I. Job Costing

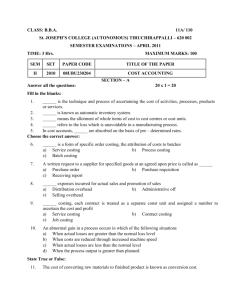

advertisement

Chapter 6 Job Order Costing System The term ‘costing’ refers to the techniques and processes of determining costs of a product manufactured or services rendered. The first stage in cost accounting is to ascertain the cost of the product offered or the services provided. In order to do the same, it is necessary to follow a particular method of ascertaining the cost. The methods of costing are applied in various business units to ascertain the cost of product or service offered. Different methods of costing are required to be used in different types of businesses. For example, costing methods used in a manufacturing business will differ from the methods used in a business that is offering services. Even in a manufacturing business, some business units may have production in a continuous process, i.e. output of a process is an input of the subsequent process and so on, while in some businesses production is done according to the requirements of customers and hence each job is different from the other one. Different methods of costing are used to suit these diverse requirements. These methods of costing are discussed in detail in this chapter. Methods of Costing As mentioned in the above paragraph, the methods of costing are used to ascertain the cost of product or service offered by a business organization. There are two principle methods of costing. These methods are as follows I. Job Costing II. Process Costing 1 Q.1. What do you mean by methods of costing? Ans.1. Methods of costing are used to ascertain the cost of product or service offered by a business organization. Q.2. There are two principle methods of costing. I. Job Costing II. Process Costing (True) Other methods of costing are the variations of these two principle methods. The variations of these methods of costing are as follows. I. Job Costing: Batch Costing, Contract Costing, Multiple Costing. II. Process Costing: Unit or Single Output Costing, Operating Costing, Operation Costing. The Job Costing and its variations are discussed in detail in the following paragraphs. I. Job Costing: This method of costing is used in Job Order Industries where the production is as per the requirements of the customer. In Job Order industries, the production is not on continuous basis, rather it is only when order from customers is received and that too as per the specifications of the customers. Consequently, each job can be different from the other one. Method used in such type of business organizations is the Job Costing or Job Order Costing. The objective of this method of costing is to work out the cost of each job by preparing the Job Cost Sheet. A job may be a product, unit, batch, sales order, project, contract, service, specific program or any other cost objective that is distinguishable clearly and unique in terms of materials and other services used. The cost of completed job will be the materials used for the job, the direct labor 2 employed for the same and the production overheads and other overheads if any charged to the job. The following are the features of job costing. It is a specific order costing A job is carried out or a product is produced to meet the specific requirements of the order Job costing enables a business to ascertain the cost of a job on the basis of which quotation for the job may be given. While computing the cost, direct costs are charged to the job directly as they are traceable to the job. Indirect expenses i.e. overheads are charged to the job on some suitable basis. Each job completed may be different from other jobs and hence it is difficult to have standardization of controls and therefore more detailed supervision and control is necessary. At the end of the accounting period, work in progress may or may not exist. Q.3. Job costing is used in Job Order Industries where the production is as per the requirements of the____________. Ans.3. Customer Q.4. In Job Order industries, the production is on continuous basis, rather it is only when order from customers is received and that too as per the specifications of the customers. (False) Ans.4. In Job Order industries, the production is not on continuous basis, rather it is only when order from customers is received and that too as per the specifications of the customers. (True) 3 Methodology used in Job Costing As discussed above, the objective of job costing is to ascertain the cost of a job that is produced as per the requirements of the customers. Hence it is necessary to identify the costs associated with the job and present it in the form of job cost sheet for showing various types of costs. Various costs are recorded in the following manner. Direct Material Costs: Material used during the production process of a job and identified with the job is the direct material. The cost of such material consumed is the direct material cost. Direct material cost is identifiable with the job and is charged directly. The source document for ascertaining this cost is the material requisition slip from which the quantity of material consumed can be worked out. Cost of the same can be worked out according to any method of pricing of the issues like first in first out, last in first out or average method as