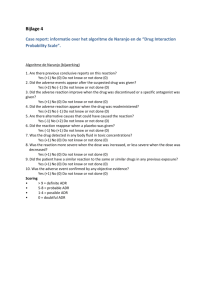

Consumer Law European Agenda doc

advertisement

Consumer Law: The European Agenda Mary Donnelly School of Law, UCC 11 December 2014 The European Union (and its predecessors) has had a substantial impact on Irish consumer law. Indeed, for some of the 1980s and much of the 1990s, Ireland had largely ceded consumer law and policy making to Brussels (with the notable exception of the Consumer Credit Act 1995), restricting domestic involvement primarily to the transposition of European directives usually with minimal domestic engagement. Fortunately, this inactive phase has come to an end and a distinct Irish consumer law is now developing. Consultation has started on the Consumer Rights Act which hopefully will be enacted within the next 18 months or so. The Central Bank’s Consumer Protection Code provides a high level of consumer protection in respect of financial services and, although the question of whether and how a breach of the Code can be relied upon before the courts remains open (see the most recent decision in this regard by Baker J: Ryan v Danske Bank A/S t/a Danske Bank [214] IEHC 236 which indicated that the Code could be used as a shield but not as a sword), the Code is clearly arguable in any complaint to the Financial Services Ombudsman: see Carr v Financial Services Ombudsman [2013] IEHC 182, where Herbert J noted that “[t]he Code is a significant feature of the landscape within which the [FSO] operates and it is probably expected by many complainants that they can rely on it”. The establishment of the Competition and Consumer Protection Commission marks a further development in the consumer law regulatory framework and it is hoped that this will further enhance the delivery of protections for Irish consumers. Notwithstanding all of these significant domestic developments, Irish consumer law remains closely linked to Europe. Understanding the European legal agenda is important because what appears on this agenda today will, within a relatively short time, become part of Irish law. Understanding the consumer policy agenda is important too, not least because not all aspects of the policy agenda will always be in Irish interests, in which case, efforts to reshape the policy agenda may be needed. 1 This paper will set out, in brief, the contemporary European consumer policy agenda and will then examine the consumer law directives which will coming up for transposition over the next 24 months – concentrating on three of particular significance – the ADR/ODR package; the Mortgages Directive and the Bank Accounts Directive. The European Consumer Policy Agenda The European consumer policy agenda developed slowly after the Treaty of Rome 1957 and really only began to become established in the mid-1980s. The bulk of Community Directives in this early phase of development were minimum harmonising Directives, requiring Member State transposition and harmonising consumer laws in Member States to a designated minimum level only. The policy imperative behind legislation was very clearly economic in nature with consumer protection being regarded as a necessary element in the growth of the single market and all directives were introduced under the auspices of the market integration elements of the Treaty. Although the European Community was accorded a specific consumer protection competence beyond market integration in the Maastricht Treaty (1992), the economic basis for consumer protection has continued although in the last couple of years, there are some signs emerging of a broader basis for consumer protection. Although the policy basis for legislative intervention remained unchanged post-Maastricht, at a legal level, there was a change. The Commission had become increasingly concerned about the impact of minimum harmonising directives on competition – with consumer protection being used as a form of ‘gold-plating’ and effectively reducing entry into domestic markets. This problem was combined with other factors which the Commission considered reduced the effectiveness of the consumer protection agenda from an economic growth perspective. These factors included the poor quality drafting of the legislation and the patchy implementation across members states. As a result, beginning in the mid-2000s, the Commission began to move towards the adoption of maximum harmonising directivessetting the maximum level of protection to be afforded and prohibiting member states from 2 exceeding this. Measures introduced during this phase included the Unfair Commercial Practices Directive; the Consumer Credit Directive; and the Payment Services Directive. While there are undeniable benefits to maximum harmonisation from a competition perspective, from a consumer protection perspective, the benefits are less clear. This is especially true for consumers from members states with more developed consumer protection regimes but even more generally, there is a problem because maximum harmonisation represents a ‘one size fits all’ approach and limits the capacity of member states to respond to the specific needs of consumers within their own jurisdictions. Many of the concerns around maximum harmonisation came to the fore in the negotiations around the Consumer