Business Plan - PsychOdyssey.net

advertisement

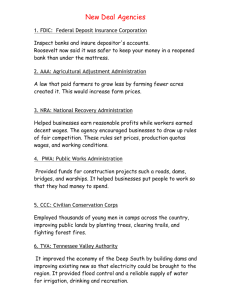

1 ACCESS OF NEW JERSEY FEDERAL CREDIT UNION (in formation) Business Plan As of March 22, 2016 2 Contents I. Environment ............................................................................................................................ 6 A. Macroeconomics .................................................................................................................. 6 II. Industry .................................................................................................................................... 7 A. Credit Union characteristics (vs. banks and thrifts) ............................................................. 7 1. Member-owned ................................................................................................................ 7 2. No Capital Stock .............................................................................................................. 7 3. Volunteer Boards.............................................................................................................. 8 Unlike banks, credit unions rely on volunteer, unpaid boards of directors whom the members elect from the ranks of membership. ....................................................................... 8 4. Not for Profit .................................................................................................................... 8 5. Restricted “Fields of Membership” .................................................................................. 8 B. Credit Union Industry Structure........................................................................................... 8 1. By number ........................................................................................................................ 8 C. Credit Union Industry Support Structure ........................................................................... 12 1. Trade Groups .................................................................................................................. 12 2. Advocates ....................................................................................................................... 12 3. Advisors ......................................................................................................................... 13 4. Researchers..................................................................................................................... 13 5. Regulators....................................................................................................................... 13 D. Products and Services ........................................................................................................ 14 1. Deposit-related ............................................................................................................... 14 2. Investment-related .......................................................................................................... 14 3. Credit-related (Loans) .................................................................................................... 14 4. Non-credit-related .......................................................................................................... 15 5. Service-related ................................................................................................................ 15 E. Regulations ........................................................................................................................ 15 1. Loans to Shares (Deposits) ............................................................................................. 15 2. Capital Adequacy ........................................................................................................... 15 3. Member Business Lending (MBL) ................................................................................ 16 4. Assets ............................................................................................................................. 16 5. Debit Interchange Fee .................................................................................................... 16 F. Issues .................................................................................................................................. 16 1. Tax Exemption ............................................................................................................... 16 3 2. Housing Finance ............................................................................................................. 17 3. Capital Requirements ..................................................................................................... 17 4. Debit Card Interchange Fee............................................................................................ 17 5. Government Supported Enterprises (e.g., Fannie Mae, Freddie Mac) ........................... 17 The long term health and viability of the secondary market is a paramount concern for credit unions as the Government-Sponsored Enterprises provide a vital source of liquidity to the industry............................................................................................................................ 17 6. Dodd-Frank Act.............................................................................................................. 17 7. The Durbin Amendment (Debit Card Interchange Fees) ............................................... 17 8. Corporate Credit Unions ................................................................................................ 17 9. Access to Alternative Capital ......................................................................................... 18 G. Performance ....................................................................................................................... 18 1. Industry As A Whole...................................................................................................... 18 2. By Size of Credit Union (by Asset Group) .................................................................... 26 H. Outlook .............................................................................................................................. 26 1. Loans .............................................................................................................................. 29 2. Earnings .......................................................................................................................... 29 III. Market ................................................................................................................................... 29 A. New Jersey ......................................................................................................................... 29 1. Individuals with Psychiatric Disabilities (“Consumers”)............................................... 29 2. Families .......................................................................................................................... 33 3. Mental Health Professionals........................................................................................... 33 4. Mental Health Agencies ................................................................................................. 33 5. Corporations ................................................................................................................... 34 6. Allies .............................................................................................................................. 