Income from business/Profession

Income from business/Profession

By

Prof. Augustin Amaladas

M.Com., AICWA.,PGDFM., B.Ed.

12/12/2007 1

INCOME FROM HOUSE PROPERTY

House property for this purpose means :

Any building which has the characteristic features of a building.

E.g.: residential building, cinema theatres etc.

12/12/2007 2

12/12/2007

INCOME FROM

HOUSE PROPERTY

Taxed on “Notional Basis”

3

Conditions for taxing income under the head house property.

There should be a building or a land appurtenant there to .

AND

The property should be owned by the assessee.

AND

Such building should not be used for own business or profession.

12/12/2007 4

Section 22(Charing Section)

“ The Annual Value of building or land appurtenant thereto is chargeable to tax in the hands of the owner provided the same is not used for own business or profession”.

E.g.: CASE 1: Mr. X lets out a HP to Mr. Y, who intends to carry on his private business. –

Income from HP.

12/12/2007 5

CASE 2: Mr. X uses his property to carry on his own private business. – No income from HP.

12/12/2007 6

Exceptions to the rule – that the rental income is taxable under HP.

Income from sub letting – Income from

OTHER SOURCES since the assessee is not the owner.

Composite rent – When a building has been let out along with the furniture , then such letting out is called composite letting.

As per sec 56(2) , when the rent is inseparable – income from other sources.

12/12/2007 7

As per CIT vs. SHAMBHU INVESTMENTS

PVT. LTD., (2003) (s.c) such inseparable composite rent is taxable under the head HP.

At present Supreme Court decision has to be followed.

12/12/2007 8

Section 23( Annual Value)

Sec 23(1)(a) –

AV = Rent at which the HP is reasonably expected to be let out.

12/12/2007 9

Sec 23( Annual Value)

Sec 23(1)(b) –

If the house property is actually let out and if rent received or receivable is higher than the reasonable rent as per sec 23(1)(a), then such rent received or receivable is taken as the

ANNUAL VALUE.

12/12/2007 10

Sec 23( Annual Value)

Sec 23(1)(c) –

If the property is actually let out and was vacant during the year and rent received or receivable is lesser due to vacancy then such lower rent shall be the annual value.

12/12/2007 11

Section 23( Annual Value)

Sec 23(2) –

If a HP is self occupied .

OR

If a HP couldn't be occupied for reasons of employment / profession elsewhere.

In such cases the AV= NIL.

12/12/2007 12

Sec 23( Annual Value)

Sec 23(3) –

Conditions for sec 23(2)-

Such HP shouldn't be let out during any part of the year.

AND

No other income is derived from such property.

12/12/2007 13

Section 23( Annual Value)

Sec 23(4) –

If the assessee owns more than one Sec

23(2) property then:

AV of one HP at the option of the assessee is NIL.

AND

All the other HP’s are Deemed Let Out

Property [DLOP] and annual value thereof is decided as per sec 23.

12/12/2007 14

Section 24 Deductions.

SEC 24(a)-Standard deductions @30% of NAV

– only for let out property and deemed let out property.

SEC 24(b)- interest on capital or loan borrowed for ACR 3 (acquisition ,construction, renewal

,repairs and reconstruction) in respect of

1. LOP/DLOP – any amount is allowed

2. SOP – Deductions is as follows:

12/12/2007 15

12/12/2007

SOP Deductions

- Normal deductions up to Rs

30000/-

- Special deduction up to Rs

150000/-

16

IMPORTANT NOTES

Interest deduction up to Rs 150000/-.It is available only for acquisition and construction. Provided:

(a) The loan taken on / after 01-04-1999. & construction completed within 3 years from the end of the financial year in which loan is borrowed.

(b) For claiming deduction’s interest certificate & details of principal outstanding, interest amount etc. Along with return of income.

12/12/2007 17

Pre- Construction Period Interest

Allowed in five equal installments commencing from the year of completion.

PCP means period commencing from the date of loan or immediately preceding the March 31 st of the year of completion which ever is earlier.

12/12/2007 18

Section 25( amounts not deductible)

Interest paid outside India without TDS or

Without having an arrangement for TDS in

India is disallowed.

12/12/2007 19

Section 25A( Unrealized rent recovered)

UR recovered is taxed in the year of receipt irrespective of whether assessee is the owner or not of such property in the year of such receipt

. No deduction is allowed against this income.

12/12/2007 20

Section 25B( Arrears of rent received)

It is taxable in the year of receipt irrespective of whether assessee is the owner or not of such property in the year of such receipt.

Deduction = 30%

12/12/2007 21

Section 26( Property owned by Co- Owners)

Share of co-owners definite, ascertainable respective share is taxable in the hands of the co owner.

Share of co-owners not definite, ascertainable entire income is taxed as the income of AOP.

12/12/2007 22

Important Points

Annual value of partly SO & partly vacant

Period based (i.e. 9 months

– SOP & 3 months – vacant) = ANNUAL VALUE

= NIL

Usage based (i.e. 75% used as – SOP & 25% as – vacant) = ANNUAL VALUE

= 25% .

12/12/2007 23

Important Points

Annual value of partly SO & partly LO

Period based (i.e. 9 months –

SOP & 3 months – LOP)

Usage based (i.e. 75% used as –

SOP & 25% as – LOP)

Treated as DLOP for entire period.

AV of SOP NIL.

12/12/2007

AV of LOP to be taken at 25%.

24

12/12/2007

Presented by :

Anirudh Prasad-05A078.

Amrut .V.Katwa-05A077.

