UCOP Career Tracks Job Database - UC Agriculture and Natural

advertisement

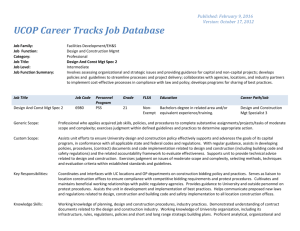

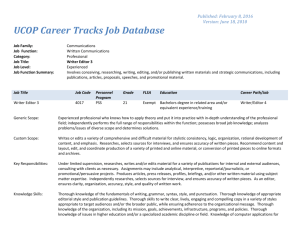

UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Professional Enterprise Risk Mgt Anl 1 Entry Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgt Anl 1 7202 Personnel Program PSS Grade FLSA Education Career Path/Job 17 NonExempt Bachelors degree in related area and/or equivalent experience/training Enterprise Risk Mgmt Analyst 2 Generic Scope: Entry-level professional with limited or no prior experience; learns to use professional concepts to resolve problems of limited scope and complexity; works on developmental assignments that are initially routine in nature, requiring limited judgment and decision making. Custom Scope: Learns to use professional risk management concepts. Applies organizational policies and procedures to resolve routine casualty, property-loss insurance and other risk management issues or customer inquiries. Works on problems of limited scope. Follows standard practices and procedures in analyzing situations or data from which answers can be readily obtained. Key Responsibilities: Learns to develop and administer basic casualty and property-loss insurance programs. Under direct supervision, responsible for analyzing simple to moderately complex potential loss areas and determines appropriate type and level of loss protection to be insured. Under direct supervision, participates in the preparation of specifications for broker or underwriter bids. Administers basic claims and monitors payments. Learns to analyze basic risk control programs to prevent losses and reduce premiums. Learns to implement and monitor basic control strategies and programs. Knowledge Skills: Is learning enterprise risk management; insurance; forecasting and analysis; accounting; knowledge of common organization-specific computer application programs; knowledge of organizational processes and procedures; understanding of organization rules and regulations. Interpersonal skills; service orientation; active listening; critical thinking; verbal communication; written communication; organization. Effective written and verbal communication skills. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Professional Enterprise Risk Mgt Anl 2 Intermediate Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgt Anl 2 7203 Personnel Program PSS Grade FLSA Education Career Path/Job 19 NonExempt Bachelors degree in related area and/or equivalent experience/training Enterprise Risk Mgmt Analyst 3 Generic Scope: Professional who applies acquired job skills, policies, and procedures to complete substantive assignments/projects/tasks of moderate scope and complexity; exercises judgment within defined guidelines and practices to determine appropriate action. Custom Scope: Uses professional enterprise risk management concepts. Applies organizational policies and procedures to resolve a variety of moderately complicated issues. Works on casualty, property-loss, and loss prevention programs and services where analysis of situations or data requires a review of a variety of factors. Key Responsibilities: Applies professional concepts to administer and perform operations relating to casualty and property-loss insurance programs and loss prevention activities. Under general supervision, analyzes and defines basic potential loss areas and determines appropriate type and level of loss protection to be insured. Assists with the preparation of specifications for and evaluation of broker or underwriter bids. Under general supervision, submits claims and monitors payments. Participates in appraisal and adjustment proceedings. Coordinates moderately complex risk control programs to prevent losses and reduce premiums. May perform moderately complex accounting and risk management financial analysis. Develops and coordinates related financial management training for the organization. Knowledge Skills: Working knowledge in the following areas: risk management; insurance; forecasting and analysis; accounting; knowledge of common organization-specific computer application programs; knowledge of organization processes and procedures; understanding of organization rules and regulations. Requires interpersonal, service oriented, active listening and critical thinking skills. Requires ability to present complex risk findings and make recommendations in a clear concise manner both in writing and verbally. UCOP Career Tracks Job Database Published: March 22, 2016 Version: May 27, 2008 UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Professional Enterprise Risk Mgt Anl 3 Experienced Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgt Anl 3 7204 Personnel Program PSS Grade FLSA Education Career Path/Job 21 Exempt Bachelors degree in related area and/or equivalent experience/training Enterprise Risk Mgmt Analyst 4 Generic Scope: Experienced professional who knows how to apply theory and put it into practice with in-depth understanding of the professional field; independently performs the full range of responsibilities within the function; possesses broad job knowledge; analyzes problems/issues of diverse scope and determines solutions. Custom Scope: Uses skills as a seasoned, experienced enterprise risk management professional with a full understanding of industry practices and organizational policies and procedures; resolves a wide range of issues. Works on problems of diverse scope where analysis of data requires evaluation of identifiable factors in the areas of physical risk, business risk, and process risk. Demonstrates good judgment in selecting methods and techniques for obtaining solutions. Key Responsibilities: Develops, implements, and administers risk management insured and self-insured programs and operations with respect to insurance claims administration, contracts and loss prevention. Interprets insurance and indemnification provisions for contracts, agreements, leases, etc. to ensure organization is not assuming third party liability for which it has no insurance coverage. Gathers, analyzes, prepares and summarizes areas of