chapter 5 the foreign exchange market

CHAPTER 5

THE FOREIGN

EXCHANGE

MARKET

CHAPTER OVERVIEW

I.

INTRODUCTION

II.

ORGANIZATION OF THE

FOREIGN EXCHANGE

MARKET

III. THE SPOT MARKET

IV. THE FORWARD MARKET

V.

INTEREST RATE PARITY

THEORY

PART I. INTRODUCTION

I.

INTRODUCTION

A.

The Currency Market: where money denominated in one currency is bought and sold with money denominated in another currency.

INTRODUCTION

B. International Trade and

Capital Transactions:

- facilitated with the ability to transfer purchasing power between countries

INTRODUCTION

C.

Location

1.

OTC-type: no specific location

2.

Most trades by phone, telex, or SWIFT

SWIFT: Society for Worldwide

Interbank Financial

Telecommunications

PART II.

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

I .

PARTICIPANTS IN THE

FOREIGN EXCHANGE

MARKET

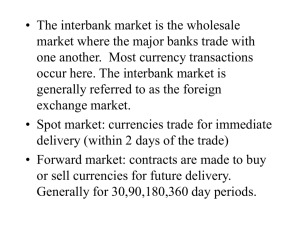

A. Participants at 2 Levels

1.

Wholesale Level (95%)

- major banks

2.

Retail Level

- business customers.

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

B.

Two Types of Currency

Markets

1.

Spot Market:

- immediate transaction

- recorded by 2nd business day

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

2.

Forward Market:

- transactions take place at a specified future date

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

C.

Participants by Market

1. Spot Market a.

commercial banks b.

brokers c.

customers of commercial and central banks

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

2. Forward Market a.

arbitrageurs b.

traders c.

hedgers d.

speculators

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

II.

CLEARING SYSTEMS

A. Clearing House Interbank

Payments System

(CHIPS)

- used in U.S. for electronic fund transfers.

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

B.

FedWire

- operated by the Fed

- used for domestic transfers

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

III. ELECTRONIC TRADING

A. Automated Trading

- genuine screen-based market

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

B.

Results:

1.

Reduces cost of trading

2.

Threatens traders’ oligopoly of information

3.

Provides liquidity

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

IV. SIZE OF THE MARKET

A. Largest in the world

1995: $1.2 trillion daily

ORGANIZATION OF THE FOREIGN

EXCHANGE MARKET

B.

Market Centers (1995):

London = $464 billion daily

New York= $244 billion daily

Tokyo = $161 billion daily

PART III.

THE SPOT MARKET

I.

SPOT QUOTATIONS

A. Sources

1.

All major newspapers

2.

Major currencies have four different quotes: a.

spot price b.

30-day c.

90-day d.

180-day

THE SPOT MARKET

B.

Method of Quotation

1.

For interbank dollar trades: a.

American terms example: $.5838/dm b.

European terms example: dm1.713/$

THE SPOT MARKET

2. For nonbank customers:

Direct quote gives the home currency price of one unit of foreign currency.

EXAMPLE: dm0.25/FF

THE SPOT MARKET

C.

Transactions Costs

1. Bid-Ask Spread used to calculate the fee charged by the bank

Bid = the price at which the bank is willing to buy

Ask = the price it will sell the currency

THE SPOT MARKET

4.

Percent Spread Formula (PS):

PS

Ask

Bid

Ask x 100

THE SPOT MARKET

D.

Cross Rates

1.

The exchange rate between 2 non - US$ currencies.

THE SPOT MARKET

2.

Calculating Cross Rates

When you want to know what the dm/ cross rate is, and you know dm2/US$ and .55/US$ then dm/ = dm2/US$

.55/US$

= dm3.636/

THE SPOT MARKET

E.

Currency Arbitrage

1. If cross rates differ from one financial center to another, and profit opportunities exist.

THE SPOT MARKET

2.

Buy cheap in one int’l market, sell at a higher price in another

3.

Role of Available Information

THE SPOT MARKET

F.

Settlement Date Value Date:

1. Date monies are due

2. 2nd Working day after date of original transaction.

THE SPOT MARKET

G.

Exchange Risk

1. Bankers = middlemen a.

Incurring risk of adverse exchange rate moves.

b.

Increased uncertainty about future exchange rate requires

THE SPOT MARKET

1.) Demand for higher risk premium

2.) Bankers widen bid-ask spread

PART II.

MECHANICS OF SPOT

TRANSACTIONS

SPOT TRANSACTIONS: An

Example

Step 1. Currency transaction: verbal agreement, U.S. importer specifies: a. Account to debit (his acct) b. Account to credit

(exporter)

MECHANICS OF SPOT

TRANSACTIONS

Step 2. Bank sends importer contract note including:

- amount of foreign currency

- agreed exchange rate

- confirmation of Step 1.

MECHANICS OF SPOT

TRANSACTIONS

Step 3. Settlement

Correspondent bank in Hong

Kong transfers HK$ from nostro account to exporter’s.

Value Date.

U.S. bank debits importer’s account.

PART III.

THE FORWARD MARKET

I. INTRODUCTION

A. Definition of a Forward

Contract an agreement between a bank and a customer to deliver a specified amount of currency against another currency at a specified future date and at a fixed exchange rate.

THE FORWARD MARKET

2. Purpose of a Forward:

Hedging the act of reducing exchange rate risk.

THE FORWARD MARKET

B.

Forward Rate Quotations

1. Two Methods: a.

Outright Rate: quoted to commercial customers.

b.

Swap Rate: quoted in the interbank market as a discount or premium.

THE FORWARD MARKET

CALCULATING THE FORWARD

PREMIUM OR DISCOUNT

= F-S x 12 x 100

S n where F = the forward rate of exchange

S = the spot rate of exchange n = the number of months in the forward contract

THE FORWARD MARKET

C. Forward Contract Maturities

1. Contract Terms a.

30-day b.

90-day c.

180-day d.

360-day

2.

Longer-term Contracts

PART IV.

INTEREST RATE PARITY THEORY

I. INTRODUCTION

A. The Theory states: the forward rate (F) differs from the spot rate (S) at equilibrium by an amount equal to the interest differential (r h two countries.

- r f

) between

INTEREST RATE PARITY

THEORY

2. The forward premium or discount equals the interest rate differential.

(F - S)/S = (r h

- r f

) where r h

= the home rate r f

= the foreign rate

INTEREST RATE PARITY

THEORY

3.

In equilibrium, returns on currencies will be the same i. e. No profit will be realized and interest parity exists which can be written

(1 + r h

) = F

(1 + r f

) S

INTEREST RATE PARITY

THEORY

B.

Covered Interest Arbitrage

1. Conditions required: interest rate differential does not equal the forward premium or discount.

2. Funds will move to a country with a more attractive rate.

INTEREST RATE PARITY

THEORY

3. Market pressures develop: a.

As one currency is more demanded spot and sold forward.

b. Inflow of fund depresses interest rates.

c.

Parity eventually

INTEREST RATE PARITY

THEORY

C.

Summary:

Interest Rate Parity states:

1.

Higher interest rates on a currency offset by forward discounts.

2.

Lower interest rates are offset by forward premiums.