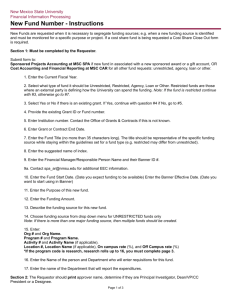

New Administrators Orientation

New Administrators Orientation

Budget and Business Processes

Lori McMahon

Associate Provost for Academic Budget and Personnel

August 7, 2014

Color of Money

•

Determined when money comes INTO the University.

•

Cannot be changed by anyone within the University.

2

•

Drives many accounting decisions

(fund accounting).

3

Unrestricted Funds

• State General Funds

-- The total $ amount is appropriated to the campus, but the campus (Chancellor) decides how/where to further allocate and spend.

• Tuition and Fee Revenue

• Institutional Trust Funds

– Unrestricted gifts

– Endowment income (unrestricted endowments)

– Contract/Grant residuals

– Certain Conference residuals

– F&A Funds (Overhead Receipts)

– Sales and Services (Recharge Units, Conf. & Event fees)

– Student Auxiliary funds

– Student Fees

Restricted Funds

• Must be determined by external parties

• Institutional Trust Funds:

– Grants and contracts (except exchange transactions)

– Restricted Gifts

• Restricted by donor for the college or department

• Can be further restricted as to how one spends the funds

(e.g. scholarships)

• Income from restricted endowments

4

• Restricted Appropriations

Discretionary Funds

5

• Can be Restricted or Unrestricted

• Restricted Funds: if outside party did not restrict funds to certain account codes (books, scholarships), funds can usually be labeled as discretionary

– Still must have a business purpose and follow all the expenditures policies and procedures of the University

• Identification of Discretionary Funds

– New funds will be marked when created as discretionary (if applicable)

– Older funds will be reviewed at department’s request to see if they qualify for discretionary spending

6

Other Types of Funds

• Endowment funds

• Agency funds

• Capital funds

• Debt Service funds

• Annuity and Life Income funds

• Loan funds

7

Endowment Funds

• True Endowment Funds

– Only created due to contribution of an outside party

– Must be held in perpetuity

– Only the income can be spent (interest generated from principle earnings; i.e., spending policy)

• Quasi Endowment Funds

– Restricted if formed with restricted sources

– Unrestricted if formed with unrestricted sources

– Function like endowments

– Management/Board decision to treat funds as endowment

– Generally, only income is spent, but principal can be divested upon management decision

• Term Endowment Funds

• Treasury Services: Jane Johansen, Director, x75432

Summary of Fund Types

Main fund types generally used on campus for spending purposes

Type of Fund Managed By Fund Number Range

Appropriated (General)

ITF: Overhead Receipts

ITF: Unrestricted

ITF: Grants & Contracts

ITF: Restricted

(ie. Scholarships)

Agency

8

Foundation

Budget Office

Treasury Services

100000-119999

120xxxx

Treasury Services 137000-139699

Grants/Contracts Admin.

5xxxxx

Treasury Services 6xxxxxx

Treasury Services

Treasury Services

83xxxx

N/A for Chart 1

Main Colors of Money at UNC Charlotte

Money comes from

(in the form of…)

State (Appropriations);

Students (Tuition, General Fees);

Misc. (surplus sales, etc.)

Types of

Fund

General

Students/Customers

Purpose Restrictions

Mainly Unrestricted. Must be used by end of fiscal year, 6/30/2xxxx

ITF: Auxiliary Unrestricted

Donors (Gifts)

Research Agencies

(Grants/Contracts Awarded)

Foundation

(initially)

Must be used consistent with purpose specified by donor, primarily restricted but may be unrestricted

ITF: Grants &

Contracts

Must be used consistent with grant/contract terms; restricted

Capital Restricted to designation

Managed by

Budget Office

Budget Office

Treasury

Services

Grants &

Contracts

Admin.

Budget Office Designated Student Fees

(e.g. Debt Proceeds paid from student fees)

9

Other ITF Depends Treasury Serv.

Takeaways

10

• University Funds have different ‘use’ restrictions depending upon the source of funds

• Discretionary Funds are a type of fund that have the most flexibility in terms of use (e.g., food/beverages)

• Policy 601.8 provides spending restrictions on certain funds

• Expenditures can generally be lumped into 3 categories of allowable transactions:

1. Ordinary business expenditures

2. Unallowable/nonoperational expenditures

3. Expenditures that require additional documentation (e.g., via FB&A form)

11

Business Processing

Financial Services Department Functions

Accounts Payable

Budget Office

Controller’s Office

Financial Data Admin

Materials Management

Treasury Services eCommerce

General Accounting

Payroll

P-card

Reporting & Fixed Assets

Student Accounts

Tax

Travel & Complex Payments

12

Roles and Responsibilities

Dept.

Head

Fund /

Business Manager

Departmental Preparers/

Financial Support Staff

Fiduciary Responsibility

Manages designated funds

Adheres to policies applicable to job duties

13

Is this you or someone you know?

14

Grace Murray Hopper

Rear Admiral, US Naval Reserve and Research Fellow in Engineering and Applied Physics at

Harvard’s Computation Laboratory.

B.A Mathematics/Physics from Vassar, 1928;

M.A and Ph.D. Mathematics from Yale University 1930/1934.

“It’s easier to beg forgiveness than to get

permission.”

15

Delegation Criteria

Dept. Heads who delegate responsibilities to a Fund Manager must:

Prior to delegation --

• Consider the circumstances: condition of funds, competence of potential fund managers, and degree of supervision that will be required.

• Communicate clearly and completely.