34 B. New York ........................................................................................................................... 34 C. Nationwide ......................................................................................................................... 34 1. The Underbanked ........................................................................................................... 34 2. The Poor ......................................................................................................................... 35 3. The Disabled .................................................................................................................. 35 IV. Competition........................................................................................................................... 35 A. Banks.................................................................................................................................. 35 B. Credit Unions ..................................................................................................................... 35 1. New Jersey ..................................................................................................................... 35 2. New York ....................................................................................................................... 36 4 V. Customer ............................................................................................................................... 36 VI. Company ............................................................................................................................... 36 A. FIN/ Finance ...................................................................................................................... 36 1. Investments..................................................................................................................... 36 2. Tools ............................................................................................................................... 37 B. GOV/ Governance ............................................................................................................. 37 1. Board .............................................................................................................................. 37 2. Advisory Committee ...................................................................................................... 37 C. MAN/ Management ........................................................................................................... 37 D. OPS/ Operations................................................................................................................. 37 E. STR/ Strategy, Tactics, and other considerations .............................................................. 38 1. Investment in Technology .............................................................................................. 38 2. The Size Question .......................................................................................................... 38 3. The Growth Question ..................................................................................................... 38 4. Board Recruitment and Involvement ............................................................................. 38 5. Succession Planning ....................................................................................................... 38 F. RES/ Research ................................................................................................................... 38 1. Interesting Comparables ................................................................................................. 38 2. Possible Partners ............................................................................................................ 38 VII. Products.............................................................................................................................. 39 A. Cash Products..................................................................................................................... 39 1. ATM access .................................................................................................................... 39 B. Credit Products................................................................................................................... 39 1. Loans .............................................................................................................................. 39 2. Credit cards .................................................................................................................... 39 C. Interest Rate Products ........................................................................................................ 39 1. Savings Accounts ........................................................................................................... 39 2. IDAs ............................................................................................................................... 39 D. Service Products................................................................................................................. 39 E. Technology Services .......................................................................................................... 39 1. Online Banking (with Intuit) .......................................................................................... 39 2. Mobile Banking .............................................................................................................. 39 F. Inducements ....................................................................................................................... 39 1. Free gas cards ................................................................................................................. 39 5 VIII. Finance ............................................................................................................................... 39 6 I. Environment By “environment”, this plan does not mean the ecological environment. Instead it means the general economic and political environment in which the proposed credit union would operate. A. Macroeconomics Since the 1970s, American households have been borrowing more and saving less. The dramatic increases and more recent lesser reductions of household debt in the 2000s are noted. The very low savings rate and the still high borrowing rates have implications for all American financial institutions, including credit unions. The image below shows the overall comparative trends. Source: Credit Union Magazine1 The now well-known difficulties of the American economy around 2008 led to a massive government response of borrowing, stimulus spending, and so-called pump-priming. As the image below shows, the monetary base has been vastly increased in 2008. This significantly increased monetary base may bring inflationary pressures in the longer term, while offering product development opportunities in the shorter term. Credit unions and other financial institutions must adjust to this new operating environment for the foreseeable future. 1 Robert D. Manning, "The Evolution of Credit Cards," Credit Union Magazine 75, no. 10 (2009). 