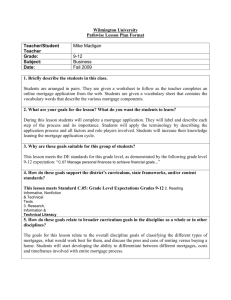

Chapter 9

advertisement

Power Point Slides for: Financial Institutions, Markets, and Money, 9th Edition Authors: Kidwell, Blackwell, Whidbee & Peterson Prepared by: Babu G. Baradwaj, Towson University and Lanny R. Martindale, Texas A&M University Copyright© 2006 John Wiley & Sons, Inc. 1 CHAPTER 9 MORTGAGE MARKETS The Unique Nature of Mortgage Markets Mortgage loans are secured by the pledge of real property as collateral. Mortgage loans are made for varied amounts - no standard denomination. Issuers of mortgages are usually small family or business entities. Weak Secondary Market Little standardization of contracts and terms. Traditionally issued and held by lender. Mortgage markets are highly regulated and supported by federal government policies. Copyright© 2006 John Wiley & Sons, Inc. 3 Fixed Rate Mortgages (FRMs) The note is the borrowing agreement. Payments amortized over time. (See Exhibit 9.1 for example) Interest is usually computed on the declining balance. The mortgage is a lien on the property used as collateral for the loan. If the contract is broken, the lender may use the property to pay the loan. When mortgage is fully paid, the lien is removed and the borrower obtains a clear title to the property Copyright© 2006 John Wiley & Sons, Inc. 4 Adjustable Rate Mortgage (ARM) Fixed-rate mortgages are not acceptable to lenders in high inflation periods. With adjustable rate contracts, borrowers' costs vary with inflation and interest rate levels. Lenders shift interest rate risk to the borrower. Caps on ARM interest rates limit interest rate risk to borrowers. Capped ARMs may have a “payment cap”, “rate cap”, or both. Payment caps limit the maximum amount the payment can go up by in any year and over the life of the loan. Interest rate caps or rate caps limit the size of the increase in the loan rate in any year and over the loan’s life. Typically, the annual cap is 1-2%, and the lifetime cap is 5%. Copyright© 2006 John Wiley & Sons, Inc. 5 Methods of Adjustment for ARMs Rate may vary in a prescribed range (caps) or without limit. Payments, maturity, or principal may vary. Rates may vary based on a previously determined interest rate index or the cost of the funds of the lender. The market prices (difference between fixed and variable rates) the extent of interest rate risk (impact of varying interest rates) assumed by borrower and lender. Common rate indices include Treasury rates, fixed rate mortgage indices, prime rate, and the LIBOR rate. Copyright© 2006 John Wiley & Sons, Inc. 6 Which is the better Choice – FRM or ARM? Copyright© 2006 John Wiley & Sons, Inc. 7 Fixed and Adjustable Mortgage Rates Copyright© 2006 John Wiley & Sons, Inc. 8 Other Mortgage Instruments Balloon Payment Mortgages Traditional loan where interest is paid until a time when the principal was due. Terms can be 3, 5 or 7 years. Loan is amortized over 15 or 30 year period so that monthly payments are no different than a FRM of equal maturity. Rate is fixed over the contract term. Popular with borrowers who may either sell or refinance prior to maturity. Rollover Mortgage (ROMs) Refinanced at new rate every few years. Adjustment period is longer than traditional ARMs. Payment is fixed Copyright© 2006 John Wiley & Sons, Inc. 9 Other Mortgage Instruments (continued) Renegotiated Rate Mortgages (RRMs) Loan terms renegotiated periodically at terms prevailing in the market. Adjustment period is longer than traditional ARMs. Payment is fixed. Interest Only Mortgages Low payments in initial years (10 to 15 years) – only includes interest on borrowed amount. After initial period, payments increase such that entire loan amount is amortized by the end of 30 years. Borrower pays interest for a considerable period on the entire loan balance, but avoids having to pay down balance in initial years. Copyright© 2006 John Wiley & Sons, Inc. 10 Other Mortgage Instruments (continued) Construction-to Permanent Mortgages Bridge financing is provided by lender over the time frame required by the borrower to purchase land and construct the house. Only interest payment is made until construction is completed. Loan is financed in increments as construction payments have to be made. On completion of the construction, loan balance is rolled over into the type of mortgage contract desired by borrower. Copyright© 2006 John Wiley & Sons, Inc. 11 Other Mortgage Instruments (continued) Reverse Annuity Mortgages (RAMs) RAMs allow homeowners to borrow against the equity on their homes at low rates. Typically obtained by older people whose home loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & Sons, Inc. 12 Other Mortgage Instruments (continued) Second Mortgage - extended at time of purchase or later as equity is borrowed from property. Home equity lines of credit became popular after the 1986 federal tax law. Home equity loans and lines of credit allow home owners to borrow against the equity built up in their homes because of paying down the loan and/or because of the appreciation of the property. Copyright© 