adms4520_-_lecture_1_-_pa

advertisement

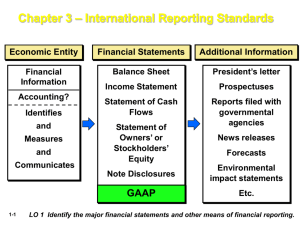

Advanced Financial Accounting I ADMS 4520 – Winter 2012 – Patrice Gelinas Lecture 1 Part 1 – A Survey of International Accounting – Jan 6 GAAP Variances and Standardization - Past GAAP variations between countries caused financial measurement and presentation differences. - GAAP differences have included income-smoothing techniques, variances in asset measurement and revaluations, and the differing nature and extent of disclosures. - Globalization of commerce and capital has increased the number of multinational companies and therefore the need to standardize financial reporting. Comparability and Cost-Benefit Constraint - The comparability objective of financial reporting is impaired by differing standards. - For example, to improve comparability to U.S. public companies, the U.S. Securities and Exchange Commission (SEC) has required Canadian companies that trade on U.S. exchanges to reconcile their net income from Canadian GAAP to U.S. GAAP. - The cost of preparing financial statements under multiple GAAP standards is significant and hinders the international flow of capital. Factors that Influence a Country’s Accounting Standards - The following factors can affect national accounting standards: o Taxation – How closely is taxable income based on accounting income? o Capital Markets – In countries where publicly traded debt and equity are the major source of business financing, disclosure standards are greater. Harmonization in the European Union - 27 European Union (EU) member countries in 2009, 17 of which use the Euro as a common currency. - EU has attempted to harmonize accounting principles of member countries by issuing ‘directives’ which often allowed flexible, alternative reporting practices. - In 1983 EU directive required the consolidation of subsidiaries, a change in practice for a number of member countries. International Accounting Standards Board (IASB) - Successor in 2001 to International Accounting Standards Committee (IASC). Canada was a founding member of the IASC in 1973. - - Current IASB objectives: o To develop a single set of high-quality, global accounting standards that require transparent and comparable information in general purpose financial statements. o To cooperate with various national accounting standard-setters in order to achieve convergence in world standards. 38 IASB standards in force as of 2009. IASB will introduce new International Financial Reporting Standards (IFRSs) and International Accounting Standards (IASs) in the future. International Adoption of Principles-Based IFRS - As of 2009, 93 countries including Canada either currently require or have announced a future requirement for the use of IFRSs for all publicly traded domestic companies. - The U.S. does not permit its domestic public companies to report using IFRS. - The EU adopted IFRS in 2005 for all publicly traded companies (over 8,000) in EU countries. - IFRSs are broad-based principles requiring the use of judgement in application, resulting in some differences in comparability. The United States - Standards set by Financial Accounting Standards Board (FASB), a private organization. - FASB pronouncements are detailed and rule-based, compared to more general and principle-based standards of the IASB. - In 2002 FASB agreed with the IASB to develop and maintain compatible accounting standards. - By December 2009 FASB had issued new or amended standards to converge with some of IASB’s standards for inventory, asset exchanges, accounting changes, financial instruments, business combinations, and subsequent events. - IASB issued new or amended standards to converge with FASB’s standards for borrowing costs and segmented reporting. - In 2007 the Securities Exchange Commission (SEC) permitted qualifying foreign companies listed on U.S. exchanges to report using IFRS without reconciling to U.S. GAAP. - SEC has issued 7 milestones that could lead to adoption of IFRS by U.S. public companies by 2014. o Milestones 1-4 focus on improvements in IFRSs and IASB accountability, and U.S. education on IFRS. - o Milestones 5-7 provide a transition plan for the potential mandatory adoption of IFRS in the U.S. More than 200 differences between U.S. GAAP and IFRS existed in 2008. Will rules-based U.S. GAAP or principles-based IFRS become the international standard? Where is Canada Going? - CICA announced in 2006a strategic plan to harmonize CICA Handbook with IFRSs. - All Canadian publicly accountable enterprises have to use IFRS effective January 1, 2011. o The debt or equity of which is traded in public markets, or o That holds assets in fiduciary capacity for the public. - From 1006-2011, any converged standards issued by FASB and IASB under their convergence project will be adopted by CICA. - 2008 and 2009 financial statements must disclose estimates effect of the future change to IFRSs. In 2010 public companies will have to keep dual records in Canadian GAAP and IFRSs, in order to provide IFRS comparatives in 2011 financial statements and a reconciliation of 2010 GAAP income to IFRS income. - Private for-profit companies may choose new Canadian GAAP for Private Enterprises beginning 2011 (2009 early adoption permitted). - Non-profit organizations will continue to use existing not-for-profit GAAP pending CICA determination in 2010.