Facts

advertisement

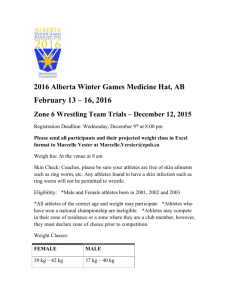

ACCT 5302 Handout Problem – Marcelle Company Reporting Results of Operations The following information was extracted from the records of Marcelle Company. Unless otherwise indicated, the information relates to 2015 events and transactions. 1. On August 1, 2015 Marcelle entered into a formal plan to dispose of its entertainment division. Prior to August 1, 2015, the entertainment division qualified as a “held and used” component under FASB ASC 360 (formerly FASB Statement 144). As of August 1, 2015, this division qualifies as a component “held for sale” under FASB ASC 360. This division represents all of Marcelle's entertainment operations. 2. Operating revenues under method A and expenses (before income taxes) for 2015 were as follows: Revenues Expenses Applicable to entertainment division 1/1/15-7/31/15 8/1/15-12/31/15 $40,000 $21,000 50,000 36,000 Applicable to remainder of Marcelle's operations $580,000 237,000 3. The entertainment division had a book value at August 1, 2015 of $200,000 and a fair value of $175,000. At August 1, 2015, the division’s estimated future cash flows was $220,000. At December 31, 2015, the entertainment division has a book value of $191,000 and a fair value of $170,000. Marcelle expects to incur a total “cost to sell” the entertainment division of $5,000. 4. During 2015 Marcelle suffered an uninsured loss from tornado damage of $60,000 before consideration of income taxes. The loss is fully deductible for income tax purposes. Tornadoes are considered to be unusual and infrequent for Marcelle's region of the country. 5. During 2015 Marcelle received proceeds of $50,000 as the final settlement of litigation that was begun in 2007. The proceeds are fully taxable. 6. On June 1, 2015, Marcelle sold land having a book value of $55,000 for $30,000. The loss is fully deductible for tax purposes. The sale of land by Marcelle is considered to be nonrecurring but is not unusual for companies in the industries in which Marcelle operates. 7. The accountant for Marcelle failed to record fines paid by Marcelle of $10,000 in each of the years 2013 and 2014. Thus, operating expenses of 2013 and 2014 are understated by $10,000 in each year. Assume that these fines are not deductible for tax purposes; thus, there is no tax effect related to these fines. 8. Marcelle had no marketable securities as of January 1, 2014. Marcelle purchased securities during 2014 at a cost of $50,000. Marcelle concluded that all of these securities should be classified as available-forsale. Marcelle sold no securities in 2014. At January 1, 2015, Marcelle showed a debit balance in its Accumulated Other Comprehensive Income account of $1,200 ($2,000 cumulative unrealized loss less $800 tax effect). All of this balance relates to Marcelle’s marketable securities classified as available-forsale. On January 1, 2015, the cost of those securities was $50,000 and the market value was $48,000. No securities were purchased in 2015 or 2016. At December 31, 2015, Marcelle’s securities had a market value of $55,000. These securities were sold on January 15, 2016 for $58,000. Assume that Marcelle is taxed only on realized gains and losses on its marketable securities and that the tax rate is the same as for all other items of revenue, expense, gain, and loss. Marcelle had no other items at December 31, 2015 or December 31, 2016 that would have had any impact on other comprehensive income. 9. On January 1, 2016, Marcelle Company voluntarily decided to change its method of accounting for certain of its revenues from method A to method B. You are to assume that both methods are acceptable methods under U.S. GAAP. Marcelle Company made the change for tax purposes as well. The impact of changing the method of accounting for these revenues is as follows: Thru 2013 2014 2015 2016 Increase (Decrease) in Operating Revenues Due to Change from Method A to Method B $40,000 20,000 10,000 15,000 Cumulative Effect of Change to January 1, Before Tax $40,000 60,000 70,000 Cumulative Effect of Change to January 1 After Tax $24,000 36,000 42,000 The entertainment division’s reported revenue was not affected by Marcelle’s change from method A to method B; the entire change in operating revenues due to the change from A to B related to the remainder of Marcelle’s operations. 10. Unless indicated otherwise, all revenues and gains are fully taxable and all expenses and losses are fully deductible for tax purposes at a tax rate of 40%. Marcelle Company had no temporary differences related to any items included in net income during any of the years 2014-2015. The only temporary differences related to any unrealized gains or losses (and reclassification adjustments) included in other comprehensive income during those years. 11. Marcelle declared and paid cash dividends in $60,000 in 2010, $65,000 in 2015, and $65,000 in 2016. 12. Marcelle's 2014 financial statements issued at the end of 2014 revealed the following income and retained earnings statement data: Revenues under method A (including $40,000 applicable to the entertainment division) Expenses (including $31,000 applicable to the entertainment division) Income before income taxes Income taxes Net income $440,000 210,000 230,000 92,000 $138,000 Retained earnings, January 1, 2014 Net income - 2014 Cash dividends - 2014 Retained earnings, December 31, 2014 $604,000 138,000 (60,000) $682,000 REQUIRED: Part A: Using good form, prepare comparative-years' income statements for 2015 and 2014, comparative-years' retained earnings statements for 2015 and 2014, and comparative-years’ comprehensive income statements for 2015 and 2014. (The comprehensive income statements should be of the form that begin with net income and end with comprehensive income.) Assume that Marcelle’s 2015 annual report (containing the 2015 and 2014 comparative-years’ financial statements was issued on January 1, 2016. You may omit the earnings per share data and any required footnotes. Part B: Using good form, prepare comparative-years' income statements for 2016 and 2015, comparative-years’ retained earnings statements for 2016 and 2015, and comparative-years’ comprehensive income statements for 2016 and 2015. In answering Part B, you are to consider the following additional information. 1. The entertainment division was sold on January 1, 2016 for $170,000. Marcelle incurred a total “cost to sell” the entertainment division of $5,300. 2. Marcelle's financial records reveal the following income statement data applicable to Marcelle's 2016 continuing operations: Operating revenues under method B Operating expenses (excluding income taxes) $700,000 450,000