potential loss recommends appropriate type and level of loss protection to be implemented. Prepares specifications for broker or underwriter bids, evaluates bids, and recommends or concludes insurance contracts. Performs complex accounting and risk finance related to this function. Implements and monitors control strategies and programs. Administers all claims for general liability, auto and property damage. Liaises with third parties and claimants to resolve in accordance with organization guidelines in a timely manner. Knowledge Skills: Thorough knowledge in the following areas: risk management; insurance; forecasting and analysis; accounting; knowledge of common organization-specific computer application programs; knowledge of organizational processes and procedures; understanding of UCOP Career Tracks Job Database Published: March 22, 2016 Version: May 27, 2008 organization rules and regulations. Requires interpersonal, service oriented, active listening and critical thinking skills. Requires ability to present complex risk findings and make recommendations in a clear concise manner both in writing and verbally. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Professional Enterprise Risk Mgt Anl 4 Advanced Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgt Anl 4 7205 Personnel Program PSS Grade FLSA Education Career Path/Job 23 Exempt Bachelors degree in related area and/or equivalent experience/training. Professional certification preferred. Enterprise Risk Mgmt Analyst 5 Generic Scope: Technical leader with a high degree of knowledge in the overall field and recognized expertise in specific areas; problem-solving frequently requires analysis of unique issues/problems without precedent and/or structure. May manage programs that include formulating strategies and administering policies, processes, and resources; functions with a high degree of autonomy. Custom Scope: Uses advanced enterprise risk management concepts and organization objectives to resolve highly complex and diverse issues. Regularly works on highly complex issues where analysis of situations or data requires an in-depth evaluation of variable factors. Exercises judgment in selecting methods, techniques and evaluation criteria for obtaining results. May serve as subject matter expert or project manager. Key Responsibilities: Initiates, develops and implements complex risk management programs and operations with respect to insurance claims administration, litigation, contracts and loss prevention. Responsible for providing analysis for highly complex potential loss areas and determines appropriate type and level of loss protection. Applies highly advanced risk management concepts to develop loss forecasts to monitor/establish accruals for self-insured retention. Prepares specifications for broker or underwriter bids, evaluates bids, and recommends or concludes insurance contracts. Initiates and designs risk control programs to prevent losses and reduce premiums and organization’s exposure. Applies highly advanced risk concepts to administer workers' compensation insurance program. May lead a team of risk management professionals. Conducts ongoing review and evaluation of existing risk management policies and procedures to understand past performance and determine present and future performance and/or areas of risk. Performs highly complex coordination between attorneys, third party claims administrators and departments to assure that the defense of litigation claims against the organization are handled and resolved properly. UCOP Career Tracks Job Database Knowledge Skills: Published: March 22, 2016 Version: May 27, 2008 Has advanced knowledge in the following areas: risk management; insurance; forecasting and analysis; accounting; litigation; contracts; knowledge of common organization-specific computer application programs; knowledge of organizational processes and procedures; understanding of organizational rules and regulations. Requires interpersonal, service oriented, active listening and critical thinking skills. Requires ability to present complex risk findings and make recommendations in a clear concise manner both in writing and verbally. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Professional Enterprise Risk Mgt Anl 5 Expert Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgt Anl 5 0326 Personnel Program MSP Grade FLSA Education Career Path/Job 25 Exempt Bachelors degree in related area and/or equivalent experience/training. Professional certification preferred. Finance > Enterprise Risk Management > Supervisory & Managerial Generic Scope: Recognized organization-wide expert. Has significant impact and influence on organizational policy and program development. Regularly leads projects of critical importance to the organization; these projects carry substantial consequences of success or failure. May direct programs with organization-wide impact that include formulating strategies and administering policies, processes, and resources. Significant barriers to entry exist at this level. Custom Scope: Having wide-ranging experience, uses enterprise risk management concepts and organizational objectives to resolve the most complex issues with organization-wide impact. Works on the most complex issues with little or no precedent where analysis of situations or data requires an in-depth evaluation of variable factors. Exercises judgment in selecting methods, techniques and evaluation criteria for obtaining results. Internal and external contacts often pertain to organizational plans and objectives. Is considered a subject matter expert and often recognized as an expert externally in the industry. Key Responsibilities: Directs, analyzes and prepares recommendations for risk assessment, business process, and controls policies and procedures having critical, organization wide impact. Independently performs the most complex accounting and risk finance related to this function. Leads a team of risk management professionals. Serves as the subject matter expert on risk, controls, business process engineering and related policies and procedures. Functions as the project manager