Provision, contingent liabilities and contingent asset

advertisement

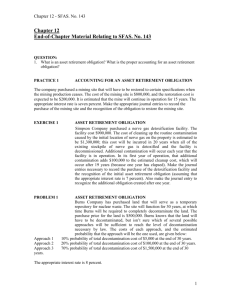

Provision, contingent liabilities and contingent asset Intermediate accounting Asset with Significant Restoration Costs at Retirement • To illustrate the initial recognition of an asset retirement obligation, assume that Bryan Beach Company purchases and erects an oil platform at a total cost of $750,000. • At the end of ten years, the platform must be dismantled and removed from the site at an estimated cost of $100,000. Using an 8% interest rate, the present value of $100,000 for ten years is $46,319. (continued) 10-2 Asset with Significant Restoration Costs at Retirement The journal entries to record the purchase and the asset retirement obligation follow: Oil Platform Cash 750,000 750,000 Oil Platform Asset Retirement Obligation (continued) 46,319 46,319 10-3 Asset with Significant Restoration Costs at Retirement • Homer Company constructs and commences operation of a nuclear power plant. Total construction cost is $400,000. • The cost of cleaning up the routine contamination is estimated to be $500,000; this cost will be incurred in 30 years when the plant is decommissioned. Additional annual contamination cleanup cost $40,000. Assume an interest rate of 9%. (continued) 10-4 Asset with Significant Restoration Costs at Retirement Initial Acquisition Nuclear Plant Cash Nuclear Plant Asset Retirement Obligation FV = $500,000; I = 9%; N = 30 years $37,686 400,000 400,000 37,686 37,686 After One Year Nuclear Plant Asset Retirement Obligation 3, 286 3,286 FV = $40,000; I = 9%; N = 29 years $3,286 10-5 Question 1 In which of the following circumstances must a provision be recognized? (a) On 20 December 20X2 the board of an entity voted at a private board meeting to close down a division. the accounting date of the company is 31December. Before 30December 20X2 the decision was not communicated to any of those affected and no other steps were taken to implement the decision. (b) The board met again and agree a detailed closure plan on 22December 20X2 and details were given to customers and employees. (c) A company is obliged to incur clean up costs for environmental damage (that has already been caused). (d) A company intends to carry out future expenditure to improve their operating efficiency in the future. Question 1: Answer (a) Provision will not be recognized as no other steps were taken to implement the decision. (Correct. Reason: no communication) (b) Provision will not be recognized. (Incorrect, since board agreed the details before the reporting period, classmates may misunderstand the case is disclosure, so they categorized the provision is not recognized.) (c) Provision will be recognized. (Correct) (d) Provision will be recognized. (Incorrect, classmates misunderstand that the contingent liability can be predicted even when no obligation (future expenditure), so they categorized the provision is recognized. Since no obligation is existed and under HKAS 37, no provision would be appropriate, and the company is just intent to do it.) Question 2 Alice Co sells goods with a warranty under which customers are covered for the cost of repairs of any manufacturing defect that becomes apparent within the first six months of purchase. The company's past experience and future expectations indicate the following pattern of likely repairs. Question 2 Note the sales invoice price % of goods sold Defects Cost of repairs $m 75 None - 20 Minor 1.0 5 Major 4.0 Question 2: Answer Expected cost of repairs: =75% x $0 m + 20% x $1.0 m + 5% x $4.0 m =0.4 m (Correct) (present obligation+reliable estimate+ probable) Dr Expenses $0.4m Cr Provision $0.4m 20%+5% =25% here does not mean the event not probable (>50%). It do happens (>50%) as it has past experience. In this question, it shows pattern of warranty. It based on it 100% happens already. Then it tells you that under100% happen How much $ the company need spend. Question 3 Wiggle Co gives warranties at the time of sale to purchasers of its products. Under the terms of the warranty the company undertakes to make good, by repair or replacement, manufacturing defects that become apparent within a period of two years from the date of sale. Should a provision be recognized? Question 3: Answer • Yes, a provision for warranties will be recognized at the best estimate of the cost of warranty claims on products sold before the financial position date. (Correct, the company cannot avoid the cost of repairing or replacing all items of products, and a provision for warranties should be made.) • (The company has obligation within the entire warranty period.) Question 4: Repair Cobo Co manufacture goods which are sold with a one year warranty against defects. (a) Should a provision be recognized for the cost of repairing faulty goods? (b) Cobo Co’s sales for the year are $40m. They anticipate that 60% of goods will not be faulty, 30% will need minor repairs costing $2m and 10% of goods will need major repairs costing $4m. How much should be provided for repairs? Question 4: answer (a)Yes, a provision should be recognized for the cost of repairing faulty goods.