• Verify the delegate’s understanding of responsibilities.

During delegation --

• Retain fiduciary responsibility for accuracy and compliance and retain management-level decision making.

• Retain open communication with delegate.

• Regularly monitor and assess each delegate’s performance.

General Guidelines – Financial

Activity

1) Planning

– Evaluate financial consequences of activities

– Evaluate anticipated costs and benefits

2) Transactions

– Comply with policies, regulations, grant terms, etc.

– Recorded accurately and timely

3) Training and Competence (Technical, Behavioral)

16

1) Corrective Actions

– Timely

– If frequent, or repeated, assess need for preventive controls, additional training, and/or sanctions

17

Fund Management

Departments are responsible for managing their funds as follows:

1.

Accurate financial reporting

2.

Prudent spending aligned with University goals and policies

3.

Safeguard assets

4.

Safeguard confidential and sensitive information

5.

Manage finances effectively

6.

Avoid financial penalties or added costs

7.

Avoid fraud

Accurate Financial Reporting

& Analysis

Department level financial management and analysis must be completed at

least monthly for the following reasons:

18

• Banner output is used as the basis for management decisions.

• Accounting must be accurate and timely in order for management to

evaluate the status of budgets, funds, cash flow, etc.

• Budgeted labor and expenditure balances by fund and account must remain positive to ensure that reporting and certifications are submitted on time to the state and budgeted cash flow is not disrupted.

• Cash flow problems may have a negative impact on vendor relationships and create complications that affect multiple departments.

• Monthly analysis and validation enable more efficient month-end and

year-end close processes since corrections and other entries are made timely.

19

Accurate Financial Reporting

& Analysis

Corrective Actions:

If reporting exceptions continue to occur, control procedures must be implemented to correct the situation.

Examples of corrective actions include:

– Revise plan or budget to reflect changed circumstances,

– Change or eliminate activities,

– Obtain additional funding,

– Modify goals or objectives,

– Correct transaction errors,

– Alter future budget assumptions,

– Implement new control procedures, or

– Document managerial decisions that depart from the budget.

Document any corrective actions taken.

20

Spend Money Wisely

All purchases and payments must be:

1. In compliance with University spending policies, and

2. Within budgetary constraints

A thorough review of all charges should occur in accordance with UNIVERSITY POLICY

601.8, APPROPRIATE USE OF UNIVERSITY FUNDS to ensure that costs are allowable and charged appropriately. (i.e. Food and Beverage Expense Form/attachments)

Other documents that should be referenced for applicable requirements include:

• University PURCHASING MANUAL (49erMart, Direct Payments, P-Card)

• University TRAVEL PROCEDURES MANUAL (Pre-Authorization, Reimbursement)

• UNC Charlotte PURCHASING CARD MANUAL

• Any documents governing grant and contract terms

Safeguarding University Assets

Cash Handling

• All cash, checks, and cash equivalents in excess of $250 are to be deposited by noon of the next day in accordance with the North Carolina

Daily Deposit Act (NC G.S. 147-77). Exceptions to this requirement are rare.

– If a department receives cash and/or equivalents that cannot be readily identified for a purpose, the department needs to contact General Accounting for direction immediately. These funds are still subject to the Daily Deposit

Act.

21

• All petty cash and change funds must be authorized by the Controller’s

Office. All cash shortages and excesses must be promptly reported to a supervisor, who must investigate them immediately. See the Petty Cash and

Change Fund Procedures

Safeguarding University Assets

22

Physical Assets

• A physical inventory of all equipment must be conducted on an annual basis. All discrepancies must be promptly reported and investigated. See the Fixed Asset Guidebook .

• All thefts of University assets, including cash, must be reported to the police.

Financial Records

• Adjustments to asset records must be documented and approved.

• Access to any forms or online resources that can be used to alter financial balances must be restricted to only those employees requiring such access to perform their University duties.

Safeguarding Sensitive Information

When dealing with University financial information, proper safeguards must be in place to ensure the security of confidential and sensitive data, as defined in Policy

311, Data and Information Access and Security.

23

Department heads should assess and address risks to in all areas of their operation.

Simple steps include:

• Determining what information is being collected and stored, and whether there is a business need to do so and ensuring any sensitive information is stored securely.

• Limiting access

• Ensuring proper information security awareness and training

• Regularly reminding employees of security policies

• Knowing how to handle a breach. See Policy 311.5

See SANS Security Awareness training information at: http://itservices.uncc.edu/security/security-awareness

Avoiding Financial Penalties & Fraud

The University has been granted additional financial and administrative authority as a “special responsibility constituent institution” (SRCI) under G.S. 116-30.1. If we were found to be negligent or noncompliant with how we spend funds, we would lose this critical designation.

24

Shared responsibilities to keep this designation:

– Maintain appropriate admin staffing, procedures and internal controls

– Resolve significant audit findings within 3 months

– Support the ability to carry out BOG-defined educational mission with our GF budget (General Fund)

– Obtain BOG approval to establish new academic, research, public service or financial aid programs in the GF

– Measure impact on student learning and development

– Submit monthly GF budget reports to governing agencies

25

Contact Information

Academic Affairs Office:

Lori McMahon, Assoc. Provost for Academic Budget/Personnel, 7-5774

Niki Moseley, Budget Manager, 7-5772

Controller’s Office:

General Accounting website: http://finance.uncc.edu/controllers-office/generalaccounting

Ron Sanders, Assistant Controller, 7-5786

Laura Williams, Compliance Manager, 7-5002

Budget Office:

Budget Office website: http://finance.uncc.edu/budget-office

Ken Smith, Assistant Budget Director, 7-5599