GASB Small Business Case Materials A - 2015

advertisement

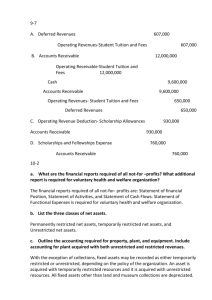

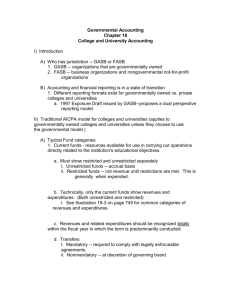

CACUBO Hands-On Case May 2015 Eastern State College. Eastern State College is a mid-sized public institution that has had a typical operating year. You are provided the beginning of the year statement of financial position as well as the transaction that were incurred during the year. You are obligated to record the recognition of each of the year’s transactions. You must write the journal entry, enter the data in the Excel file, record closing and adjusting entries. Then you must close the operating accounts and prepare the Statement of Revenue and Expenses to derive the 2015 Statement of Net Position. Once all of this is accomplished, you are requested to prepare a cash flow statement using the worksheets and draft cash flow worksheet. During the fiscal year ended June 20, 2015, the following transactions occurred (amounts are in thousands). 1. Student tuition and fees were assessed in the amount of $18,350. Scholarship allowances were made, for which no services were required, in the amount of $1,490. Graduate and other assistantships were awarded, in the amount of $1,420. All scholarships and assistantship allowances were credited against student’s bills. Collections were made on account in the amount of $15,700. 2. The $500 in prepaid revenues relate to cash collected prior to June 20, 2014. And to tuition revenue that should be recognized in the current year. Also $720 of the tuition and fees in (1) above applies to fees that should be recognized as revenue in the year ended June 30, 2016 (that is, next year). 3. State appropriation were received in cash as follows: #13,020 for general operations and $800 for capital outlay, set aside for specific purposes. 4. Federal grants and contracts, for restricted purposes, were received in cash in the amount of $3,310. State and local grants and contracts, also for restricted purposes, were received in cash in the amount of $890. 5. Revenues from auxiliary enterprise services amounted to $12,450 of which $12,100 was received in cash. 6. Contributions were received in cash as follows; unrestricted, $650; restricted for capital projects, $300; restricted for other purposes, $500. 7. Donors contributed $600 for endowments, the principal of which may not be expended. The income from these endowments is all restricted for operating purposes. The cash was immediately invested. 8. Interest receivable at the beginning of the year was collected (both unrestricted and restricted). 9. During the year, investment income was earned on investments whose income is unrestricted in the amount of $200 of which $175 was received in cash. Investment income was earned on investments whose income is restricted in the amount of $1,500 of which $1,250 was received in cash. 10.All accounts payable and accrued liabilities as of the end of the previous year were paid in cash at year-end, using unrestricted cash. 1 11. Unrestricted expenses amounted to; salaries – faculty $14,123; salaries- exempt staff $10,111; nonexempt wages $6,532; benefits - $6,112; other operating expenses $4,100; Cash was paid in the amount of $36,878; the remainder was payable at yearend. 12. Restricted expenses amounted to; salaries - $2,256; salaries – exempt staff - $745; nonexempt wages $213; benefits - $6,112; other operating expenses $1,100. Cas was paid in the amount of $4,612; the remainder was payable at year-end. 13. Depreciation was recorded in the amount of $1,370, all charged as unrestricted expense. 14.During the year, disbursements were made for property, plant and equipment in the amount of $3,195 of which $1,050 was from resources restricted for capital outlay and the remainder from unrestricted cash. 15. Interest on bonds payable, all related to capital outlay purchases, amounted to $348; all but $22 was paid in cash. Bonds were paid in the amount of $800; next year $300 will be payable. No new revenue bonds were issued during the year. $300 will be payable. No new revenue bonds were issued during the year. Unrestricted cash was used for all these transaction. 16. An additional $100 was deposited with the bond trustee, in accord with legal requirements. 17. The accrued liability for compensated absences increased by $88 during the year. 18. All short-term investments existing at the beginning og the year were sold for $2,450. New short-term investments were purchased for $2,650. Unrealized gains were recorded at year end as follows; short-term investments (unrestricted), $40; long-term investment (restricted), $120 (endowments restricted) $120; endowment investments $61. 19. Closing entries were prepared, separately, for each new position class. 20. GASB standard No. 68 must be recognized as of June 30, 2015. The utilization of cash for the pension obligation is included in the amount recognized for benefits. The statement of net position accounts must be reclassified for the accumulated pension obligations that have no cash impact that have previously been disclosed in the notes. The recognition is as follows: Deferred outflow $93; Unrestricted Net Position for prior year obligations $782; Noncurrent liabilities for pension obligations $20; and unrestricted net position $875. REQUIRED: A, Prepare journal entries for each of the above transactions and post these to the Taccounts provided in the excel file. B. Prepare closing entries and calculate the ending balances for each of the classes of et position. C. Prepare the Eastern State College Statement of Revenues, Expenses, and Changes in the Position for the year ending June 30, 2015. D. Prepare the Eastern State College Statement of New Position as of June 30, 2015. E. Using the June 30, 2015 Statement of Revenues, Expenses and Changes in the Position and the June 30, 2015 Statement of Net Position, prepare the Statement of Cash Flows for Eastern State College. 2