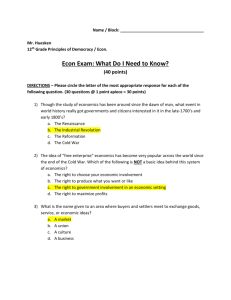

The International Financial Crisis

advertisement