per the policy of the organization. The actual material cost can be compared with standard cost to find out any variations between the two. However, as each job may be different from the other, standardization is difficult but efforts can be made for the same. Direct Labor Cost: This cost is also identifiable with a particular job and can be worked out with the help of ‘Job Time Tickets’ which is a record of time spent by a worker on a particular job. The ‘job time ticket’ has the record of starting time and completion time of the job and the time required for the job can be worked out easily from the same. Calculation of wages can be done by multiplying the time spent by the hourly rate. Here also standards can be set for the time as well as the rate so that comparison between the standard cost and actual cost can be very useful. 4 Direct Expenses: Direct expenses are chargeable directly to the concerned job. The invoices or any other document can be marked with the number of job and thus the amount of direct expenses can be ascertained. Overheads: This is really a challenging task as the overheads are all indirect expenses incurred for the job. Because of their nature, overheads cannot be identified with the job and so they are apportioned to a particular job on some suitable basis. Predetermined rates of absorption of overheads are generally used for charging the overheads. This is done on the basis of the budgeted data. If the predetermined rates are used, under/over absorption of overheads is inevitable and hence rectification of the same becomes necessary. Work in Progress: On the completion of a job, the total cost is worked out by adding the overhead expenses in the direct cost. In other word, the overheads are added to the prime cost. The cost sheet is then marked as ‘completed’ and proper entries are made in the finished goods ledger. If a job remains incomplete at the end of an accounting period, the total cost incurred on the same becomes the cost of work in progress. The work in progress at the end of the accounting period becomes the closing work in progress and the same becomes the opening work in progress at the beginning of the next accounting period. A separate account for work in progress is maintained. Q.5. The source document for ascertaining direct material cost is the ___________________from which the quantity of material consumed can be worked out. Ans.5. Material requisition slip 5 Q.6.Direct labor cost is identifiable with a particular job and can be worked out with the help of ________________which is a record of time spent by a worker on a particular job. Ans.6. ‘Job Time Tickets’ Q.7. If a job remains incomplete at the end of an accounting period, the total cost incurred on the same becomes the cost of work in progress. (True) Advantages of Job Costing The following are the advantages of job costing. Accurate information is available regarding the cost of the job completed and the profits generated from the same. Proper records are maintained regarding the material, labor and overheads so that a costing system is built up. Useful cost data is generated from the point of view of management for proper control and analysis. Performance analysis with other jobs is possible by comparing the data of various jobs. However it should be remembered that each job completed may be different from the other. If standard costing system is in use, the actual cost of job can be compared with the standard to find out any deviation between the two. Some jobs are priced on the basis of cost plus basis. In such cases, a profit margin is added in the cost of the job. In such situation, a customer will be willing to pay the price if the cost data is reliable. Job costing helps in maintaining this reliability and the data made available becomes credible. Limitations of Job Costing Job costing suffers from certain limitations. 6 These are as follows. It is said that it is too time consuming and requires detailed record keeping. This makes the method more expensive. Record keeping for different jobs may prove complicated. Inefficiencies of the organization may be charged to a job though it may not be responsible for the same. In spite of the above limitations, it can be said that job costing is an extremely useful method for computation of the cost of a job. The limitation of time consuming can be removed by computerization and this can also reduce the complexity of the record keeping. Q.8. What are the limitations of the job costing? Ans.8. Limitations of Job costing are as follows. It is said that it is too time consuming and requires detailed record keeping. This makes the method more expensive. Record keeping for different jobs may prove complicated. Inefficiencies of the organization may be charged to a job though it may not be responsible for the same. Q.9. Write the advantages of job costing. Ans.9. Following are the advantages of job costing. Accurate information is available regarding the cost of the job completed and the profits generated from the same. Proper records are maintained regarding the material, labor and overheads so that a costing system is built up. Useful cost data is generated from the point of view of management for proper control and analysis. 