Online retail - Amazon Web Services

advertisement

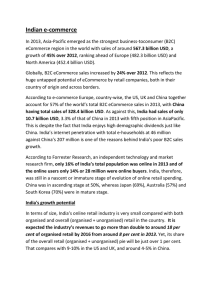

E-commerce in India What is E-commerce? E-commerce (electronic commerce or EC) is the buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, primarily the Internet. These business transactions occur either business-to-business, business-toconsumer, consumer-to-consumer or consumer-to-business. The term e-tail is also sometimes used in reference to transactional processes around online retail. Modes of E-commerce Transaction Business-to-Consumer (B2C): The B2C market in India generates the bulk of revenues across the consumer-facing modes of e-Commerce. Furthermore, though online travel has typically held a major share of the B2C market, online retail is also growing rapidly and is expected to significantly increase its share. Consumer-to-Consumer (C2C): India’s C2C market, though currently small, is set to grow with the entry of several players. These entrants are attracting VC investment. Their online portals are also garnering significant traffic. We expect the C2C segment to show rapid growth in coming years. Business-to-Business (B2B): The most common users of B2B online classifieds are micro, small and medium enterprises (MSMEs). These small businesses lack the requisite financial resources and, therefore, find it difficult to market their products and services to potential clients through traditional media such as newspapers, banners and television. Trade through online B2B portals increases the visibility of MSMEs in the marketplace and helps them overcome barriers of time, communication and geography. E-commerce Ecosystem Online travel, ticketing, etc : Ticketing for air, rail, bus, movies, events Online retail : Retail products sold through online route Online marketplace : Platform where sellers and buyers transact online Online deals : Deals purchased online, redemption may or may not happen online Online portals classified : Includes car, job, property and matrimonial portals Online Business Model Marketplace Self-owned inventory Private Label White label Marketplace and pick-up & drop is a model where sellers often partner with leading marketplaces to set up a dedicated online store on the latter’s website. Here sellers play a key role of managing inventory and driving sales. They leverage on high traffic on the marketplaces’ website and access their distribution network. However, the sellers have limited say on pricing and customer experience. Self-owned inventory is a model where the eCommerce player owns the inventory. The model provides better postpurchase customer experience and fulfilment. It provides smoother operations due to ready information on the inventory, location, supply chain and shipments, effectively leading to better control over inventory. On the flipside, however, there are risks of potential mark downs and working capital getting tied up in inventory. Private label reflects a business where an eCommerce company sets up its own brand goods, which it sells through its own website. This model offers a wide-ranging products and pricing to its customers and competes with branded labels. Here, margins are typically higher than third-party branded goods. White label involves the setting up of a branded online store managed by the eCommerce player or a third party. The brand takes the responsibility of generating website traffic and providing services by partnering with payment gateways. It helps build trust, customer affinity and loyalty and provides better control of brand and product experience. Indian e-commerce In 2013, Asia-Pacific emerged as the strongest business-toconsumer (B2C) eCommerce region in the world with sales of around 567.3 billion USD, a growth of 45% over 2012, ranking ahead of Europe (482.3 billion USD) and North America (452.4 billion USD). Globally, B2C eCommerce sales increased by 24% over 2012. This reflects the huge untapped potential of eCommerce by retail companies, both in their country of origin and across borders. According to e-commerce Europe, country-wise, the US, UK and China together account for 57% of the world’s total B2C eCommerce sales in 2013, with China having total sales of 328.4 billion USD. As against this, India had sales of only 10.7 billion USD, 3.3% of that of China in 2013 with fifth position in AsiaPacific. This is despite the fact that India enjoys high demographic dividends just like China. India’s internet penetration with total e-households at 46 million against China’s 207 million is one of the reasons behind India’s poor B2C sales growth. According to Forrester Research, an independent technology and market research firm, only 16% of India’s total population was online in 2013 and of the online users only 14% or 28 million were online buyers. India, therefore, was still in a nascent or immature stage of evolution of online retail spending. China was in ascending stage at 50%, whereas Japan (69%), Australia (57%) and South Korea (70%) were in