International Trade and Foreign Exchange Markets

advertisement

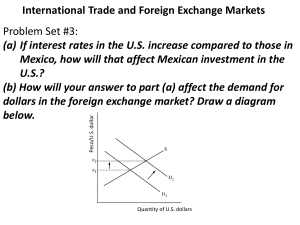

International Trade and Foreign Exchange Markets I. The Balance of Payments – The sum of all the transactions that take place between a country and foreign countries. For our purposes, they are recorded in two accounts: A. The Current Account - the sum of a country’s exports (+) and imports (-). 1. Goods 2. Services 3. Investment income 4. Net transfers. International Trade and Foreign Exchange Markets B. The Financial Account (used to be Capital Account) – Purchase or sale of assets from and to foreigners. 1. Foreigners buy U.S. assets (+) 2. U.S. citizen buys foreign assets (-) 3. Real assets a. Factories b. Office buildings c. etc. 4. Financial assets a. Government bonds b. Corporate bonds c. Stocks d. etc. International Trade and Foreign Exchange Markets C. The current account and the financial account must always balance. 1. There is some discrepancy about this. Different textbooks say different things. 2. Your textbook includes a separate “official reserves account,” but this seems to have disappeared in recent texts and on the AP exam. It has become part of the financial account (which your book calls the capital account). 3. Suffice it to say: Any credit in the current account must be matched by a debit in the financial account and vice versa. International Trade and Foreign Exchange Markets Problem Set #1: Which of these is a current account transaction? (A) India buys $10 billion of new U.S. treasury bonds. (B) A U.S. firm buys 5% of the stock of another US. Firm. (C) A U.S. firm builds a new factory in Kenya. (D) A U.S. firm sells $500 million worth of candles to an Australian importer. (E) The U.S. buys $8 billion worth of euros. International Trade and Foreign Exchange Markets Problem Set #2: (a) What does it mean to say that a country has a current account deficit? (b) If a country does have a current account deficit, what must be true of its financial account (née capital account)? International Trade and Foreign Exchange Markets II. Foreign Currency exchange rates and the foreign currency market. A. To buy imports, you need the currency of the country your importing from. For example, when Best Buy imports Korean televisions, it needs won, not dollars. B. To do so, Best Buy would buy Korean won on the foreign exchange market (from a bank or currency dealer). C. Foreign exchange rates are flexible, meaning the value of one currency against another can fluctuate. D. The price of a foreign currency is set by supply and demand in the foreign exchange market, just like anything else. http://www.xe.com/currencycharts/?from=KRW}&to= USD&view=1Y International Trade and Foreign Exchange Markets E. So what determines the value of one currency versus another? Supply and demand. If demand for a nation’s currency increases, the currency will appreciate. If demand decreases, the currency will depreciate. appreciate – When a currency goes up in value. depreciate – When a currency goes down in value. Flexible Exchange Rates The Market for Foreign Currency (Pounds) P Dollar Price of 1 Pound (Dollar/Euro) S1 $3 $2 Dollar Depreciates (Pound Appreciates) Exchange Rate: $2 = £1 Dollar Appreciates (Pound Depreciates) $1 D1 0 Q1 Q Quantity of Pounds LO3 38-9 • • LO3 Flexible Exchange Rates Determinants of exchange rates Factors that shift demand/supply –Changes in tastes –Relative income changes –Relative price-level changes • Purchasing-power-parity theory –Relative interest rates 38-10 Flexible Exchange Rates The Market for Foreign Currency (Pounds) P Dollar Price of 1 Pound (Dollar/Euro) S1 c $3 Exchange Rate: $3 = £1 a x $2 b D 2 Exchange Rate: $2 = £1 $1 D1 0 Q1 Q2 Q Quantity of Pounds LO3 38-11 International Trade and Foreign Exchange Markets Peso/U.S. dollar Problem Set #3: (a) If interest rates in the U.S. increase compared to those in Mexico, how will that affect Mexican investment in the U.S.? (b) How will your answer to part (a) affect the demand for dollars in the foreign exchange market? Draw a diagram below. Quantity of U.S. dollars International Trade and Foreign Exchange Markets Problem Set #3: (c) How will your answer to part (b) affect the supply of pesos in the foreign exchange market? Draw a diagram below? What will happen to the dollar price of pesos? Show this on your diagram. U.S. dollars /Canadian Dollars International Trade and Foreign Exchange Markets Problem Set #4: (a) Assume the real interest rate in Canada increases relative to the real interest rate in the U.S. Draw a graph of the value of the Canadian dollar in terms of the U.S. dollar that demonstrates this change. Quantity of Canadian dollars International Trade and Foreign Exchange Markets Problem Set #4: (b) Given your answer to part (a), what will happen to the level of Canadian exports? Explain. - Canadian exports will decrease because the appreciation of the Canadian dollar makes Canadian products more expensive for American consumers. International Trade and Foreign Exchange Markets Problem Set #4: (c) Will there be an inflow or an outflow of capital into Canada as a result of the change in interest rates in part (a)? Explain. - There will be an inflow of capital into Canada because the higher relative interest rate in Canada will attract foreign investment. International Trade and Foreign Exchange Markets Problem Set #4: (d) Allright, now let’s put it all together. Reconcile the Canadian balance of payments as a result of these changes? (How will it balance?) - The current account will be in deficit due to decreased exports, but the financial (ne’e capital) account will be in surplus due to