Chapter 3 - Trinity College Dublin

advertisement

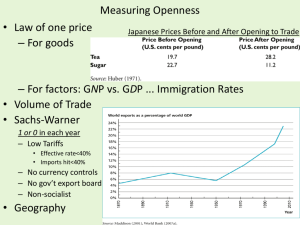

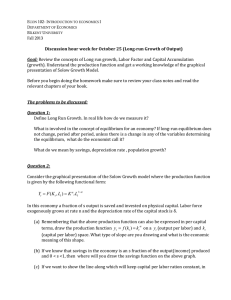

EC3040 Economics of LDCs Module B Professor Patrick Honohan http://www.tcd.ie/Economics/staff/phonohan 1 EC3040 Economics of Less-developed Countries Module B January-May 2009 Professor Patrick Honohan Room C6.009, Institute for International Integration Studies, 6th Floor, Arts Building, Trinity College, Dublin Office hour: Monday 3-4pm or email me at phonohan@tcd.ie Outline This module begins (in January 2009) with a look at some of the economic models that have been used to analyze cross-country differences in overall economic growth. We then focus on international and financial dimensions to development, including the problem of LDC debt. The final topic covers aid, government and institutions. Sources Text: Todaro, Michael P. and Stephen C. Smith. 2008. Economic Development 10th Edition (Addison-Wesley) (Earlier editions will do) The aim is to cover Chapters 3-4 and 11-17 of the core text (Todaro and Smith) in this module. 2 There will not be sufficient time to discuss all the material in the lectures so students should ensure they read these chapters. Additional background reading will be listed in a note on tutorial topics and some other items will be mentioned in the lecture notes to be posted below. Topics 1. Theories of growth: old and new Slides will be available here 2. International trade: Engine of growth or obstacle to development Slides will be available here 3. Finance: “neither a borrower nor a lender be”? Slides will be available here 4. Aid, government and institutions Slides will be available here 3 EC3040 Economics of LDCs Module B Topic 1 Theories of Economic Growth (Drawn mainly from Todaro-Smith Ch 3 & 4) 4 …we start with an animation from www.gapminder.org 5 2006 6 Deaton, JEP 2008 7 Deaton, JEP 2008 Average growth rates 1960-2000 Source for these blue figures: Weil (2007) 8 9 What causes economic growth? The role of capital • Rostow’s “Stages of growth” – Emphasized mobilization of savings • The Harrod-Domar growth model – Saving→ increasing stock of capital → growth of output • Solow’s model – Recognizes diminishing returns – Reaches dramatically different conclusions! 10 11 The Harrod-Domar Model S sY (3.1) I K (3.2) Y K/k SI Y K / k (3.3) (3.4) 12 The Harrod-Domar Model (2) S sY kY K I (3.5) sY kY (3.6) Y s Y k (3.7) 13 The Harrod-Domar Model (2) S sY kY K I (3.5) sY kY (3.6) Y s Y k (3.7) 14 15 Interlude – how good is all this data? 16 The Solow Model S sY I K K (3.2) Y F (K ) (3.3) SI (3.4) *Adding this alone to Harrod-Domar just changes s to s-δk in 3.7 (3.1) Depreciation* With diminishing returns 17 The Solow Model (2) Y Y K 0 K K Diminishing returns implies increasing “incremental capital output ratio” 18 The Solow Model (3) Y K K 0 Y K Eventually capital (and output) grow to the point where saving is only sufficient to pay for depreciation 19 Long-term equilibrium in simplest Solow model Y sY δK K 20 Long-term equilibrium in simplest Solow model Y sY δK K 21 Long-term equilibrium in simplest Solow model Y sY δK Stationary point K 22 Long-term equilibrium in simplest Solow model Y sY δK Stationary points K 23 Long-term equilibrium in simplest Solow model Y high saving sY low saving δK Stationary points K 24 Harrod-Domar and Solow model predictions • Harrod-Domar says growth is proportional to savings rate …and inversely to capital-output ratio • Although Solow agrees that (at the same level of income per head) a country with higher savings will grow faster… • Solow also says growth eventually stops despite savings (unless population or technology changes) • But eventual income per worker will depend on savings 25 26 Role of population growth in Solow model • Reduces the effect of diminishing returns to capital • So boosts long-term growth of output • But still no long-term growth in per capita output • (See figures in Appendix to Chapter 3) 27 Role of population growth in Solow model (2) • Focus shifts from output Y and capital K to output/labour ratio Y/L written y and capital/labour ratio K/L, written k. Warning: this is not the same k as in the Harrod-Domar model! • If population is growing at the rate n, then k sy (n )k 28 29 30 Quantifying the Solow model Let’s be specific about the function f(y) in y=f(k) Log-linear function has the kind of shape we want: y Ak Which is the same as 1 Y AK L Also called: “Cobb-Douglas” production function 31 Weil (2007). Uses Solow model Cobb-Douglas production function with capital share of 1/3 32 Weil (2007). Uses Solow model Cobb-Douglas production function with capital share of 1/3 33 Quantifying the Solow model (2) Solow made the most of this gap: Her argued that the missing element must be improvements in technology. These got called the “Solow residual” – and represented most of growth for advanced economies But where does the technology come from? 34 35 36