Rights directive in which Ireland, among other member states, began to assert the importance of existing consumer rights in Ireland which would be removed if the measure as proposed were brought into force. The extensive proposals were ultimately jettisoned and the final measure is much more restricted than the original proposal. In addition, in place of the wide-ranging proposals, the Commission has been working towards the development of a common European sales law, intended to apply in cross-border contexts. However, progress has been slow – and the final fate of this harmonisation remains unclear. It seems that the Commission has learned some lessons from the controversies around Consumer Rights directive and as will be seen in the discussion of the new directives below, although directives still tend to be maximum harmonising, there is typically quite extensive scope s for member state derogation. The contemporary European consumer protection policy agenda is outlined in Commission Communication, A European Consumer Agenda—Boosting confidence and growth which was issued in 2012. This would seem to show some degree of shift in emphasis away from a solely economic underpinning policy to include some elements of broader social justice aspects of the Bank Accounts directive, to be discussed below, reflect this shift. The current policy priorities are: enhancing consumer safety; enhancing consumer knowledge; and, improving implementation, stepping up enforcement and securing redress. The sectors 3 which have been identified for specific attention are: the digital sector; the financial services sector; the energy sector; misleading environmental claims; and, transport. ADR Directive and ODR Regulation Improving consumer access to redress has been on the EU consumer radar for over two decades. However, progression of the agenda has come through non-binding recommendations in the first instance, followed in the ADR context by a binding directive and in the ODR context by a directly-effective regulation. While most of the discussion will focus on these, it is worth noting that in 2013, the Commission issued a non-binding recommendation on Collective Redress (Recommendation C (2013) 3539/3) accompanied by a Commission Communication (COM (2013) 401 final). The Collective Redress Recommendation states that collective redress procedures should be fair, equitable, timely and not prohibitively expensive and that collective redress claims should be “opt-in” rather than “opt-out”. The Recommendation also indicates that national collective redress systems should contain certain procedural safeguards. These include that contingency fees should not be permitted, or, if exceptionally permitted in a Member State, these fees should be subject to appropriate national regulation, that compensation awarded should not be punitive, that representative entities should be nonprofit making, that there should be a direct relationship between the objectives of the entity and the rights that are alleged to have been violated, and that it should be verified at the earliest possible stage of litigation that manifestly unfounded cases are not continued. Additionally, it is recommended that parties should be encouraged to settle disputes collectively, consensually or through appropriate means. If the legislative trajectory follows the norm in this area, it may reasonably be expected that a directive on Collective Redress will be following within the next couple of years. Moving on to alternative dispute resolution (ADR) and online dispute resolution (ODR). The encouragement of ADR as a means of settling consumer disputes has been part of European policy for the past decade or so and the ADR Directive (Directive 2013/11 on alternative dispute resolution for consumer disputes [2013] OJ L 165/63) was finally 4 published in June 2013. The final date for transposition of this directive is 9 July 2015 and in June 2014, the Department of Jobs, Enterprise and Innovation published a consultation paper on transposition. The paper notes the limited awareness of ADR among Irish consumers (citing a National Consumer Agency study which found that 56% of Irish consumers were unaware of out-of-court procedures for settling consumer disputes) and also the limited number of sectors in which ADR procedures currently exists. The currently reported ADR schemes (as required by the European Commission) are: The Financial Services Ombudsman, the Office of the Pensions Ombudsman, the Scheme for Tour Operators, Chartered Institute of Arbitrators, the Advertising Standards Authority of Ireland (ASAI) and the Direct Selling Association of Ireland. In fact however the latter two bodies are really not ADR entities. The stated purpose of the ADR Directive is “to contribute to proper functioning of the internal market” by ensuring that consumers can submit complaints against traders to “entities offering independent, impartial, transparent, fast and fair alternative dispute resolution procedures”. This is achieved in two ways – first the ADR directive requires member states to ensure the availability of ADR; secondly, the directive imposes procedural requirements for the operation of ADR. Unusually, for a contemporary consumer measure, the