7 Source: Credit Union Magazine2 II. Industry The credit union industry is a small but distinct component of the overall American financial system. By assets it constitutes about 6.7% of the total system. A. Credit Union characteristics (vs. banks and thrifts) 1. Member-owned Unlike the private stock basis of banks, credit unions are member-owned and very democratically governed. Each member, regardless of his number of shares (deposits) is entitled to one vote in selecting board members and in certain other decisions. Although other mutual institutions are also member-owned, voting rights are generally allocated according to the size of the mutual member’s deposits, rather than being “one member, one vote.”3 2. No Capital Stock Credit unions do not issue capital stock. Credit unions create capital, or net worth, only by retaining earnings. Most credit unions begin with no net worth and gradually build it over time.4 2 Steve Rick, "A Sea of Liquidity," Credit Union Magazine 77, no. 7 (2011). U.S. Department of the Treasury, Comparing Credit Unions with Other Depository Institutions (2001). 4 Ibid. 3 8 3. Volunteer Boards Unlike banks, credit unions rely on volunteer, unpaid boards of directors whom the members elect from the ranks of membership.5 4. Not for Profit Credit unions operate as not-for-profit institutions, in contrast to shareholder-owned depository institutions. All earnings are retained as capital or returned to the members in the form of interest on share accounts, lower interest rates on loans, or otherwise used to provide products or services.6 5. Restricted “Fields of Membership” Credit unions may only accept as members those individuals identified in a credit union’s articulated field of membership. A field of membership may consist of a) a single group of individuals that share a common bond, or b) more than one group, each of which consists of individuals sharing a common bond, or c) a geographical community. A common bond may take one of three forms: an occupational bond applies to the employees of a firm; an associational bond applies to members of an association; and a geographical bond applies to individuals living, working, attending school, or worshiping within a particular defined community.7 A multiple common bond credit union holds more than one occupational or associational common bond or a combination of both types of common bonds. (Community common bonds may not be part of a multiple common bond federal credit union.) According to the U.S. Treasury Department, nearly half of federal credit unions have multiple common bonds, but hold 71% of federal credit union assets. Of the institutions organized around a single common bond, most serve particular occupational groups. Occupational bonds accounted for 31% of all federal credit unions and 16% of federal credit union assets.8 B. Credit Union Industry Structure 1. By number Since 1935, when President Roosevelt signed legislation enabling the credit union industry, the number of credit unions rose steadily until reaching a peak in the last 1960s. Since then, the number of credit unions has declined as the industry has consolidated. Today there are about 7500 credit unions in the U.S. 5 Ibid. Ibid. 7 Ibid. 8 Ibid. 6 9 Source: Credit Union National Association The number of New Jersey credit unions, currently around 200, has seen a similar pattern of growth and contraction over the same period, as shown below. It is noted also that New Jersey’s credit unions are predominately federally chartered (as Access has applied to be) rather than state chartered. 10 a) By Total Assets and Number of Members Since the last 1960s, when the number of credit unions peaked but then began to consolidate, total assets in credit unions continued to increase steadily. Source: Credit Union National Association The assets and number of members of New Jersey credit unions have seen similar growth over the same period, as shown below. Source: Credit Union National Association b) By jurisdiction Credit unions can be chartered and regulated either at the Federal or state level. (1) Federal (a) Federally Chartered Credit Unions Federally chartered credit unions (FCUs) obtain their charters from, and are regulated by, the National Credit Union Administration (NCUA). Their member shares (deposits) are insured by the National Credit Union Share Insurance Fund (NCUSIF), which is administered by NCUA. As of June 2011, there were 4,534 FCUs, with total assets of $517.6 11 billion and a membership base of approximately 50.6 million.9 (b) Federally Insured Credit Unions All FCUs are required to be insured by the NCUSIF. State-chartered credit unions in some states are required to be federally insured, while others may elect to be insured by the NCUSIF. The term “federally insured credit unions” (FICUs) refers to both federal and state-chartered credit unions whose accounts are insured by the NCUSIF. Thus, FCUs are a subset of FICUs. As of June 2011, there were 7,239 FICUs, with assets of $942.5 billion and a membership base of approximately 91 million.10 (c) Privately Insured Credit Unions Private primary share insurance for state-chartered credit unions has been authorized in some states. Currently there are privately insured credit unions operating in nine states. There is only one private insurance company (American Share Insurance of Dublin, Ohio) offering credit unions primary share insurance and only one other private insurer (Massachusetts Share Insurance Corporation) offering excess deposit insurance coverage. 11 (d) Corporate Credit Unions Corporate credit unions are credit unions for credit unions, also considered wholesale credit unions. Corporate credit unions provide investment products, advisory services, item processing and loans to their members. In 2009, the corporate credit unions experience an asset quality crisis as a result of the mortgage market debacle. As a result, the NCUA put the two largest corporate credit unions into conservatorship and began an industry-wide exercise of securing and recapitalizing these critical credit union industry intermediaries. As of June 2011, there were 26 corporate credit unions with assets of $62.4 billion of which five were under conservatorship.12 (2) c) State By Type (1) Regular A regular credit union is chartered under standard terms to serve standard fields of membership. (2) 9 Low-income-designated National Association of Federal Credit Unions, Nafcu 2011 Report on Credit Unions (National Association of Federal Credit Unions, 2011). 10 Ibid. 11 Ibid. 12 Ibid. 12 A low-income-designated credit union has a majority of its members (or the majority of residents in the community that the credit union serves) making less than 80 percent of the average wage for all wage earners (established by the Bureau of Labor Statistics), or having an annual household income that falls at or below 80 percent of the median household income for the nation (established by the Census Bureau).13 Low-income-designated credit unions enjoy special access to certain supplemental capital programs offered by the NCUA. Because most individuals with psychiatric disabilities quality as low income, Access is applying to be a low-incomedesignated credit union. C. Credit Union Industry Support Structure 1. Trade Groups a) National Association of Federal Credit Unions (NAFCU) The National Association of Federal Credit Unions is a trade association that exclusively represents the interests of federal credit unions before the federal government and the public. Membership in NAFCU is direct; there are no state or local leagues, chapters or affiliations standing between NAFCU members and the NAFCU headquarters in Arlington, VA. NAFCU has nearly 800 members and represents 62% of total Federal credit union assets and 58% of all FCU member owners.14 2. Advocates a) Credit Union National Organization (CUNA) CUNA is the largest American advocacy organization for credit unions, representing 92% of CUs nationally. CUNA provides members with information and resources and published Credit Union Magazine. b) National Credit Union Foundation (NCUF) As a philanthropic and social responsibility leader of America's credit union movement, the National Credit Union Foundation (NCUF) raises funds, makes grants, manages programs, and provides education empowering consumers to achieve financial freedom through credit unions. NCUF was started by and maintains close links to CUNA. c) National Federation of Community Development Credit Unions Established in 1974 by a coalition of credit union leaders dedicated to revitalizing low-income communities, the Federation's mission is to strengthen those credit unions that serve low-income, urban and rural communities, known as community development credit unions or CDCUs. NFCDU also provides consulting and technical service assistance to CDCUs in formation. 