for the development and implementation of all organization financial training programs. Performs needs analyses, monitors results, develops continual improvement processes, counsels control units and departments on all financial training and development matters. Develops financial training course content. Facilitates involvement of subject matter experts, instructional design experts and other advisory groups to continually enhance the organization’s financial programs. Directs, analyzes, and prepares recommendations for addressing and mitigating risk related to UCOP Career Tracks Job Database Published: March 22, 2016 Version: May 27, 2008 Conflict of Interest and Enterprise/Department/Process reviews and assessments. Conducts ongoing review and analysis of existing controls systems and processes, and participates in reengineering and major systems development projects. Coordinates the Regents' Controls Initiative. Determines significant operational and control risks, implements appropriate process improvements and best practices, and manages campus communications structure to improve control environment. Performs strategic risk assessments to identify highest risks and need for controls. Knowledge Skills: Has expert and specialized knowledge in the following areas: risk management; insurance; forecasting and analysis; accounting; risk modeling process; knowledge of common organization-specific computer application programs; knowledge of organizational processes and procedures; understanding of organizational rules and regulations. Requires an in-depth knowledge of risk management. Requires interpersonal, service oriented, active listening and critical thinking skills. Requires ability to present complex risk findings and make recommendations in a clear concise manner both in writing and verbally. Has expert ability to develop course materials and deliver content effectively to diverse population. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Supervisory & Managerial Enterprise Risk Mgr 1 Manager 1 Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgr 1 0327 Personnel Program MSP Grade FLSA Education Career Path/Job 25 Exempt Bachelors degree in related area and/or equivalent experience/training Enterprise Risk Manager 2 Generic Scope: Spends the majority of time (50% or more) achieving organizational objectives through the coordinated achievements of subordinate staff. Establishes departmental goals and objectives, functions with autonomy. Manages the accountability and stewardship of human, financial, and often physical resources in compliance with departmental and organizational goals and objectives. Ensures subordinate supervisors and professionals adhere to defined internal controls. Manages systems and procedures to protect departmental assets. Custom Scope: Receives assignments in the form of objectives and determines how to use resources to meet schedules and goals. Has responsibility for organization-wide program management and compliance activities designed to promote health and safety of employees and reduce financial risks. Oversees program management and coordination, loss prevention, analysis communications, training, reporting, and financial outcomes. Erroneous decisions or failure to achieve goals results in additional costs and personnel, and serious risk to organization. Key Responsibilities: Develops and monitors operational and budget processes, staff FTE, finance, human resources and space planning. Establishes and recommends changes to policies which affect the department. Define, implement and assist in the operation of effective loss prevention and control programs that meet departmental needs and result in effective cost controls and claims. Manages, through subordinate supervisors, the coordination of activities of a department with responsibility for results in terms of costs, methods, and employees. Has management and oversight responsibility for organization’s claims administration. Identifies critical areas of legal and technical compliance, develops management interventions and implements strategic initiatives to improve overall program financial and claims management performance. Analyzes data, identifies trends, makes recommendations and implements required changes to risk management programs. Oversees daily coordination and management of Vocational Rehabilitation program. Provides oversight of programmatic direction. Promotes teamwork and coordination with and between departments involved in UCOP Career Tracks Job Database Published: March 22, 2016 Version: May 27, 2008 managing claims. Consult with managers on issues of risk or case management, providing technical advice and action planning to reduce risk. Oversee training and education of managers and employees regarding risk management and related compliance issues. Knowledge Skills: Broad understanding of costs, benchmarking and best practices as they relate to risk management activities. Specialized knowledge and experience in workers' compensation, vocational rehabilitation, disability management and applicable law. Strong ability to establish and maintain effective working relationships with all levels across the organization, outside vendors and administrators. Strong management experience and ability to administer complex office that supports services to faculty and staff. Strong collaborative and communication skills to interface departmental services with other faculty, staff, student and community programs. Client services oriented, has good listening, critical thinking and analytical skills. Ability to multi-task. