(HO) theory postulates that

advertisement

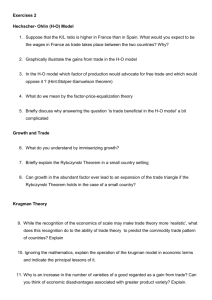

School of International Trade and Economics, Guangdong University of Foreign Studies 广东省精品课程《国际贸易》 CH4 Neo-classical Trade Theories 刘 芹 Chapter 4 The Basic Model of Neoclassical Trade Theories H-O Model After studying this chapter, you should be able to: (1) Understand the concepts of factor abundance(要素丰裕度) and factor intensity(要素密集度) (2) Know what the factor proportion(要素比例论) or the Heckscher-Ohlin theory postulates (3) Explain how international trade affects the income distribution: specific theorem and Stolper-Samuelson theorem (4) Know some empirical tests of the H-O theory: Leontief Paradox(里昂惕夫之谜) H-O model, Factor Endowment Theory H-O Theorem Factor-price Equalization theorem Factor Growth and IT Empirical Tests of H-O Model Rybzynski Theorem Leontief Paradox and its Explaination §1 Introduction In this chapter, we extend our trade model in two important directions: First, we explain the basis of (i.e., what determines) comparative advantage. We’ll go one step further and explain the reason, or cause, for the difference in relative commodity prices and comparative advantage between the two nations. The second way is to analyze the effect that international trade has on the earnings of factors of production in the two trading nations. That is, we’ll examine the effect of intl trade on the earnings of labor and capital, as well as intl differences in earnings. Heckscher-Ohlin (H-O) theory postulates that (1) a nation exports commodities intensive in its relatively abundant and cheap factor and (2) international trade brings about equalization (均等化) in returns to homogeneous(同质的) factors across countries. So, the H-O theory can be expressed in the form of two theorems: the so-called H-O theorem (which deals with and predicts the pattern of trade) and the factor–price equalization theorem(要素价格均等化定理) (HO-S theorem) (which deals with the effect of international trade on factor prices). Eli F Heckscher (1879-1959) was born in Swedish Jewish family. His greatest contribution was that he introduced quantitative(定量 的) analysis. In 1919, He published his classical work The Effect of Foreign Trade on the Distribution of Income and explore the core of Factor Endowment Theory ------ the difference in factor endowment is the basis for comparative advantage and international trade. In 1933, Ohlin, another Swedish economist and former student of Heckscher, published his famous book “Interregional and International Trade”, further explaining his teacher’s theory and completing factor endowment theory. He was awarded the 1977 Nobel prize in economics for his contribution to the theory of international trade. • Paul Samuelson (1915--2009), 1970 Nobel Prize in economics. • "International Trade and the Equalization of Factor Prices", 1948 • “Factor Price and Commodity Price in the General Equilibrium”, 1953 • Factor-price equalization theorem is referred to as the H-O-S theorem §2 Heckscher-Ohlin Factor Endowment Trade Model 2.1 Assumptions of H-O Model: (1) two nations(1, 2), two commodities (X,Y), and two factors of production (labor ,capital); (2) Both nations use the same technology in production; (3) In both nations, X is labor-intensive (i.e., the ratio of labor to capital in the production of X is greater than in Y); Y is capital-intensive; (4) Both commodities are produced under constant returns to scale(规模报酬不变); (5) There is incomplete specialization(不完全的专业 化生产) in production); (6) Tastes are same in both nations; (7) There is perfect competition in both commodity and factor markets; (8) There is perfect factor mobility within each nation but no international factor mobility; (9) There is no transportation costs, tariffs, or other obstructions to the free flow of international trade; (10) All resources are fully employed; (11) Trade is balanced. 