ADR directive does not impose the upper limits of protection but allows member states to introduce rules which go beyond those laid down in the directive. Accordingly, there is quite a degree of Member state discretion – and this is evident in the questions put in the Consultation paper. Availability/Accessibility The ADR Directive applies to procedures for the resolution of both domestic and crossborder disputes between consumers and traders “concerning contractual obligations” stemming from sales contracts/services contracts through an ADR entity “which proposes or imposes a solution or brings the parties together with the aim of facilitating an amicable solution”. Both binding and non-binding ADR is covered and it is left to the competence of Member States to determine whether ADR entities in their territories have the power to impose a solution on the parties. The Directive is also stated to be without prejudice to 5 national legislation which makes participation in ADR mandatory, provided that this legislation does not prevent parties from exercising their right of access to the judicial system. So for example, the ADR directive does not change existing frameworks such as the Financial Services Ombudsman or the Pensions Ombudsman. Art 5 (1) of the ADR directive requires member states to facilitate access by consumers to ADR procedures and to ensure that disputes covered by the Directive can be submitted to an ADR entity which complies with the requirements of the Directive. This obligation may be fulfilled by ensuring the existence of a residual (or “catch-all”) ADR entity which is competent to deal with disputes which are not covered by an existing ADR entity and/or by relying on ADR entities established in another Member State or on regional, transnational or pan-European dispute resolution entities. One of the questions asked in the consultation document is whether there are currently an existing body to cover the lacuna in ADR coverage. I would suggest that there is not – ADR remains sector-specific and the Small Claims Procedure (which may be considered to be ADR) is very restrictive is scope (limit of €2000). Thus, one might assume the need for development of new ADR mechanisms in order to meet this aspect of the ADR directive. In terms of accessibility of schemes, the ADR directive requires Member States to ensure that ADR entities accept both domestic and cross-border disputes, including disputes covered by the ODR Regulation (discussed below). However, member states may at their discretion, permit ADR entities to maintain/introduce procedural rules which allow them to refuse to deal with a given dispute on any/all of the following grounds: The consumer did not attempt to contact the trader concerned and seek as a first step, to resolve the matter with the trader The dispute is frivolous or vexatious The dispute is being/has previously been considered by another ADR entity or by a court The value of the claim falls below/above a pre-specified monetary threshold (although these must not be set at a level which would significantly impair access to ADR) 6 The consumer has not submitted the complaint to the ADR entity within a prespecified time limit (which must not be less than one year from the date on which the consumer submitted the complaint to the trader) Dealing with such a type of dispute would otherwise serious impair the effective operation of the ADR entity The Departmental consultation document has asked which if any of these permitted grounds of refusal should be used. Member states may also permit ADR entities to prescribe minimum and maximum monetary thresholds. The service must be provided either free to consumer or at a minimal cost. The ADR directive does not require mandatory participation by traders in ADR – although – as noted above- it does allow member states to do so. So one of the questions in the consultation is whether this approach (as for example applies in respect of financial services) should be adopted across the board. Art. 13 of the ADR directive does require however that where traders are covered by an ADR scheme, they must be required to inform consumers about the applicable ADR entity/ies, including relevant websites on the trader’s website and in the general terms and conditions of sale or service contracts. Procedural Requirements In terms of quality requirements for ADR, the directive outlines a set of standards which all ADR entities must meet. In brief these relate to Expertise, independence and impartiality (Art. 6) The natural persons in charge of ADR processes must possess the necessary knowledge and skills in the field of ADR as well as a general understanding of the law. Transparency (Art. 7) ADR entities must make designated information available on their websites, on a durable medium if requested and by any other means they consider appropriate. The information must be clear and easily understandable and must include: 7 o o o o o o o o o o o o o o o Contact details A statement that the ADR entity is listed Names of natural persons in charge of ADR, the method of their appointment and the length of their mandate A statement regarding expertise and impartiality Membership of ADR networks facilitating cross-border dispute