mature stage. India's growth potential In terms of size, India’s online retail industry is very small compared with both organised and overall (organised + unorganised) retail in the country. It is expected the industry’s revenues to go more than double to around 18 per cent of organised retail by 2016 from around 8 per cent in 2013. Yet, its share of the overall retail (organised + unorganised) pie will be just over 1 per cent. That compares with 9-10% in the US and UK, and around 4-5% in China. Since the eCommerce industry is fast rising, changes can be seen over a year. The sector in India has grown by 34% (CAGR) since 2009 to touch 16.4 billion USD in 2014. The sector is expected to be in the range of 22 billion USD in 2015. India’s online retail industry has grown at a swift pace in the last 5 years from around Rs 15 billion revenues in 2007-08 to Rs 139 billion in 2012-13, translating into a compounded annual growth rate (CAGR) of over 56 per cent. The 9-fold growth came on the back of increasing internet penetration and changing lifestyles, and was primarily driven by books, electronics and apparel. Currently, eTravel comprises 70% of the total eCommerce market. eTailing, which comprises of online retail and online marketplaces, has become the fastest-growing segment in the larger market having grown at a CAGR of around 56% over 2009-2014. The size of the eTail market is pegged at 6 billion USD in 2015. Factors that will fuel growth Growing Internet Penetration : A significantly low (19%) but fast-growing internet population of 243 million in 2014 is an indicator of the sector’s huge growth potential in India. It is evident that in absolute terms India’s internet users are short by only 36 million as compared with 279 million in the US and higher than that in Japan, Brazil and Russia. However, in relation with its population, only 19% Indians use the internet. This indicates the potential of internet use in India and as internet penetration increases, the potential of growth for the eCommerce industry will also increase. An analysis of the demographic profile of internet users further testifies that eCommerce will rise rapidly in India in coming years. Around 75% of Indian internet users are in the age group of 15 to 34 years. This category shops more than the remaining population. Peer pressure, rising aspirations with career growth, fashion and trends encourage this segment to shop more than any other category and India, therefore, clearly enjoys a demographic dividend that favours the growth of eCommerce. In coming years, as internet presence increases in rural areas, rural India will yield more eCommerce business. Rising middle class with disposable income: Throughout India’s short history, the country has been a land of “haves” and “have-nots”. However, with the rise of small and medium enterprises, foreign direct investment, and India’s own powerful multinational corporations creating millions of new jobs, a new generation of globally-minded Indian consumers has been created. These consumers are spread across the country. Furthermore, access to many global and domestic brands is limited to major metropolitan regions, such as Delhi, Mumbai, and Bangalore. Therefore, this growing middle class is increasingly turning to e-commerce as the primary outlet for sophisticated consumer products and services. Payment gateways & logistics: One of the largest challenges to e-commerce in India is the lack of infrastructure to support new businesses. Logistics companies have been notoriously unreliable, and complex interstate regulations mean that interstate logistics and paperwork is more like international customs. Additionally, Indians have an aversion to credit cards – only an estimated 2 percent of the nation has a credit card. However, the new breed of domestic logistics companies recognize the importance of reliable delivery and technology investment, and a number of new payment gateway companies such as CC Avenue have sprung up to service the growing ecommerce ecosystem. Alternative payment methods such as netbanking and cash on delivery are now mandatory offerings for leading e-commerce platforms and can drive as much as 75 percent or more of transactions, and sophisticated technical integrations make the experience seamless. User Experience: Of course, the primary driver for e-commerce anywhere is the user experience. Customers prefer a trusted relationship with an ecommerce brand, and the conveniences and reliability of e-commerce businesses have to outweigh the benefits of traditional retail outlets. Because there have been a relatively small number of successful consumer Internet companies in India, there has been less competitive pressure to force implementation of global best practices. However, as the number of ecommerce companies has grown, companies have started to place more emphasis on investing in the user experience. Best practices that have driven e-commerce globally are now a key focus of successful