What steps is the IFRS Foundation taking to engage

advertisement

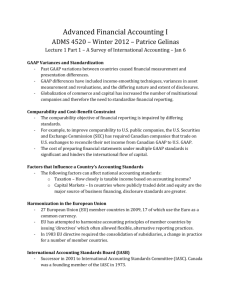

Retos futuros para el IASB Stephen A. Zeff Rice University 1 I. How should the IASB manage its future relations with the SEC and FASB/FAF? II. How should the IASB manage the diverse feedback it receives on its agenda and drafts? III. What steps is the IFRS Foundation taking to engage with country regulators so that they will become vigilant and proactive in securing the compliance by listed companies with IFRSs? 2 IFRS Foundation trustees’ strategy review 2011: ‘To support the IFRS Foundation’s interest in consistent application of IFRSs and to comply with the IASB’s standard-setting mandate, the Foundation and the IASB should undertake [to] Establish formal cooperation arrangements with securities regulators, audit regulators and national standard-setters to receive feedback on how IFRSs are being implemented and to encourage actions aimed at addressing divergence.’ 3 IV. What steps is the IFRS Foundation taking to persuade countries to require transparent disclosure of departures from the full set of IFRSs for listed companies? V. In order to promote genuine global comparability of financial reporting, the IASB must take into account differences in tax incentives and disincentives, and business customs and practices – what will the IASB do to promote genuine worldwide comparability? 4 I. How should the IASB manage its future relations with the SEC and FASB/FAF? A. SEC 1. There is currently an absence of process between the IASB and the SEC 2. The final Staff Report on its Work Plan, issued in July 2012 under chief accountant Jim Kroeker, who has departed, contained no recommendations to the Commission for action 5 a. Paul Beswick, a deputy chief accountant, was named chief accountant in December 2012 3. SEC Chair Mary Schapiro has departed, and her successor, Elisse Walter, will serve for only a few months a. President Obama has nominated Mary Jo White, formerly a federal prosecutor, to chair the SEC – her views on IFRS, if she has any, are unknown 6 4. SEC continues to be represented on the IFRS Foundation’s Monitoring Board 5. Will the SEC’s lack of commitment to IFRSs influence the commitment of other countries, such as Japan, China and India? B. FASB/FAF 1. The strong support of either convergence or adoption under FASB Chair Robert Herz and FAF Chair Robert Denham began to dissipate in February 2009 with Denham’s departure – Herz resigned abruptly in August 2010 7 2. Once the ongoing major convergence projects are completed (leases, revenue recognition, financial instruments, insurance) – if they ever are – convergence between the boards will come to an end 3. IASB has already decided that it will complete the conceptual framework on its own 4. Once convergence is over, whether the FASB will endeavor to converge toward IFRS is not known – divergence may occur 8 5. Will there be an attempt to exclude American representatives from the IASB Board and IFRS Foundation trustees? 9 II. How should the IASB manage the diverse feedback it receives on its agenda and drafts? A. There have been the following feedback groups 1. European Financial Reporting Advisory Group (EFRAG), since 2001 2. IFRS Advisory Council (formerly SAC), since 2001 3. World Standard-Setters, since 2002 4. Capital Markets Advisory Committee (formerly Analyst Representative Group), since 2003 10 5. International Forum of Accounting Standard setters (formerly National Standard-setters), since 2005 6. Global Preparers Forum, since 2008 7. Asian-Oceanian Standard-Setters Group (AOSSG), since 2009 8. Emerging Economies Group, since 2011 9. Group of Latin American Standard Setters (GLASS), since 2011 10. Pan African Federation of Accountants (PAFA), since 2011 11 B. In November 2012, the IASB proposed a 12-member Accounting Standards Advisory Forum to meet four times a year, to ‘rationalise its relationships’ with national standard setters and regional bodies – members must commit to support ‘a single set of high quality globally accepted accounting standards’ 1. In December 2012, FAF advised the IASB that the criterion for participation should instead be commitment to ‘highly comparable (but not necessarily identical) financial reporting standards…based on a common set of international standards’ 12 2. On February 1, IASB responded: ‘The ASAF members must formally commit to supporting and contributing to the IFRS Foundation in its mission to develop, in the public interest, a single set of high quality, understandable, enforceable and globally accepted financial reporting standards’ 3. In January 2013, the UK, French, German and Italian standard setters complained that a membership of 12 is too few (especially the 2 allotted to the EU), it does not distinguish between full adopters and non-adopters, and it gives preference to regional bodies 13 III. What steps is the IFRS Foundation taking