Draft Rule Investment 17122013

advertisement

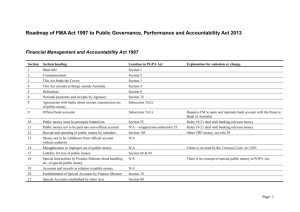

PUBLIC GOVERNANCE, PERFORMANCE AND ACCOUNTABILITY RULE A rule for Investment by the Commonwealth to support section 58 of the PGPA Act Please note that this version of the rule for investment by the Commonwealth to operationalise section 58 of the PGPA Act has been developed for consultation. 1 Public Release 17 December 2013 1. Introduction The purpose of the proposed rule is to support the investment provision in section 58 of the PGPA Act by prescribing other forms of investments that the Finance Minister and the Treasurer are authorised to invest in on behalf of the Commonwealth. To reflect the high level of care that the Commonwealth should take in handling public resources, the PGPA Act limits the persons that can make investments to the Finance Minister and the Treasurer (and their delegates), and the types of investments that can be made. 2. Intent and Rationale for the proposed Rule The proposed rule is based on regulation 22 of the FMA Regulations which provides a list of authorised investments to supplement those already mentioned in section 39 of the FMA Act. The operation of the equivalent provisions in section 58 of the PGPA Act and the proposed rule will not change investment policy for agencies currently under the FMA Act. The investments authorised by the proposed rule are: a bill of exchange accepted or endorsed only by a bank; a professionally managed money market trust (if the Finance Minister or Treasurer is satisfied of certain conditions); and a debt obligation registered on the Austraclear system (a dematerialised security). 3. Comparable Existing Legislative Requirements Investment by the Commonwealth is covered by section 39 of the FMA Act and regulation 22 of the FMA Regulations. Subsections 39(1) and (2) of the FMA Act authorises the Finance Minister and the Treasurer to invest public money on behalf of the Commonwealth in a range of authorised investments. These investments, specified in FMA Act subsection 39(10) and FMA regulation 22, include securities of an Australian government, deposits with a bank, a bill of exchange accepted or endorse by a bank and a dematerialised security. Only the Treasurer can invest in debt instruments. Subsections 39(2A) to (9) of the FMA Act cover matters concerning the status of the Commonwealth when investing in securities, the handling of public money debited from a Special Account for investment, re-investment of proceeds, appropriation of the CRF and any trust terms that apply to the money in question. FMA regulation 22 also enables the Treasurer to delegate his or her investment power to an official. This authority is now covered by Section 108 of the PGPA Act. 2 Public Release 17 December 2013 4. Proposed rule for investment by the Commonwealth Investment by the Commonwealth To specify the forms of authorised investment that the Finance Minister and the Treasurer can make on behalf of the Commonwealth. For subparagraph 58(8)(a)(iii) of the Act, each of the following forms of investment are an authorised investment: (a) a bill of exchange that is accepted or endorsed only by a bank; (b) a professionally—managed money market trust, but only if the Finance Minister or the Treasurer is satisfied that: (i) the only investments managed by the trust are those referred to in paragraph (a) or subparagraph 58(8)(a)(i) or (ii) of the Act; and (ii) a charge over trust assets does not support any borrowings by the trust; (c) a dematerialised security that: (i) is deposited in the Austraclear System; and (ii) is the equivalent of an investment referred to in paragraph (a) or subparagraph 58(8)(a)(ii) of the Act. Note: Information about the Austraclear System can be found on the Australian Securities Exchange’s website (www.asx.com.au). 5. Date of Effect The substantive provisions of the PGPA Act will commence on 1 July 2014 and it is intended that this rule will commence at the same time. 6. Guidance Material Finance Circular No. 2005/11 Investment of public money – section 39 of the Financial Management and Accountability Act 1997 provides investment guidance to Chief Executive Officers of FMA Act agencies (generally the accountable authorities of non-corporate Commonwealth entities under the PGPA Act). The Circular covers matters such as the scope of authorised investments, the preparation of an investment management plan and other requirements of section 39 of the FMA Act. Current guidance will be updated to refer to the appropriate provisions of the PGPA Act and rules. 7. Linkages to other Elements of Reform The proposed rule on investment by the Commonwealth is related to other provisions on the use and management of public resources in Chapter 2 Part 2-4 of the PGPA Act. 3 Public Release 17 December 2013 8. Impact There will be no impact on non-corporate Commonwealth entities. 