Internet companies, including merchandising, customer service, user interface design, and guaranteed delivery and return policy. In this competitive drive to differentiate via user experience, the ultimate winner is the Indian online consumer. Recent Innovation Smart Phones penetration With mobile apps being developed by most eCommerce websites, smartphones are increasingly replacing PCs for online shopping. In 2013, only 10% of the mobile users used smartphones, and only 5% of the eCommerce transactions were made through a mobile device. This figure has more than doubled, and more than 13% of all eCommerce transactions today happen via mobile . According to some industry players, over 50% of the orders are being placed through mobile apps, which is not only leading to substantial customer acquisition but also building customer loyalty for various brands. However, most mobile transactions so far are for entertainment, such as booking movie tickets and music downloads. This trend will change soon with more and more merchandise being ordered online. Business Strategies Exclusive partnership with leading brands : Over the year or so, there has been a trend of exclusive tie-ups between eTailers and established boutiques, designers, and high-end lifestyle and fashion brands. For instance, in 2014, Jabong added international fashion brands such as Dorothy Perkins, River Island, Blue saint and Miss Selfridge, along with local fashion brands through Jabong Boutiques. Similarly, Myntra benefited from exclusive tie-ups with brands such as Harvard Lifestyle, Desigual and WROGN from Virat Kohli. Expanding Product Basket : There is a recent trend of relatively newer products such as grocery, hygiene, and healthcare products being purchased online. Similarly, lingerie and Indian jewellery has also been in great demand among customers outside India. Export comprises 95% of cross-border eCommerce, with the US, UK, Australia, Canada and Germany being the major markets. Aggressive Price Strategy : With intense competition the profitability is decreasing due to aggressive pricing strategies, heavy discounts and offers, free delivery, high commissions to affiliates and vendors during sale period to name a few. Online retailers lost around ` 10 billion because of heavy discounts to attract customers. Online retailers, especially large retailers in competitive markets, tend to adjusts prices constantly as they seek to drive consumers to the site. This is a bit counter intuitive as one would think the transparency of online prices would lead to no price dispersion, but in fact it leads to the opposite (this is known as a Varian model). The result of this theory are two pricing strategies: Competitive Price Fluctuation: If selling widely consumed products (think Amazon), constantly adjust the price to drive traffic to the site as consumers will want to (1) purchase the low price products or (2) monitor prices for a drop Static Prices with Discounts: If you don't sell a competitive product, then fluctuating prices may actually hurt your brand/product image. In this situation, promotional discounts is the best way to reach consumers at all price levels CoD (Cash on Delivery) : Cash On Delivery (COD) is currently one of the most popular mode of payments among Indian online stores. The major reason for its popularity is that the buyers do not have to pay anything before the goods are delivered to them. This helps in giving some confidence to new buyers as ecommerce is still a growing concept in India which is fairly nascent at this stage. Reasons why CoD is popular in India 1. Lack of payment alternatives : Most of India’s population either does not have a Debit or Credit card and the ones that do, do not such it much for online transactions. Cards are basically used to withdraw cash from ATMs but not for making payments online. Therefore COD is one means where a seller can reach out to buyers even if they don’t have means to make an online payment. 2. Scam Scare! : The trust for online shopping and ecommerce has been increasing in India but many still fear using new ecommerce companies and fear that they’ll be scammed. 3. Customer Nature Like mentioned, Indians love to have the ability to see, feel and touch things that they are going to buy. People have similar expectations when they buy online as well. If it wasn’t for COD, people would still walk in to a store so as to meet this criteria. Quicker delivery options : If e-tailers can give customers the near-instant gratification of buying in a store, they can eliminate one of the most powerful advantages held by their bricks-and-mortar competitors. for example : AMAZON INDIA Scheme 1: It does have a same-day delivery like the others, but the service is available only in Mumbai and Bangalore. Scheme 2: Under its one-day delivery scheme, the company offers 2.75 lakh products and services 20 cities. When launched a few months ago, one-day delivery option was only available in 6 cities. Since then, Amazon