2.2 Factor Endowments and Relative Supply 2.2.1 Factor Intensity It measures the input ratio of production factors in the production. That is, factor intensity is measured by the ratio of capital to labor putting into the production. If the capital-labor ratio (K/L) used in the production of Y is greater than that in X, commodity Y is capital-intensive and commodity X is labor-intensive. It is not the absolute amount of capital and labor used in the production of commodities, but the amount of capital per unit of labor (K/L). In Nation 1, K/L in X: 1/4 ; in Y : 1 In Nation 2, K/L in X: 1 ;in Y:4 So, X is L- intensive commodity; Y is K-intensive So, X is L-intensive commodity, Y is K-intensive • Why does Nation 2 use more K-intensive production techniques in both commodities than Nation 1 ? The answer is that capital must be relatively cheaper in Nation 2 than in Nation 1, so that producers in Nation 2 use relatively more capital in the production of both commodities to minimize their costs of production. Why is capital relatively cheaper in Nation 2 ? To answer this question, we must define factor abundance and examine its relationship to factor price. 2.2.2 Factor Abundance • It measures the relative abundance of one nation’s economic resources. a. physical units ( 实 物 单 位 ) : the overall amount of capital and labor available to each nation. Nation 2 is capital-abundant if (TK/TL)2>(TK/TL)1 b. relative factor prices: the rental price of capital and the price of labor time in each nation. Pk/Pl=r/w r: interest rate; w: wage rate Nation 2 is capital-abundant if (r/w)2<(r/w)1. • In terms of physical units, the definition of factor abundance considers only the supply of factors. But in terms of relative factor prices, the definition considers both demand and supply. • Since we have assumed that tastes, or demand preferences, are the same in both nations, the two definitions of factor abundance give the same conclusions in our case. 2.2.3 factor abundance and the shape of the production frontier Y Nation 1 is the L-abundant nation and X is the L-intensive commodity. So, Nation 1 can Nation 2 Nation 1 produce relatively more commodity X. The PPF of Nation 1 is relatively flatter and wider than Nation 2’s. it is skewed toward the horizontal axis which measures commodity X. X 2.3 Heckscher-Ohlin Theorem H-O theorem, the part of H-O theory, postulates that a nation will export the commodity whose production requires the intensive use of the nation's relatively abundant and cheap factor and import the commodity whose production requires the intensive use of the nation's relatively scarce and expensive factor. In short, The relatively labor-rich nation exports the relatively labor-intensive commodity and imports the relatively capital intensive commodity. Of all the reasons for differences in relative commodity prices and comparative advantage among nations, the H-O theorem isolates the difference in relative factor endowments among nations as the basic cause of comparative advantage and international trade. For this reason, the H-O model is often referred as the factor-proportions or factor-endowment theory. CASE STUDY 4-1 Each nation should specialize in the production of and export the commodity intensive in its relatively abundant and cheap factor and imports the commodity intensive in its relatively scarce and expensive factor. 2.3.1 Illustration of the H-O theory Indifference curve I and II are common to both nations because of the assumption of equal tastes. Indifference curve I is tangent to the PPF of Nation 1 at point A and tangent to the PPF of Nation 2 at A’. This defines the no-trade equilibrium relative commodity price of PA=1/2 in Nation 1 and PA’=2 in Nation 2. Since PA < PA’ , Nation 1 has a comparative advantage in commodity X and Nation 2 in commodity Y. With trade (see the right panel) Nation 1 produces at point B and by exchanging 40X for 45Y reaches point E in consumption (see trade triangle BCE). Nation 2 produces at B’ and by exchanging 45Y for 40X reaches point E’ (which coincides with E). Both nations gain from trade because they consume on higher CIC II. 2.3.2 Trade between two countries whose factors are different---general equilibrium analysis U.S. China Steel Steel 出口 PPF 0 0 30 50 Rice 40 60 Rice In isolation, China is in equilibrium at point A. The rice’s price P0=0.5 in China is lower than 1.5 in US. So China has a comparative advantage in rice and US in wheat. With trade, China would specialize in the production of rice incompletely, moving from point A down to point S1 (60rice and 30wheat) because of increasing opportunity costs. By then exchanging 20rice for 20wheat with US at P1=1, China ends up consuming at point C1 (40rice and 50wheat) on higher CIC1. The situations are the same in US. Therefore, both China and US gain from specialization and trade. Partial Equilibrium Analysis We can derive Supply Curve, Demand Curve and Domestic Equilibrium Price of one commodity in both nations from