resolution, if applicable Types of disputes they are competent to deal with and any applicable thresholds Procedural rules governing the resolution of a dispute and grounds on which the ADR entity may refuse to deal with a dispute The language in which complaint may be submitted and the language in which the procedure is conducted The types of rules the ADR entity may use for the resolution of the dispute Any preliminary requirements before ADR may be commenced Whether the parties can withdraw from the procedure The costs, if any, to be borne by the parties, including the rules on awarding costs at the end of the procedure The average length of the ADR procedure The legal effect of the outcome of the procedure, including the penalties for noncompliance with a binding decision The enforceability of the ADR decision. ADR entities must also provide annual activity reports, containing designated information. Effectiveness (Art. 8) ADR procedures must be effective and must be available online and off-line to both parties. The procedure must be available without the obligation to retain a lawyer but it must not deny to the parties their right to independent advice or third party representation. The outcome of the ADR procedure must be made available within a period of 90 calendar days from the date on which the ADR entity received the complete complaint file. However, provision is made for extension of this 90 day period by the ADR entity in the case of a “highly complex dispute”. In the event of such extension, the parties must be informed of the extension and of the expected length of time for resolution. Fairness (Art. 9) The parties to the ADR procedure must be able to express their point of view within a reasonable period of time after being provided with relevant documentation. They must be informed that they do not need legal representation but that they may use this or other third-party advice and they must be informed of the outcome of the ADR procedure in writing or on another durable medium and be provided with the grounds for the outcome. 8 Liberty (Art. 10) Any agreement between a consumer and a trader to submit all disputes to an ADR entity may not be made binding on the consumer if the agreement was concluded before the dispute materialised and if it has the effect of depriving the consumer of his or her right to take legal action in the courts. Where a procedure is binding on the parties, they must be informed in advance of this and must have specifically accepted this. Legality (Art. 11) Where the ADR procedure aims to impose a solution in circumstances where there is no conflict of laws, the solution must not deprive the consumer of the protections afforded him by provisions which cannot be derogated from by agreement under the laws of the member state where the consumer and the trader are habitually resident. A further procedural point to note is that the ADR directive requires that where parties choose to use a (non-binding) ADR procedure, this should not prevent them from bringing an action before the courts as a result of expiration of limitation periods during the ADR procedure. The Consultation paper states that the State will provide for a stay on limitations periods in order to accommodate resolutions covered by the ADR directive. Giving Effect to the ADR Regime Every member state must designate at least one competent authority and communicate the name of this to the Commission which will then publish a list of all competent authorities across member states. It might reasonably be assumed that the competent authority for Ireland with be the Competition and Consumer Protection Commission although it may be the case that the Central Bank will also be designated as a competent authority (reflecting the split in regulatory agencies between goods and services/financial services. The designated competent authority must assess whether each ADR entity means the procedural requirements under the ADR directive and then compile a list of qualifying ADR schemes for transmission to the Commission. 9 Art. 21 of the ADR directive also requires member states to provide for the imposition of effective, proportionate and dissuasive penalties for traders in respect of the consumer information requirements imposed on traders ODR (online dispute resolution) ODR is essentially ADR but using internet technology. Technology can play a range of roles – including facilitating easier communication but also playing a more active role in the negotiation/solution process. Indeed, advocates of ODR sometimes refer to technology – as the fourth party (in addition to the mediator and parties) to a resolution process. Technology can be used at each stage of the process. At negotiation phase, the entire process can be automated. For example, one commonly used form of ODR is double blind bidding – where each party makes offers and these offers are revealed to the other side only when the difference between the offers falls within a pre-set limit. It is also argued by advocates of ODR that technology in the form of language use/web interfaces can be used as a way of facilitating a more constructive communication and facilitate settlement. From an EU consumer policy perspective, the main