13 14 Ibid. Ibid. 13 Access considered itself to be a community development credit union and has had contacts with NFCDU. 3. Advisors a) Credit Union Retired Executives CURE is a new online advisory service established in 2009 by CUNA. b) Credit Union Executives Society (CUES) CUES is a membership society of credit union executives. It publishes Credit Union Management Magazine. 4. Researchers a) Filene Research Institute The Filene Research Institute is dedicated to scientific and thoughtful analysis about issues affecting the future of consumer finance and credit unions. Through Filene, leading scholars and consultants analyze managerial problems, public policy questions, and consumer needs for the benefit of the credit union system. b) Callahan & Associates Callahan & Associates is a private Washington, DC consulting firm to the credit union industry. Its publications provide data-based insights and concrete solutions to credit union issues, helping credit unions to improve their financial performance and provide better value for members. (See www.creditunions.com) c) Cudata.com cudata.com is a private subscription data service for credit union executives based in Provo, UT. See www.cudata.com. 5. Regulators a) National Credit Union Administration (NCUA) NCUA has a dual role as credit union deposit insurer and credit union regulator. The NCUA Office of Small Credit Union Initiatives, led by Ms. Tawana James. b) National Credit Union Share Insurance Fund (NCUSIF) 14 c) D. National Association of State Credit Union Supervisors Products and Services 1. Deposit-related a) Savings b) Checking c) Certificates of Deposit 2. Investment-related 3. Credit-related (Loans) a) Personal loans (1) Payday loans Payday loans are short-term loans secured by a future payment of a salary paycheck. In the credit union industry, about 75% of payday loans had tenors of two weeks or less, as shown below. Payday Loan Composition, 2010 Source: Credit Union Magazine15 15 Sharyn Alden, "Payday Lending," Credit Union Magazine 77, no. 7 (2011). 15 4. b) Home loans c) Car loans d) Credit cards e) Education loans f) Member Business Loans (MBL) Non-credit-related a) 5. E. Money orders Service-related a) ATMs b) Electronic services (1) Balance inquiries and histories (2) Bill payment (3) Transfers (4) Home banking c) Financial education d) Representative payee services Regulations 1. Loans to Shares (Deposits) 2. Capital Adequacy a) Equity/Total Assets (1) “Well Capitalized” > = 7.0% (2) “Complex / Adequately Capitalized” = 6.0% to 6.99% (a) LT real estate loans > = 25.0% total assets (b) MBLs outstanding + MBL commitments > = 12.5% total assets (c) LT investments > = 15.0% total assets (d) Loans sold with recourse > = 5.0% total assets 16 As an industry standard, a ratio of net worth to deposits of 7% is considered “well capitalized”. 3. Member Business Lending (MBL) When Congress passed the Credit Union Membership Access Act (CUMAA) in 1998, it put in place restrictions on the ability of credit unions to offer member business loans. Congress codified the definition of a member business loan and limited a credit union’s member business lending to the lesser of either 1.75 times the net worth of a well-capitalized credit union or 12.25% of total assets.16 Thus lending by credit unions to business members is currently capped at 12.25% of assets, although member business loans under $50,000 do not count within this total. Legislation pending in Congress would increase this ratio to 27.5%.17 Specific regulations related to MBLs are listed below: MBL loan balances < 1.75x Net Worth OR 12.25% Total Assets Single borrower MBL < 15% TNW OR $100,000 All loans must be collateralized; Maximum Loan to Value of all liens < 80%, excluding MBL vehicle loans MBL maturies <= 12 years Waivers permitted on request to Regional Director MBL credit analyst > 2 years direct experience 4. Assets a) 5. F. NCUSIF deposit = 1% of insured member shares Debit Interchange Fee Issues 1. Tax Exemption Credit Unions are non-profit member associations which enjoy tax exemption. While there appears to be no serious challenge in Congress to this privilege at the moment, some in the credit union industry are concerned that the national budgetary woes could pressure Congress to abolish this exemption. 16 Unions. Debbie Matz, The State of the Credit Industry: Statement before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, December 9, 2010 (2010). Miss Matz is chair of the National Credit Union Administration. 17 17 2. Housing Finance 3. Capital Requirements Credit unions are the only financial services providers with a capital regulation system for insured depository institutions that: a) relies primarily on a static net worth ratio, rather than riskbased capital standards, in setting required capital levels; and b) excludes potential sources of reliable capital that could strengthen credit unions to allow them to better meet the credit needs of consumers, contribute to the liquidity of the financial system, and support national economic growth and stability.18 4. Debit Card Interchange Fee The Federal Reserve Bank has set a cap on debit card interchange fee of $0.21 plus 5 basis points of the cost of a transaction. According to the NAFCU, this is considered too low a fee for credit unions in light of the cost of operating a debit card system. Credit union advocates are asking for consideration especially for those entities with less than $10 billion in assets.19 5. Government Supported Enterprises (e.g., Fannie Mae, Freddie Mac) The long term health and viability of the secondary market is a paramount concern for credit unions as the Government-Sponsored Enterprises provide a vital source of liquidity to the industry. 6. Dodd-Frank Act The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) and other regulatory changes since the beginning of the financial crisis are generally aimed at abusive practices and exotic financial products. Nonetheless, the 253 new rules mandated by the Act will impact virtually all financial institutions and will significantly increase the cost of compliance for credit unions. 7. The Durbin Amendment (Debit Card Interchange Fees) The Durbin Amendment poses numerous challenges for credit unions. While the ultimate impact of the amendment cannot be judged before the Fed's rule-making, it will undoubtedly affect the profitability of the current credit union business model. While it will not be the make-or-break measure for most credit unions, it could ultimately affect the viability of some of the less profitable small or medium-sized credit unions. 