+ Infrastructure Private Insurance - The Early Childhood Technical

advertisement

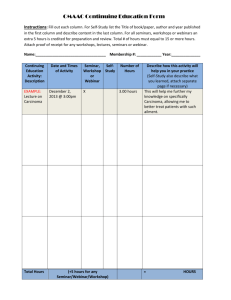

+ Utilizing Private Insurance in Supporting Part C Services Ron Benham MA Part C Coordinator Private Insurance Webinar + Objectives from the webinar on public insurance: Provide foundational background for learning about Private Insurance Introduce key types of Private Insurance and their components related to Part C Display private insurance information from the 2014 ITCA Financial Survey and what forms of Private Insurance state Part C systems are accessing Highlight developments and directions in Private Insurance and opportunities they may offer Part C systems Private Insurance Webinar + Private Insurance Webinar 3 Early Intervention Services Sec. 303.12 Payor of last resort Sec. 303.510 Policies related to use of public benefits or insurance or private insurance to pay for Part C services Sec. 303.520 System of payment and fees Sec. 303.521 + 4 § 303.510 Payor of last resort. (a) Nonsubstitution of funds. Except as provided in paragraph (b) of this section, funds under this part may not be used to satisfy a financial commitment for services that would otherwise have been paid for from another public or private source, including any medical program administered by the Department of Defense, but for the enactment of part C of the Act. Therefore, funds under this part may be used only for early intervention services that an infant or toddler with a disability needs but is not currently entitled to receive or have payment made from any other Federal, State, local, or private source (subject to §§ 303.520 and 303.521). Private Insurance Webinar + 5 ERISA and non-ERISA Policies Employee Retirement Income Security Act of 1974 Non-ERISA : A fully insured group health plan under which the benefits are provided by the sponsoring employer or union through the purchase of health insurance coverage from an HMO or an insurance company. In exchange for a premium, the HMO or the insurance company bears full risk for the cost of the benefits provided. Fully-insured plans are accountable to the your State Department of Insurance. ERISA: A self-insured (or self-funded) plan is a group health plan under which the risk for the cost of the benefits provided is borne by the sponsoring employer or union. The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other administrative services), but the financial liability for the cost of the benefits provided remains with the employer or union. Private Insurance Webinar + 6 Within ERISA and non-ERISA Health plans: various delivery models Indemnity Fee Plans for Service Managed Private Insurance Webinar Care + 7 Private Insurance Utilization Private Insurance Webinar + 8 System of Payments (n=36) Private Insurance Webinar + 9 Statutory Language Related to Use of Private Insurance (n=21) Private Insurance Webinar + 10 Statutory Cap on Insurance Payment (n=21) Private Insurance Webinar + 11 Decrease in Insurance Revenue from Family Refusing Access (n=21) Private Insurance Webinar + 12 Reported Revenue Private Insurance: 14 of the 21 states reporting use of private insurance could provide revenue information. Total: Private Insurance Webinar $75,430,080 + 13 Part C Services included in the ACA Essential Benefits(n=31) Private Insurance Webinar + 14 Infrastructure Private Insurance (21) State Personnel 1 Regional Personnel 1 Local Personnel 0 SICC 0 Child Find Public Awareness 2 Eligibility Determination 12 CSPD 0 Monitoring 0 Dispute Resolution 0 Data System 1 IFSP Development 5 Private Insurance Webinar + Private Insurance Webinar Direct Services 15 Private Insurance (21) Assistive Technology 15 Audiology 14 Family Training 11 Health 15 Medical (diagnostic) 15 Nursing 15 Nutrition 14 Occupational Therapy 17 Physical Therapy 17 Psychology 16 Service Coordination 10 Special Instruction 12 Speech Therapy 16 Sign or Cued Language 8 Social Work 11 Transportation 10 Vision 12 + 16 Massachusetts: A State Example Private Insurance Webinar + MA Medicaid Participation as precursor to billing private insurance 1985 - present Reimbursement model changed from cost reimbursement to unit based Currently 7 reimbursable services & current hourly rates (divisible by 15 minute increments for program based model: Home Visits Center Individual Community Based Group EI Only Group Parent Group Screening Assessment $ 81.80 68.60 31.40 23.88 30.68 95.60 109.72 DPH serves as gatekeeper to Medicaid Private Insurance Webinar 17 + 18 MA Private Insurance Mandate Bill introduced in 1986 Legislation passed in January 1990 Law took effect in April 1990 Fully in effect April 1991 “Medically Necessary” criteria Service costs capped Initial $2,400 yearly/ $7,200 aggregate SFY- 97 - $3,200 yearly/$9,600 aggregate SFY- 03 - $5,200 yearly/$15,600 aggregate SFY-13 – Cap removed Private Insurance Webinar + 19 MA Use of Private Insurance Legislation allowing access to a family’s private insurance coverage for covered Part C services w/ consent The dependent coverage of any such policy shall also provide coverage for medically necessary early intervention