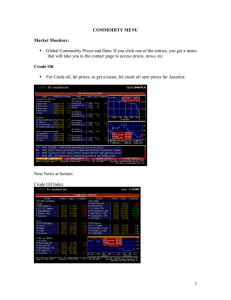

Intermarket & Sentiment analysis

advertisement

Basic Premise : All markets are related What happens in one market has an effect on another. Four interrelated markets: Commodity Currency Bond Stock Markets • • • • • Rising interest rates are bad for stock markets and vice versa Interest rates are affected by direction of commodity prices. Higher commodity prices puts pressure on inflation which puts upward pressure on interest rates Commodity prices and interest rates are influenced by the direction of a country’s currency A falling currency usually gives a boost to commodity prices quoted in that currency. This boost in commodity prices reawakens inflation fears and puts pressure on central bankers to raise interest rates, which has a negative impact on the stock market. Not all stocks, however, are affected equally. • • • • 1987, 1990 and 1994 – fall of world stock markets at same times Hyperinflation in 1970’s was global Disinflationary trends in 1980s and 1990s were worldwide 2007-2008 crisis very much global and visible • Most of the time sectorial stocks leads commodities prices hence giving important reversal signals