25

Charging Section[Sec.28]

Profits and gains of any profession/profession

Any compensation received related business

Income received from members of similar profession

Any benefit or perquisites from business

/profession

Export incentives from government

12/12/2007 26

Charging -Continue

Any interest, salary, bonus, commission or remuneration received by a partner from firm.

Sum received(compensation) from other company not to carry on any business for know how, patent, copy right, trademark.

Profits and gains of managing agency

12/12/2007 27

Meaning of business

Profit motive

Business and rendering services to others

Business cannot be carried on with oneself

12/12/2007 28

Export incentives

Duty drawback import entitilement licences

Are taxable u/s 28-Business/profession

12/12/2007 29

Business income not taxable u/s 28

1. Rental income in case of dealer in property taxable under the head income from house property[u/s22].

2. Dividend on shares in case of a dealer in shares- taxed under income from other sources

[u/s 56].

3. winning from lotteries (lottery business) taxed u/s 56-income from other sources.

12/12/2007 30

Losses deductible from business income

Loss due to natural calamity

Loss due to non acceptance of goods

Reduction in value of foreign currency which is meant for purchase of stock.

Loss of cash/goods due to embezzelment, burglary, forfeiture of deposits.

Loss of forgoing advance given by sugar industries to formers due to monsoon failure

12/12/2007 31

Loss not deductible from business

Loss due to destruction of Capital asset.

Loss on sale of investments held as investment.

Loss of advance to set up a business but business could not be started.

Depreciation in value of foreign currency for capital purpose

Anticipated future losses.

Loss of discontinued business

Loss from illegal business[T.A.Qureshiv.CIT(2006)SC]

12/12/2007 32

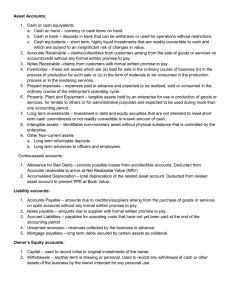

Computation of assessable profits/loss for tax

Net profit as per P/L Account

Add : Amount debited to P/L A/c in respect of the following

Loss of earlier years

Capital losses

Personal expenses (such as drawings)

Income tax, surtax, wealth tax, gift tax, estate duty[Direct taxes], tax penalty, penal interest, fine.

12/12/2007 33

Continues

Add: Charity and donation

Gifts and presents to others

All reserves/provisions such as tax provision,

Reserve for dividend, provision for bad debts except provision for depreciation

All expenses related to other heads of income

12/12/2007 34

Continues

Add : Expenses not deductible u/s 40 and 40A

Expenses debited to P/L A/C not admissible u/s 30 to 40A

Add : Amount not credited to P/L A/c

Deemed income

Deduct :Income credited to P/L A/c but not chargeable under other heads

12/12/2007 35

Less :

Capital gain(u/s 45)

Dividend[ Income from other sources(56)]

Direct taxes refund such as Income tax, Wealth tax, estate duty, surtax refunds

Bad debts, excise duty recovered not allowed as expenditure preceding previous years

Deduct:

Expenses not debited to P/L A/c but allowed u/s 30 to 40A

Depreciation u/s 32

Income chargeable under income from business/profession.

12/12/2007 36

Specific deductions expressly allowed u/s 30 to 37

1.Rent (Sec.30)

Repairs(including painting of a house )

Land revenue, local taxes and municipal taxes

Insurance against risk of damage or destruction

Not allowed: a) arrears of rent b) share of profit instead of rent c.

12/12/2007 37

Repairs and insurance of machinery, plant and furniture(sec.31)

Revenue repair-allowed

Capital expenditure – not allowed

Quantum of expenditure is not important

12/12/2007 38

Depreciation Allowances(sec.32)

Conditions:

Asset must be owned by the assessee(Registration is not important),full control over asset,right to retain the possession and defend are characteristics of ownership.

Used or ready to use for business purpose

Used in the previous year

Both tangible and intangible assets

Right on occupancy on Lease property is entitled for depreciation

If hirer purchaser has right over asset and hire seller will loose all rights- Depreciation is allowed.

12/12/2007 39

Depreciation-Continues

Insurance premium, repairs and other expenditure incurred on leased business asset are deductible in the hands of lessor.

If any asset is fully controlled such as lease the capital expenditure incurred by lessee can provide depreciation[32(1)(ii).

12/12/2007 40

Lease property

Registered ownership is not necessary Sec. 53A of the transfer of property Act.

If the assessee can be the co-owner to claim depreciation

Any capital expenditure incurred by the person who takes building can provide depreciation on capital expenditure.

Rules of Accounting Standard (AS19) not applicable for depreciation as per IT Act.

12/12/2007 41

Hire purchase

Conditions:

Hire purchaser can provide depreciation if hire purchaser has uninterrupted right over the asset.

The seller looses his right

Who can provide depreciation?

Hire purchaser.

12/12/2007 42

12/12/2007

Residential quarters

If used by the assessee’s employees – depreciation is allowed.

43

50% of rate of depreciation

If an asset acquired during the previous year.

Put into use or ready to use for less than 180 days.

Exceptions:1. Put into use for less than 180 days but ready to use for more than 180 days –full rate of depreciation

If asset purchased in the preceding year to current previous year but put into use for less than 180 days during the current previous year what is the rate of depreciation rate?

If an asset is not used at all-No depreciation not only for first year but also for subsequent period

12/12/2007 44

Full rate of depreciation.

Can depreciation be provided on intangible assets such as know- how, patent rights, copy right, trade mark, licences, franchises etc. depreciation?

12/12/2007 45

Meaning of Building and Plant

Building means: Super structure only. It does not include site.

Plant : Includes ships, vehicle, books, technical know-how report, scientific apparatus and surgical equipment.

It does not include tea bushes or livestock or building or furniture and fittings.

