Financing Options in Today's Market

advertisement

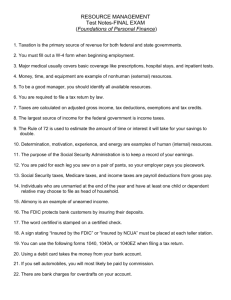

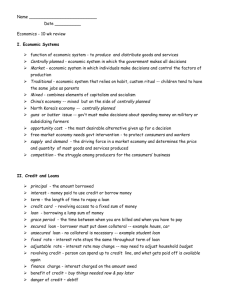

Financing Options in Today’s Market Searching for capital to grow your small business? Understanding current financing options in today’s market from MultiFunding CEO and Entrepreneur columnist Ami Kassar. MultiFunding 921A Bethlehem Pike Suite 206, Ambler PA 19002 1-800-276-0690 Financing Options in Today’s Market Color Key*: ■ High Complexity, Highest Rates, Longest Timeframe to Fund (60+ Days) ■ Low Complexity, Competitive Rates, Fastest Timeframe to Fund (1-30 Days) ■ Medium Complexity, Average Rates, Moderate Timeframe to Close (30-60 Days) *times may vary based on individual circumstances Traditional Bank Loans Banks can offer business owners “traditional” term loans, based on business profitability, cash flow, credit history, and collateral. These loans are increasingly hard to qualify, but generally have among the lowest interest rates. Small business owners tend to have better luck with community banks than with larger national banks. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Lines of Credit Like a credit card, a line of credit offers business owners standing access to capital in a set amount. Ready access to credit can accelerate growth, but is often available only to wellestablished businesses. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Commercial Mortgages Similar to a home mortgage, banks offer mortgages to businesses to help them purchase business properties. A commercial mortgage requires equal monthly payments over a set number of years and uses the building and/or land financed as collateral. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Debt Consolidation Loan By refinancing current debts and securing a lower interest rate, proactive loan consolidation can potentially save you thousands in finance charges every year. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Accounts Receivable Financing/Factoring Accounts Receivable can be used as collateral in place of physical assets for some lines/loans. This type of financing is common in certain service-based industries or where key assets are leased. Typically, the lender “buys” future A/R receipts with cash up front, at a discount based on historical receipts. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ SBA Loans These loans are very similar to traditional bank loans, but are guaranteed (in part, usually) by the Small Business Administration (SBA). This lowers the bank’s risk, which usually means it can offer a more reasonable interest rate. These loans require a fair amount of time – and paperwork – for approval, and aren’t always easy to come by in today’s lending market. SBA loans account for 12% of all business loans by dollar volume. MultiFunding 921A Bethlehem Pike Suite 206, Ambler PA 19002 1-800-276-0690 Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ USDA Loans Like an SBA Loan, the United States Department of Agriculture’s (USDA) loan program can guarantee certain loans that contribute to the economic development of rural areas. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Equipment Leasing Instead of locking up substantial capital in an equipment purchase, it may make sense to lease your equipment from the manufacturer or one of the many lenders that specialize in equipment financing. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Equipment Sales Lease Back If your only collateral is your equipment, lenders can “buy” it from you at a percentage of liquidation value and later “resell” it to you once the loan has been paid off. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Inventory Purchase Loan/Purchase Order Financing When a cash infusion is needed to quickly fulfill an order, lenders can cut a check for the inventory directly to the supplier. This money – plus a fee – is then debited from your account in equal payments over set number of days. Inventory purchase loans can be expensive, but can help you complete a profitable order on short notice. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Inventory Financing High-value inventory (cars, jewelry, etc.) can sometimes be used as collateral in securing a traditional loan or line of credit. A car dealership would be an ideal candidate for inventory financing. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Merchant Cash Advance Loans Merchant cash advance lenders offer business owners a sum of cash up front, which can be used to expand the business or to meet obligations in the short term. In return, the lender receives a set percentage of the business’ future credit/debit card sales until the loan is repaid. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ Credit Cards Small business owners can use business credit cards to make day-to-day purchases and cover certain business expenses in a pinch, but should avoid using them for longer-term financing. Speed of Approval: ■ Collateral Required: ■ Typical Interest Rates: ■ MultiFunding 921A Bethlehem Pike Suite 206, Ambler PA 19002 1-800-276-0690