has been setting up warehouses in more and more cities. The service costs about Rs 99 per order. Scheme 3: It also offers a two-day delivery option for Rs 49 per order. It is not clear whether this option is available across India or not. Comparison The Indian online retailing market is still evolving and certainly has room for growth; e-commerce accounts for just 0.1 per cent of total retail sales vis-à-vis more than 2.9 per cent in China This number is quite low compared to the online retail penetration enjoyed by developed markets such as the US (7.0 per cent). The study: “Global Retail E-commerce index” states that 39 million (3.9 Cr) or less than 3% of India’s population have ever bought something online, a percentage which is below countries like Saudi Arab and Ireland, which are much smaller countries. The good thing is that we witnessed one of the highest growth in ecommerce segment at 27% to reach $3.8 billion, and 21% is the projected growth rate for the next 5 years. But at present, India is not in the global ecommerce map. Global Leaders of Ecommerce Globally, ecommerce market is worth $840 billion, which increased 20% compared to 2013 (hence, India experienced more growth compared to global average). With market size of $238 billion, USA topped the chart to emerge as undisputed leader of ecommerce, globally. Interestingly, ecommerce is just 10% of USA’s total retail market, wherein in India, ecommerce is just 3% of total retail. China is world second biggest ecommerce market, as 30% of its population has purchased online, and 80% of them does regular online shopping. Alibaba reported that on Singles Day (November 11), they sold more than $9.3 billion worth of goods in China, which is 7% of their annual sales. Above is a survey analysing the ranks of countries according to e-commerce penetration on various parameters. Market Growth parameters Things the eCommerce companies need to do to accelerate growth: Customer experience : As the customers progress from research to purchase to fulfilment stages, their expectations change fast. eCommerce companies need to understand these change drivers and adapt their proposition accordingly. Easy transitions between ordering on tablets, mobile phones or PCs will have to be facilitated. Besides, convenient multichannel returns and delivery options need to be developed along with the provisions of touch and feel the product before buying. They should also ensure sufficient after sales service and support. Online product reviews and ratings, videos, more advanced sizing and fitting tools should be provided. Technological advancements : eCommerce companies constantly have to upgrade their offerings with changing technology. For instance, shopping through mobiles have truly arrived, they need to devise easy to use mobile apps for their websites. They need to ensure that their websites have the required speed to do fast business, especially during sale, deals and discounts. Solutions enabling seamless integration of back-end and front-end infrastructure, customer experience enhancement initiatives, integrated inventory management and analytics would be crucial for the eCommerce firms. Convergence of online and off line channels : As the customers progress from research to purchase to fulfilment stages, their expectations change fast. eCommerce companies need to understand these change drivers and adapt their proposition accordingly. Easy transitions between ordering on tablets, mobile phones or PCs will have to be facilitated. Besides, convenient multichannel returns and delivery options need to be developed along with the provisions of touch and feel the product before buying. They should also ensure sufficient after sales service and support. Online product reviews and ratings, videos, more advanced sizing and fitting tools should be provided. Delivery experience : With lack of integrated end to end logistics platform, the eCommerce industry is facing issues related to procurement operations and transportation. Online purchases from Tier-2 and Tier-3 cities are expected to significantly increase, thanks to the emergence of low cost smartphones, however, poor lastmile connectivity could act as a deterrent. Keeping control on logistics and on ground fleet management, especially courier companies, is essential for growth. Payments and transactions : India continues to be a cash-based society due to limited banking and credit card penetration. This, combined with a lack of consumer trust in online merchants, has forced companies to offer CoD services, which imposes significant financial cost for firms in the form of labour, cash handling and higher returns of purchased items. Data protection and the integrity of the system that handles the data and transactions are serious concerns. Companies should take necessary action for management even if this imposes a cost on them. Tax and regulatory environment : Laws regulating eCommerce in India are still evolving and lack clarity. Favourable