If assessee does not claim depreciation whether is depreciation available?

12/12/2007 46

Method of depreciation

Yes.

Block asset method.

What is block asset method?

Similar nature of asset having the same rate of depreciation are clubbed together.

12/12/2007 47

100% depreciation?

1. Building acquired on or after September 1,

2002 forming part of water supply project

2. Pollution control equipments

3. waste control equipment

4.wooden parts used in artificial silk manufacturing machine

5.cinimatograph films

6. Books

12/12/2007 48

Commercial vehicle

If acquired and used before 31,March 2002.

-Rate of depreciation is

50% .

12/12/2007 49

calculation of depreciation

Block value in the beginning

Add:- Purchase of asset of the same block

Less:- Net sale value of the consideration received/receivable in cash /cheque/draft if any of the block of assets sold during the year

12/12/2007 50

Continuation

Calculate depreciation of the balance amount.

If it reaches to Zero value no more depreciation is allowed.

If net sale consideration exceeds the block it amounts to short term capital gain.

12/12/2007 51

continues

Once asset is depreciated the gain on sale of block never be a long term gain

Index can not be used for the calculation of capital gain.

If all assets of the assets sold out but block continues it amounts to short term capital loss.

12/12/2007 52

###Intangible assets

Depreciation is allowed at the rate of

25%

Include: know- how, patent rights, copy rights, trade mark, licenses, franchises etc.

12/12/2007 53

Imported Cars

Purchased between March 1, 1975 and

March 31, 2001 for hire for touristno depreciation is allowed if used in India for business purposes other than for hire for tourist

Used outside india for business-alowed

For hire for tourist-allowed

After 31 st March 2001- all purposes depreciation is allowed

12/12/2007 54

Change in the ownership in any part of the year due to amalgamation , absorption or demerger

Calculate depreciation for the previous year as if no amalgamation/re-organization taken place

Apportion between the companies on time basis.

12/12/2007 55

###Computation of additional depreciation

Manufacture or production of any article

Purchased entirely new machinery Not used any part of the world

Acquired and installed after March 31, 2005

Rate-20%

If used less than 180 days-Half of the rate

Excludes ships and aircrafts, used in the guest house, or office road transport vehicles

12/12/2007 56

Actual Cost

Total cost-subsidy

Includes: interest on money borrowed before the asset is put into use

Bank charges

Loading

Unloading

12/12/2007 57

Actual cost-continues

Modification before first put into use

Training of staff to operate the machine

Other related expenses required such as cold storage.

Traveling expenses to acquire the

58

Un-absorbed depreciation

Deduct the depreciation of the previous year from income from business or profession

Deduct it from other heads of income except salary

If not able to absorb-carry over to subsequent assessment year (s) – No

59

Subsequent assessment years

Order of priority to set off:

1. current depreciation

2.Brought forward business losses

3. Un-absorbed depreciation

Note: Continuity of business is not relevant.

The same assessee only can carry forward

12/12/2007 60

Depreciation on Straight Line basis/WDV

Applicable to Power units(generating and distribution of power)

Assets acquired after 31 st march

1997.

12/12/2007 61

Terminal depreciation

If straight line depreciation method followed on power generating units

sold after the use of such asset more than one previous year

Terminal depreciation=WDV> Net

Sale consideration

Capital gain=Net sale>WDV

12/12/2007 62

Tea, coffee and rubber development account[Sec.33AB]

Deposit with NABARD or Deposit account of tea, coffee or rubber Board

With in 6 months from the end of the previous year or before the last date of filing of returns whichever earlier

Exemption:

Amount deposited or 40% of profit whichever is less

Can amount be withdrawn?

12/12/2007 63

withdrawal

Only for the purpose stated

If unutilised within the previous year it is treated as income

If business closed or dissolved-treated as taxable profit

If death of the taxpayer/partition of HUF/liquidation of company will not be treated as income

Purpose: installed in plant and machinery in low priority sector or entitled to get 100% depreciation.

Maximum 8 years

12/12/2007 64

Site restoration fund[sec.33ABA]

Production of Petroleum /Natural gas in India

Deposit with SBI/account opened as per petrolem and Natural Gas Commission In a scheme specified

Before the end of the previous year

Amount withdrawn should be used for low priority sector/100% depreciated and utiled within 8 years at the end of previous year.

12/12/2007 65

###Scientific research[Sec.35]

In house research

All Revenue expenditure and Capital expenditure related to one’s business during the current previous year or even

3*** preceding previous years allowed

[Except Land]

Even asset is not put into use –it is allowed.

No depreciation is allowed on such capital asset

If such asset is sold what could be the consequences?

12/12/2007 66

If scientific asset sold?

If not used for any other purpose:

***Sale or deduction already allowed whichever is less taxed as business profit.

Capital gain=Sale-Cost (index if required)

12/12/2007 67

Contribution to National laboratory

Including

University, IIT

Weighted deduction=

1.25

times of contribution can be treated as Expenditure.

*** Even approval is withdrawn after the payment to such institution the assesssee who contributed can enjoy the benefit

12/12/2007 68

Expenditure on Patent rights and copy rights[35A]

Capital Expenditure incurred before

April 1998

1 st

14 instalments

After 1 st April 1998-

Depreciation can be claimed-25%

Revenue expenditure-

Fully allowed expenditure in the year such expenditure incurred.

12/12/2007 69

Technical know how

12/12/2007

Only depreciation

25% allowed

70

Amortisation of telecom license fees[35ABB]

Conditions

Capital Expenditure

Acquiring any right to operate telecommunication services

Incurred before or after commencement of Business

Mainly incurred to obtain license.