8. Corporate Credit Unions Reforming and stabilizing the corporate credit union system remains an ongoing issue for the industry. In September 2010, the NCUA issued a final rule amending its corporate regulations. Among other issues, the rule significantly altered capital requirements and 18 19 Unions. Ibid. 18 matters related to concentration risk. It is estimated that 18 to 19 corporate credit unions will be recapitalized and meet the initial, heightened capital requirements. 9. Access to Alternative Capital Increasing capital only be retaining earnings takes too long in a low yield environment. According to Credit Union Magazine, there are three possibilities for alternative capital 20: G. a) Voluntary Patronage Capital b) Mandatory Membership Capital c) Subordinated Debt Performance 1. Industry As A Whole a) Finance Industry Market Share There are about 7,400 credit unions serving 90 million credit union members and having total assets over $900 billion.21 CUs hold about 6.7% of all household financial assets, a share of the financial market that has remained at about this level for the last 25 years.22 According to the NCUA, credit union memberships have increased by 5 million since 2006. Shares have grown over same period by $178 billion, or 30%, to $780 billion. Memberships grew in 2010 alone by 0.61 million or 0.68%. b) Revenues Credit union revenues are a function of net interest margin. Net interest margin is the difference between interest earned on loans and other assets less interest paid for deposits and borrowings. Since the 1980s, the net interest margin for the industry has declined as the business of the sector has gotten more competitive, reaching their lowest point in 2008, as shown below. Since then, net interest margins have increased slightly. But they are expected to remain thin for the foreseeable future, posing a management challenge to the profitability of the credit union industry. 20 Bill Merrick, "Could Alternative Capital Unleash Cus' True Potential?," Credit Union Magazine 76, no. 9 (2010). Matz. 22 Credit Union National Association, The State of the Credit Union Industry: Statement Submitted by the Credit Union National Association to the Senate Banking Committee, December 9, 2010. (2010). 21 19 Source: Credit Union Magazine23 Earnings, as measured by the return on average assets ratio, increased from 0.18% to 0.51% in 2010. This increase was in part a function of improving net interest rate margins, as shown below. Although the yield on loans in 2010 reduced from 6.28% to 6.06% and on investments from 2.63% to 1.95%, the cost of funds also fell from 1.74% to 1.21%, as seen below. Source: National Credit Union Association24 23 24 Steve Rick, "Meager Margins," Credit Union Magazine 77, no. 12 (2011). National Credit Union Administration, 2010 Yearend Statistics for Federally Insured Credit Unions (2010). 20 c) Strength (capitalization, or Net Worth) The net worth ratio measures the relative financial strength of credit unions. The regulatory minimum net worth ratio for “adequately capitalized” credit unions is 6% and for “well capitalized” ones is 7%. According to the NCUA, total industry net worth increased 5.15% in 2010, or by $4.51 billion to $92.07 billion. The average net worth ratio also rose, from 9.89% to 10.06% of total assets.25 Over ninety five percent of all credit unions are “well capitalized”.26 d) Assets (loans and investments) Credit union assets increased $29.87 billion, or 3.38%, in 2010.27 Assets include loans and investments. (1) Loans Loans account for 62% of all credit union assets, with more than half secured by real estate. Loans declined in 2010 by $7.68 billion, or by -1.34%. This decline, coupled with positive share growth, resulting in a drop in the loans to shares ratio from 76.06% to 71.82%, the lowest since 2004.28 Credit unions have asset portfolios of various types of loans, including personal loans, home loans, new car loans, used car loans, credit card facilities. Net loan charge-offs as a percentage of average loans decreased from 1.21% to 1.13% by the end of 2010 and to 0.95% by June 20111on an annualized basis. (a) Home Loans According to CUNA, the largest category of credit union loans is first mortgage home loans to members, amounting to 40.3% of all loans as of June 30, 2011, as seen in the left chart below.29 Fixed rate mortgages were 63% of total mortgage loans. 25 Ibid. Ibid. 27 Ibid. 28 Ibid. 29 Association. 26 21 Source: Credit Union Magazine Delinquent real estate loans in credit unions totaled 0.34% in 2006. Due to the recession, they increased to 2.06% by September 2009. Real estate charge-offs rose to 0.63% by the third quarter of 2009, compared to 7.67% in banks.30 Sixty-eight percent of credit unions offer mortgage loans, originating $55 mm in 3Q10. In first 9 months of 2010, mortgage loans rose by $667 mm, to be 54.6% of total loans.31 (b) Vehicle Loans Vehicle loans in 2010 rose by $45.37 million to account for 29.11% of all credit unions loans.32 30 Matz. Ibid. 32 Administration. 31 22 (c) Member Business Loans (MBLs) The average credit union business loan is about $250,000. About 2,210 credit unions (about 30% of total) offer these kinds of loans. MBLs total 6.5% of all outstanding loans, or $36.7 billion, mostly secured by real estate. MBLs constitute only 4% of all credit union industry assets and about 1% of commercial loans in financial markets. The level of delinquent MBLs rose from 0.53% to 4.29% from 2006 to September 2010. MBL charge-offs rose to 0.71%.33 As shown in the chart below, credit union business loan charge-offs historically have been significantly less than for banks, underscoring the more conservative loan management practices of credit unions generally. Source: Credit Union National Association (2) Investments Credit union investments increased in 2010, due to positive share growth and reducing loans. The maturity structure of the investment portfolio remains short-term, resulting in a low interest rate risk profile. However, movement from investments under one year to longer maturities continues. Credit union investment quality remains strong. Forty-two percent of all investments are in cash or cash-equivalents, deposits in corporate credit unions, and deposits at other financial institutions. Of the remaining investments, 89% of in U.S. government or Federal agency securities.34 33 34 Matz. Administration. 23 e) Liabilities (also known as shares or deposits) In credit union terminology, savings, checking, and certificates of deposit are called regular shares, share drafts, and share certificates respectively. Total credit union shares increased in 2010 by $33.81 billion or 4.49%.35 The largest percentage growth in shares was in money market shares, followed closely by regular shares, while the largest decline was in share certificates. The largest credit union average portion of shares overall was in regular shares, amounting to 29.4% of all, as seen below: Source: Credit Union Magazine f) Asset (Credit) Quality Asset quality is measured by loan delinquencies and loan charge-offs. Asset quality improved last year for credit unions. According to the NAFCU, the FICU delinquency rate was 1.58 % as of June 2011, down from 1.76 % in December 2010, but still above the 0.68% reported at the end of 2006. The loans subject to bankruptcy-to-total loans ratio for FICUs decreased from 0.9% at year-end 2010 to 0.4% as of June 30, 2011. The decline is in part a result of tightening credit standards throughout the industry, particularly for real estate loans. 36 Since the end of 2006, aggregate delinquent loan ratio and charge-off ratios more than doubled to 1.84% and 1.21% respectively at year end 2009. While high for credit unions, these numbers compare favorably to banks, where overall delinquencies total 5.21%.37 The bottom graph just below compares the delinquency rates of credit unions and banks. 