TTTT – Debt Presentation – 09

advertisement

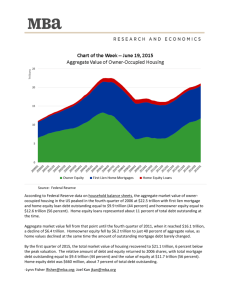

#1 During fiscal year 2012, the U.S. government spent 3.7 trillion dollars but it only brought in 2.4 trillion dollars #2 When Ronald Reagan took office, the U.S. national debt was less than 1 trillion dollars. Today, the U.S. national debt is over 15.2 16.6 17.5 trillion dollars #3 During 2011, U.S. debt surpassed 100 percent of GDP for the first time ever #4 According to Wikipedia, the monetary base “consists of coins, paper money (both as bank vault cash and as currency circulating in the public), and commercial banks’ reserves with the central bank.” In 2011, the U.S. monetary base is sitting somewhere around 2.741 trillion dollars. So if you went out and gathered all of that money up it would only make a small dent in our national debt. But afterwards there would be no currency for anyone to use #5 U.S. Government spent over $224 Billion dollars just on net interest on the national debt in fiscal 2012. Will spend $1 Trillion by 2020 #6 The U.S. government has total assets of 2.7 trillion dollars and has total liabilities of 18.4 trillion dollars. The liabilities do not even count 4.9 trillion dollars of intra-governmental debt that is currently outstanding #7 During the Obama administration, the U.S. government has accumulated more debt than it did from the time that George Washington took office to the time that Bill Clinton George Bush took office #8 It is being projected that the U.S. national debt will surpass 21.6 trillion dollars in 2019 #9 According to the GAO, the U.S. government is facing 34 $45.8 Trillion dollars in unfunded liabilities for social insurance programs such as Social Security and Medicare. These are obligations that we have already committed ourselves to but that we do not have any money for #10 Others estimate that the unfunded liabilities of the U.S. government now total over 117 trillion dollars #11 According to the GAO, the ratio of debt held by the public to GDP is projected to reach 287 percent of GDP by 2086 #12 Others are much less optimistic. A recently revised IMF policy paper entitled “An Analysis of U.S. Fiscal and Generational Imbalances: Who Will Pay and How?” projects that U.S. government debt will rise to about 400 percent of GDP by the year 2050 #13 The United States government is responsible for more than a third of all the government debt in the entire world #14 If you divide up the national debt equally among all U.S. taxpayers, each taxpayer would owe approximately $134,685 $146,200 $151,343 #15 Mandatory federal spending surpassed total federal revenue for the first time ever in fiscal 2011. That was not supposed to happen until 50 years from now #16 Between 2007 and 2010, U.S. GDP grew by only 4.26%, but the U.S. national debt soared by 61% during that same time period #17 During Barack Obama’s first two years in office, the U.S. government added more to the U.S. national debt than the first 100 U.S. Congresses combined #18 When you add up all spending by the federal government, state governments and local governments, it comes to 46.6% of GDP #19 Our nation is more addicted to government checks than ever before. In 1980, government transfer payments accounted for just 11.7% of all income. Today, government transfer payments account for 18.4% of all income #20 U.S. households are now actually receiving more money directly from the U.S. government than they are paying to the government in taxes #21 A staggering 48.5% of all Americans live in a household that receives some form of government benefits. Back in 1983, that number was below 30% #22 Back in 1965, only one out of every 50 Americans was on Medicaid. Today, one out of every 5 Americans was on Medicaid for at least a month! #23 In 1950, each retiree’s Social Security benefit was paid for by 16 U.S. workers. According to new data from the U.S. Bureau of Labor Statistics, there are now only 1.75 full-time private sector workers for each person that is receiving Social Security benefits in the United States #24 The Medicare trust fund's expenditures have exceeded its income each year since 2008 #25 Right now, spending by the federal government accounts for about 24 percent of GDP. Back in 2001, it accounted for just 18 percent #26 If the U.S. government was forced to use GAAP accounting principles (like all publicly-traded corporations must), the U.S. government budget deficit would be somewhere in the neighborhood of $4 trillion to $5 trillion each and every year #27 If you were alive when Christ was born and you spent one million dollars every single day since His death, you still would not have spent one trillion dollars by now. But in one year alone the U.S. government will add more than a trillion dollars to the national debt #28 If right this moment you went out and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars #29 A trillion $10 bills, if they were taped end to end, would wrap around the globe more than 380 times. That amount of money would still not be enough to pay off the U.S. national debt #30 If the federal government began right at this moment to repay the U.S. national debt at a rate of one dollar per second, it would take over 470,000 years to pay off the national debt #31 If Bill Gates gave every penny of his fortune to the U.S. government, it would only cover the U.S. budget deficit for 15 days #32 According to Professor Laurence J. Kotlikoff, the U.S. is facing a “fiscal gap” of over 200 trillion dollars in the future. The following is a brief excerpt from a recent article that he did for CNN…. The government’s total indebtedness — its fiscal gap — now stands at $211 trillion, by my arithmetic. The fiscal gap is the difference, measured in present value, between all projected future spending obligations — including our huge defense expenditures and massive entitlement programs, as well as making interest and principal payments on the official debt — and all projected future taxes. #33 If you add up all forms of debt in the United States (government, business and consumer), it comes to more than 56 trillion dollars. That is more than $683,000 per family. Unfortunately, the average amount of savings per family in the U.S. is only about $4,735 #34 The U.S. national debt is now more than 5000 times larger than it was when the Federal Reserve was created back in 1913 #35 Can We Grow Our Way Out Of The Debt? Do we want to? Missouri Constitution: Article 1 Section 3 That the people of this state have the inherent, sole and exclusive right to regulate the internal government and police thereof, and to alter and abolish their constitution and form of government whenever they may deem it necessary to their safety and happiness, provided such change be not repugnant to the Constitution of the United States. Ruger 10/22 American Farmer Edition 22LR Talo Exclusive Rifle MSRP $499.00 Rifle Specifications Caliber/Gauge .22 LR Action Type Semi-Automatic Barrel 20" Receiver/Finish Blued Alloy Stock Laser Engraved Rich Walnut Front Sight Gold Bead Rear Sight Adjustable Magazine Capacity 10+1 Magazine Type Rotary Magazine Magazines 1 Packaging Specially Designed Cardboard Box Features Talo Exclusive one of 3,300 Overall Length 38.5" Weight 7.50lb