Course Descriptor Template - Heriot

advertisement

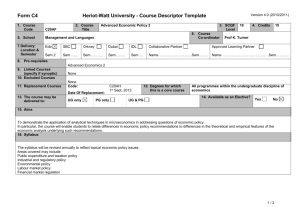

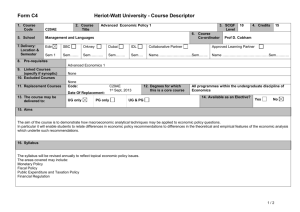

Form C4 Version 4.0 (2010/2011) Heriot-Watt University - Course Descriptor Template 1. Course Code 2. Course Title G10EE 6. Course Co-ordinator 5. School Engineering and Physical Sciences 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Sem 1 Sem……. Sem……….. Sem…….. Sem…. 8. Pre-requisites 3. SCQF Level Energy and Petroleum Business Economics Collaborative Partner Baku Higher Oil School, Azerbaijan Sem 1 10 4. Credits 15 4th Year Director of Studies Approved Learning Partner Name …………………………………Sem……….. Satisfactory completion of Stage 3 courses 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only UG & PG BEng Petroleum Engineering 14. Available as an Elective? Yes No 15. Aims The overall aim is to: understand the economic concepts involved in project evaluation understand the value of investments as defined within a fiscal system evaluate risks associated with economic decisions 16. Syllabus Introduction: General financial aspects of the petroleum industry; nature and evolution of demand for oil; evolution of oil supply; role of the National Oil Company versus International oil company; financial parameters or statistics reflecting performance of a petroleum company; principal sectors of petroleum activity Evaluation methods: Definition of an asset; Evaluation concepts and objectives; Book value and depreciation; Market value and models; Cash flow concept - “capex” and “opex”; Cash flow models Time value of money: Time Value; Compound Interest; Discounting; present value of a single cash flow; Annuities; Price Inflation - Money of the day Real terms, constant money; Purchasing power; Conversion of money of the day to real terms and vice versa Project parameters: Cash Flow Modelling - project screening and ranking, Maximum capital outlay, Payback period, Terminal cash surplus, Profit to investment ratio (undiscounted); Discounted Measures of Value; Net Present Value (NPV) from project cash flows; Annual Capital Charge (ACC); Internal Rate of Return (IRR); NPV and IRR for acceleration projects; NPV, NPVI and IRR as screening criteria; NPV, NPVI and IRR as ranking criteria Government: Importance of petroleum to government; Resource Ownership; United Nations Convention on the Law of the Sea; Petroleum licensing; forms of licensing agreement; Petroleum Development and government concerns; definition of “good oilfield practice”; purpose of a field development programme; flaring of methane; reservoir unitisation and describe its conceptual evolution; field abandonment; Taxation - petroleum revenues; tax-reference price; corporate taxation of project - standalone and consolidated economic models; progressive and regressive taxes Sources of uncertainty and risk: Geology - concept of exploration success; Facilities – problems encountered in subsurface and surface; environmental issues pertaining 1/2 Form C4 Version 4.0 (2010/2011) Heriot-Watt University - Course Descriptor Template to oilfield development; human failure; Government – imposition of changes to project;Describe an example of such a process; taxation policy and investment decisions; concept and implications of demand elasticity; function of spot markets and marker crudes; oil price uncertainty; market for gas; gas sales contract; gas pricing; exchange rate variation and influence on project economics; risk associated with borrowing money; Partners – risks associated with partnerships Risk Management: Sources of information to reduce uncertainty; transferring risk – financial instruments and commodity trading; Diversification; joint ventures; scenario planning; relevant information in the context of decision-making; Simple Decision Methods; sensitivity analysis; spider diagram; Monte Carlo and Latin Hypercube sampling; Mathematical Expectation; Binomial probability Function to calculate expected value; Preference Theory; Decision Trees and value of information 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) On completion of the course, the student should be able to: understand the financial system within which project decisions are made calculate net present value, internal rate of return for a project use statistical techniques to assess risk associated with development of oil and gas fields be able to make economic decisions based on calculated risks Personal Abilities Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT In this course, students will be explicitly encouraged to: be aware of the importance of time management; develop their personal skills, including an awareness of both traditional and internet-based information sources; develop their skills in problem solving use appropriate tools to make project viability and ranking decisions an ability to apply theoretical knowledge to practical problems. provide constructive feedback to teaching staff. 18. Assessment Methods 19. Re-assessment Methods Method Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Examination Coursework 2 hours Duration of Exam Diet(s) (if applicable) 80% 20% Examination Coursework as appropriate 3 3 2 hours 20. Date and Version Date of Proposal 13-8-2012 Date of Approval by School Committee Date of Implementation Version Number 2/2 1.1