35 Ibid. Unions. 37 Matz. 36 24 Source: Credit Union Magazine g) Investment Quality Average credit union investments total about one third of total credit union assets. They are generally short term, with about half maturing in less than one year. The majority are invested in Federal Government securities, the most conservative of all investments. 25 h) Liquidity An important aspect of lending is portfolio liquidity. Credit unions benefit by their ability to create liquidity either by increasing their access to other financial institutions willing to lend to them and to secondary markets to which to sell their loans from time to time.38 Corporate credit unions (which are credit unions for credit unions) are an important source of credit union liquidity. But there have been significant problems in corporate credit unions caused by the recent recession. The NCUA has increased its supervision of this sector.39 Problems also with Fannie Mae and Freddie Mac have reduced credit unions’ access to secondary markets for their real estate loans. Accordingly, credit unions have reduced their reliance on these traditional liquidity sources and have increased their access to other sources like the Federal Home Loan Bank.40 i) Earnings Average earnings at credit unions have been depressed over last several years, much due to lower interest rates and compressed interest margins. Industry observers believe they are likely to remain stressed in the near future. Average ROA was 0.45% in 2010 compared to 0.82% in 2006. Lower earnings creates a challenges to the building of equity. j) Membership Membership numbers, as mentioned above, have continued to grow over time. Yet the composition of membership has also continued to grow older. The number of young members constitutes a very low percentage of the total, as shown below, suggesting a challenge for the industry’s future. 38 Unions. Ibid. 40 Ibid. 39 26 Source: Credit Union Magazine41 2. By Size of Credit Union (by Asset Group) A distinct difference exists in performance among the different credit union asset groups. Size matters. As the chart below shows, net worth ratios remained strong in all four asset groups, particularly in the under $10 million category. But at the end of 2010 the smaller credit unions had the greatest challenge with earnings, loan growth, overall delinquency, and membership growth. The larger credit union categories benefited from their economies of scale, as reflected in lower operating expense ratios, and generate greater net income due to these efficiencies. 42 Source: National Credit Union Administration43 H. Outlook According to Callahan & Associates, credit unions as of June 2011 were showing stability and improving financial results across all measures of performance. Credit unions’ growing loan momentum is the most important trend reported by the $955 billion credit union system. Consumer loan originations increased by 10% in the first six months of 2011 compared to the first six months of 2010. First mortgage volume grew 7.3% over the same period, even though 41 Kristina Grebener, "Cus Need a Youth Movement," Credit Union Magazine 76, no. 2 (2010). Administration. 43 Ibid. 42 27 credit unions continue to sell a significant portion (45%) of their production volume to the secondary market. This selling rate is almost double the 24-28% level in the years prior to the Great Recession. Record low interest rates, expected to continue for the foreseeable future, should facilitate home loan refinances.44 Total credit union capital passed $106 billion, resulting in the capital-to-assets ratio rising above 11%. Credit unions’ major challenge is converting the $345.5 billion of investments and cash into loans. This would reverse the downward trend in the loan-to-share ratio, which stands at 70.1% at midyear, down from 72.8% at mid-year 2010.45 A positive indicator for future credit union loan growth is that consumer expenditures are nearing more normal, pre-recession levels. Spending as a percentage of disposable income is now nearly 92%, up almost four percentage points from the trough of the financial crisis. Additionally, the household financial obligations ratio, or the burden of debt repayments, is at the lowest point since 1994. Consumers are benefiting from refinancing outstanding debts and credit unions are taking the lead in enhancing their members’ personal balance sheets. New loan volume is averaging nearly $1 billion every business day.46 Increasing loan volume is also increasing credit union market share. The industry’s share of the auto finance market is 16.2% at midyear; this is the highest level of the past 12 months. The 5.7% of total year-to-date mortgage originations is double the pre-crisis level and continues to increase.47 See the cluster of charts below. 44 Lisa Mallow, "Credit Unions Increase Lending by 8% and Grow Total Revenue [Press Release of Callahan & Associates]," (Callahan & Associates, 2011). 45 Ibid. 46 Ibid. 47 Ibid. 28 Source: National Credit Union Administration48 48 Administration. 29 Source: Callahan & Associates 1. Loans Credit union loan balances are expected to rise 4% in 2011 and 6% in 2012, following a decline of 1.5% in 2010. Auto loans, private student loans, credit card loans, and purchase mortgages are expected be strong growth areas. The recession created a large pool of potential borrowers with subprime credit scores. Credit unions with disciplined underwriting and subprime pricing will see significant lending opportunities. For members in need of credit repair products, focus on price, convenience, and availability of funds.49 2. Earnings Credit union earnings were expected to climb back to 60 basis points (bp) in 2011 and to 70 bp in 2012 (after NCUA’s corporate assessments of a projected 20 bp this year and 15 bp in 2012). Through 2012, rising earnings will be supported by lower loan loss provisions, rising net interest margins, and continued cost-containment efforts.50 III. Market How big is the potential market of Access customers? This is a function of the numbers of individuals with SMI as well as for their families, their providers, and all others in or related to behavioral health care in the State. A. New Jersey 1. Individuals with Psychiatric Disabilities (“Consumers”) a) General Population According to figures released by the United States Census Bureau1, the 2009 adult 49 50 Credit Union National Association, "Top Ten Trends," (2011). Ibid. 30 population of New Jersey was 6,878,1272. The size of the New Jersey child population was 2,089,741. Using the same estimates (3.7% lower, 5.4% middle, and 7.1% upper), the estimates of adults with severe mental illness (SMI) in New Jersey in 2009 was 254,491 (lower), 371,419 (middle), and 488,347 (upper). In 2010, the projected size of the total New Jersey adult population is 6,930,007. The estimate of adults with SMI, in New Jersey, in 2010, ranges between 256,410 (lower estimate), 374,220 (middle estimate) and 492,030 (upper estimate). The projected size of the total New Jersey adult population for year 2011 is 6,979,2683 – an increase of 0.71% relative to 2010. The projected estimate of adults with SMI, in New Jersey, for 2011, ranges between 258,233 (lower estimate), 376,880 (middle estimate) and 495,528 (upper estimate).51 b) Specific Populations (1) Collaborative Support Programs of New Jersey Collaborative Support Programs of New Jersey is a leading consumer-led support services agency. In