attraction of ODR is that it provides some means of facilitating cross-border dispute resolution. While the ECC has been quite effective, the legal framework (European Communities (Small Claims Procedures) Regulations 2008) has not. The lack of effective cross- border dispute mechanism limits market integration and slows the growth of the single market. Regulation 524/2013 on ODR (the ODR Regulation) [2013] OJ L 165/1 is the Commission’s attempt to address this difficulty. The Regulation (which is directly effective) operates alongside the ADR directive as transposed and provides for a platform for ODR. It should be remembered that although the platform is online, it is not restricted to online disputes. The platform will be developed by the Commission; testing is to begin in January 2015 and the platform must become operative from January 9 2016. The platform must be userfriendly and must respect the privacy of users at all stage in the process. Each EU member state must nominate one ODR contact point and inform the Commission of this – this may be the European Consumer Centre in the state. Each ODR contact point must have at least 10 two ODR advisors. The contact point must support the process, including assisting on the completion of the complaint submission. Under the ODR Regulation, all complaints must be submitted electronically and if the form is not fully completed, it must be returned to the complainant. The form will be drawn up in a way to facilitate easier negotiation. Once completed, the complaint is transmitted by the ODR platform to the respondent together with information on the ADR entities competent to deal with the complaint (recall that under the ADR directive, all member states are required to have appropriate ADR entities available). The complainant trader affirms whether and which entity it will (or is obliged to) use. This information is then communicated by the ODR platform to the complainant and the ADR entity. The ADR entity must inform the parties without delay if it will deal with the dispute and must then reach a resolution within 90 days. If the parties cannot agree on an ADR entity within 30 days, the ODR aspect of the process comes to an end and the complainant will be advised to contact the ODR advisor in the member state for alternative forms of seeking redress. All online traders – regardless of whether they use ODR – will be required to provide a link t the ODR platform. Mortgages Directive Directive 2014/17/EU on credit agreements for consumers relating to residential immovable property (the Mortgages directive) [2014] O.J. L. 60/34 was published in March 2014 and must be transposed by 21 March 2016. Thus, the Mortgages directive comes into effect post-financial crisis and reflects some of the lessons learned from the crisis. The proposal was underpinned by a series of studies of the European mortgages market. Nonetheless, it proved highly controversial with particular concerns being raised about information overload and excessive intervention in the buy-to-let mortgage market. A compromise proposal was put forward during the Irish Presidency of the Council of the EU and this ultimately provided the basis for the Mortgages Directive. Reflecting the compromise nature of the final measure, the Mortgages Directive is a maximum harmonising measure but only to a very limited degree. Article 2(1) states that 11 the “directive shall not preclude Member States from maintaining or introducing more stringent provisions in order to protect consumers, provided that such provisions are consistent with their obligations under Union Law”. Additionally, many of the substantive provisions in the Directive leave extensive Member State discretion regarding how the protections provided for are to be delivered in the Member State. However, Member States are restricted in one respect - they are precluded from maintaining or introducing provisions diverging from the designated requirements in respect of the European Standardised Information Sheet (ESIS). Reflected the range of transposition choices, in September 2014, the Department of Finance published a public consultation. As well as specific questions on individual aspects of the transposition, questions asked include whether Ireland should introduce more stringent measures than those in the directive. Scope of Directive The Mortgages Directive applies to: (a) Credit agreements which are secured either by a mortgage or by another comparable security commonly used in a Member State on residential immovable property or secured by a right related to residential immovable property; and, (b) Credit agreements the purpose of which is to acquire or retain property rights in land or in an existing or projected building. Designated agreements are excluded from the ambit of the Directive. These are: Certain equity release credit agreements; Credit agreements where credit is granted by an employer to employees as a secondary activity where the credit is free of interest or at a lower APRC (annual percentage rate of charge) than the prevailing market rate and not offered to the public; Credit agreements where the credit is free of interest/charges other than recovery costs directly related to the securing of the credit; Credit agreements in the form of an overdraft where the credit must be repaid within one month; Credit agreements which are the outcome of a settlement reached in court or before another statutory authority; Credit agreements which relate to the deferred payment, free of charge of an existing debt and which are not secured by a mortgage or other comparable security over residential immovable property. 