If conditions fulfilled claim can be done u/s 35ABB otherwise u/s 37(1) as business expenditure.

12/12/2007 71

Payment to associations and institution for rural development program

Institutions approved before

1

st

March 1983

Deduction up to the amount paid

12/12/2007 72

Amortisation of preliminary expenses

Indian Company or resident non corporate assessee

Foreign company excluded

Legal charges on MOA, AOA,printing of MOA,

AOA,Registration fees,expenses connected to issue of shares or debentures

Is there any limit?

12/12/2007 73

Limit of preliminary expenses

Corporate assessee Non-Corporate assessee

5% of cost of project or

5% of capital employed

Whichever is

More(dil monge more)

5% of the cost of the project

Actual cost= costs incurred initially and additional costs after commencement

Of business

12/12/2007 74

Preliminary Exp. Continue

The value on the last day of the previous year in which the business of the assessee commences.

Deduction:

1/5

of the qualifying expenditure

12/12/2007 75

Expenses on issue of shares/Debentures

New company even Old industrial company issue shares - u/s 35 D

Old company-- u/s 37(1) except issue of shares)

Old industrial company issue shares-35D

Non industrial company – All expenses related to bonus issue, issue of debentures or raising of long term or short term loans

Note: old non industrial company-

Expenditure related to issue of shares

can not be

claimed

12/12/2007 76

Amortisation of expenditure incurred for amalgamation[35DD]

Indian company

Deductions in

five

successive installments

12/12/2007 77

Amortisation of expenditure under voluntary retirement scheme[35DDA]

Any assessee

Deduction

1/5 every year

Voluntary retirement scheme need not be accordance with guidelines prescribed under section 10(10C)

12/12/2007 78

Amartisation of expenditure on development of certain minerals[35E]

Indian companies and

Resident assessee

I/10 every year allowed

12/12/2007 79

Insurance premium to protect the asset or employees[36(1)(i)]

Allowed

Bonus to employees[36(1)(ii)]

12/12/2007 80

Interest on borrowed capital[36 (1)(iii)

Interest on own capital is not allowed.

Interest paid by a firm to partner is deductibleper annum Simple interest

12%

Interest paid to wife and daughter- allowed

Interest before the asset is put into use to be

capitalised

12/12/2007 81

Interest paid outside India without deducting TDS

Not allowed

12/12/2007 82

Discount on Zeeero coupon

Discount Bonds[36(1)(iiia)]

Issued after June 1, 2005

Minimum 10 years and Maximum 20 years

Deduction on pro rata basis.

12/12/2007 83

***Unpaid liabilities

Includes:

1.

2.

3.

Local taxes, duty cess or fee under any law

Sum payable to employees such PF, Gratuity, superannuation fund to employees, BONUS, OR

COMMISSION

Interest on loan borrowed from public financial institution such as ICICI,IFCI, IDBI,LIC AND

UTI ONLY

DEDUCTION ALLOWED ON PAYMENT BASIS

OR ACCRUAL BASIS?

12/12/2007 84

Payment/ Accrual?????

No paymentNot allowed

If deposited

EVEN before the

last date of

filing of returns

with

Proof for

paymentfully allowed(page 336)

12/12/2007 85

****Employees’ contribution towards staff welfare scheme such as PF[36(1)(va)]

Amount received by employer-

Included with the assessee’s Income

If Paid to the employees’s account???

12/12/2007 86

If paid !!!!!

Due date #### as per the PF rules or

Gratuity rules Usually with in a month of deduction from employees.

*****not as per IT rules

12/12/2007 87

Written off of allowance for animals

[36(1)(vi)]

If died /useless

Used as capital asset

Allowed loss = Original cost- Carcasses

or ( sale of animals)

No depreciation is allowed any time on animals

12/12/2007 88

Bad debts

[36(1)(vii)]

!!!

If actual- allowed

Provision –Never allowed

If recovered[41(4)]-----If earlier allowed it is taxable

If earlier denied - not taxable

12/12/2007 89

Provision for Bad and doubtful debts to rural branches of scheduled and non scheduled commercial banks[36(1)(vii)] bank and Institution

Non scheduled bank

Scheduled Financial Foreign

5% 7.5% of income 5%

10% of advances --made by rural branchs

---

12/12/2007 90

Transfer to SPECIAL RESERVE

[36(1)(viii)]

Long term (5 years or more) financial corporation/public company/government company

Finance for industry/agriculture/infrastructure facilities in

India.

Deduction: Whichever is less

1. amount transferred to such account or

2. 40% of profit from business activities before such deductions

3. 200% of paid up capital and reserve on the last day of

PY(- )amount in special reserve account in the beginning of the PY

12/12/2007 91

Family planning expenditure

[36(1)(ix)]

For Company assessee

Revenue expenditure- Fully allowed

Capital Expenditure -

1/5

th

every year

Non-corporate assessee can claim u/s

32(Depreciation on capital expenditure) and

37(1)(Revenue expenditure)

12/12/2007 92

Advertisement Expenditure[37(2B)]

Advertisement In publication of

party

-----Not allowed political

All advertisements -Allowed

12/12/2007 93

Expenses incurred by commission agent from insurance UTI agents etc.If commission less than 60,000 commission Adhoc deduction Max. deduction

3 1

LIC –first year

2

50% of commission

15%

OF THE

COMMISSION

Renewal commission

First & renewal

Commission

Bonus

33 1/3%

No deduction

UTI/agents of

20,000

94

Contribution towards Exchange risk

Administration fund

[36(1)(x)]

By Public financial institution

Deductible upto the assessment year 2007-08

12/12/2007 95

12/12/2007

Benefits to public financial institutions

96

General deductions[37(1)]

It should not be a capital expenditure or

Not personal

Not prohibited by law such as fine, penalty

Not be an illegal expenditure

Can we see some of the expenditures allowed as per various case laws?