2006 John Wiley & Sons, Inc. 13 What Does it Take to Buy a Home? Several factors influence a home buyer’s ability to secure a mortgage loans. Borrower Income from all sources gives the lender an idea of the ability of the borrower to meet the monthly mortgage commitment. Down Payment refers to the amount of cash the borrower can contribute towards the cost of the house as their equity. Mortgage Insurance is necessary for borrowers who are unable to come up with a 20 percent down payment. Copyright© 2006 John Wiley & Sons, Inc. 14 Conventional and Insured Mortgages Conventional mortgages represent lending/borrowing in the private markets. Insured and/or guaranteed mortgages are supported by federal and state agencies. Federal Housing Administration (FHA). Veterans Administration (VA). Down payment and rates may be lower. Copyright© 2006 John Wiley & Sons, Inc. 15 Private Mortgage Insurance Conventional mortgage borrowers with low down payments must usually buy private mortgage insurance (PMI). PMI premiums are added to mortgage payments until the value of the mortgage is less than 75% of the value of the house. Copyright© 2006 John Wiley & Sons, Inc. 16 Private Mortgage Insurance Uninsured conventional mortgage Equity Uninsured Mortgage $25,000 down payment $100,000 mortgage at 10% APR. Privately Insured conventional mortgage $12,500 down Equity payment Insured Risk $12,500 mortgage insurance Uninsured Mortgage $112,500 mortgage at 10% plus insurance premium = 10¼ to 10½% APR on $112,500 balance Copyright© 2006 John Wiley & Sons, Inc. 17 Mortgage-Backed Securities One way to develop a secondary market for mortgages Mortgage pass-through securities pass through payments of principal and interest on pools of mortgages to holder of the securities. Other Mortgage backed securities use pools of mortgages as collateral for debt securities. Copyright© 2006 John Wiley & Sons, Inc. 18 Development of a Secondary Market U. S. Congress initiated the development of a secondary market for mortgage loans in 1934 by creating the Federal Housing Administration (FHA). In 1938, the Federal National Mortgage Association (FNMA) which was authorized to buy FHA insured loans. In 1968, FNMA was split up into two entities – FNMA and GNMA (Government National Mortgage Association). GNMA was authorized by Congress to guarantees mortgage pools insured by FHA, VA and other federal agencies. In 1970, the Federal Home Loan Mortgage Corporation (FHLMC) was created to help create a secondary market for conventional mortgages. Copyright© 2006 John Wiley & Sons, Inc. 19 Advantages of MBS over Individual Mortgages Issued in standardized denominations and are negotiable. Issued or backed by quality borrowers. Usually insured and highly collateralized. Repayment schedules vary, but many are similar to other bonds. Copyright© 2006 John Wiley & Sons, Inc. 20 Types of Pass-Through Securities - GNMA Ginnie Mae Pass-Throughs - pools of government insured mortgages. GNMA guarantees the timely payment of principal and interest on MBS backed by federally insured or guaranteed loans. GNMA charges issuers of pass-throughs a fee ranging from 0.25 % to 0.75 % to offer its guarantee. Investors in Ginnie Mae securities will earn a lower yield reflecting a lower default risk because of the dual guarantee by GNMA on the MBS and the FHA/VA guaranty on the original loans. Copyright© 2006 John Wiley & Sons, Inc. 21 GNMA (continued). Ginnie Mae I are pass-throughs secured by a mortgage pool consisting of the same type of mortgage loans. Have the same interest rate. Are originated by the same lender. The minimum pool size is $1 million. Ginnie Mae II are also pass-throughs secured by a mortgage pool consisting of the same type of mortgage loans, but are different in other aspects. They may be issued by multiple lenders. Interest rates may vary over the portfolio of loans by as much as 75 basis points (or 0.75%). The minimum pool size is $250,000 for multi-lender pools and $1 million for single-lender pools. Copyright© 2006 John Wiley & Sons, Inc. 22 Types of Pass-Through Securities - Freddie Macs PCs Freddie Mac Participation Certification - pools of conventional mortgages. Issued by the Federal Home Loan Mortgage Corporation (FHLMC). • Participation certificates (PCs) are issued by the FHLMC and conventional loans are purchased from S&Ls. • PCs are different from GNMA securities. • Include conventional mortgages as collateral. • Mortgages are not federally insured. • Mortgages are pooled by FHLMC, not by private-sector originators. • Interest rates among pooled mortgages vary. • Larger individual mortgages • Mortgage originators service the mortgages (collect payments) for a fee. Copyright© 2006 John Wiley & Sons, Inc. 23 Types of Pass-Through Securities (Continued) Fannie Mae pass-throughs - pools of conventional or insured mortgages. Issued by FNMA. Offers securities similar to FHLMCs' PC. Can issue pass-throughs for either conventional or federally insured mortgage loans. Privately Issued Pass Throughs (PIP) First issued in 1977 by Bank of America. PIPs are issued