12 In addition, Member States may decide not to apply the Directive to the following agreements: Buy-to-let mortgages; Credit agreements relating to credit granted to a restricted public under a statutory provision with a general interest purpose, free of interest or at lower borrowing rates than those available on the market Bridging loans; Credit agreements with non-profit mutual societies However, in respect of these agreements, an alternative framework must be put in place, the details of which are at the discretion of the member state Member States may also decide to apply the information requirements in Directive 2008/48/EC (transposed into Irish law by the European Communities (Consumer Credit Agreements) Regulations 2010 (SI No 281 of 2010) rather those in Directive 2014/17/EU to credit agreements for consumers, secured by a mortgage or other comparable security where the purpose of which is not to acquire or retain the right to residential immovable property. Information Article 11 outlines standard information to be including in advertising, including specified standard information which must be included in any advertisement and Article 13 outlines required general information which must be made available by creditors or, where applicable, by tied credit intermediaries. In order to facilitate cross-EU comparison mortgage shopping, Art. 14 introduces the requirement for provision of pre-contract information which must be provided as specified in the ESIS (which is set out in Annex II of the Directive). This requirement (and the presentation requirements for the ESIS) may not be varied by Member States except in so far as in permitted in Annex II. The main issue regarding the ESIS to be determined on transposition is whether the ESIS should be provided before a binding offer 13 The Mortgages Directive also imposes a positive obligation on Member States to ensure that creditors/credit intermediaries/appointed representatives are required to provide “adequate explanations” to the consumer in relation to the proposed credit agreement and any ancillary service so as to enable the consumer to assess whether the proposals are adapted to his/her needs and financial situation. Withdrawal/Reflection Period There must be a 7 day period during which consumers may assess and compare offers. Member states are offered a choice as to whether this is a reflection period before the conclusion of the agreement or a withdrawal period following the conclusion of the agreement. The question on transposition is which Ireland should adopt and whether if a reflection period is adopted, the consumer should be permitted to accept the offer within the reflection period. Limits on Tying Practices Article 12 requires Member States to prohibit tying practices subject to a number of permitted exceptions. Tying is defined as “the offering or the selling of a credit agreement in a package with other distinct financial products or services where the credit agreement is not made available to the consumer separately.” There are a number of possible permissible tying arrangements – at the discretion of member states. Member States may permit creditors to request the consumer/his or her family member or close relation to: Open or maintain a payment or saving account, where the only purpose of the account is to accumulate capital to repay the credit, to service the credit, to pool resources to obtain the credit or to provide additional security for the credit Purchase or keep an investment or private pension product, where the product which primarily offers the investor an income in retirement, serves also as an additional security for the creditor in the event of default or to accumulate capital to repay the credit Conclude a separate credit agreement in conjunction with a shared-equity credit agreement to obtain credit. 14 Creditworthiness/Suitability Requirements Reflecting the increased significant of responsible lending in European consumer credit policy, the Mortgages Directive requires Member States to introduce requirements to check creditworthiness and to ensure reliable valuation standards for residential property. Member States must ensure that, before concluding a credit agreement, the creditor makes a thorough assessment of the consumer’s creditworthiness, taking appropriate account of factors relevant in verifying the prospect of the consumer being able to meet his or her obligations under the credit agreement. The assessment must be carried out on the basis of information on the consumer’s income and expenses and other economic circumstances which is “necessary, sufficient and proportionate” and it must not rely predominantly on the value of the property exceeding the amount of the credit or the assumption that the property will increase in value. Member States are required to ensure that the creditor