12/12/2007 97

Expenses allowed

*Litigation expenses to protect the trade or business

/asset/or to retain title of asset

*Legal expenses to receive loan

*Litigation expenses in restoring trade mark

***Legal expenses to alter the AOA in conformity with the changes brought about in the companies ACT

****Damages paid to workers/fulfil the contract

***Damages for breach of contract

12/12/2007 98

Expenses allowed

**Contribution to the union formed to oppose the nationalisation of assessee’s business

**Expenses incurred during festival

***Premium paid for loss of profit

*Professional tax paid

All maintenance expenditure

**Expenses incurred to register trade marks

*****Entertainment expenses

**Periodical payment for the use of goodwill

12/12/2007 99

Expenses allowed-case laws

###Estimated probable liability for free maintenance

CIT vs Modi Olovetti ltd.(2004)

***Expenditure to car even it is huge[CIT vs

Mangalchand premchand& co.[2004]

**Repairs to maintain building taken on lease

[Sumitomo Corpn. India (p) ltd.

Expenditure on civil work on leased asset [Hero Honda motors vs CIT

***Interest on delayed payment of Provident fund[CIT vs Ishwari Khetan Sugar Mills (P0 ltd.(2004)

12/12/2007 100

Important notes & controversial issues

Expenditure to issue of shares fees paid to Registrar to increase the authorised capital disallowed[Brook

Bond India ltd Vs CIT(SC)

Retrenchment compensation payable at the time of partial closure of business Is deductible. But at the time of closure of industry is not deductible[CIT vs MGF India(2004)

12/12/2007 101

Expenses allowed

****Expenditure to issue of debentures

bonus shares allowed

12/12/2007 102

Controversial Continues

***Foreign study expenses incurred by the company even though the employee is a director’s son-allowed [J.B

Advani& co Vs CIT](2005)

12/12/2007 103

Controversial Continues

Medical expenses of wife employee of cine actor-Allowed [Ajay Singh

Deol Vs CIT]

Payment on account of membership fees for health club and also paid membership fees for an another club-Allowed [Sterlite

Industries (India) Vs CIT(2006)

12/12/2007 104

Controversial- Continues

###Provision made for contribution towards Provident

Fund maintained by Government of Tamilnadu sent on deputation to the assessee corporation-allowed[

CIT Vs Kattabomman Transport

Corporation Ltd.(2004)

12/12/2007 105

Controversial Continues

***Interest on arrears of tax , sales tax compensatory in nature and not penal

– allowed(Lachmandas Vs CIT(SC)

(2002)

***Interest paid for late payment of tax is disallowed. Even Income-tax itself disallowed.

12/12/2007 106

Disallowed Expenditure

*****Interest paid on borrowed funds to pay Income tax is disallowed

Interest paid on installment of the price of property

*****Expenditure to raise capital

***Expenditure on shifting of registered office

12/12/2007 107

Penalty/fine /interest on penalty

*#*#*#

Disallowed

12/12/2007 108

Important question to be asked!!!

****Protecting Business or protecting the title to capital asset.

Capital Expenditure or revenue expenditure

12/12/2007 109

Expressly disallowed expenditures

Interest, Royalty, fees for technical services payable outside India

***TAX TO BE DEDUCTED

AND PAID WITHIN 7 DAYS

FROM THE LAST DAY OF THE

MONTH IN WHICH TAX WAS

DEDUCTED OR

12/12/2007 110

Expressly disallowed expenditures

AMOUNT PAID TO GOVERNMENT

IN THE FINANCIAL YEAR IF NOT

PAID WITHIN 7 DAYS FROM THE

LAST DAY OF THE MONTH.

Anything paid after the financial year and after the expiry of 7 days FROM THE

LAST DAY OF THE MONTH deductible only in the year of payment.

12/12/2007 111

Fringe benefit tax

Fringe benefit tax, Income tax, wealth tax, securities transaction tax- Not Taxable

12/12/2007 112

Salary payable outside India without

TDS

Outside India both resident and non-resident

In India to NON-REDIDENT

NOT ALLOWED

12/12/2007 113

Payment from provident fund

If TDS not done- Not allowed

12/12/2007 114

Tax on perquisites paid by the employer

Tax paid by employer- Not taxable to employees

Perquisites paid- Not deductible to employer

(Non monetary)

See illustration- para 82.1.8- page 328

12/12/2007 115

Payment to relatives[ Sec. 40A(2)]

Excess or unreasonable disallowed

Relative: husband, wife, brother or sister or lineal ascendant or descendant of that individual.

Substantial interest:- at least 20% of equity or 20% profits of a concern at any time during the year

12/12/2007 116

Expenditure exceeding Rs. 20,000

Should be paid account payee crossed cheque or account payee demand draft.

If not - 20% of such payment is disallowed.

Note: on the same day any number of cheques less than 20,000 each can be given

Partly cash, partly cheque without account payee crossed cheque without exceeding

117

Payment to unapproved gratuity by employer

12/12/2007

Not deductible expenditure.

118

Recovery of earlier deductions

If recovered in the subsequent assessment years it is taxable even there is

no

business and taxed in the hands of

recepient.

12/12/2007 119

Undisclosed income

Cash credit[sec.68]

Undisclosed investment[sec.69]

Unexplained money [sec. 69A]

Amount of investments not fully disclosed

[sec.69B]

Unexplained expenditure [sec.69C]

Amount borrowed or repaid on hundi[sec.69D]

They are deemed income of the current previous year.