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 27, 2008 Finance Enterprise Risk Management Supervisory & Managerial Enterprise Risk Mgr 2 Manager 2 Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgr 2 0328 Personnel Program MSP Grade FLSA Education 26 Exempt Advanced degree in related area. Professional certification required. Career Path/Job Generic Scope: Oversees through subordinate Managers a large department or multiple smaller units, OR manages a highly specialized technical function/team. Has significant responsibility to achieve broadly stated goals through subordinate Managers. Determines objectives, directs programs, develops strategies and policies, manages human, financial, and physical resources, and functions with a high degree of autonomy. Proactively assesses risk to establish systems and procedures to protect organizational assets. Determines strategies for a program with organization-wide impact. Custom Scope: Establishes objectives and work plans, and delegates assignments to subordinate managers. Responsible for managing, preparing, administering and directing resources. Reviews and approves recommendations for functional programs. Involved in developing, modifying and executing policies that affect immediate operation(s) and have organization-wide effect. Decisions require an evaluation of a variety of factors, including an understanding of current business trends. Erroneous decisions or failure to achieve goals results in additional costs, personnel and/or risk. Key Responsibilities: Strategic planning, design and development of a organization-wide system of enterprise risk management and internal controls. Identifies risks, implements process improvements, develops management tools and training to improve operational effectiveness and reduce risk. Implements and monitors organization wide control strategy and programs. Manages cross-functional and crossorganizational teams to review control issues, develop solutions and ensure quality deliverables and outcomes. Develops and coordinates financial management training. Conducts ongoing review and evaluation of existing policies and procedures. Assesses and mitigates risk with respect to Conflict of Interest and Enterprise/Department/Process reviews and assessments. Oversees all operations performed in the Office of Risk Management, including insurance administration, litigation, contracts and loss prevention. Performs outreach and participates in numerous committees. UCOP Career Tracks Job Database Knowledge Skills: Published: March 22, 2016 Version: May 27, 2008 Requires advanced knowledge about theory and practice related to internal controls assessments. Requires advanced knowledge in all areas of enterprise risk management. Requires extensive knowledge of financial analysis, benchmarking, research review, accounting principles and practices, performance measurement tools. Communicates information in a clear and concise manner in writing and verbally. Client services oriented, has good listening, critical thinking and analytical skills. Ability to multi-task. UCOP Career Tracks Job Database Job Family: Job Function: Category: Job Title: Job Level: Job Function Summary: Published: March 22, 2016 Version: May 1, 2013 Finance Enterprise Risk Management Supervisory & Managerial Enterprise Risk Mgr 3 Manager 3 Involves protecting the institution from loss. Develops and coordinates activities and programs that are designed to promote accountability. Helps identify and minimize risk of all types, and strengthen effectiveness and efficiency of controls. Job Title Job Code Enterprise Risk Mgr 3 0362 Personnel Program MSP Grade FLSA Education 27 Exempt Advanced degree in related area. Professional certification required. Career Path/Job Generic Scope: Oversees through subordinate Managers a large, complex organization with multiple functional disciplines/occupations, OR manages a program, regardless of size, that has critical impact upon the organization. Has significant responsibility for formulating and administering policies and programs, manages significant human, financial, and physical resources, and functions with a very high degree of autonomy. Oversees through subordinate Managers the accountability and stewardship of department resources and the development of systems and procedures to protect organizational assets. Custom Scope: Serves as an organization ERM official. Directs the overall operation of designated, systemwide Enterprise Risk Management programs, including responsibility for compliance and overall program management. Creates, develops and implements strategies and programs to meet changing demands and ensures protection and consideration of the public interest. Applies broad spectrum risk management, enterprise expertise and knowledge to University research and educational needs and requirements, financial obligations/considerations, and/or public/private partnerships. Key Responsibilities: Directs the overall operation of Enterprise Risk Management for designated programs. Advises senior management on short and longterm strategies regarding Enterprise Risk Management. Responsible for comprehensive personnel administration including selection, performance management, corrective action as required and providing leadership and direction to subordinate managers and staff members. Oversees and influences Enterprise Risk Management University organizations that may have specific technical needs. Develops and implements policy and training programs. Directs the coordination of the risk assessment and response programs. Knowledge Skills: Comprehensive and advanced knowledge and understanding of all areas of enterprise risk management. Advanced management skills to effectively lead and direct a comprehensive enterprise risk management program. Advanced Human Resource management UCOP Career Tracks Job Database Published: March 22, 2016 Version: May 1, 2013 expertise to lead and direct subordinate managers and staff, including advanced skills in comprehensive personnel administration. Advanced skills in managing highly complex budgets. Advanced skills to appropriately and efficiently respond to and direct the response to emergencies and critical situations, including follow-up evaluation and critique of response efficacy; creates, develops and implements changes to emergency situations as required. Advanced written, verbal and interpersonal communications skills to effectively address complex and potentially sensitive subject matter, including expertise and skill to interact successfully with a diverse array of technical, scientific, legal, poliitcal, and public entities. Advanced ability to be a change agent.