regulatory environment would be key towards unleashing the potential of eCommerce and help in efficiency in operations, creation of jobs, growth of the industry, and investments in backend infrastructure. Furthermore, the interpretation of intricate tax norms and complex inter-state taxation rules make eCommerce operations difficult to manage and to stay compliant to the laws. With the wide variety of audience the eCommerce companies cater to, compliance becomes a serious concern. Companies will need to have strong anti-corruption programs for sourcing and vendor management, as well as robust compliance frameworks. It is important for the eCommerce companies to keep a check at every stage and adhere to the relevant laws, so as to avoid fines. Operational framework : Business models have been evolving rapidly in the eCommerce sector largely due to heightened competition and the inability of players to sustain high costs. Companies in eCommerce will need to adapt and innovate constantly to sustain their businesses. Furthermore, several of these companies entered into the eCommerce industry as startups and have grown to a huge size aided by the continuous growth in the market but lack well defined capabilities and organisational structure. System building, financial and talent management become key. Customer acquisition : The customer acquisition costs in Indian eCommerce have been climbing rapidly due to intense competition between multiple wellfunded players. Only 2% of website visits currently result into transaction. Thus, there is a gap between potential and actual buyers. Coupled with high transaction costs, this area could pose serious problems. In the US, 75% of consumers have stated that they will usually switch between brands, and for the rest of the world, this rate is 60%, according to Ecommerce Foundation.7 This suggests companies should constantly work on their brand positioning. Digital infrastructure : Digital disruption has driven change in the eCommerce industry with shoppers embracing multiple touch points in their purchase journeys. Companies should spend enough resources on technology development as also advertising and branding, especially because the younger population is demanding. In the journey toward digital business transformation, embedding SMAC technologies in the business becomes crucial. Addressable markets : To grow their businesses, the Indian eCommerce sector needs to closely watch the growth of their markets in the Tier 2 and 3 cities. They need to improve their logistics and supply chain management in these cities, do an effective demand management to keep an eye on what products are being sought in these cities. With eCommerce largely being a borderless activity companies need to keep in mind that customers always have the option to buy across the border if they cannot fulfil customers’ expectations. Concerns In India Generation and sustenance of traffic : Competition from established eCommerce players is making it difficult for private label brands to generate traffic on their white-label websites. High payment cost: CoD services impose substantial financial cost. In India, unlike in developed markets, CoD continues to be a preferred route of payment. Last-mile delivery: Poor last-mile connectivity, especially in remote areas with larger population, is another problem faced by Indian eTailers. Low profitability: Profitability is negatively impacted by high customer acquisition costs, free shipping and high rejection rate of CoD orders. Skilled manpower: Lack of talent availability and high attrition are causing manpower crunch, which is fast becoming a hurdle Effect of E-commerce on traditional market E-commerce firms including Flipkart, Snapdeal,Myntra and Jabong are confronting resistance from all stakeholders of modern retail—from consumer goods makers and distributors to offline retailers—as they try and grab a larger share of the consumer’s wallet by dangling attractive discounts. Wholesalers and brick-and-mortar retailers, the worst hit by the boom in online shopping, are putting pressure on brands to help them compete more effectively with e-commerce websites. Coupon discounts refer to price-offs that all major online retailers and marketplaces offer customers if the purchase value of goods exceeds a certain amount (usually about Rs.1,500-2,000 across online retailers). Although e-commerce accounts for less than 1% of the total retail market in India, it is by far the fastest growing retail channel. Online vs offline Online stores are projected to account for only 3% of India's total retail market by 2020, PwC said in its report 'eCommerce in India Accelerating growth'. Issues such as poor last-mile connectivity, high payment cost, low profitability, regulatory barriers and a dearth of skilled manpower are weighing on online retailers in India, PwC said. Cash on delivery (CoD) services impose substantial financial cost for online retailers, as unlike in developed markets, this