12/12/2007 120

Maintenance of books compulsory[Sec.44AA]

Legal medical, engineering, architectural, accountancy,

Film artist technical consultancy, or interior decoration and other notified profession [Specified professional]

If gross receipts exceed 1,50,000 in any of the three years preceding the previous year.

Non-specified professional- Income exceed Rs.

1,20,000 and total gross receipts exceed 10,00,000

What are those books maintained?

12/12/2007 121

Specified Books to be maintained

Cash book

A Journal on mercantile basis

Ledger

Carbon copies of machine numbered bills exceeding Rs. 25 issued by the person

Original bills if exceed Rs. 50. If bills are not issued payment vouchers signed by the person

12/12/2007 122

Medical practitioner

Additional books required:

Daily cash register showing date, patient’s name, nature of professional services rendered, fees received and date of receipt

Stock register for medicines and other consumable accessories .

12/12/2007 123

Audit of Accounts[sec.44AB] if crossed limit

Business-Gross receipts

/sales exceed 40 lakhs

Profession- gross receipts exceed 10 lakhs

12/12/2007 124

Audit compulsory with out any limit of income/receipt

Person engaged in:

1. civil construction[44AD]- 8% of gross receipts

2.Business of plying, leasing or hiring trucks[44AE]-

Heavy vehicles Rs. 3500 pm (owned months), other vehicles- 3150 pm (not owned more than 10 vehicles any time during the previous year.No expenditure is deductible .

Retail traders[44AF]- 5% of turnover is considered as income

12/12/2007 125

Important points to solve problems

Bonus-before last date of filing

Depreciation- permitted as per income tax

Direct taxes-disallowed

Indirect taxes-allowed if paid before due date of filing

Capital expenditure-disallowed

Bad debts recovered-if allowed earlier taxable

Income from other heads such as salary, house property etc-if included in the P/L /A/c deduct.

12/12/2007 126

Points to solve problems

Outstanding statutory liabilitybefore due date to be paid

statutory penalty-disallowed

Contractual penalty-allowed

Personal expenditure-disallowed

12/12/2007 127

Points to solve problems

Entertainment expenditure-fully allowed

Maintenance of guest house-fully allowed

Revenue advertisement including gift to customers-fully allowed.

12/12/2007 128

Points to solve problems

Capital expenditure on advertisementdepreciation is allowed.

Amount paid for expenses beyond 20,000 without crossed a/c payee cheque or draft -

20% disallowed

Any expenditure incurred (traveling) out side india –allowed to the extent of RBI’s permission

12/12/2007 129

Points to solve problems

paid on borrowing-Not allowed

Expenditure to audit-allowed

Expenditure to prepare accounts for IT –allowed interest

12/12/2007 130

Points to solve problems

Interest on borrowing to pay direct tax such as

Income tax-disallowed

Copy right , technical know how, patent rightamount paid disallowed but depreciation 25% only allowed.

Employee’s contribution to PF- treated as income

If such employee’s contribution is paid before due date as per the PF act- allowed.

12/12/2007 131

Points to solve problems

Capital expenditure on travelling-disallowed

Traveling expenditure to buy stock-allowed

Insurance to asset or employees-fully allowed expenditure

Profit on sale of capital asset which is included in the P/L /a/c- disallowed

12/12/2007 132

Points to solve problems

Rent received from outsider other than employee- credited to P/L A/cdisallowed income-subtract from net profit-Income from House property.

Any payment to workers/Government-Before the last date of filing returns is allowed

12/12/2007 133

Points to solve problems

All reserves/provision except depreciation provision-disallowed

Interest on own capital-disallowed

Direct taxes refund like It refund shown in P/L

A/C –disallowed income= subtract from profit

Revenue repair to building , furniture even leasehold –allowed expenditure

12/12/2007 134

Points to solve problems

Capital expenditure on family planning- 1/5 is allowed

Loss of cash, goods-allowed.

Donation and charity-disallowed

Fringe benefit tax-disalowed

Expenditure on issue of shares-disallowed

;where as expenditure on issue of debentures, arrangement of loan (borrowed capital)- allowed

12/12/2007 135

Points to solve problems

Income from other heads-inadmissible income

Advance payment of tax, provision for tax, income tax refund-disalloed

Life insurance premium of owner paid from business-disallowed

Scientific Research (in house)-fully allowed including capital expenditure

Family planning revenue expenditure-allowed

12/12/2007 136

Points to solve problems

Unapproved statutory fundsdisallowed

Closing stock and opening stock to be valued in the same manner

12/12/2007 137

particulars

Profit and loss account

Amount

Rupees particulars Amount

Rupees

10,00,000 Salaries

Rent and rates

Office expenses

Stock destroyed

Depreciation

Discount

Advertisement

Interest on loan

Scientific research expenses

Bad debts

RBD

Insurance on building

Insurance stock

12/12/2007

Income tax

Gross profit

Interest on bonds

Dividend received

Rent

Rent paid in advance

Profit on sale of investment discount

138

12/12/2007

Closing stock is 10% less than the actual value

Opening stock was over valued by 8%

Advance payment of tax

provision for tax

income tax refund

Loss of cash, goods

Capital expenditure on family planning

Loss of cash, goods

Donation and charity

Fringe benefit tax

Expenditure on issue of shares expenditure on issue of debentures , arrangement of loan on borrowed capital

Bonus paid on 2 nd september

Copy right

technical know how

patent rights

Cash Amount paid for expenses 25000

139

Bad debts written off recovered (earlier disallowed) statutory penalty

Contractual penalty

Personal expenditure

Interest paid on borrowed funds to pay

Income tax

Interest paid on installment of the price of property

Expenditure to raise capital

Expenditure on shifting of registered office

12/12/2007 140

ALTERNATIVE WORK IS REST

Learn every day

Everyone is good

No bad day. It depends upon our mind set

Enjoy whatever you do

THANK YOU

Two sides in a coin.