7 Performance analysis with other jobs is possible by comparing the data of various jobs. However it should be remembered that each job completed may be different from the other. If standard costing system is in use, the actual cost of job can be compared with the standard to find out any deviation between the two. Some jobs are priced on the basis of cost plus basis. In such cases, a profit margin is added in the cost of the job. In such situation, a customer will be willing to pay the price if the cost data is reliable. Job costing helps in maintaining this reliability and the data made available becomes credible. Format of Job Cost Sheet The format of job cost sheet is given below. XYZ LTD. JOB ORDER COST SHEET Customer Invoice No. Selling Price Per Unit: Cost Per Unit: Date: Job Order No: Total Cost Product Description Particulars Direct Materials: Dept I Dept II Dept III Total Direct Labor Overheads Total Costs Dates and Ref. No. 8 Total Amount [SR ] Per Unit [SR] Example 6.1 A factory uses a job costing system. The following data are available from the books at the year ending on 31st March 2014. Particulars Amount [SR] Direct Materials Direct Wages Profit Selling and Distribution Overheads Administrative Overheads Factory Overheads 1800000 1500000 1218000 1050000 840000 900000 Required: A. Prepare a job cost sheet showing the prime cost, works cost, production cost, cost of sales and sales value. B. In the year 2014-15, the factory has received an order for a number of jobs. It is estimated that the direct materials would be SR2400000 and direct labor would cost SR1500000. What would be the price for these jobs if the factory intends to earn the same rate of profit on sales, assuming that the selling and distribution overheads have gone up by 15%. The factory recovers factory overhead as a percentage of direct wages and administrative and selling and distribution overhead as a percentage of works cost, based on the cost rates prevalent in the previous year. 9 Solution: The Job Cost Sheet is shown below Particulars Total Amount [SR ] Total Amount [SR ] Direct Costs: - Direct Materials 1800000 Direct Labor 1500000 3300000 Prime Cost [Direct Materials + Direct Labor] Factory Overheads 900000 Factory/Works Cost [Prime Cost + Factory 4200000 Overheads] Administrative Overheads 840000 Cost of Production [Factory Cost + Administrative 5040000 Overheads] Selling and Distribution Overheads 1050000 Cost of Sales [Cost of Production + Selling 6090000 and Distribution Overheads Profit [As Given ] 1218000 Sales [Cost of Sales + Profit ] 7308000 % of Factory Overheads to Direct Wages: SR900000/1500000*100 = 60% % of Administrative Overheads to Works Cost: SR840000/4200000 *100 = 20% % of Selling and Distribution Overheads to Works Cost: SR1050000/4200000*100 =25% B. Statement showing Price Quotation for a Job Particulars Direct Costs: - Direct Materials Direct Labor Prime Cost [Direct Materials + Direct Labor] Factory Overheads– 60% of Direct Labor Factory/Works Cost [Prime Cost + Factory Overheads] Administrative Overheads –20% of Works Cost Cost of Production [Factory Cost + Administrative Overheads] Selling and Distribution Overheads 28.75% of Works Cost [25% + 15% = 28.75%] Cost of Sales [Cost of Production + Selling and Distribution Overheads Profit 16.67 % of Sales [20% on cost] Sales [Cost of Sales + Profit ] 10 Total Amount [SR ] 2400000 1500000 Total Amount [SR ] 3900000 900000 4800000 960000 5760000 1380000 7140000 1428000 8568000 Example 6.2 The following information for the year ended on 31st March 20014 is obtained from the books and records of a manufacturing company. Particulars Raw material supplied from stores Wages Chargeable expenses Material returned to stores Completed Jobs SR. 88000 100000 10000 1000 Work In Progress SR. 32000 40000 4000 --------------- Factory overheads are 80% of wages. Office overheads are 25% of factory cost and selling and distribution overheads are 10% of cost of production. The completed jobs realized SR410000. Prepare: Work in Progress Ledger Control Account, Completed Job Ledger Control Account and Cost of Sales Account. Solution: Consolidated Work-in-Progress Account Dr. Particulars Raw materials consumed Wages Chargeable expenses Factory overheads [80% of wages] Factory cost Administrative overheads [25% of SR 108 000] Total Amount (SR) 32 000 40 000 4000 32000 Particulars Cr. Amount (SR) 108 000 27 000 135000 Note: In the above account, selling and distribution overheads are not charged. 11 Consolidated Completed Job Account Dr. Particulars Raw Materials: SR88 000 Less: Returns 1 000 Wages Chargeable Expenses Factory overheads [80% of direct wages] Factory Cost Administration overheads [25% of SR 277 000] Cost of production Selling and distribution expenses Net profit transferred to Profit and Loss A/c Total Amount (SR) Particulars 87000 Customer’s Account 100000 10000 80000 277 000 69250 Cr. Amount (SR) 410000 346 250 34 625 29 125 410 000 410 000 Cost of Sales Account Dr. Particulars Materials consumed Wages Direct charges Factory overheads [80% of wages] Factory cost Administrative overheads [25% of SR277 000] Cost of production Selling and distribution 10% of Cost of production Cost of sales Amount (SR) Particulars 87 000 Balance c/d 100 000 10000 80 000 277 000 69250 Cr. Amount (SR) 