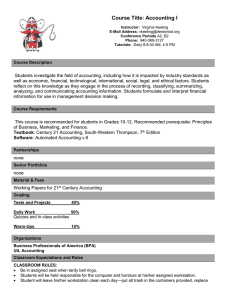

ACCOUNTING 1 COURSE CODE: 5001 COURSE DESCRIPTION:

advertisement

ACCOUNTING 1 COURSE CODE: 5001 COURSE DESCRIPTION: This course is designed to help the student develop the skills necessary for the highly technical interaction between accounting and business, to develop an understanding of the steps of the accounting cycle as applied to several different kinds of business operations, and to develop an understanding of accounting concepts, principles, and practices. Use of the computer in simulated activities gives the student an opportunity to see the advantages of technology in accounting procedures. OBJECTIVE: Given the necessary equipment, supplies, and facilities, the student will complete all of the following core standards successfully. RECOMMENDED GRADE LEVEL: 10-12 COURSE CREDIT: 1 unit PREREQUISITE: Completion of Algebra I or equivalent with a grade of C or better and/or Accounting instructor approval COMPUTER REQUIREMENT: one computer per student; Internet access RESOURCES: www.mysctextbooks.com A. SAFETY AND ETHICS 1. Identify major causes of work-related accidents in offices. 2. Describe the threats to a computer network, methods of avoiding attacks, and options in dealing with virus attacks. 3. Identify potential abuse and unethical uses of computers and networks. 4. Explain the consequences of illegal, social, and unethical uses of information technologies (e.g., piracy; illegal downloading; licensing infringement; inappropriate uses of software, hardware, and mobile devices). 5. Differentiate between freeware, shareware, and public domain software copyrights. 6. Discuss computer crimes, terms of use, and legal issues such as copyright laws, fair use laws, and ethics pertaining to scanned and downloaded clip art images, photographs, documents, video, recorded sounds and music, trademarks, and other elements for use in Web publications. 7. Identify netiquette including the use of e-mail, social networking, blogs, texting, and chatting. 8. Describe ethical and legal practices in business professions such as safeguarding the confidentiality of business-related information. B. EMPLOYABILITY SKILLS 1. Identify positive work practices (e.g., appropriate dress code for the workplace, personal grooming, punctuality, time management, organization). 2. Demonstrate positive interpersonal skills (e.g., communication, respect, teamwork). C. STUDENT ORGANIZATIONS 1. Explain how related student organizations are integral parts of career and technology education courses. 2. Explain the goals and objectives of related student organizations. 3. List opportunities available to students through participation in related student organization conferences/competitions, community service, philanthropy, and other activities. 4. Explain how participation in career and technology education student organizations can promote lifelong responsibility for community service and professional development. D. ACCOUNTING CYCLE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. List the parts of the basic accounting equation. Define each part of the basic accounting equation. Classify accounts as assets, liabilities, or capital. Prepare a beginning balance sheet. Analyze transactions to determine a) which accounts are affected. b) which account is debited. c) which account is credited. Open an account in a(n) a) general ledger. b) accounts receivable ledger. c) accounts payable ledger. Identify source documents required for journalizing transactions. Journalize transactions in a) a general journal. b) special journals. Post from the journal(s) to the a) general ledger. b) accounts receivable ledger. c) accounts payable ledger. Prepare a schedule of a) accounts receivable. b) accounts payable. Prepare a trial balance. Complete a worksheet with adjustments to determine a) net loss. b) net gain. Prepare the following financial statements: a) income statement and b) balance sheet. Journalize a) adjusting entries. b) closing entries. Post 16. 17. 18. E. a) adjusting entries. b) closing entries. Prepare a post-closing trial balance. Demonstrate knowledge of accounting terminology. Demonstrate knowledge of accounting concepts. CASH MANAGEMENT 1. 2. 3. 4. 5. Endorse checks. Prepare a deposit slip. Complete a check stub. Write a check. Journalize the entry for a) a bank service charge. b) credit card fees. c) direct deposit. d) ATM withdrawals. e) automatic payment withdrawals. 6. Journalize the entry for returned items. 7. Reconcile a bank statement. 8. Journalize reconciling items. F. AUTOMATED ACCOUNTING 1. Describe the differences between manual and computerized accounting systems. 2. Demonstrate ability to access accounting programs. 3. Demonstrate basic use of accounting software. 4. Demonstrate an awareness of and the ability to manipulate a chart of accounts. 5. Analyze and input transactions. 6. Print financial statements. G. PAYROLL SYSTEMS 1. 2. 3. 4. 5. 6. 7. 8. Identify methods of calculating employee earnings. Prepare a payroll register. Update employee earnings record. Journalize the entry to record employee earnings and withholdings. Post the entry to record employee earnings and withholdings. Identify employer’s payroll tax obligations. Journalize the entry to record employer’s tax obligations. Post the entry to record employer’s tax obligations. STUDENTS WILL NEED: A classroom set of books are provided for the students. Students are also able to check out textbook, if needed. A notebook and a pen are also needed. Students are to keep notes and projects completed in class in the notebook. LEARNING STRATEGIES: Students will be exposed to a variety of learning strategies: classroom discussion, group work, project work, research, classroom presentations, interviews, and surveys. CLASSROOM RULES: Classroom rules are posted in the classroom and the teacher goes over these rules at the beginning of the year and as needed throughout the year. Consequences for breaking rules are listed on the classroom rules sheet. EVALUATIONS: Class Work Test Problems Chapter Terms and Questions 25% 30% 30% 15% ASSESSMENTS: Students will be graded on each assignment. Assignments will include class work (daily) and chapter terms and questions. Major assessments will include written tests and projects. The following grading scale follows district guidelines: A B C 93 – 100 85 – 92 77 – 84 D F 70 – 76 69 and Below STUDENT RECORDS: Class records are maintained via internet through PowerTeacher. PARENT COMMUNICATION: Parents will be notified of the student’s grades each 9 week grading period. An interim report at the middle of the 9 week grading period is also issued. Both of these will be sent home with the student. Final grades will be given at the end of each 9 week grading period. Absences will be recorded and phone calls to the parent will be made with excessive absences. A parent will be notified by phone if the teacher finds that to be the most appropriate method of communication for that particular student about class participation, work record, discipline or any other notification for that parent. Parents may also log in to Power School to monitor student progress and attendance. SUPPLEMENTARY MATERIALS/ACTIVITIES: Oral questioning, pretest, and/or informal surveys will be utilized as initial diagnostic techniques for course content to be adjusted for maximum class benefits. To accommodate for student learning differences, assignments may vary in degree of difficulty. Also, supplementary materials will be given to students who would benefit from additional practice. COOPERATIVE LEARNING: Students will work together in teams to complete projects, teamwork exercises, and test taking skills. Students learn from each other and the experience of others in the classroom.