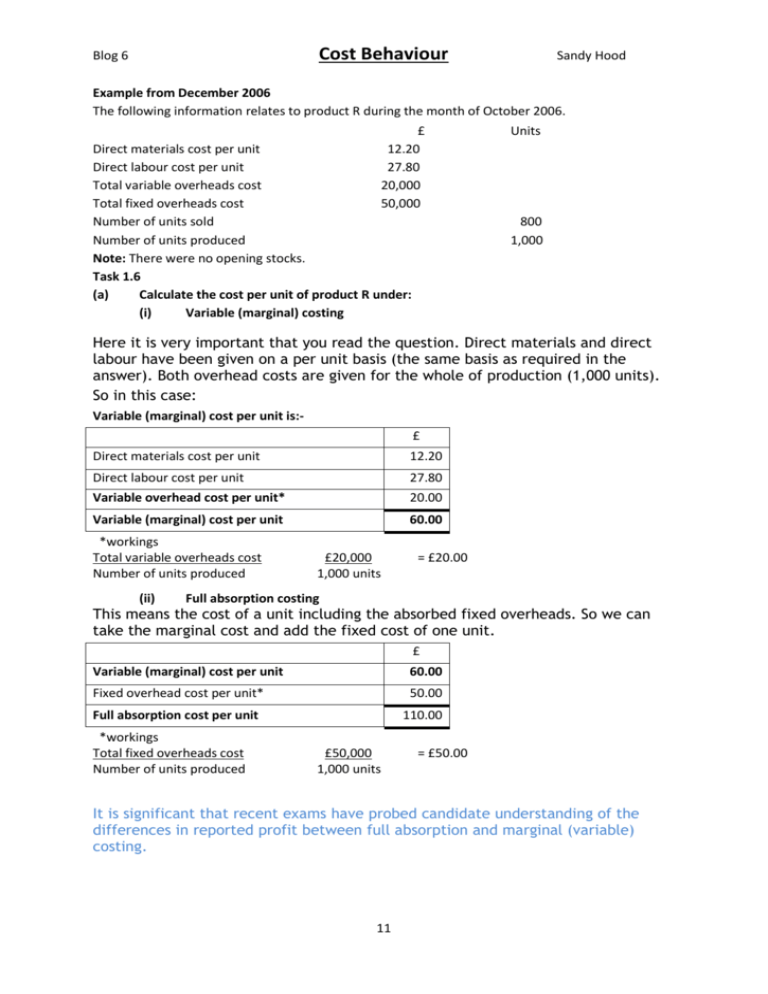

Cost Behaviour Blog 6 Sandy Hood Example from December 2006 The following information relates to product R during the month of October 2006. £ Units Direct materials cost per unit 12.20 Direct labour cost per unit 27.80 Total variable overheads cost 20,000 Total fixed overheads cost 50,000 Number of units sold 800 Number of units produced 1,000 Note: There were no opening stocks. Task 1.6 (a) Calculate the cost per unit of product R under: (i) Variable (marginal) costing Here it is very important that you read the question. Direct materials and direct labour have been given on a per unit basis (the same basis as required in the answer). Both overhead costs are given for the whole of production (1,000 units). So in this case: Variable (marginal) cost per unit is:£ Direct materials cost per unit 12.20 Direct labour cost per unit 27.80 Variable overhead cost per unit* 20.00 Variable (marginal) cost per unit 60.00 *workings Total variable overheads cost Number of units produced (ii) £20,000 1,000 units = £20.00 Full absorption costing This means the cost of a unit including the absorbed fixed overheads. So we can take the marginal cost and add the fixed cost of one unit. £ Variable (marginal) cost per unit 60.00 Fixed overhead cost per unit* 50.00 Full absorption cost per unit 110.00 *workings Total fixed overheads cost Number of units produced £50,000 1,000 units = £50.00 It is significant that recent exams have probed candidate understanding of the differences in reported profit between full absorption and marginal (variable) costing. 11 Cost Behaviour Blog 6 Sandy Hood The previous example comes from the December 2006 exam, task 1.6 (a). Recent exams (for example December 2009) have gone further and asked for profit and loss accounts under each type of costing. If we know the selling price of product R is £180 per unit we can produce profit and loss accounts under each type of costing: Marginal costing (MC) £ £ Sales Opening stock Variable production costs Closing stock Cost of sales (MC basis) Contribution Fixed costs Profit As in the previous questions, I recommend adding a column (or two) as below: £ per unit units Sales 180 £ £ 800 144,000 Opening stock Variable production costs 60 1000 60,000 Closing stock 60 200 12,000 Cost of sales (MC basis) 60 800 48,000 120 800 96,000 Contribution 0 - Fixed costs 50,000 Profit 46,000 By adding the unit column you are merely copying out figures calculated earlier and adding a contribution per unit ~ in this case £120 I added the unit column so we can see a physical summary in terms of units. 12 Cost Behaviour Blog 6 Sandy Hood The alternative profit and loss account is under full absorption costing (FAC) principles. £ £ Sales Opening stock Production costs Closing stock Cost of sales (FAC basis) Profit £ per unit units Sales 180 £ £ 800 Opening stock 144,000 0 - Production costs 110 1000 110,000 Closing stock 110 200 22,000 Cost of sales (FAC basis) 110 800 88,000 Profit 56,000 The two different approaches to costing have given two different profits. This difference is entirely explained by the treatment of fixed overheads. In the marginal costing method, fixed costs are all charged to the profit and loss as a cost of the “accounting period”. No attempt is made to charge fixed costs to the product. In the full absorption costing method, fixed costs are divided between the units produced to give a product cost that includes all the variable costs of production and the fixed costs on a unit basis. I recommend that you attempt tasks 2.1 and 2.2 from the December 2009 exam. CPL is considering what the effect would be of costing its products under marginal costing (MC) principles, instead of under full absorption costing (FAC) principles that it currently follows. The following information relates to one of the company’s products: Selling price per unit £12 Prime cost per unit £4 Variable production overhead cost per unit* £3 Budgeted fixed production overhead £30,000 per month Budgeted production 15,000 units per month Budgeted sales 12,000 units per month Opening stock 2,000 units *I added the word “overhead” to the original question (for clarity) 13 Cost Behaviour Blog 6 Task 2.1 (14 minutes) (a) Calculate the contribution per unit (on a MC basis): (b) Calculate the profit per unit (on a FAC basis): 14 Sandy Hood