Identification Subject (code, title, credits) ACC 801: Financial

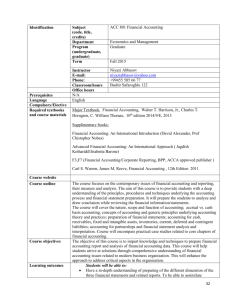

Identification Subject

(code, title, credits)

Department

Program

(undergraduate, graduate)

Term

ACC 801: Financial Accounting - 3KU/6ECTS credits

Economics and Management

MBA

Fall 2015

Instructor

N/A

Mirismayil Seyidov

E-mail: mirismayil.seyidov@gmail.com

Phone:

Classroom/hours Bashir Safaroghlu 122, Room #,

Office hours

Prerequisites

Language

Compulsory/Elective

English

Required textbooks and course materials

Walter T. Harrison, Charles T. Horngren, C. William Thomas, Financial Accounting

,10 th edition 2014

Course website

Course outline

Course objectives

Learning outcomes

Teaching methods

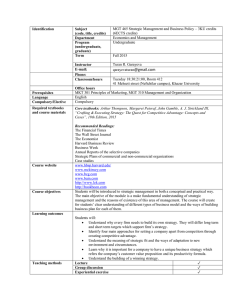

Financial Accounting course is concerned with analyzing financial performance and position of different companies using Financial Statements. The topics include understanding basic accounting concepts and principles and preparation analyzing of

Financial Statements. Students will need to demonstrate technical proficiency in the use of double entry techniques, including the preparation of basic financial statements for incorporated and unincorporated entities, as well as simple consolidated financial statements for group incorporated entities. Students also need to be able to conduct a basic interpretation of financial statements.

The main objective of this course is to give the students knowledge of preparation of financial statements and analysis of financial accounting data.

Students will be able to:

Analyze Financial Statements of different companies;

Prepare Income Statements, Statement of Financial Position, Statement of

Equity and Cash Flow Statement;

Calculate the closing inventory using different methods such as FIFO, LIFO and AVCO;

Calculate the amount of depreciation of PPE using different methods such as

Straight Line and Reducing method;

Explain the difference between the cash basis and accrual accounting;

Analyze the financial performance and position of companies through financial ratios;

Explain the difference between US GAAP and IFRS;

Lecture

Group discussion

Experiential exercise

Case analysis

Simulation

Problem Solving

Others

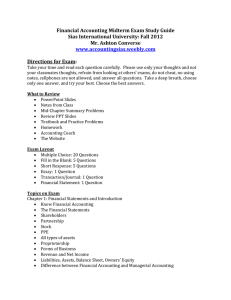

Evaluation Methods Date/deadlines Percentage (%)

Midterm Exam 25

32

Case studies

Class Participation

Assignment and quizzes

Project

Presentation/Group

Discussion

Final Exam

Others

Total

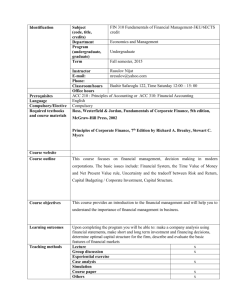

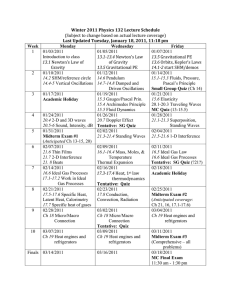

Tentative Schedule

Topics

5

20

10

40

100

Policy

Date/Day

(tentative)

Textbook/Assignments

7

8

5

6

1

2

3

4

14.09.2015 Introduction of Financial Accounting; Financial Statements

21.09.2015 The use of double entry – Transaction analysis

28.09.2015 Accrual Accounting & Income

5.10.2015 Internal Control & Cash – Quiz 1

12.10.2015 Short term investments & Receivables

19.10.2015 Inventory & Cost of Goods Sold

26.10.2015 Plant Assets, Natural Resources, & Intangibles- Quiz 2

02.11.2015 Midterm exam & Preparation of financial statements

9 09.11.2015 Long-Term Investments & the Time Value of Money

10 16.11.2015 Liabilities

11 23.11.2015 Stockholders’ Equity– Quiz 3

12 30.11.2015 The Income Statement, the Statement of

Comprehensive Income, & the Statement of

Stockholders’ Equity

13 7.12.2015 The Statement of Cash Flows

14 14.12.2015 Financial Statement Analysis– Quiz 4

15 21.12.2015 Interpretation of financial statements and calculation of ratios - Presentation

16 TBA Final exam

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Chapter 7

Handouts

Chapter 8

Chapter 9

Chapter 10

Chapter 11

Chapter 12

Chapter 13

Chapter 13

33