(Correct, the company cannot avoid the expenditure of repairing the faulty goods.) (b) They anticipate 40% (1-60%) of goods will be faulty. So $40m*40%= $16m $16m+$2m+$4m=$22m So $22m should be provided for repairs. Dr. Expense $22m Cr. Provision $22m Question 4: answer (b) (Incorrect, classmates misunderstood the sales $40m as the repair cost, we only have to calculate the repair cost.) ((60% x $0m)+ (30% x $2m (repair cost) )+ (10% x $4m (repair cost) ) = $1m. $1m should be provided for repairs. Dr. Expense $1m Cr. Provision $1m Question 5: Exam Practice Darren company Limited (DCL) is engaged in the manufacture of batteries. On the unaudited as at 30June 20X8, It has recognized the following provisions as current liabilities: (a) A provision for late delivery penalty In May 20X8 (within the period), DCL received a sales order for 7m unites of rechargeable batteries for which the agreed delivery date is 31 August 20X8 (after the period). It is expected that DCL would earn a gross profit of $1 per unit. Due to a shortage in the supply of raw materials, at the reporting date(within the period), the management realized that they could only supply the goods at the earliest on 10 September 20X8 (after the period). According to the sales contract, DCL would compensate the customer for late delivery at $0.01 per unit per day. Expected GP: $1 per unit Contract: Sales order Year-end 7m May Contract: Delivery Date Aug June Penalty: Late delivery$0.01 per unit per day 10th Sept 10 days penalty No 7m stock Realized: no stock At that date For warranty topic: Present Obligation: Dr. Warranty expenses Cr Provision for warranty Expected to have 7m stock For future operating loss: No obligation This is just the expectation on future from June. They may have stock on Aug. No present obligation on May. future operating losses Not happen now Not a liability obligation Can avoid expectation Not a provision Impairment Indication Asset (PPE) Not under HKAS 37 HKAS 36 Applied Question 5 (b) A provision for annual safety inspection of the production line The last inspection was carried out in June 20X7(last year).Due to a large backlog存貨 of sales order, the management decided to postpone the annual inspection until mid-September 20X8 (after the period). (C)A provision for the loss on sales of aged finished goods the products were manufactured in late 20X6 with an expected normal usage period of two years from the date of production (should expire at late of 20x8). Due to short expiry period, they were sold at a price below cost in July 20X8.(after the period) (d) A provision for bonus payment to two executive directors In accordance with the directors service contract, two executive directors are entitiled to receive, in addition to monthly salaries, a bonus of equivalent to 5 per cent of the profit before taxation and the accrued bonus. Year-end May June No inspection as usual. Aug Mid- Sept Expected to do inspection This is just the expectation on future action from June. No present obligation on June. Question 5: answer (a) It is an onerous contract which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it. If an entity has a contract that is onerous, the present obligation under the contract shall be recognised and measured as a provision just like this case. Dr. provision (I/S) 700,000 Cr. provision (FP-lib) 700,000 • ( Incorrect, classmates recognized the event is a kind of provision, and they have included the loss. • .However, the compensation will reduce the expected gross profit, but will not result in an onerous contract for DCL. • This is future operating loss. • Accordingly, no provision is required for this late delivery penalty as at 30 June 2008. Question 5: answer (b) It is a restructuring which did not obligation arises for the sale of an operation until the entity is committed to the sale, ie there is a binding sale agreement. A restructuring provision shall include only the direct expenditures arising from the restructuring, which are those that are both: •(a) necessarily entailed by the restructuring; and •(b) not associated with the ongoing activities of the entity. (Incorrect, As at 30 June 2008, DCL has no obligation to perform the safety inspection of the production line, accordingly no provision should be recognized. The cost of inspection should be recognized as expense when incurred.) Or The information provided in the question has not stated whether DCL, by an established pattern of past practice, published policies or a sufficiently specific current statement, has indicated to other parties that it must carry out the safety inspection on an annual basis and therefore, it has created a valid expectation on the other parties in respect of this activity. If there is evidence to prove the above, this can be considered as a constructive obligation and therefore a provision should be provided. Question 5: Answer (c) A contingent liability is a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or nonoccurrence of one or more uncertain future events not wholly within the control of the entity; or a present obligation that arises from past events but is not recognised because it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or the amount of the obligation cannot be measured with sufficient reliability. (Correct for no provision made already, this should be recognized as a write down of inventories, and no separate provision should be recognized in current liabilities.) (It is internal company decision to cut the price) Question 5: Answer (c)(Correct, this should be recognized as a write down of inventories, and no separate provision should be recognized in current liabilities.) -Any future loss on sales of aged finished goods should be considered in the measurement of the net realizable value of the inventory under HKAS 2 instead of HKAS 37. -The net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. -Sales of finished goods at a price below the cost immediately after the financial position date (July 2008) is a strong indicator of the amount of net realizable value at 30 June 2008. -Accordingly, this should be recorded as a write down of inventories and no separate provision should be recognized in the current liabilities. Question 5: Answer (d) It is a contingent gains that circumstances involving potential “gains ” that will not be resolved until some future event occurs. (Incorrect, they recognized the case as entitle (not potential) payment (not gain) but the fact is DCL has obligation to pay the bonus* and a provision should be recognized, the amount should be made a reliable estimate of provision amount.) (*based on the amount of profit before tax and the accrued bonus)