AirborneExpress1998Spring2008Beethoven

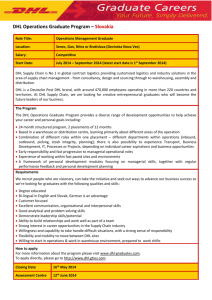

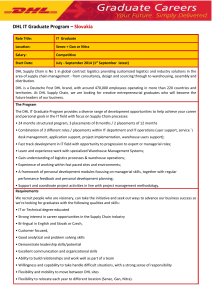

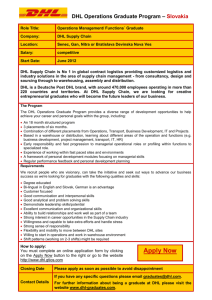

advertisement

MGT 693 Spring 2008 Team Bethoveen Agenda Value Chain Industry Analysis Airborne Strategy Recommendations Current Situation Update 2 Express Mail Value Chain Customers Express Mail Companies Sorting Facilities Ground Air Transportation Transportation Destination -Businesses -Fed Ex -Hub & Spoke -Vans -Cargo planes -Businesses -Individuals -UPS -Trucks -Hub & Spoke -Individuals -Postal Service -Airborne Express 3 Industry Analysis Rivalry Threat of Entrants Fierce Competition Price is Basis for Competition Strong Brand Images Access to a Large Fleet of Transportation Vehicles Long-term Contracts with Customers Threat of Substitutes Low Threat of Traditional Substitutes Technology is Creating a New Threat 4 Industry Analysis Power of Suppliers Fuel Suppliers Packaging Equipment Service Suppliers Power of Buyers Moderate Power due to Price Competition Dependent on Technology, Service, and Speed 5 Airborne’s Differences & Sources of Advantage Owns Hub Airport in Wilmington, OH Operates nation’s only foreign trade zone in Wilmington Less automation, more human resources Runs aircraft 80% full Shippers/Receivers in major metro areas Majority afternoon & second day deliveries 6 Airborne’s Differences & Sources of Advantage No retail service centers Pick-up and delivery by consultants Pick-up and deliver more parcels per stop Later delivery times Lower customer service levels Technology not always “cutting edge” 7 Recommendations for Airborne and Robert Brazier Strengthen its alliance with RPS Form a similar alliance with an international partner Follow the industry lead and move toward distance-based pricing Continue to focus on costsavings strategies to remain low price leader 8 Recommendations for Airborne and Robert Brazier Continue a targeted marketing strategy aimed at logistics managers, etc. Maintain the niche philosophy-- “Since we can’t be all things to all people, we’ll pick our kind of customer deliberately.” 9 Timeline: Airborne Express and DHL Enters Fortune 500 Start of ground service Airborne@Home alliance with USPS 1998 1999 Purchased by Van Gend & Loos Euro Express Shareholders approve DHL acquisition of $1 billion 10:30am Delivery, Airborne.com services 2000 2001 2002 Deutsch Post World Net (DPWN) acquires majority shares (51%). Remaining shares purchased in 2002. 2003 Acquires Airborne Express and begins to integrate it into DHL Old and new DHL merge 10 DPWN and DHL today Initial high cost to expand ground network to catch-up with FedEx and UPS No longer expect to meet target break-even of 2009 Struggle to integrate Airborne Express into DHL Write down of fixed U.S. assets $800 million in 2006, $900 million in 2007 Annual losses of nearly $1 billion $25 million class action settlement Paid to contractors over payment system trouble 11 The Future of DHL John Allen, new CFO of DPWN (Nov ‘07) Focus on cutting costs and pleasing investors Rumors DPWN may give up control of DHL Await 2007 Annual Report (March 6, 2008) FedEx to acquire DHL? Anti-trust issues FedEx 49% of U.S. Market Share DHL 9% of U.S. Market Share 12 Questions? 13