PPF and CIC. With international trade, the commodity price will be balanced on the condition that the exports equal the imports or the supply equals the demand. The total social welfare is determined by consumer’s surplus(消费者剩余) and producer’s surplus(生产者剩余). If there is remains, international trade brings net social welfare. Actually, free trade must result in net welfare gain. Consumer surplus is the difference between what consumers are willing to pay for a specific amount of a commodity and what they actually pay for it. Graphically, consumer surplus is measured by the area under the demand curve above the going price. Producer surplus is defined as a payment that need not be made in the long run in order to induce producers to supply a specific amount of a commodity. Graphically, producer surplus is measured by ? Decision of the Price China P(K) a 40 World c e f b 60 Rice U.S. 20 30 d 50 §3 Factor - Price Equalization and Income Distribution 3.1 The Factor-Price Equalization Theorem International trade will equalize the relative and absolute returns to homogeneous or identical factors across nations. International trade acts as a substitute(替代品) for the international mobility of factors. So, international trade will cause the prices of homogeneous labor and capital to be the same in all trading nations, that is, w and r will be the same in both nations. This is true not only for relative but also absolute or real wages and interest rates. Illustration of Factor Price Equalization The horizontal axis measures w/r and the vertical axis PX/PY. Before trade, Nation 1 is at point A, with w/r =(w/r)1 and PX/PY =PA while Nation 2 is at point A’, with w/r =(w/r)2 and PX/PY =PA’. Since w/r is lower in Nation 1 than in Nation 2, PA is lower than PA’, Nation 1 has a comparative advantage in X. With trade, Nation 1 specializes in the production of commodity X and increases the demand for labor relative to capital, w/r rises. Nation 2 specializes in the production of commodity Y and increases its relative demand for capital, w/r falls. This will continue until point B=B’, at which PB= PB’ and w/r =(w/r)* in both nations. 3.2 Effect of Intl Trade on the Short-run Distribution of Income: Specific-Factors Model(特定要素模型) 3.2.1 The Price of Production Factors From microeconomic theory, we know that the value of the marginal product (边际产品价 值) of labor in the production of X is equal to the price of commodity X times the marginal physical product (边际产品) of labor in the production of X. That is, VMPLX=(PX)(MPLX). Similarly, VMPLy=(Py)(MPLy). Meanwhile, VMPKX=(PX)(MPKX); VMPKy=(Py)(MPKy). Suppose that in Nation 1 (the L-abundant nation) labor is mobile between industries but capital is not. That is, some type of capital could be used only or was specific to the production of one good. Since labor is mobile, the wage of labor will be the same in the production of commodities X and Y in Nation 1. We also know that if a firm employs more labor with a given amount of capital, VMPL declines because of the law of diminishing returns(报酬递减规律). Finally, to maximize profits, firms will employ labor until the wage they must pay equals the value of the marginal product of labor (i.e., w=VMPL). 3.2.2 Specific-factors Model The model analyzes the effect of a change in commodity price on the returns of factors in a nation when at least one factor is W W not mobile between industries. C W2 E1 W1 W0 VMPLY E0 VMPL’X VMPLX O’ O L0 L1 Labor is mobile between the two industries, but capital is not. The horizontal axis measures the total supply of L available to Nation 1, and the vertical axis the wage rate. Before trade, the intersection of the VMPLX and VMPLY curves determines w0 in the two industries. OL0 of L is used in the production of X and L0O’ in Y. With trade, PX/PY increases and shifts VMPLX up to VMPL’X, w rises from w0 to w1, and L0L1 of L shifts from Y to X. Since w rises less than PX, w falls in terms of X but rises in terms of Y. With more L used with fixed K in the production of X, VMPKX or r increases in terms of X. With less L used with fixed K in Y, VMPKY or r falls in terms of both commodities. Suppose that labor was mobile, but capital was not. Then, we have the specific-factors model. The opening of trade leads to: (1)an increase in the return or earning of capital specific or used to produce the nation’s export commodity; (2)a reduction in the return or earning of capital specific or