fiscal year 2010, the 31 self-help centers operated by the consumer-led Collaborative Support Programs of New Jersey served 5,595 individuals with psychiatric disabilities, which represented an approximate 20% increase in participation over 2009.52 (2) Supportive Housing Residents According to the NJ Division of Mental Health and Addiction Services, there were 3,444 individuals with psychiatric disabilities served in New Jersey supportive housing in 2009.53 (3) PACT clients The Programs in Assertive Community Treatment (PACT) is an evidence-based model of service delivery in which a multi-disciplinary, mobile, treatment team provides a comprehensive array of mental health services to a targeted group of individuals with serious mental illness. The statewide PACT caseload census increased from 1,900 in June 2008 to 1,986 in June 2010.54 (4) Intensive Case Management Services clients (5) Served by the System (non-emergency) In its reporting of the number of consumers served across the system and including those served in County Hospitals, DMHAS estimates that there are 96,088 unduplicated seriously mentally ill 51 New Jersey Department of Mental Health and Addiction Services, "Community Mental Health Services Block Grant Funding Agreement Application for Fiscal Year 2013. Retrieved from Http://Www.Nj.Gov/Humanservices/Dmhs/News/Publications/Final%2020122013%20joint%20block%20grant%20application.Pdf," (2011). p. 176. 52 Ibid. 53 Ibid., p. 159. 54 Ibid., p. 160. 31 (SMI) consumers that were served in non-emergency settings in the first three quarters of FY 2010. This represents 88.39% of the total SMI population served.55 Statistics kept by the NJDMHAS also suggest the ethnic distribution of New Jerseyans with psychiatric disabilities. The table below shows for 2009 those served by community agencies and short-term care facilities (but excluding county hospitals and youth services). The total percentage of minority group members with severe mental illness (SMI) served in 2009 was 45%.56 FY 2009 Unduplicated Adults Served in New Jersey Community Based Services American Indian or Alaska Native Asian or Pacific Islander Black or African American White Hispanic Other/Unknown TOTAL SERVED Non SMI 1,359 1,742 25,484 98,595 20,166 7,333 154,679 SMI 1,164 1,365 23,680 59,280 16,741 5,927 108,157 Total 2,523 3,107 49,164 157,875 36,907 13,260 262,836 % Total SMI Minorities Served 1% 1% 19% 60% 14% 5% 100% 45% Source: New Jersey Department of Mental Health and Addiction Services (6) Wildwood Wellness Retreat participants In 2010, the Wildwood Retreat, a program developed with DMHS funding and support to provide a training/networking site for consumers who participate in self-help centers and are part of the statewide support services program, served 395 individuals -- primarily members of both CSP-sponsored and non-CSP self-help centers and residents from CSP Support Services.57 (7) Peer Recovery Warm Line callers The Mental Health Association in NJ operates the Peer Recovery Warmline, which helping peers avoid unnecessary psychiatric screenings and hospitalizations by providing telephonic support and linkage to peer support programs and other community services. From October 1, 2009 to June 30, 2010, the Peer Recovery Warmline, PRW has answered over 8,000 calls.58 (8) 55 Ibid., p. 179. Ibid., p. 187. 57 Ibid., p. 145. 58 Ibid., p. 146. 56 GROW Self-Help Group participants 32 GROW is an international self-help movement of individuals with psychiatric disabilities and others. In the United States GROW has two organized state initiatives of which one is in New Jersey. Funded in part by the NJ Division of Mental Health and Addiction Services, GROW New Jersey has 19 weekly two-hour self-help groups around the State, each with three to fifteen participants. According to the NJ Division of Mental Health and Addiction Services, GROW served 255 individuals with psychiatric disabilities in fiscal year 2010.59 (9) Peer Wellness Coaches In November, 2008, the NJ Division of Mental Health and Addiction Services was awarded a Transformation Transfer Initiative (TTI) Grant through the National Association of State Mental Health Program Directors (NASMHPD) from the Substance Abuse & Mental Health Services Administration (SAMHSA) to expand and enhance the role of consumers in the workforce through the creation of the position of a Medicaid reimbursable Peer Wellness Coach. This project, which is collaboration among the Division, New Jersey’s nationally recognized Institute for Wellness & Recovery Initiatives, and the University of Medicine & Dentistry’s School of Health-Related Professions, allowed for the training and certification of 32 Peer Specialists working in residential settings, self-help centers, crisis services and other program elements to address the significant health challenges of mental health consumers.60 (10) COMHCO members The Coalition of Mental Health Consumer Organizations (COMHCO) of New Jersey is a statewide membership organization whose purpose is to enhance the education, empowerment, and advocacy of mental health consumers across New Jersey. With a self-proclaimed membership of over 5,000 consumers, COMHCO represents all New Jersey self-help centers and all of NJ’s 21 counties. According to COMHCO’s executive director, a substantial overlap (about 80%) exists of its membership with that of Collaborative Support Programs of New Jersey.61 (11) Consumer Connections graduates The Consumer Connections Program of the Mental Health Association in NJ recruits, trains, and supports consumers of mental health services to become providers of mental health services as volunteers, or as full or part-time paraprofessionals or professionals. According to the Division of Mental Health and Addictions Services, the program since its inception in 1997 has had 1,232 graduates.62 According to an officer of the Mental Health Association of New Jersey, the number of graduates may approach about 2000.63 (12) 59 NAMI Hearts and Minds Program Ibid., p. 149. Ibid., p. 145. 61 Annette Wright, COMHCO, Personal correspondence, February 15, 2012. 62 Ibid., p. 170. 63 Robert Kley, MHANJ, Personal correspondence, February 16, 2012. 60 33 The Hearts & Minds Program is a highly effective and efficient project as it is staffed by two part-time presenters who are responsible for marketing, coordinating and making presentations given a relatively small budget. Last year, the presenters, who are both peer providers, conducted the program intervention at 43 sites across the state, including five self-help centers, 25 partial care programs, four community-based hospitals, two residential programs, two PACT Programs, one state hospital and at three statewide conferences. In 2010, the program served 1,291 consumers and 156 family members across 18 of the 21 counties throughout the state.64 (13) Consumer Providers Association of New Jersey CPANJ, a trade association of consumer providers, believes it currently has 125 members. 2. Families a) NAMI New Jersey According to the legislative director of NAMI New Jersey, NAMI New Jersey has a e-mailing list of 5000 names.65 b) Peer Support Network The Consumer Parent Support Network (CPSN) provides support to parents with a mental illness in their parenting efforts and to promote the healthy functioning of their families. An essential feature of the program is the employment of consumer parents to provide peer support and advocacy services to the participants in the program. The CPSN has been accepting clients since November 2002, and has provided services and support to 107 consumer parents who have a combined total of 182 children with psychiatric disabilities.66 3. 