greater foreign investment in Canada. This will balance Canada’s balance of payments. International Trade and Foreign Exchange Markets Problem Set #5: Assume there is an increase in investment demand in the U.S. (a) What will happen to the real interest rate? (b) What will happen to the capital stock? (c) What will happen to the international value of the dollar? International Trade and Foreign Exchange Markets Problem Set #5: Assume there is an increase in investment demand in the U.S. (d) Choose a graph to demonstrate your answers to parts (a) and (c) (one graph for each part: 2 graphs total) (a) (c) International Trade and Foreign Exchange Markets Problem Set #6: If the inflation rate in Kerseyland is much higher than that of its neighbors, what will be the effect on (a) The demand for its products? (b) The value of its currency? International Trade and Foreign Exchange Markets Problem Set #7: If the dollar appreciates compared to the rest of the world’s currencies, what will be the effect on (a) The volume of U.S. exports? Explain. U.S. exports will decrease because the appreciation of the dollar makes U.S. products more expensive to foreigners. (b) The volume of U.S. imports? Explain. U.S. imports will increase because the dollar will have more purchasing power in foreign countries due to the increase in its value compared to foreign currencies. International Trade and Foreign Exchange Markets Problem Set #8: Assume a French company buys computers from a U.S. firm. Draw side by side graphs of the dollar and the Euro on the Foreign Exchange market. Demonstrate the effect of this transactions on both currencies. FRQ #1 1. Japan, the European Union, Canada, and Mexico have flexible exchange rates. (a) Suppose the real interest rate in Canada increases relative to that in Mexico. (i) Using a correctly labeled graph of the foreign exchange market for the Canadian dollar, show the effect of the change in real interest rate in Canada on the international value of the Canadian dollar (expressed as Mexican pesos per Canadian dollar). FRQ #1 1. Japan, the European Union, Canada, and Mexico have flexible exchange rates. (ii) How will the change in the international value of the Canadian dollar that you identified in part (a)(i) affect Canadian exports to Mexico? Explain. Canadian exports to Mexico will decrease because the appreciation of the Canadian dollar makes Canadian products more expensive for Mexican consumers. FRQ #1 1. Japan, the European Union, Canada, and Mexico have flexible exchange rates. (b) Suppose Japan attracts an increased amount of investment from the European Union. (i) Using a correctly labeled graph of the loanable funds market in Japan, show the effect of the increase in foreign investment on the real interest rate in Japan. FRQ #1 1. Japan, the European Union, Canada, and Mexico have flexible exchange rates. (b) Suppose Japan attracts an increased amount of investment from the European Union. (ii) How will the real interest rate change in Japan that you identified in part (b)(i) affect the employment level in Japan in the short run? Explain. Lower real interest rates in Japan will lead to increased investment* spending, which will increase aggregate demand and output, leading to an increase in the employment level. *Note on AP scoring guidelines, I’m seeing the term “interest-sensitive spending” a lot. I think you would get credit for “investment spending,” but if you can remember, use “interest-sensitive.” It includes consumer spending financed by loans. FRQ #2 1. Assume that yesterday the exchange rate between the euro and the Singaporean dollar was 1 euro = 0.58 Singaporean dollars. Assume that today the euro is trading at 1 euro = 0.60 Singaporean dollars. (a) How will the change in the exchange rate affect each of the following in Singapore in the short run? (i) Aggregate demand. Explain. Aggregate demand will increase because the depreciation of the Singaporean dollar makes Singapore’s exports less expensive in Europe. Therefore, net exports will increase in Singapore, increasing aggregate demand. FRQ #2 1. Assume that yesterday the exchange rate between the euro and the Singaporean dollar was 1 euro = 0.58 Singaporean dollars. Assume that today the euro is trading at 1 euro = 0.60 Singaporean dollars. (a) How will the change in the exchange rate affect each of the following in Singapore in the short run? (ii) The level of employment. Explain. Employment in Singapore will increase because the increased aggregate demand will lead to greater output, requiring greater employment. FRQ #2 (b) Suppose that Singapore wants to return the exchange rate to 1 euro = 0.58 Singaporean dollars. (i) Should the Singaporean central bank buy or sell euros in the foreign exchange market? This Singaporean central bank should sell euros. (This will increase the supply of euros on the foreign exchange market, lowering the price of euros in terms of Singaporean dollars.) (Or it will increase the demand for Singaporean dollars.) FRQ #2 1. Assume that yesterday the exchange rate between the euro and the Singaporean dollar was 1 euro = 0.58 Singaporean dollars. Assume that today the euro is trading at 1 euro = 0.60 Singaporean dollars. (b) Suppose that Singapore wants to return the exchange rate to 1 euro = 0.58 Singaporean dollars. (ii) Instead of buying or selling euros, what domestic openmarket operation can the Singaporean central bank use to achieve the same result? Explain. The Singaporean central bank could sell government securities (bonds). This will raise interest rates in Singapore, attracting foreign investment to Singapore and raising demand for Singaporean dollars.