9. Issues for consideration and feedback N/A. 4 Public Release 17 December 2013 Attachment A Existing regulatory provisions Financial Management and Accountability Act 1997 – section 39 Investment of public money (1) The Finance Minister may, on behalf of the Commonwealth, invest public money in any authorised investment. (2) The Treasurer may, on behalf of the Commonwealth, invest public money in any authorised investment. (2A) For the purposes of investing public money under this section in securities of the Commonwealth, the Commonwealth is to be treated as if it were a separate legal entity to the entity issuing the securities. (3) An investment of public money under this section must not be inconsistent with the terms of any trust that applies to the money concerned. (4) If an amount invested under this section was debited from a Special Account, then expenses of the investment may be debited from that Special Account. (5) Upon realisation of an investment of an amount debited from a Special Account, the proceeds of the investment must be credited to that Special Account. (6) At any time before an investment matures, the Finance Minister or Treasurer, as the case requires, may, on behalf of the Commonwealth, authorise the re-investment of the proceeds upon maturity in an authorised investment with the same entity. Note: The proceeds of investment of the original investment will not become public money when the investment matures because the proceeds will not be received by or on behalf of the Commonwealth before the proceeds are re-invested. (9) The CRF is appropriated as necessary for the purposes of this section. (10) In this section: authorised investment means: (a) in relation to the Finance Minister—any of the following investments: (i) securities of the Commonwealth or of a State or Territory; (ii) securities guaranteed by the Commonwealth, a State or a Territory; (iii) a deposit with a bank, including a deposit evidenced by a certificate of deposit; (iv) any other form of investment prescribed by the regulations; and (b) in relation to the Treasurer—any of the following investments: (i) securities of the Commonwealth or of a State or Territory; (ii) securities guaranteed by the Commonwealth, a State or a Territory; 5 Public Release 17 December 2013 (iii) a deposit with a bank, including a deposit evidenced by a certificate of deposit; (iv) debt instruments issued or guaranteed by the government of a foreign country being debt instruments with an investment grade credit rating; (iva) debt instruments issued or guaranteed by a financial institution whose members consist of foreign countries, or of Australia and foreign countries, being debt instruments with an investment grade credit rating; (ivb) debt instruments denominated in Australian currency with an investment grade credit rating; (v) any other form of investment prescribed by the regulations. Financial Management and Accountability Regulations 1997 - Regulation 22 Investment of public money (Act s 39) (1) For subparagraphs (a)(iv) and (b)(v) of the definition of authorised investment in subsection 39(10) of the Act, each of the following is another form of investment: (a) a bill of exchange accepted or endorsed only by a bank; (b) a professionally managed money market trust if the Finance Minister or the Treasurer is satisfied that: (i) the only investments managed by the trust are mentioned in subparagraph (a)(i), (ii) or (iii), or (b)(i), (ii) or (iii), of the definition of authorised investment in subsection 39(10) of the Act, or in paragraph (a); and (ii) a charge over trust assets does not support any borrowings by the trust; (c) a dematerialised security that is the equivalent of an investment mentioned in subparagraph a(iii) or (b)(iii) of the definition of authorised investment in subsection 39(10) of the Act; (d) a dematerialised security that is the equivalent of an investment mentioned in paragraph (a). (1A) The Treasurer may delegate to an official, by signed instrument, the Treasurer’s powers or functions under subregulation (1). (1B) In exercising powers and functions under a delegation, the official must comply with any directions of the Treasurer. (2) In subregulation (1): dematerialised security means a debt obligation that is registered on Austraclear. Note: The Austraclear system is operated in accordance with the Austraclear Regulations of Austraclear Limited. In mid-2008, this was available on the internet at: http://www.asx.com.au/supervision/pdf/sfe_operating_rules/austraclear_system_regula tions.pdf 6 Public Release 17 December 2013 Attachment B Public Governance, Performance and Accountability Act 2013 Section 58 Investment by the Commonwealth (1) The Finance Minister or the Treasurer may, on behalf of the Commonwealth, invest in any authorised investment. (2) For the purposes of investing under this section in securities of the Commonwealth, the Commonwealth is to be treated as if it were a separate legal entity to the entity issuing the securities. (3) An investment under this section must not be inconsistent with the terms of any trust that applies to the money concerned. (4) If an amount invested under this section was debited from a special account, then expenses of the investment may be debited from that special account. (5) The proceeds of an investment of an amount debited from a special account must be credited to the special account. (6) At any time before an investment matures, the Finance Minister or Treasurer, as the case requires, may, on behalf of the Commonwealth, authorise in writing the reinvestment of the proceeds upon maturity in an authorised investment with the same entity. (7) The CRF is appropriated as necessary for the purposes of this section. (8) Any of the following are an authorised investment: (a) in relation to both the Finance Minister and the Treasurer: (i) securities of, or securities guaranteed by, the Commonwealth, a State or a Territory; or (ii) a deposit with a bank, including a deposit evidenced by a certificate of deposit; or (iii) any other form of investment prescribed by the rules; (b) in relation to the Treasurer—debt instruments with an investment grade credit rating that: (i) are issued or guaranteed by the government of a foreign country; or (ii) are issued or guaranteed by a financial institution whose members consist of foreign countries (which may also include Australia); or (iii) are denominated in Australian currency. 7 Public Release 17 December 2013 8 Public Release 17 December 2013