4. Mental Health Professionals a) Psychiatrists b) Psychologists c) Psychiatric Nurses d) Psychiatric Social Workers e) Psychiatric Rehabilitation Practitioners (NJPRA) Mental Health Agencies In New Jersey there are over 120 agencies providing community mental health services to individuals with psychiatric disabilities. 64 Ibid., p. 154. Lubitz, P. (2012). Personal communication. 66 Ibid., p. 157. 65 34 [See List of New Jersey Agencies and Providers] 5. Corporations 6. Allies NAMI National Donors B. New York C. Nationwide 1. The Underbanked According to the FDIC, about 7.7% of all U.S. households, approximately 9 million comprising 17 million adults, are unbanked. About 17.9% of all households, roughly 21 million, are underbanked.67 Many of these are considered to be lower-income. Nearly 20 percent of lowerincome U.S. households, about 7 million earning below $30,000 per year, do not have a bank account.68 About 66 percent on unbanked households use alternative financial services (AFS) such as non-bank money orders and non-bank check-cashing, pawn shops, payday loans, rent-toown agreements, and refund anticipation loans. About one-quarter do not use any AFS, suggesting strong reliance on cash transacting.69 Certain racial and ethnic minorities are more likely to be underbanked than the population overall. These include blacks (31.6 percent), Native Americans (28.9 percent and Hispanics (24.0 percent). Asians and whites are less likely to be underbanked (7.2 percent and 14.9 percent respectively).70 The percentage of unbanked households increases for those with lower incomes. Those more likely to be unbanked have an annual household income below $30,000. They also tend to have less than a high school degree, or are less than 45 years old. 67 Federal Deposit Insurance Corporation, Fdic National Survey of Unbanked and Underbanked Households2009. Ibid. 69 Ibid. 70 Ibid. 68 35 Source: FDIC National Survey of Unbanked and Underbanked Households, 2009 Percentages vary by state and region. Of New Jersey’s total 3.1 million households, 233,000, or 7.4%, are unbanked, while 12.0% are underbanked. Of New York’s 7.7 million households, 761,000, or 9.8%, are unbanked, while 19.3% are underbanked . In percentage terms, Utah has the lowest percentage of unbanked families (1.7%) while Mississippi has the highest (16.4%). 71 IV. 2. The Poor 3. The Disabled Competition A. Banks B. Credit Unions 1. New Jersey a) Community Development Credit Unions in NJ The following New Jersey credit unions are classified as community development credit unions. 71 Ibid. 36 Entertainment Industries FCU 16 West Grand Street Elizabeth NJ 1st Bergen FCU 241 Moore Street Hackensack NJ OCNAC #1 FCU 1082 Summit Avenue Jersey City NJ Lakewood Community FCU P.O. Box 722 Lakewood NJ Franklin-St. John's CU 142 Maple Avenue Newark NJ New Community FCU 274 South Orange Avenue Newark NJ Renaissance Community Development CU P.O. Box 328 Somerset NJ Source: National Federation of Community Development Credit Unions 2. V. Customer VI. Company A. New York FIN/ Finance 1. Policy a) Accounting Access intends to abide by conservative generally accepted accounting policies for comparable credit unions and financial institutions as mandated by the National Credit Union Administration. b) Risk exposure The following elements of risk exposure will be monitored closely: interest rate risk, liquidity risk, credit risk, concentration risk, default risk. c) Assets and Liabilities Structure 37 2. 3. Investments a) US Treasuries b) Municipal Securities c) Mutual Funds d) FDIC Certificates e) Loan participations f) Corporate capital Tools a) B. QwickRate GOV/ Governance 1. Board 2. Advisory Committee 3. Reporting a) Financial Performance Access intends to monitor and analyze relevant performance ratios at least monthly. In particular, the Access Board will compare actual performance to budgeted ratios, investigate significant deviations, and document contributing factors. The Board will also monitor changes in market conditions and economic forecasts and adjust budgeted ratios whenever sound business practice dictates. Intended guidelines for the performance ratios is included in the Appendix. C. LEG/Legal Access has retained [Andora & Romano, LLC] to advise on legal matters. D. MAN/ Management E. OPS/ Operations 1. Policy Access has instituted an initial Operations Manual: Policies and Procedural Guidelines (dd January 22, 2010. 38 F. STR/ Strategy, Tactics, and other considerations 1. Investment in Technology Internet bank? A credit union created entirely on the web may look something like ING Direct Bank. By using products such as XpressAccounts, LoansPQ, RoboDocs, DepoZip and others, a web based credit union can become a reality. FiServ also has a web based core processor operating in Canada. The conversion from client server delivery to web based delivery of credit union applications has begun. Check out the National Association of Realtors charter application to get a look at the future (today). G. 2. The Size Question 3. The Growth Question 4. Board Recruitment and Involvement 5. Succession Planning RES/ Research 1. Interesting Comparables SCE Federal Credit Union Bethex Federal Credit Union, Bronx, NY (See: The Plight of Small CUs) 2. Possible Partners Common Good Finance Self Help New Jersey Credit Union Foundation 39 VII. Products A. Cash Products 1. B. Credit Products 1. 2. C. ATM access Loans a) Housing b) Vehicle c) Personal d) Business Credit cards Interest Rate Products 1. Savings Accounts 2. IDAs D. Service Products E. Technology Services 1. Online Banking (with Intuit) 2. Mobile Banking Idea: develop a program to give consumers phones by which to bank? F. Inducements 1. VIII. Finance Free gas cards 40 41 References: Administration, National Credit Union. 2010 Yearend Statistics for Federally Insured Credit Unions. 2010. Alden, Sharyn. "Payday Lending." Credit Union Magazine 77, no. 7 (2011): 30-34. Association, Credit Union National. The State of the Credit Union Industry: Statement Submitted by the Credit Union National Association to the Senate Banking Committee, December 9, 2010., 2010. ________. "Top Ten Trends." (2011). Corporation, Federal Deposit Insurance. Fdic National Survey of Unbanked and Underbanked Households, 2009. Grebener, Kristina. "Cus Need a Youth Movement." Credit Union Magazine 76, no. 2 (2010): 30-34. Mallow, Lisa. "Credit Unions Increase Lending by 8% and Grow Total Revenue [Press Release of Callahan & Associates]." Callahan & Associates, 2011. Manning, Robert D. "The Evolution of Credit Cards." Credit Union Magazine 75, no. 10 (2009): 35-38. Matz, Debbie. The State of the Credit Industry: Statement before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, December 9, 2010. 2010. Merrick, Bill. "Could Alternative Capital Unleash Cus' True Potential?" Credit Union Magazine 76, no. 9 (2010): 30-35. Rick, Steve. "Meager Margins." Credit Union Magazine 77, no. 12 (2011): 16-16. ________. "A Sea of Liquidity." Credit Union Magazine 77, no. 7 (2011): 16-16. Services, New Jersey Department of Mental Health and Addiction. "Community Mental Health Services Block Grant Funding Agreement Application for Fiscal Year 2013. Retrieved from Http://Www.Nj.Gov/Humanservices/Dmhs/News/Publications/Final%2020122013%20joint%20block%20grant%20application.Pdf." (2011): 424. Treasury, U.S. Department of the. Comparing Credit Unions with Other Depository Institutions. 2001. Unions, National Association of Federal Credit. Nafcu 2011 Report on Credit Unions. National Association of Federal Credit Unions, 2011. 42