used in the nation’s import-competing(进口竞争性) industry; (3)ambiguous(模糊的) results in the return or earning of labor (the mobile factor). The result for specific capital is clear. Since capital is specific to each industry, the opening of trade does not lead to any transfer of capital from the production of Y to the production of X in the nation. Since the specific capital in the production of commodity X has more labor to work with, VMPKx and r increase in terms of both commodities. With the opening of trade, the real income of the capital rises in the production of X. On the other hand, since less labor is used with the fixed capital in the production of Y, VMPKy and r fall in terms of both commodities. With the opening of trade, the real income of the capital falls in the production of Y. The effect of this on the real wage rate of labor in the nation is ambiguous (not clear). The reason is that the increase in Px/Py and in the derived demand for labor will be greater than the increase in the nominal wage rate, and so the real wage rate of labor, w/Px, falls in terms of X. On the other hand, since the nominal wage rate increased but the price of Y declined, the real wage rate increased in terms of Y, w/Py. Thus, the real wage rate in the nation falls in terms of X but rises in terms of Y. The effect on the real wage of labor is, therefore, ambiguous. 3.3 Effect of Trade on the Long-run Distribution of Income: Stolper-Samuelson Theorem Stolper-Samuelson Theorem postulates that free international trade reduces the real income of the nation’s relatively scarce and expensive factor and increases the real income of its relatively abundant and cheap factor. It holds only if all factors are completely mobile between the different industries or sectors in each economy. In developed nations, labor is relatively scarce and capital is relatively abundant, int’l trade tends to reduce the real income of labor and increase the real income of capital owners. On the other hand, in less developed nations, labor is relatively abundant, international trade will increase the real income of labor and reduce the income of capital owners. Shouldn’t the U.S. government restrict trade? No. The loss that trade causes to labor is less than the gain received by owners of capital. CASE STUDY 4-2 In real world, trade has not equalized the earnings or returns to identical factors across countries. Actually wages are much higher for doctors, engineers, technicians, mechanics, secretaries, and laborers in U.S. and Germany than in Mexico and China. The reason is that many of the simplifying assumptions on which the H-O theory rests do not hold in the real world, and many other forces (such as more rapid technological change in some countries than in others) also operate and tend to increase international inequalities. However, wages have been certainly equalized across industrial countries over the past decades. §4 Empirical Tests of the Heckscher-Ohlin Theory 4.1 Leontief Paradox Wassily Leontief (1906-1999) ,1973 Nobel Prize in economics. His most significant one is input-output economics(投入-产出 经济学). • Leontief expectations: to find United States exported K-intensive commodities and imported L-intensive commodities and prove H-O model. He used the input-output table to calculate the amount of labor and capital in the exports and import substitutes(进口替 代产品) in U.S.. • The results: U.S. import substitutes were about 30% more K-intensive than U.S. exports. This is contrary to the H-O trade model, which predicts that, as the most Kabundant nation, the United States should import L-intensive products and export Kintensive products. • import substitutes are commodities, such as automobiles, that U.S. produces at home but also imports from abroad. 1947 trade Export Import Substitutes $2550,780 $3091,339 182 170 $14,010 $18,180 Export Import Substitutes $2256,800 $2303,400 Labor (manyears) 174 168 Capital/Labor $12,977 $13,726 Capital Labor (manyears) Capital/Labor 1951 trade Capital 4.2 Some Possible Explanations of Leontief Paradox His First Explanation: In 1947, U.S. labor was 3 times as productive as foreign labor, so the U.S. was L-abundant nation if we multiplied the U.S. labor force by 3 and compared this figure to the availability of capital in the nation. Therefore, it exports L-intensive products. But this is not reasonable. His Second Explanation (demand reversal 需求 逆转): U.S. consumers' tastes are