services delivered by certified early intervention specialists, as defined in the early intervention operational standards by the department of public health and in accordance with applicable certification requirements. Private Insurance Webinar + 20 MA Use of private insurance, cont. Such medically necessary services shall be provided by early intervention specialists who are working in early intervention programs certified by the department of public health, as provided in sections 1 and 2 of chapter 111G, for children from birth until their third birthday. Reimbursement of costs for such services shall be part of a basic benefits package offered by the insurer or a third party… Private Insurance Webinar + 21 MA Use of private insurance, cont. and shall not require co-payments, coinsurance or deductibles; provided, however, that co-payments, coinsurance or deductibles shall be required if the applicable plan is governed by the Federal Internal Revenue Code and would lose its taxexempt status as a result of the prohibition on co-payments, coinsurance or deductibles for these services. Private Insurance Webinar + 22 MA Use of Private Insurance, cont. Family Co-Pay or Deductible Historically, Massachusetts EI paid co-pays and deductibles of families which allow greater access to private insurance reimbursement Paying insurance premiums for Part C enrolled children Such payments may occur but this is not a widespread activity Private Insurance Webinar + 23 What has worked in MA VISION, COMMITMENT, PERSISTENCE Positive, cooperative working relationship with insurers and Medicaid Insurance/Health Plans with Early Intervention coordinators work best Insurers did not strongly oppose withdrawal of cap in SFY -13 Joint efforts related to billing/claims submission Ongoing identification of systemic problems, programs, payers Private Insurance Webinar + 24 Strategies for Accessing Private Insurance Research and utilization of other state’s insurance legislation: Colorado New Hampshire Connecticut New Mexico Indiana New York Massachusetts Rhode Island Virginia http://ectacenter.org/topics/finance/statelegis.asp Determine the type of coverage you seek discrete therapy program driven model service type vs. discipline specific Private Insurance Webinar + 25 Additional Strategies for Accessing Private Insurance Determine congruence between system design and what insurers reimburse Conduct a Circle of Influence (who will champion your effort?) Get away from viewing Health Plans as “the enemy” Understand the importance of meeting “medical necessity” (what is your eligibility criteria?) Draft cost saving arguments (Early Intervention vs. rehabilitation services) Private Insurance Webinar + Circles of Involvement: 26 Developing Key Relationships for Implementation Circle of Possibility Circle of Information Awareness Circle of Champions Circle of Engagement Giving Permission Attending Meetings Core Circle Bringing on new leaders Input Planning Financial Support The Strategic Plan Initiation Adding Influence Holding Meetings Doing the work Decisions Coordination Advice Technical Support Private Insurance Webinar Adapted from “Creating a Framework of Support and Involvement” originally created by the Canadian Institute of Cultural Affairs © 2002-2012 + Circles of Involvement: 27 Developing Key Relationships for Implementation More “External” Private Sector: Voluntary Sector: Business, Media, Investors/Funders Faith Community, NonProfits, Associations Public Sector: Informal Sector: Government, Education, Public Figures Kinship relations, interest groups, neighbors The Strategic Plan Resource Partners: “Who is providing resources?” Supportive involvement, program circle, suppliers, networking “Who is authorizing it?” Management, the board, framing Beneficiaries: “Who is benefiting from it?” The “customer”, the “stakeholder”, on whose behalf it is being done, those affected by it Private Insurance Webinar Policy Partners: Practitioners: “Who is doing it?” Direct involvement, staff, mobilizing More “Internal” Adapted from “Creating a Framework of Support and Involvement” originally created by the Canadian Institute of Cultural Affairs © 2002-2012 + 28 Other Considerations Be aware of Maintenance of Effort (MOE) concerns – funding accessed thru private insurance reimbursement does not count for meeting federal MOE requirements (state and local public funds). The process of accessing private insurance isn’t necessarily quick. Legislation mandating coverage is most useful (utilize other state examples). Private Insurance Webinar + 29 Additional Resources A useful background link on insurance coverage in all states, http://www.rwjf.org/content/dam/farm/reports/reports/2014/rwjf412274 Examples of state insurance legislation for Early Intervention http://ectacenter.org/topics/finance/statelegis.asp Private Insurance Webinar Thank you for your attention! This is the third of four webinars in a series on Part C Finance presented in 2014. Resources related to this call and other calls in the series are available at the following URL: http://ectacenter.org/~calls/2014/financepartc/financepartc.asp