One is failure(50% )

Other is success(50%)

Happiness by giving but not receiving

12/12/2007

Accepting failure leads to success

141

12/12/2007

Capital gains

By

Augustin Amaladas.Lourduswamy

M.Com.,AICWA.,B.Ed.,PGDFM

142

Capital Assets

Any stock-in-trade, consumable stores or raw materials held for the purpose of his business or profession;

Personal effects, i.e., movable property (including wearing apparel and furniture, excluding jewellery), held for personal use by the assessee or any member of his family dependent on him.

Agricultural land in India, not being land situated in the following:-

In any area which is comprised within the jurisdiction of a municipality

(whether known as a municipality, municipal corporation, notified area committee, town area committee, town committee, or by any other name) or a cantonment board and, which has a population of not less than ten thousand according to the last preceding census.

In any area within such distance, not being more than eight kilometers, from the local limits of any municipality or cantonment board referred to in item

12/12/2007 143

Capital assets

6.5 per cent Gold Bonds 1977, or 7 per cent

Gold Bonds 1980, National, Defence Gold

Bonds, 1980, issued by the Central

Government;

Special Bearer Bonds, 1991, issued by the

Central Government;

Gold Deposit Bonds issued under the Gold

Deposit Scheme, 1999 notified by the Central

Government.

12/12/2007 144

transfer of house property

Under S 54, exempt from tax provided

The following conditions are satisfied

The house is a residential house is taxable under the head

"income form house property"

The house property, which may be self-occupied or let out, is a long term capital asset (i.e. held for a period of more than 36 months before sale or transfer.)

1+2 or 3

Invest upto capital gain in the same nature of asset

The house property, so purchased or constructed, has not been transferred within a period of 3 years from the date of purchase or construction.

12/12/2007 145

consequences if a new house is transferred within 3 years?

the amount of capital gain that arise, together with the amount of capital gains exempted earlier, will be chargeable to tax in the year of the sale of the new house property.

12/12/2007 146

If new house transferred?

The gain along with exempted gain is taxed as short term

12/12/2007 147

Short term capital gain

Computation of Short-term capital gain

1. Find out the full value of consideration

2. Deduct the following: a. Expenditure incurred wholly and exclusively in connection with such transfer.

b. Cost of acquisition. c. Cost of improvement

3. From the resulting sum deduct the exemption provided by section 54B, 54D and 54G.

4. The balancing amount is the short-term capital gain.

12/12/2007 148

Computation of Long-term capital gain

1. Find out the full value of consideration

2. Deduct the following: a. Expenditure incurred wholly and exclusively in connection with such transfer b. Indexed Cost of acquisition c. Indexed Cost of improvement.

3. From the resulting sum deduct the exemption provided by section 54, 54B, 54D, 54EC,, 54F and 54G, and 54GA.

4. The balancing amount is the long-term capital gain.

12/12/2007 149

How IS long term capital gain taxed?

Flat rate-20%+Surcharge+Educational cess+ Secondary and higher education cess.

Surcharge-10% if net income exceed Rs.10,00,000 for individual,HUF,AOP,BOI

12/12/2007

Educational cess-2 % on tax

Companies -10% if net income does not exceed 1 crore rupees. 2% educational cess

For Assesment year 2008-09 secondary and higer education cess-1% on( tax+surcharge)

150

Indexed cost of acquisition

Formula

Cost *Index of the year of sale/index of the year of acquisition of the present owner

cost= cost of acquisition of the present owner or

Cost of acquisition of the previous owner in case of will or gift

12/12/2007 151

indexed cost of acquisition?

S 48 defines "indexed cost of acquisition" as the amount, which bears to the cost of acquisition the same proportion as Cost Inflation Index for the year, in which the asset is transferred, bears to the Cost Inflation Index for the first year in which the asset was held by the assessee or for the year beginning on the 1st day of April, 1981, whichever is later.

The Cost Inflation Index, in relation to a previous year, means such Index as the Central Government may, having regard to 75% of average rise in the

Consumer Price Index for urban non-manual employees for the immediately preceding previous year to such previous year, by notification in the Official

Gazette.

12/12/2007 152

tax shelter for avoiding capital gains tax?

The Income Tax Act grants total/partial exemption of capital gains under Sec.- 54, 54B,

54D, 54EC, 54F, 54G and 54H.

12/12/2007 153

Under S 54

Under S 54, exempt from tax provided

The following conditions are satisfied

The house is a residential house is taxable under the head

"income form house property"

The house property, which may be self-occupied or let out, is a long term capital asset (i.e. held for a period of more than 36 months before sale or transfer.)

1+2 or 3

Invest upto capital gain in the same nature of asset

The house property, so purchased or constructed, has not been transferred within a period of 3 years from the date of purchase or construction.

12/12/2007 154

Under S 54B

a.

b.

Individuals agricultural land used for atleast for 2 years before transfer provided the assessee has purchased another land for agricultural purpose within a period of 2 years from the date of such transfer.

In the case of compulsory acquisition, It is exempted from tax as per section 10(37) with effect from assessment year 2005-06 onwards.

12/12/2007 155

***Capital gains exemted U/S 10 para 95.2

1. Capital gain on transfer of US 64[Section 10(36)]- both long term and short term

2. Long term capital gain on transfer of BSE-500 Equity

Shares[10(36)]-long term

3.Compulsory acquisition of urban agriculture land[10(37)]longterm and short term.-individual and HUF.

