Testing of Forward rate is an unbiased future spot rate

advertisement

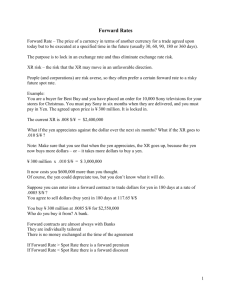

Testing the hypothesis that: (UIP) Forward exchange rate is unbiased estimate of future spot rate. This is equivalent to test the hypothesis of Uncovered Interest Parity. Due to arbitrage principle, Covered Interest Arbitrage holds in unrestricted capital markets, if we ignore transaction costs and default risks by depository entities. The forward rate is equal to: Forward price for currency i, j= (1+ Interest rate in country i)/(1+interest rate in country j) * spot rate of currency i, j. If this doesn’t hold, there will be arbitrage profit, i.e., if the higher interest rate country’s currency price expressed in forward terms doesn’t depreciate in the time period of our consideration, one can simply save in higher interest countries (exchange your currency to the higher yielding one) and cover the proceeds with a forward and earn abnormal return. If, on the other hand, the value of the higher yielding currency in dollar terms (for example) depreciates (in forward terms) more than the interest rate differential dictates, then one can borrow the weaker currency and invest in the stronger one and make abnormal return, this is, of course, suppose that there is same access to borrowing for private person as well as for institutions. Forward price are expressed as points. It is valued as 0,0001 for 1 point. In order to get the forward rate, you need to add back the forward points to the spot rate of your chosen. Step 1: Collecting data of spot rate over Swedish Kronor and US dollars, (or Euro and USD if you prefer), forward points, 3 month forward, for the latest 2 years. 1 Forward point is equivalent to 1/10000 SEK, should be added to the spot rate to get the forward rate. Step 2: Testing if the Future spot rate differential is equal to the forward differential. F0/S0. St / S0 ( F0t / S0 ) or in Ln form: ( to transform st, st-1, F tt-1 simply transform the data using =ln( ) ) 𝑡 𝑆𝑡 − 𝑆𝑡−1 = 𝛼 + 𝛽(𝐹𝑡−1 − 𝑆𝑡−1 ) + 𝜀𝑡 If the theory holds true we will have β=1 and α=0. The result is presented as follows (for your comparison). Regression result of SEKUSD=R (SEK/$) forward rate vs. future spot rate empirical testing: SUMMARY OUTPUT Regression Statistics Multiple R 0.14479 R Square 0.02096 Adjusted R Square 0.01792 Standard Error 0.04628 Observations 324 ANOVA df Regression Residual Total 1 322 323 SS 0.01477 0.68970 0.70447 Intercept Ft-st-1(3m) Coefficients 0.00140 0.11817 Standard Error 0.00265 0.04500 MS 0.01477 0.00214 F 6.89504 Significance F 0.00906 t Stat 0.53009 2.62584 P-value 0.59641 0.00906 Lower 95% -0.00380 0.02963 The forward differential and the future spot rate differential is not equal. Because the coefficient β is 0,118. The forward rate is closely following the current rate, but not an indication to future spot rate. To say that is to say that the market is random. This means that the forward rate is not an unbiased predictor of the future spot rate.