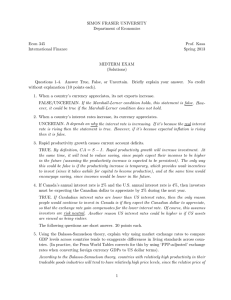

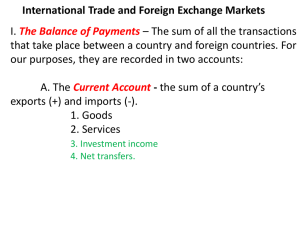

(a) (b) International Trade and Foreign Exchange Markets

International Trade and Foreign Exchange Markets

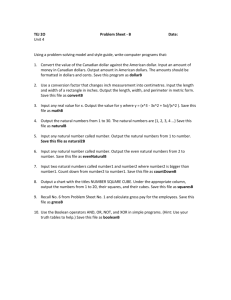

Problem Set #3:

(a) If interest rates in the U.S. increase compared to those in

Mexico, how will that affect Mexican investment in the

U.S.?

(b) How will your answer to part (a) affect the demand for dollars in the foreign exchange market? Draw a diagram below.

Quantity of U.S. dollars

International Trade and Foreign Exchange Markets

Problem Set #3:

(c) How will your answer to part (b) affect the supply of pesos in the foreign exchange market? Draw a diagram below? What will happen to the dollar price of pesos? Show this on your diagram.

International Trade and Foreign Exchange Markets

Problem Set #4:

(a) Assume the real interest rate in Canada increases relative to the real interest rate in the U.S. Draw a graph of the value of the Canadian dollar in terms of the U.S. dollar that demonstrates this change.

Quantity of Canadian dollars

International Trade and Foreign Exchange Markets

Problem Set #4:

(b) Given your answer to part (a), what will happen to the level of Canadian exports? Explain.

- Canadian exports will decrease because the appreciation of the Canadian dollar makes Canadian products more expensive for American consumers.

International Trade and Foreign Exchange Markets

Problem Set #4:

(c) Will there be an inflow or an outflow of capital into

Canada as a result of the change in interest rates in part (a)?

Explain.

- There will be an inflow of capital into Canada because the higher relative interest rate in Canada will attract foreign investment.

International Trade and Foreign Exchange Markets

Problem Set #4:

(d) Allright, now let’s put it all together. Reconcile the

Canadian balance of payments as a result of these changes?

(How will it balance?)

- The current account will be in deficit due to decreased exports, but the financial (ne’e capital) account will be in surplus due to greater foreign investment in

Canada. This will balance Canada’s balance of payments.

International Trade and Foreign Exchange Markets

Problem Set #5:

Assume there is an increase in investment demand in the

U.S.

(a) What will happen to the real interest rate?

(b) What will happen to the international value of the dollar?

See graphs on the next slide for answers to these questions.

International Trade and Foreign Exchange Markets

Problem Set #5:

Assume there is an increase in investment demand in the

U.S.

(c) Choose a graph to demonstrate your answers to parts (a) and (b) (one graph for each part: 2 graphs total)

(a) (b)

International Trade and Foreign Exchange Markets

Problem Set #6:

If the inflation rate in Kerseyland is much higher than that of its neighbors, what will be the effect on

(a) The demand for its products?

Will decrease.

(b) The value of its currency?

Will decrease because foreigners will want to buy fewer exports from Kerseyland, lowering the demand for its currency.

International Trade and Foreign Exchange Markets

Problem Set #7:

If the dollar appreciates compared to the rest of the world’s currencies, what will be the effect on

(a) The volume of U.S. exports? Explain.

U.S. exports will decrease because the appreciation of the dollar makes U.S. products more expensive to foreigners.

(b) The volume of U.S. imports? Explain.

U.S. imports will increase because the dollar will have more purchasing power in foreign countries due to the increase in its value compared to foreign currencies.

International Trade and Foreign Exchange Markets

Problem Set #8:

Assume a French company buys computers from a U.S. firm.

Draw side by side graphs of the dollar and the Euro on the

Foreign Exchange market. Demonstrate the effect of this transaction on both currencies.