continues to be a preferred mode of payment in India. PwC said profitability for online retailers in the country was affected by free shipping offered to customers and a high rejection rate on CoD orders. Moreover, customer acquisition costs are rising due to competition by companies with more funds. Traditional market on backfoot Over the past 4-5 years, competition from online retailers such as Flipkart (in books, music and electronics), Myntra and Jabong (in apparel) has eaten into the revenues of physical retailers. Specifically, competition in the last three years has been intense compelling many to go online even as their net store additions slowed. At an aggregate level, operating and net margins of companies such as Shoppers Stop, Cantabil, Kewal Kiran, Provogue, and Trent have all shown a declining trend. Even Net Store Additions CRISIL Opinion parameters such as same-store sales growth, conversion ratio and sales per square feet have been on a decline. For example, in the case of Shoppers Stop, sales per square feet have declined from Rs 8,518 in 2010-11 to Rs 7,837 in 2012-13, while the conversion ratio has come down from 24 per cent to 22 per cent over the same period. To be sure, the surge in online retailing is not the only reason for the weak performance of traditional retailers. There are other factors such as economic slowdown and local competition, but what’s irrefutable is that the online upstarts are chomping away business. The fact that online discounts and sales have come to dictate pricing in India is widely known. While customers benefit from reduced pricing and increased convenience, the extent of the impact that online retailers like Flipkart and Amazon are having on the day-to-day operations of brick-and-mortar stores is something very few have paused to think about. Traditional retailers being forced to move online To stay in the game, traditional retailers have been working on their internet strategy. For instance, Shoppers Stop, which started its online store in 2008, has boosted presence and improved features and user interface to bring its online visage on a par with leading e-commerce websites. The company is also trying to leverage its physical network by giving customers the option to return products at its stores. Apart from Shoppers Stop, Croma has an online store with options such as store pickup and cash on delivery. Info from USA What we are witnessing in India today played out in the US about a decadeand-a-half back. That was when today’s big daddies such as eBay and Amazon debuted. In the next 4-5 years, by the turn of the century, they had become big enough to pose a threat to traditional retailers such as Wal-Mart, forcing them to come up with online strategies of their own. Similarly, physical retailers in India will have to establish their presence online quickly. And, with the right strategies, they can even compete effectively. For instance, to tackle the queue problem at its stores, WalMart allows customers to shop online and opt for either home delivery or store pick-up. Today, WalMart is among the top 5 online retailers in the US with estimated revenues of USD 10 billion in 2013 from the online segment alone. FDI : How it matters? In September 2012, the Indian government allowed 51% FDI in multi-brand retail, subject to certain conditions. However the Department of Industrial Policy and Promotion (“DIPP”) of the Ministry of Commerce and Industry later clarified that this mandate did not apply to B2C e-retail and would apply only to retailers with brick-and-mortar operations. Disadvantages 1. There will be loss of jobs and creation of a monopoly by multinational companies. 2. Allowing the entry of inventory-based large foreign e-retailers like Amazon and e-Bay may shrink Indian entrepreneurship and the Micro, Small and Medium Enterprises (“MSMEs”) sector. 3. It is apprehended that organized retailers would source their goods from cheaper markets abroad, which will adversely affect the Indian manufacturing sector. Favouring FDI 1. creation of infrastructure, more jobs and better consumer service. 2. The move will reduce the need for middlemen, lower transaction costs, reduce overhead charges, and reduce inventory and labour costs. 3. The spread of e-commerce in the rural and suburban India will provide choices to the growing number of customers there who have disposable income and are willing to spend for their choices. It will also help the rural economies integrate faster with the national economy. 4. The government‘s discussion paper observes that e-commerce has the potential to contribute more than 4% to India‘s GDP by 2020. 5. If and when the new government introduces FDI in B2C e-retail, it will be interesting to see the entry routes, FDI caps and limits on the percentage of sourcing from domestic manufacturers. Supportive foreign investment regulations will help in easing capital constraint and building a constructive growth environment for the e-retail industry.