Project

advertisement

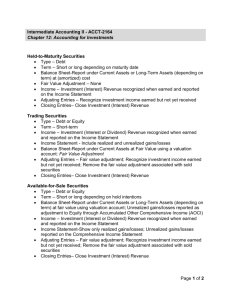

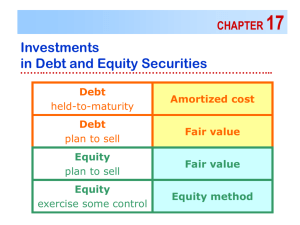

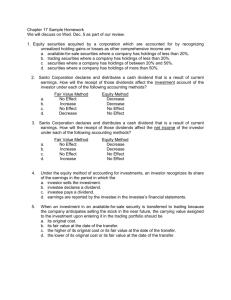

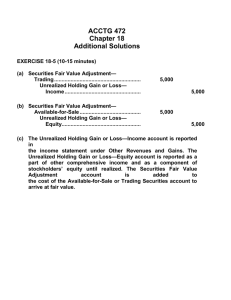

STI Project Description • Track a portfolio of roughly five stocks and three bonds throughout the fall • Report on performance for September, October, and November (possibly) • Design a spreadsheet to track your performance and feed the monthly financial statements Project Objectives • Learn about stocks and bonds • Learn the accounting and reporting for short-term investments • Learn how to do on-line or library research of securities • Evaluate the performance of your investment On-line Research • Stock quotes are easy • Bond quotes are a bit more challenging – Using Yahoo Finance, Go to stock quotes – Click on Symbol Lookup – Enter the ticker symbol and the integer portion of the interest rate of your bond (CAT9 for Caterpillar 9.5% bonds) STI--Some Accounting Tips • See p. 132 for (sparse) coverage of STI • Bonds are described on pps. 225-230 – Bonds are explained from the viewpoint of the borrower, not the INVESTOR. The explanations are still useful. • Stocks are described on pps. 257-260 (most of you are probably familiar with stocks) • See the remainder of the PP slides. Note: • I do not expect you to understand completely the remaining slides from your first reading. However, after my explanations in class you should be in good shape. Marketable Securities Statement of Financial Accounting Standard (SFAS) No. 107 Requires disclosure of actual (or estimates of) year-end market value pertaining to financial instruments (FI) Mark-to-Market Certain Debt Investments and Equity Securities Hold-to-Maturity Trading Securities Available-for-Sale Securities Mark-to-Market Certain Debt Investments and Equity Securities Security Debt Management Intent at Purchase Hold-tomaturity security Balance Sheet Classification Income Statement Effects *Interest income, including Current asset amortization of premium or or noncurrent Amortized cost discount asset *Realized gains/losses = proceeds–unamortized cost Trading security Current asset (actively trade in near term) Debt or equity Balance Sheet Valuation *Dividend income or interest income, including amortization of premium or Fair value with discount contra asset *Realized valuation gains/losses=proceedsallowance latest balance sheet fair value *Unrealized gains/losses Mark-to-Market Certain Debt Investments and Equity Securities Management Security Intent at Purchase Trading security Debt or equity (actively trade in near term) Balance Sheet Classification Current asset Available-fordale security (securities not Current asset fitting into or noncurrent either of asset above categories) Balance Sheet Valuation Income Statement Effects *Dividend income or interest income, including Fair value with amortization of premium or contra asset discount valuation *Realized gains/losses= allowance proceeds–latest balance sheet fair value *Unrealized gains/losses Fair value with contra asset valuation allowance and owners' equity is adjusted for unrealized gains/lossses *Dividend income or interest income, including amortization of premium or discount *Realized gains/losses=proceedslatest balance sheet fair value + or - owners' equity Trading Security Example Prepare the necessary journal entry for Cars Ltd. to adjust the trading securities to fair market value at December 31, 19X4. Trading Security Gloves, Inc. SportsWear No. of Unit Shares Cost 1,000 $6 1,500 12 Total Cost $6,000 18,000 Fair Value $ 6,500 16,000 Trading Security Example Trading Security Gloves, Inc. SportsWear No. of Unit Shares Cost 1,000 $6 1,500 12 Net Unrealized Holding Loss Total Cost $6,000 18,000 Fair Value $ 6,500 16,000 Gain or (Loss) $ 500 (2,000) $ (1,500) Trading Security Example GENERAL JOURNAL Date Description Dec. 31 Valuation Allowance: Gloves, Inc. Unrealized Loss Valuation Allowance: SportsWear The unrealized loss account will appear on the income statement. Page 34 Post. Ref. Debit Credit 500 1,500 2,000 Trading Security Example • During 19X5, the investment in SportsWear is sold for $15,000. Prepare the journal entry to record the sale. GENERAL JOURNAL Date 19X5 Description Cash Valuation Allowance: SportsWear Realized Loss Marketable Securities: SportsWear Page 35 Post. Ref. Debit Credit 15,000 2,000 1,000 18,000 Mark-to-Market Certain Debt Investments and Equity Securities Management Security Intent at Purchase Balance Sheet Classification Balance Sheet Valuation Fair value with Available-forcontra asset sale security valuation (securities not Current asset allowance and Debt or equity fitting into or noncurrent owners' equity either of asset is adjusted for above unrealized categories) gains/losses Income Statement Effects *Dividend income or interest income, including amortization of premium or discount *Realized gains/losses= proceeds–latest balance sheet fair value + or – owners' equity accum. unrealized g/l Available-for-Sale Security Example Prepare the necessary journal entry for Cars Ltd. to adjust the available-for-sale securities to fair market value at December 31, 19X4. Available-for-Sale No. of Unit Security Shares Cost Gloves, Inc. 1,000 $6 SportsWear 1,500 12 Net Unrealized Holding Loss Total Cost $6,000 18,000 Fair Value $ 6,500 16,000 Gain or (Loss) $ 500 (2,000) $ (1,500) Available-for-Sale Security Example GENERAL JOURNAL Date Description Page 34 Post. Ref. Debit Dec. 31 Valuation Allowance: Gloves, Inc. Accumulated Unrealized Loss Valuation Allowance: SportsWear The unrealized loss account will appear in the equity section of the balance sheet. Credit 500 1,500 2,000 Available-for-Sale Security Example • During 19X5, the investment in SportsWear is sold for $15,000. Prepare the journal entry to record the sale. GENERAL JOURNAL Date 19X5 Description Cash Valuation Allowance: SportsWear Realized Loss Unrealized Loss Marketable Securities: SportsWear Page 35 Post. Ref. Debit Credit 15,000 2,000 3,000 2,000 18,000 Reclassification of Securities Reclassify to: Hold-to-Maturity Trading Available-for-Sale Reclassify from: Hold-to-Maturity Trading Available-for-Sale A D B B C A Accounting for gains/losses at reclassification date: A=Record in income statement only the unrealized gains/losses arising from last valuation date. B=Record in income statement any net unrealized gains/losses to date not reflected in prior income statements. C=Record in owners’ equity any net unrealized gains/losses to date not reflected in prior income statements. D=The unrealized gains/losses already accumulated in a separate owners’ equity account is not reclassified but is amortized over the remaining life of the security.