so biased in favor of K-intensive commodities that the relative prices for these commodities were very high. Therefore, their import substitutes are more capital intensive. This is not reasonable. Other Explanations: 1. The year 1947 was too close to World War II to be representative. (X) 2. Ignored human capital 人力资本(education, job training, and health embodied in workers, which increase their productivity). (√) 3. The U.S. dependence on imports of many natural resources. (√) 4. Factor-intensity reversal 要素密集度逆转(a rather rare occurrence) (X) • A given commodity is the L-intensive commodity in the L-abundant nation and the K-intensive commodity in the K-abundant nation. 5. U.S. trade policy protected the L-intensive industries. (X) Key Terms Constant returns to scale Factor intensity, Factor abundance H-O theorem Factor-price equalization (H-O-S) theorem Specific-factors model Import substitutes Leontief paradox Human capital Factor-intensity reversal calculation Suppose that China is a small importer of car. The supply of and demand for car are: Dc=2000-0.02P, Sc=1200+0.02P The world price is $10000. Please explain the following questions with figures and numbers: (1) Before trade, the equilibrium production and price in China; (2) With free trade, the production and trade volume of China; (3) The welfare impacts of free trade on consumers and producers and the whole society. Suppose both nations A and B apply the same technology: producing 1 coat needs 1 capital and 3 labors; producing 1 food needs 2 capitals and 2 labors. Nation A has 160 labors and 100 capitals; nation B has 120 labors and 80 capitals. Questions: (1) Which nation is K-abundant? (2) What commodity is L-intensive? (3) If all resources are utilized at the most efficient way, how many coats and foods can be produced at most in both nations? (4) If the tastes are the same in both nations, which one will export coat? Which one will export food? Questions for Review 1. In what ways does the H-O theory represent an extension of the trade model presented in the previous chapters? What did classical economists say on these matters? 2. State the assumptions of the H-O theory. What is the meaning and importance of each of these assumptions? 3. What is meant by labor-intensive commodity? Capital-intensive commodity? Capital-labor ratio? 4. What is meant by capital-abundant nation? What determines the shape of the production frontier of each nation? 5. What determines the capital-labor ratio in the production of each commodity in both nations? Which of the two nations would you expect to use a higher capital-labor ratio in the production of both commodities? Why? Under what circumstance would the capital-labor ratio be the same in the production of both commodities in each nation? 6. If labor and capital can be substituted for each other in the production of both commodities, when can we say that one commodity is capital intensive and the other labor intensive? 7. What does the H-O theory postulate? Which force do Heckscher and Ohlin identify as the basic determinant of comparative advantage and trade? 8. What does the factor-price equalization theorem postulate? What is its relationship to the international mobility of factors of production? 9. Explain why the H-O theory is a general equilibrium model. 10. What is meant by the Leontief paradox? What are some possible explanations of the paradox? How can human capital contribute to the explanation of the paradox? 11. What were the results of empirical tests on the relationship between human capital and international trade? Natural resources and international trade? What is the status of the H-O theory today? 12. What is meant by factor-intensive reversal? Why would the prevalence of factor reversal lead to rejection of the H-O theorem and the factor-price equalization theorem? What were the results of empirical tests on the prevalence of factor reversal in the real world? Problems 1.Starting with the production frontiers for Nation 1 and Nation 2 shown in the figure “The H-O Model”, show graphically that sufficiently different tastes in the two nations could conceivably neutralize the difference in their factor endowments and lead to equal relative commodity prices in the two nations in the absence of trade. 2. Draw a figure similar to the figure “The H-O Model” but showing that the H-O model holds, even with some difference in tastes between Nation 1 and Nation 2.