File - Personal Finance

advertisement

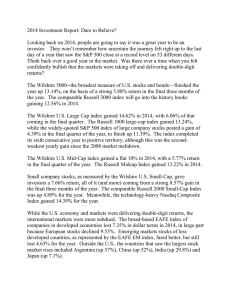

Casandra Ramos 4/1/13 Pg. 276, 1-3 Pg. 290, 1-4 Pg. 299, 1-3 Page 276 1. Companies issue common stock to raise money to start up their businesses and then to help pay for ongoing activities. 2. Most investors purchase common stock to make money in three different ways: They profit when they receive dividends, when the dollar value of their stock appreciates and when the stock splits and increases in dollar value. 3. Preferred stock is considered a “middle investment.” It’s considered a safer investment than common stock, but not as safe as bonds. People who want a steady source of income often buy preferred stock. Page 290 1. Different types of Stock Investments Blue-Chip Stocks Income Stocks Growth Stocks Cyclical Stocks Defensive Stocks Large-Cap Stocks Small-Cap Stocks Penny Stocks 2. Sources to Evaluate Stocks Newspapers Internet Stock Advisory Services Corporate News Publications 3. Current Yield, Total Return, Earning per Share, and the Price-Earning. 4. If the company is earnings increase then the stock’s price goes up too. But if the company’s earnings lower and the stock value lower then you may consider selling the stock and replacing it with one of higher value. Page 299 1. The primary market is a market in which investors purchase new security issues from a corporation trough an investment bank or some other representative of the corporation. The secondary market is a market for existing financial securities currently traded among investors. Casandra Ramos 4/1/13 Pg. 276, 1-3 Pg. 290, 1-4 Pg. 299, 1-3 2. Full service charges the highest commission in exchange for personalized service and free research information. Discount brokerage firms do not charge a lot of money for research reports but the fees can add up. 3. Long-Term Techniques Buy-and-Hold Technique Dollar-Cost-Average Shot-Term Techniques Buying on Margin Selling Sorting