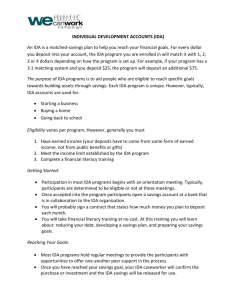

IDA Program

advertisement

IDA Program Angelita Hernandez and Gwendy Brown Lenders for Community Development Asset Building Through an IDA I D A stands for : Individual stands for: Development stands for: Account A matched savings account 1. Provides money management training 2. Helps you pay for College or start your own business Matched Saving Account For every $1 you save, receive $2 in matched funds Save up to $2,000, earn up to $4,000 in matched funds Do The Math $2,000 (your savings) $4,000 (matched funds) $6,000 (total funds) Part 1: Money Management • • • • 12 hours of free workshops on: – Budgeting – Saving and goal setting – Credit building and repair Held on evenings and weekends Free childcare and meals provided Spanish and Vietnamese classes available Part 2: Saving for your Goal • Open a free IDA account, with Citibank • Save between $20 and $167 per month • Save every month for 1-2 years • Enroll in automatic deposit service from checking account ZERO Risk With An IDA Account • Your savings are always yours: No penalties for exiting the program • Emergencies allowed • 2,000 people have joined since 1999. Part 3: Investing in your Education • Use money for post-secondary education for yourself, your spouse and your dependents. • Eligible schools include: – Vocational/technical schools – Community College – University and graduate school • Start spending money after 6 months • Access money for 2 years Education: Can I use IDA Funds for? Yes No Tuition Fees Books Supplies Equipment Room & Board Student loans Electronics Car/transportation Parking IDA Savings Period: An Example Sara starts saving in October 2007 She saves $100 per month. October 2007 March 2008 September 2008 6 months Sara begins saving $100 per month Sara has saved $600 and earned $1,200. She can now pay for her school expenses at Cañada College. Sara has transferred to SJSU. She and now spends IDA funds every semester for tuition, fees and books. September 2009 Sara has spent all $6,000 of her IDA money on school and is on the way to her degree! How To Qualify? • Be 16 years or older • Have earned income (and/or CalWORKS) • Speak English or Spanish • Have “reasonable” credit • Earn less than income limits (see next slide) IDA Income Limits-2006 Persons in Family or Household Gross Income 1 $19,600 2 $26,400 3 $33,200 4 $40,000 5 $46,800 6 $53,600 7 $60,400 8 $67,200 For each additional person, add $6,800 Should I apply? 1. Do you (and/or your parents) work and earn less than income limits? 2. Do you need money for school now or plan to transfer in the next year? 3. Do you want to learn more about how to manage your money and achieve your financial goals? If the answer is YES, Please fill out an application and sign up for a 1-on-1 appointment. The 1-on-1 takes about 30 minutes, please bring: • Photo ID • Proof of income (2006 taxes for you and/or your parents, or 4 recent pay stubs) Questions? Contact: Gwendy Donaker Brown 408-516-4688 gwendy@L4CD.com OR Angelita Hernandez 408-516-4699 angelita@L4CD.com