380875 346250 34625 380875 12 380875 Example 6.3 A company has two manufacturing shops. The shop floor supervisor presented the following cost for Job No. A to determine the selling price. Particulars Material Direct wages Department X–8 hours, Department Y – 6 hours = 14 hours @ SR.2.50 per hour Chargeable expenses [stores] Amount SR. Per Unit 70 35 5 110 37 Add: 33 1/3 % for overheads 147 Analysis of the Profit and Loss A/c shows the following Dr. Profit and Loss Account Particulars To Materials used To Direct wages Department X Department Y To Stores expenses To Overheads Department X Department Y To Gross profit c/d Total Amount SR. Particulars 1,50,000 By Sales less returns Cr. Amount SR. 2,50,000 10,000 12,000 4,000 5,000 9,000 60,000 2,50, 000 Total 2,50, 000 It is noted that average hourly rates for the two departments, X and Y are similar. You are required to [a] Draw up a job cost sheet [b] Calculate the revised cost using overheads figures as shown in the profit and loss account as the basis of charging overheads to department X and Y. [c] Add 20% of total cost to determine selling price. 13 Solution: Calculation of Overhead Absorption Rates Based on Direct Labor Hour Rate Particulars I] Direct wages as per Profit and Loss A/c II] Direct wage rate per hour III] Direct labor hours [I /II] IV] Overheads V] Overheads rate per labor hour [IV / III] Department X SR10, 000 SR2.50 4, 000 hours SR5000 SR1.25 Department Y SR12, 000 SR2.50 4, 800 hours SR9000 SR1.875 Calculation of Overhead Absorption Rates Based on Percentage of Direct Wages Particulars Department X SR5000 SR10, 000 50% Overheads Direct wages % of overheads to direct wages Department Y SR9000 SR12, 000 75% Job Cost Sheet [Overheads absorption on the basis of Direct Labor Hour Rate] Particulars Material Direct wages: Department X: SR2.50 * 8 hours = SR20.00 Department Y: SR2.50 * 6 hours = SR15.00 Chargeable expenses Prime Cost [Material + Labor + Chargeable expenses] Overheads: Department X: SR1.25 * 8 hours = SR10.00 Department Y: SR1.875 * 6 hours = SR11.25 Total Cost Add: Profit 20% on cost Value of Job A 14 Amount SR. Per Unit 70.00 35.00 5.00 110.00 21.25 131.25 26.25 157.50 Job cost sheet [overhead absorption rate based on percentage of direct wages] Particulars Material Direct wages: Department X: SR2.50 * 8 hours = SR20.00 Department Y: SR2.50 * 6 hours = SR15.00 Chargeable expenses Prime Cost [Material + Labor + Chargeable expenses] Overheads: Department X: 50% of SR.20 = SR.10.00 Department Y: 75% of SR.15 = SR.11.25 Total Cost Add: Profit 20% on cost Value of Job A Amount SR. Per Unit 70.00 35.00 5.00 110.00 21.25 131.25 26.25 157.50 Example 6.4 From the following details, you are required to calculate the cost of Job No.215 and find out the price to give a profit of 25% on total cost Materials SR 2000 Wages Dept. - A -30 hours @ SR3 per hour B -20 hours @ SR2 per hour C- 10 hours @ SR5 per hour Overhead expenses for these three departments were estimated as follows: Variable Overheads Dept. - A- SR 1,000 for 1,000 labour hours B- SR 6,000 for 3,000 labour hours C- SR 2,000 for 400 labour hours Fixed Overheads Estimated at SR l0000 for 5000 normal working hours 15 Solution: Job Cost Sheet (Job. No.2I5) Amounts SR Direct Materials Wages Dept. A =30hrs x SR 3 = 90 B =20hrs x SR 2 = 40 C =10 hrs x SR 5= 50 Amounts SR 2000 180 Variable Overheads Dept. A = 30 x (SR 1,000 /1,000 hrs) = 30 Dept. B = 20 x (SR 6,000 /3,000 hrs) = 40 Dept. C = l0 x (SR 2,000 /400 hrs) = 50 Fixed Overheads 60 hrs x (SR 10,000 /5,000 hrs) = Total Cost Profit 25% on total cost [(25/100) x 2,420] = Selling Price 120 120 2,420 605 SR 3,025 Example 6.5 The information given below has been taken from the records of an engineering works in respect of Job. No. 111 and Job. No. 222. Job. No.111 Job. No.222 SR SR Materials Supplied 5,000 3,000 Wages Paid 1,100 800 Direct Expenses 400 200 Material transferred from 222 to 111 300 300 Materials return to stores 200 You are required to find out the cost of each of Job and calculate profit or loss if any assuming that Job No. 222 is completed and invoiced to the customer at SR 4000/-. 16 Solution: Job. No. 111 Particulars To Materials To Wages To Direct Expenses To Material transferred From Job. No. 222 To Balance b/d Amount SR Particulars 5,000 By Balance c/d 1,100 400 300 6,800 6,800 Amount SR 6,800 6,800 Job. No. 222 Particulars To Materials To Wages To Direct Expenses To P & L a/c (Profit transferred) Amount SR Particulars 3,000 By Materials transferred 800 to Job. No. III 200 By Materials return to stores By Sales 500 4,500 Amount SR 300 200 4,000 4,500 Question 1 The accounts of the RR Engineering Company Ltd. show the following cost figures for 2013: SR Materials consumed 350000 Direct manual and machine labour wages 270000 Works overhead expenses 810000 General overhead expenses 56000 Show the work cost and the total cost of manufacture, the percentages that the works overheads bear to the direct manual and machine labour cost and the percentage that the general overheads bear to the works cost. What price should the company quote to manufacture a refrigerator which is estimated to require on expenditure of SR 7200 in materials and SR 6000 in wages so that it will yield a profit of 20% on the selling price? 17