by private institutions or mortgage bankers. They are similar to “Ginnie Maes” except that they are backed by conventional mortgages. Typically used to securitize large, non-conforming mortgage loans called jumbo loans. Copyright© 2006 John Wiley & Sons, Inc. 24 Types of Pass-Through Securities (concluded) Collateralized Mortgage Obligations (CMOs) - fixed maturity date and interest payments similar to bonds . CMOs are mostly sold by FHLMC; other GSEs and private issuers can also issue CMOs. CMOs are like serial bonds. CMO issues have between 3 and 10 classes. Investors can choose the class that matches their maturity preference. CMOs are sometimes split into “interest only” (IO) and “principal only” (PO) classes (similar to stripped treasuries). CMOs have a major disadvantage because they can create tax problems for the originators. Copyright© 2006 John Wiley & Sons, Inc. 25 Types of Pass-Through Securities (concluded) Real Estate Mortgage Investment Conduit (REMIC) Investor pays taxes. Type of CMO. Differs from CMOs only in how they are set up legally. Copyright© 2006 John Wiley & Sons, Inc. 26 Stripped Mortgage Backed Securities (SMBS) Like pass throughs in that SMBS pass on all payments of principal and interest to investors. Two kinds – Interest Only (IO) and Principal only (PO). Investors in IO receive cash flows only from the interest payments on the mortgage pool. Cash flows decline as mortgage loans in the pool are paid down. Holders of Pos receive all cash flows from the principal payments on the mortgage pool. Finite number of payments before loans are paid off! Copyright© 2006 John Wiley & Sons, Inc. 27 Mortgage-Backed Bonds Federal agencies like FNMA and FHLMC issue bonds to raise funds using the mortgage loans they own as collateral. These are referred to as “Fannie Mae” bonds and “Freddie Mac” bonds respectively. Private institutions and investor groups also issue mortgage backed bonds using the pool of mortgage loans they own. Typically use higher than 100% of mortgage pool as collateral. Maturities range from 5 to 10 years. Often are rated AAA, thus lowering the required yield. State and local government housing agencies also can issue similar securities to fund low income housing development. Exempt from federal income tax because they are munis. Copyright© 2006 John Wiley & Sons, Inc. 28 Mortgage Prepayment Risk Mortgages guaranteed by Agencies have yields above U.S. Treasury Bonds, indicating some risk besides default risk. Prepayment risk - the risk that the borrower will repay (call) the debt before maturity causing the expected yield to be different from expected. When interest rates decline, homeowners (borrowers) refinance, paying off their old mortgage and creating a new one. The mortgage investor then receives their principal back when interest rates are lower. Copyright© 2006 John Wiley & Sons, Inc. 29 Mortgage Prepayment Risk (continued) When rates are high and rising, homeowners will be slow to refinance or trade homes, thus extending the length of their mortgage financing, keeping the rates to the mortgage lender below market rates. This extension risk keeps the lender's return below current market yields. Prepayment and extension risk causes the actual return of mortgage investors to vary from that expected. Copyright© 2006 John Wiley & Sons, Inc. 30 Participants in the Mortgage Markets Thrifts - dominated and increased share of market until 1970s. Banks - Increased share of market and increased powers to make mortgage loans. Insurance Companies and Pension Funds. Pools - Pass-through certificates have become an important source of funds. Pools represented the largest component of mortgage investment. Copyright© 2006 John Wiley & Sons, Inc. 31 Participants in the Mortgage Markets (concluded) Government Holdings - All Levels of Government FNMA, FHLMC, Federal Land Banks, Farmers Home Administration. State and local housing authorities issue bonds and buy subsidized, lower-rate mortgages, often for first-time home-buyers. Copyright© 2006 John Wiley & Sons, Inc. 32 Mortgages Outstanding Copyright© 2006 John Wiley & Sons, Inc. 33 Other Participants Mortgage Insurers Developed in 1930s to enhance acceptability of mortgages and to encourage more risky low equity/loan lending. FHA guaranteed payment to lender in case of default. VA insurance (1944) for mortgage loans to veterans. Private mortgage insurance covered low down payment conventional mortgages. Mortgage insurance has enhanced the development of secondary markets. Copyright© 2006 John Wiley & Sons, Inc. 34 Other Participants (concluded) Mortgage bankers originate mortgages, sell them, and often service the mortgage Mortgage bankers originate mortgages, collecting fees for origination. Mortgage bankers do not fund mortgages. They sell them. Mortgage bankers often retain the service rights to the mortgage, collecting payments, taxes, and collecting delinquent payments. Mortgage banking and loan servicing are very competitive with technology applications decreasing expenses with time. Copyright© 2006 John Wiley & Sons, Inc. 35