Chapter 6 - #1 - The Journal and Source Documents

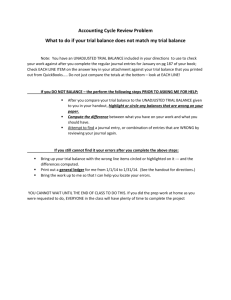

advertisement

Introduction to Accounting 120 Chapter 6: The Journal and Source Documents Mr. Binet Moncton High School Chapter Highlights • The Journal • Source Documents • Provincial Sales Tax • The Goods and Services Tax • Analyzing Financial Data: Trend Analysis The Journal • In the past two chapters we have recorded changes caused by transactions, the ledger accounts called TAccounts. • These ledger accounts alone do not satisfy all of The Journal • Each transaction required two or more entries that must balance. • Transactions mount up and become scattered within the ledger. • It may become difficult to put The Journal • Entries are recorded in a journal before they are recorded in the ledger. • Each transaction is recorded in the order of their occurrence. Two-Column General Journal • The accounting entries for the transactions are referred to as journal entries. • An entry is made up of all the accounting changes from one transaction, in the form in which they are written up in the general journal. Journalizing • This is the process of recording accounting entries in the journal. • The journal is known as a book of original entry because each balanced accounting entry is recorded Journalizing 1. Transactio ns Occur 2. Transactio ns are recorded in 3. The accounting entries are transferred to the ledger accounts Journalizing in the Two-Column General Ledger • From Page 169: • 1. The year: Enter the year in small figures on the first line of each page. Do not repeat it for each entry. Enter a new year at the point on the page where it occurs. • 2. The month: Enter the month on the first line of each page. Do not repeat it for each entry. Enter a new month at the point where it occurs. • 3. The day: Enter the day on the first line of each journal entry. The day is repeated no Steps in Recording a Journal Entry • Step 1: Enter the day in the date column • Step 2: Enter the names of the accounts to be debited at the left side of the Particulars column. Enter the debit amounts in the Debit money column. • Step 3: Enter the names of the accounts to be credited. They are intended 3 spaces in the Particulars column. Enter the credit amounts in the Credit money column. • Step 4: Write a brief explanation for the entry at the left side of the Particulars Usefulness of the General Journal • The purpose of the genera journal is to provide a continuous record of the accounting entries in the order in which they occur. • The accounting clerk works out the accounting works out the accounting entries from the source documents and records them in the journal. • The clerk can then see the work in an organized way. • A job well done at this stage reduces errors 6.2 Source Documents Mr. Binet Moncton High School Source Documents • The accounting department is informed of transactions by means of business papers that are sent to it. These papers are called source documents. • This is a business paper that shows the nature of a transaction and provides all of the info needed to account for it properly. • Almost all accounting entries are based on source documents. Source Documents • For some transactions, such as the owner drawing money from the company, there is no official formal document. • For this, they must issue a memo from the owner. • A company is required to keep source documents on file. • They are used for reference, locating errors and provide factual evidence to verify transactions of the business. • Provides proof that the records have been Source Document Types • Cash Sales Slip: is a business form showing the details of a transaction for goods or services that are sold to a customer for cash. • Sales Invoice: Some business do not have cash sales and all sales are on account. A sales invoice is a business form showing the details of the transaction in which goods or services are sold on account. • Dual Purposes Sales Slip: is a business form showing the details of a transaction in which goods or services are sold either for Source Document Types • Purchase Invoice: Is a business form representing a purchase of goods or services on account. • Cheque Copies: Is a document supporting the accounting entry for a payment by cheque. • Cash Receipts Daily Summary: Is a business paper that lists the money coming in from customers. • Bank Debit/Credit Advice: is a bank document informing the business of an GAAP: The Cost Principle • The cost principle states that the accounting for purchases must be at the cost of price to the purchaser. Chapter 6 – Assignment #1 • On the O: drive, open the “Chapter 6 – Assignment #1” Document and Excel file and complete. • This will be due Wednesday in Class.