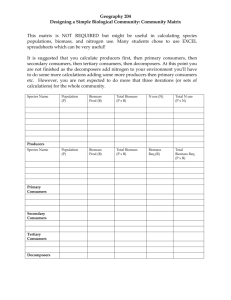

ASEAN Ministers Target: 30 % of installed capacity by 2020

advertisement

MIDA BIOMASS CONFERENCE 2015 9 JUNE 2015 Driving the National Biomass Agenda - Power Generation Perspective Ir Dr Ali Askar Sher Mohamad Chief Operating Officer SEDA Malaysia 1 Malaysia:Energy Renewable Energy Policies Renewable Development in Malaysia 8TH Malaysia Plan (2001 2005) • RE as the 5th Fuel • Implied target of 5% RE in energy mix • Targeted RE capacity to be connected to power utility grid: • 300 MW – Peninsular Malaysia; 50 MW - Sabah • Targeted power generation mix: 9th Malaysia Plan (2006 – 2010) RE as of 31st December 2011 • 56% natural gas, 36% coal, 6% hydro, 0.2% oil, • 1.8% Renewable Energy • Carbon intensity reduction target: 40% lower than 2005 levels by 2020 • Connected to the utility grid (as of 2011): 68.45 MW (20% from 9th MP target) • Off-grid: >430MW (private palm oil millers and solar hybrid) 2 Biomass target for 2015 is 330 MW Increased to 1.6 % on Jan 2014 RE Act gazetted in June 2011 FiT introduced in Dec 2011 Solar PV target for 2015 is only 65 MW Targets and more targets REPAP Targets Year Cumulative RE Capacity RE Power Mix (vs Peak Demand) 2015 985 MW 5.5%-6% 2020 2,080 MW 11% 2030 4,000 MW 17% ASEAN Energy Minister’s meeting in Oct 2014 decided to: 1. Redefine large hydro and off-grid hybrid as renewable 2. Target 30 % of installed capacity to come from RE by 2020 ASEAN Ministers Target: 30 % of installed capacity by 2020 Shortfall: 3000 MW Expected installed capacity by 2020 30,000 MW 30 % RE 9000 MW Existing and new large hydro and off-grid hybrid by 2020 4500 MW Expected FiT installations by 2020 1500 MW 4 The Reality – FiT statistics as at 30 APRIL 2015 Applications approved Installations commissioned No Capacity (MW) No Capacity % (in terms of capacity) Biogas 81 140.05 7 12.83 9% Biomass 34 324.79 6 62.90 19 % Small Hydro 36 284.84 5 15.70 5.5 % 6601 313.36 3819 191.75 61 % 6,752 1,063.03 3,837 283.18 Resource Solar PV Total 5 Points to Ponder 2015 Target under REPAP is 985 MW 30 April 2015 achieved only 285 MW Today is about 300 MW Best case scenario is 400 MW by end 2015 – only 40 % of target 2015 Target for PV was 65 MW Today achieved almost 200 MW Expected to hit 300 MW by end 2015 2015 Target for biomass was 330 MW Today achieved only about 63 MW from 6 plants If lucky, another plant will be commissioned this year, bringing the total to 7 plants and installed capacity of 75 MW 6 biomass plants achieved COD so far All 6 plants were already approved under SREP, then migrated to FiT 3 plants had already COD under SREP 3 plants COD under FiT but 1 plant already under receivership now 6 Problems facing biomass RE developers Most of these issues are not faced by PV developers! Feedstock issues Most biomass RE developers do not own the feedstock, they’re neither plantation nor mill owners They are at the mercy of the feedstock owners who can raise the price anytime or withhold the supply At least 2 plants at present are running at less than 50 % capacity due to feedstock issues Long term feedstock contracts are a must for plants to be viable, but most feedstock owners will not sign for more than 1 or 2 years Best case scenario is for feedstock owners to go into the RE business, or at least part of the feedstock should be their own 7 Plant technical issues Problems with boilers Most boilers used in the plantation industry are designed to provide steam, and some power for internal use; they’re not designed to be efficient Most imported boilers designed to generate power are designed for wood chips or other feedstock with low moisture and high calorific value Boilers specifically designed to be highly efficient using EFB as feedstock with minimum maintenance are still being improved Fuel handling Critical to have effective fuel handling system with sufficient storage, shredding and drying, and proper feeding into the boiler Many plants do not have sufficient space for storage, or an effective drying system, resulting in fuel with high moisture content being fed into the boiler 8 Grid connection issues Distance from Grid; most plantations located away from the Grid, making it uneconomical for grid-connection Even when grid is available, remote location of the biomass plants, away from the load centres, lead to technical issues like voltage rise and reverse power flow, making grid-connection difficult. In some places, the utility existing fault current is too high to allow any more generator to be connected. When everything else has been settled, there are often delays and other problems with utility connection at the local level Finance Some pioneer failed and failing biomass plants have given a negative perception of biomass RE Long lead time and security of feedstock issues, leading to higher risk Most commercial banks shy away from financing biomass plants, leaving only institutions with a specific mandate, like MDV, to provide the finance 9 Steps taken by SEDA to promote biomass RE FiT rates for biomass (and biogas) All degression in FiT rates has been set to zero since 2014 Introduction of new bonus rates, e.g. locally fabricated boiler gets additional 5 sen/kWh New higher rates have resulted in many new applications Biomass quota is exhausted as soon as its released But no guarantee that any plants will commission and run successfully if they still make the mistakes described earlier. Grid connection issues Ongoing discussions with utilities to allow for reverse power flow back to Transmission levels Proposal to developers to cluster their biomass plants together so that total capacity exceeds 30 MW Facilitate connection to Transmission line 10 Some parting remarks Based on the 1.6 % contribution to the RE Fund, Seda has set an annual new quota release of 20 MW for biomass and 15 MW for biogas until 2025. This quota should be sufficient to provide for most of the plants that can be economically grid-connected However, potential developers must be aware of the problems mentioned earlier, especially the feedstock and plant technical issues, before they rush into applying for quota If the quota is exhausted, and there are still more plants to be connected, we’ll need to increase the contribution to the RE Fund to 2 % 11