4. Securities not chargeable to tax if covered under transaction tax-such as mutual fund equity linked issued by domestic companies.

5. Capital gain arising in the reconstruction or revival of power generation business [10(41)]

12/12/2007 156

a.

Under S 54D, capital gains, arising on compulsory acquisition of any land or building forming part of an industrial undertaking, is exempt from tax, provided such land or building was used by the assessee for the purpose of the industrial undertaking for at least 2 years preceding the date of compulsory acquisition and, the assessee has, within a period of 3 years after that date, purchased any other land or building or right in any other land/ building or constructed any other building for the purpose of shifting or reestablishing the said undertaking or setting up another industrial undertaking.

12/12/2007 157

Under S 54EC

where the capital gain arises from the transfer of a long-term capital asset before the 1st day of

April, 2000, and the assessee has, at any time within a period of six months after the date of such transfer invested the whole or any part of capital gains, in any of the assets,

Bonds in NHAI, Rural Electrification

12/12/2007 158

Under S 54 F

where, in the case of an assessee being an individual or a Hindu undivided family , the capital gain arises from the transfer of any longterm capital asset ,

not being a residential house, within a period of one year before or two years after the date on which the transfer took place purchased, or has within a period of three years after that date constructed, a residential house.

12/12/2007 159

S 54 G Voluntary transfer of industry

The shifting of such industrial undertaking to any area other than an urban area, and

the assessee has, within a period of 1 year

,before

or 3 years after the date on which the transfer took place, purchased a new machinery or plant for the purposes of business of the industrial undertaking

12/12/2007 160

Sec.54GA Shifting from urban to

Special Economic Zone

Industry

1year before or 3 years after transfer

New asset can not be transferred with in 3 years.

12/12/2007 161

Special Cases

1.a capital asset is converted by the owner thereof into (or is treated by him as) stock-intrade of a business that is carried on by him, such conversion (or treatment) of the capital asset shall also be treated as "transfer of the asset" and hence chargeable to income tax

12/12/2007 162

How is it computed?

Sec.45(2) Conversion amount to transfer in the year of conversion.

But taxed in the year such stock is sold.

Capital gain=FMV on the date of conversion into stock in trade –cost(Index) of acquisition.

Business gain=sale-FMV

12/12/2007 163

Transfer of personal asset to partnership firm

Sec.45(3),(4):

It amounts to transfer in the year of transfer to partnership firm.

Capital Gain=Amount entered in the books of the firm-cost (Index).

If retransferred to partners:

Capital gain=FMV-Book value in the partnership firm

12/12/2007 164

Capital gain on self generated assets(Sec.115F)

Like goodwill, tenancy right, route permit

Cost of acquisition is NIL

Cost of improvement is considered

Fair market value on

1 stApril 1981 is irrelevant

12/12/2007 165

Bonus Shares

If alloted before 1981 –cost of acquisition is

FMV on 1 st April 1981.

If aquired after 1 st April 1981 cost of acquisition is NIL

12/12/2007 166

Right shares

Cost of acquiring right shares =cost of acquisition like any other assets

12/12/2007 167

S 54H relaxation of time due to delay in compensation

, the period of acquiring the new asset under S

54, 54B, 54D, 54EC and 54F by the assessee or the period for depositing or investing the amount of capital gain shall be extended in relation to such amount of compensation as is not received on the date of transfer. The extended period shall be reckoned from the date of receipt of the amount of compensation.

12/12/2007 168

Inherited by the assessee or gifted to the assessee

the cost of acquisition of the asset for which the previous owner acquired it, shall be deemed to be the cost of acquisition of the asset as increased by the cost of improvement of the assets if any, incurred or borne by the previous owner or the assessee as the case may be.

12/12/2007 169

Amalgamation

cost of acquisition of the asset shall be deemed to be the cost of acquisition to him of the shares(s) in the amalgamating company.(old company )

12/12/2007 170

conversion of bonds or debentures, debenture-stock

the cost of acquisition of the asset to the assessee shall be deemed to be that part of the cost of debenture, debenture- stock or deposit certificates in relation to which such asset is acquired by the assessee.

12/12/2007 171

Demerger

The cost of acquisition of the shares in the resulting company shall be the amount which bears to the cost of acquisition of shares, held by the assessee in the demerged company

12/12/2007 172

Compensation for loss of capital asset(Insurance claim)

It amounts to extinguishment of right

Sec.45(1A)

Taxable in the year of compensation

12/12/2007 173

Compensation for revenue assetstock in trade

It amounts to revenue receipt u/s-28 from business

Or income from other sources u/s 56

12/12/2007 174

Buy back of shares

Sec.46A

Transfer in the year of buy back

Capital gain=consideration received minus cost of acquisition(Index if long term)

12/12/2007 175

Slump sale[50B]

Assets are not sold individually but collectively

Capital gain=Sale- Net worth

Net worth= Assets—liabilities appearing in the books of accounts

No index

12/12/2007 176

Advanced money received and forfeited

Negotiation failed advance money forfeited by the current owner

Deduct from the original cost of acquisition before calculating index cost of acquisition

Amount forfeited by the previous owner is not deductible

12/12/2007 177

Computation of capital gain on land and Building[50C]

Both for depreciable and non depreciable asset

Sale=The

stamp duty

valuation all purposes

If disputed – FMV if it is lower than Stamp duty value.

12/12/2007 178

No Index

please!!!

Depreciated asset

Bonds[Debentures]

Short term assets

12/12/2007 179

Personal effect

Only Movable assets

used by the assessee or by the family members

Not a capital asset -No capital gain and will not be taxed under any other heads

12/12/2007 180