Identification Subject (code, title, credits) ACC 801 Financial

advertisement

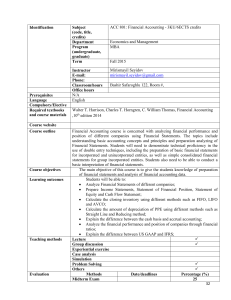

Identification Prerequisites Language Compulsory/Elective Required textbooks and course materials Subject (code, title, credits) Department Program (undergraduate, graduate) Term ACC 801 Financial Accounting Instructor E-mail: Phone: Classroom/hours Office hours N/A English Niyazi Abbasov niyaziabbasov@yahoo.com +99455 505 66 77 Bashir Safaroghlu 122 Economics and Management Graduate Fall 2015 Major Textbook. Financial Accounting, Walter T. Harrison, Jr., Charles T. Horngren, C. William Thomas, 10th edition 2014/9/E, 2013 Supplimentary books: Financial Accounting: An International Introduction (David Alexander, Prof Chistopher Nobes) Advanced Financial Accounting: An International Approach ( Jagdish Kothari&Elisabetta Barone) F3,F7 (Financial Accounting/Corporate Reporting, BPP, ACCA approved publisher ) Carl S. Warren, James M. Reeve, Financial Accounting , 12th Edition 2011 Course website Course outline Course objectives Learning outcomes The course focuses on the contemporary issues of financial accounting and reporting, their measure and analysis. The aim of this course is to provide students with a deep understanding of the principles, procedures and techniques underlying the accounting process and financial statement preparation. It will prepare the students to analyze and draw conclusion while reviewing the financial information/statements. The course will cover the nature, scope and function of accounting; accrual vs. cash basis accounting, concepts of accounting and generic principles underlying accounting theory and practices; preparation of financial statements; accounting for cash, receivables, fixed and intangible assets, inventories, current, deferred and contingent liabilities; accounting for partnerships and financial statement analysis and interpretation. Course will encompass practical case studies related to core chapters of financial accounting. The objective of this course is to impart knowledge and techniques to prepare financial accounting report and analysis of financial accounting data. This course will help students arrive at solutions through comprehensive understanding of financial accounting issues related to modern business organization. This will enhance the approach to address critical aspects in the organization. Students will be able to: Have a in-depth understanding of preparing of the different dimension of the three financial statements and related reports. To be able to assimilate 32 Teaching methods Evaluation information from the statements for strategic decision making. Effectively use the understanding of accounting principles to enable the computation of the calculations that go into the preparation of financial reports Lecture Group discussion Experiential exercise Case analysis Simulation Problem Solving Others Methods Date/deadlines Percentage (%) Midterm Exam 25 Case studies Class Participation 10 Assignment/ quizzes (4) 25 Project Presentation/Group Discussion Final Exam 40 Others Total 100 Week Policy Date/Day (tentative) 1 2 3 17.09.2015 24.09.2015 4 5 6 7 8 9 10 11 08.10.2015 15.10.2015 22.10.2015 29.10.2015 05.11.2015 12.11.2015 19.11.2015 26.11.2015 12 13 14 15 16 01.10.2015 03.12.2015 10.12.2015 17.12.2015 24.12.2015 Tentative Schedule Topics The Financial Statements Holiday Transaction Analysis Accrual Accounting and income Internal control and cash (Revision class and Quiz 1) Short term investments and receivables Inventory and cost of goods sold Plant assets Natural Resources Intangibles (Quiz 2) Long term investments and time value of money Midterm Exam Liabilities Stockholders Equity The Income Statement and Statement of comprehensive income (Quiz 3) Statement of cash flows Financial Statement Analysis (Revision class and Quiz 4) Revision Final exam Textbook/Assignments Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 33