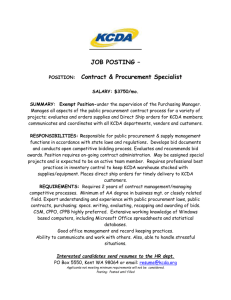

Healthcare Procurement and Market Development

Healthcare Procurement

Procurement and Market

Development

Scoping third sector engagement 23 rd November 2009

Peter Hawkins - Associate Director of Healthcare Procurement

Context

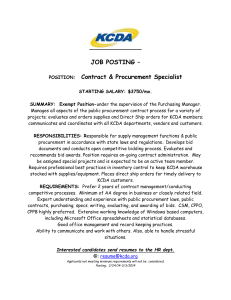

NHS reform over the last 18 months with the advent of WCC, PRCC, PCT Procurement

Guide, the framework for managing choice and competition led PCTs to drive more effective procurement of healthcare services.

•

Provider driven

• Increased patient choice

• Competing Providers

•

Commercial drivers

• Input and target driven

Commissioner led

Market place stimulus

Improved service and quality

Patient and taxpayer value

Outcome/quality driven

It was and is recognised that implementing such changes would require a significant change in the way the PCT sourced, selected, contracted, and managed its provider base, with PCTs needing to develop new skills and expertise to deliver this level of change.

What did this mean?

Complimenting commissioning skills with commercial procurement

What is a market

• The term “market” refers to the interaction between the demand for and supply of services.

• When markets work, the processes of choice and competition drive efficiency in how goods and services are produced and in the mix of services provided

• Translating this to the health context implies that markets have the potential to encourage providers to improve the quality of care delivered for a given cost

• However, for markets to work effectively, a number of conditions must be satisfied:

- well-informed purchasers/consumers

- purchasers/consumers have the ability to observe price and quality of different suppliers, and respond accordingly

- competing suppliers, or a credible threat of market entry

- Low or mitigated barriers to entry for new suppliers

What factors influence future choice of market structure?

Examples of demand side factors

• Volume of demand

• Geographic distribution of demand

• Urgent/non-urgent

• Priority for patient choice

• Willingness of patients to travel

Examples of supply-side factors

• Economies of scale

• Economies of scope

• Barriers to entry and exit

• Dependency on other services

• Uniformity of costs

Creating the opportunity for stimulus commissioners

Commissioning-led service cannot look to acute care for all the answer:-

▪ New market reforms offer an opportunity for purchasers and providers to impose themselves by reducing the strength of local monopolies,

▪

The focus on community services is in part a reflection of the need to move services away from the acute sector

▪ Consider using the potential separation of provider services as an opportunity to stimulate the market by introducing new entrants

▪ Identify areas of supplier capability that will impact the achievement of key commissioning objectives in community services

▪ Set out the key steps and activities needed to introduce a new provider into the health economy

▪

Key performance monitoring metrics will be used or developed to incentivise the achievement of the health outcomes and reductions in inequalities required

Shaping the structure of supply

– develop the future requirement

Developing the correct organisational capacity and potential solutions to allow market shaping

Commissioners intentions – the likely view of work plans and therefore care markets

Not just about volume related care contracts – more about wider diversity of providers to allow choice

Easing of market entry – financial risk share if entry costs are prohibitive eg. capital investment

Redesigning care pathways – dialogue with providers

Potential monopolies due to market immaturity and PCTs need proactive policies to guide the market

Policy objectives of economic growth (SME encouragement and development) and social welfare

(social enterprises and third sector)

Competition in purchased healthcare – the players

Local authorities

Private Sector

Foundation Trusts

GPs

Third Sector

- direct say via OSCs, but will this influence diminish?

- Unitary Authorities will add complexity and ….. Potential

- Will they take on risk, TUPE issues, can they attract patient referrals

- Local Authority social care example

- Can support integrated care models but medium DGH style could be at risk

- same as any other supplier/provider

- Smaller GP consortia have tremendous potential in short term to extend existing services

- PBC and the more entrepreneurial GPs can have real influence

- COI issues

- Bureaucracy still a entry barrier but they do have extensive networks

- Where commercial skills exist could be a goldmine (Age Concern)

Patient focus group professionals and social enterprises influenced by patient needs could flourish as they take control of services themselves

Seizing the opportunity - providers

“All organisations have a fundamental need to sell their services, satisfy their customers and create the means to satisfy customers in the future”

(Source Operations Management 4 th edition Slack N, Chambers S and Johnston R 2004)

Know your business

Capacity and Ability

Vision, leadership, acumen, skills

Market and demand analysis

Values and Culture

Responsive, customer led, value driven

Develop your business - providers

Do you really know and understand….

What you want to provide and what you don’t

Where does your income come from

The commissioning intentions…. and the small print

How are you going to manage the implications of potential business losses

How are you going to use your experience and your intelligence to win business

And perhaps most importantly….

What is going on in your organisation – patient experience

Never underestimate it’s power and influence

The PCT procurement landscape –

Providers and Commissioners

Providers

• Provider capability/willingness to change ?

• Bid support

• Lead times on change

• Asset / equipment inflexibility

• Understanding the market

• Conflicts of Interest

• Too many / too few providers

• Sector “Silos” constrain providers’ solutions

• Co-ordinated / Managed Care

• Be more commercial and business minded! balanced with a service culture

Commissioners

• Tender or not to tender? Contract extensions

• Mergers and vertical integration

• Engagement and workforce issues

• Planning capacity

• Developing the market

• Contract management

• Conflicts of Interest

• Be more commercial and business minded! balanced with a service culture

• NHS as preferred provider

Challenges or opportunities

• Financial challenges may mean a changed focus – especially on contracting

• Assist in the redesign of care pathways and services to eradicate inefficiencies and highlight efficiencies

• Creating a strategic improvement framework – health market analysis and service reviews will inform service prioritisation, business planning and therefore contestability/non contestability decisions. Co-operation versus competition

• Identifying (and harvesting) the harder to reach fruit. Getting more from what we already have – provider relationship management in the context of the wider Manchester health economy.

Improving the dialogue with existing providers

• Redesign or develop new services – opportunity for providers to shape outcomes

• Additional capacity – service review to validate capability of provider

Emerging policy agenda

- preferred provider

• Preferred provider may mean some changes in PCT procurement strategy….but not it’s underlying principles

• New PRCC rules and strategy will align more to co-operation (that can stand up to scrutiny) than competition

• A need to improve our understanding of health provider economics and the interaction with commissioned services

• Accuracy of data sets and information will become key to contract monitoring and relationship building

• A more integrated model approach to the wider health economy

• The drive will still be the same around improving healthcare quality, financial robustness and providing best value

Securing our shared future

•

•

•

•

•

•

•

•

We are all committed to improving health in Manchester

We face an unsustainable financial position across all parts of the Health Economy

‘Securing our Shared Future’ aims to re-design care pathways and bring about transformational change – delivering long-term financial viability

We are working jointly to take decisive and coordinated action based on common goals

Patients and the public have an important role to play

Will involve all major service providers and commissioners

Solution is city wide and system wide including social care so must be co-produced

This challenge is a shared challenge across the Health Economy