to engage with country regulators so that they will become vigilant and proactive in securing the compliance by listed companies with IFRSs? A. Without a comparable high level of proactive compliance by national regulators, worldwide comparability is seriously diluted B. There is a high variability in regulator performance even in the EU 1. Sweden relies on a stock exchange to regulate compliance with IFRSs 14 2. In December 2012, Austria finally got round to setting up an enforcement process – the last country in the EU to do so – which will not take effect until July 2013 3. Many regulators do not have sufficient staff and an ample budget – and authority – to be effective 4. Regulators in Civil Code countries are unable to require restatements C. The European Securities and Markets Authority (ESMA) has been making its own assessment of the adequacy of companies’ financial reporting 15 1. Hans Hoogervorst’s letter to ESMA of August 2011, expressing ‘great concern’ over companies’ unconservative impairments on Greek sovereign debt, had an impact a. ESMA: the issue is of ‘great importance’ 2. In January 2013, ESMA criticized companies for under-reporting their impairments of goodwill and for inadequate impairment disclosures D. The International Organization of Securities Commissions (IOSCO) can do no more than cajole regulators into becoming more proactive – is it proactive enough? 16 IV. What steps is the IFRS Foundation taking to persuade countries to require companies and auditors to affirm compliance with IFRS? A. In the EU, companies and auditors are required to affirm compliance with ‘IFRSs as adopted by the EU’ – how does a reader outside the EU know to what degree such an affirmation corresponds with ‘IFRSs as issued by the IASB’? 17 B. If Japan adopts IFRS, the plan is for companies and auditors to affirm compliance with IFRSs, but with ‘Designated IFRSs’ if there are any differences C. In Hong Kong, companies fully adopt IFRSs, but they and their auditors are required to affirm compliance with Hong Kong Financial Reporting Standards – how does a reader outside of Hong Kong know that HKFRSs and IFRSs are the same? D. In 2008, IOSCO urged companies to divulge whether, and to what extent, their financial statements comply with ‘IFRSs as issued by the IASB’ 1. SEC insists on an affirmation of compliance with ‘IFRS as issued by the IASB’ to avoid a reconciliation with 18 US GAAP V. In order to promote genuine global comparability of financial reporting, the IASB must take into account differences in tax incentives and disincentives, and business customs and practices – what will the IASB do to promote genuine worldwide comparability? A. Uniformity of methods around the world is impracticable – business cultures are different B. How can a consolidation standard be adapted to Japan and South Korea, where networks of affiliated companies, known as keiretsu and chaebol, are not headed by a parent company – it can’t 1. ‘Comparability is not uniformity’– IASB/FASB 19 conceptual framework (2010) C. How does the standard setter adapt its standards to the way business is done in Islamic countries? D. Increasingly, as the IASB’s standards are seen as leading to more volatile net incomes or as adversely affecting debt-equity ratios – or as not reflecting reality – lobbying by interested parties becomes more intense and insistent 1. Countries will sometimes decline to adopt standards until they are revised (Malaysia on IAS 41; Malaysia, Singapore, the Philippines, India on IFRIC 15) or exclude an industry segment until a standard is issued (Canada on rate-regulated 20 activities) 2. Brazil requires the equity method of accounting for subsidiaries in parent-only financial statements – instead of using cost or fair value 3. Argentina and Mexico do not allow banks to use IFRS – and Singapore does not allow banks to use the incurred-loss loan provisioning in IFRS 4. Endemic inflation in Latin America E. IASB is now expected to conduct an ‘effect analysis’ as part of judging the costs and benefits of prospective standards – can such an analysis be truly global? F. Possible conflict between securities market regulators and prudential regulators 21 VI. The task that lays ahead is a large one: how to maintain the highest practicable degree of worldwide comparability by securing the support of 1. standard setters or government agencies that endorse IFRSs promptly and fully in their respective jurisdictions, 2. external auditors who see to it that companies adhere to all of the terms of IFRSs, and 3. regulators who proactively enforce compliance by companies with IFRSs 22 Also important is a vigilant financial press that draws attention to deficient financial reporting The IASB’s task is to issue standards that call for accounting information which reflects economic reality and is complemented to the extent necessary by full disclosure of pertinent supplementary information 23