only makes credit available to the consumer where the result of the creditworthiness assessment indicates that the consumer will be able to meet the obligations in the credit agreement. This would require an extension of the current requirement under Consumer Protection Code 2012 which requires only that creditors should “take account” of the affordability assessment carried out. Member States are also required to ensure that reliable residential property valuation standards are developed within their territory and to require creditors to ensure that these standards are used in carrying out valuations. Advisory Services New requirements are introduced for “advisory services”. These are defined as “the provision of personal recommendations to a consumer in respect of one or more transactions relating to credit agreements and constitutes a separate activity from the granting of a credit and from credit intermediation activities as defined. Member States must ensure that creditors/credit intermediaries/appointed representatives explicitly inform the consumer, in the context of any given transaction, whether advisory services are being, or can be, provided to the consumer and must ensure that before the provision of the services (or the conclusion of the contract to provide the services), designated information is provided to 15 the consumer. This information must include whether any recommendation will be based on consideration only of the advisor’s own product range or a wide range of products from across the market and, where applicable, the fee charged to the consumer or, where this cannot be ascertained at the time, the method used for its calculation. Right to Early Repayment Member States are required to ensure that consumers have the right to discharge fully or partially the obligations under a credit agreement prior to the expiry of the agreement and to ensure that consumers are entitled to a reduction in the total cost of the credit, consisting of the interest and the costs for the remaining duration of the contract. Member States are, however, permitted to introduce conditions for the exercise of the right to early repayment. These may include time limitations on the exercise of the right; a different treatment depending on the type of borrowing rate or the time (referred to as the “moment”) the consumer exercises the right, or restrictions with regard to the circumstances in which the right may be exercised. Member States may allow for “fair and objective” compensation for the creditor in the event of early repayment; however, this must be restricted to “possible costs directly linked to the early repayment” and cannot include the imposition of a sanction on the consumer. Arrears and Foreclosure Reflecting a new recognition of the relevance of arrears issues to European consumer credit policy, Art. 28(1) introduces a requirement for Member States to adopt measures “to encourage creditors to exercise reasonable forbearance before foreclosure proceeding are initiated”. Although the concept of “foreclosure” no longer exists in Irish law, this provision might reasonably be interpreted to mean actions for repossession more generally. Member States are also permitted to require the creditor to restrict charges on default to charges no greater than those required to compensate the creditor for costs incurred as a result of the default and to cap any additional charges imposed by creditors in the event of default. 16 Bank Accounts Directive Directive 2014/92 on Comparability of Fees relating to Payment Accounts, Payment Account Switching and Access to Payment Accounts with Basic Features, [2014] O.J. L257/214 came into effect in September 2014 and must be transposed by 18 September 2016 although some aspects have an earlier start date. The directive has three key aims: to facilitate comparability of bank account fees, thus allowing for consumer comparisons; to facilitate switching between payment accounts; and to provide access to basic payment accounts. The first two aims fit within the classic marketdriven vision of consumer protection, protecting consumers through the facilitation of competition between service providers. The third aim of the proposal is more in line with a broader vision of consumer protection as a matter of social justice. The Directive applies to “consumers” defined in the traditional way. The first aim of the Directive (ensuring the comparability of account fees) is delivered in stages. First, each Member State must compile a list of at least 10 and no more than 20 of the most representative services linked to a payment account. The list must be notified to the Commission and the European Banking Authority (EBA). The EBA must then draft regulatory technical standards setting out standard terminology across Member States, which must then be integrated into the list for each Member State. This must then be published with the corresponding fee in the form of a “Fee Information Document”, which must be provided to consumers prior to opening a bank account. Member States must also ensure that consumers have access to at least one fees-comparison website. The second aim (facilitating switching) is achieved, first, through a requirement for all Member States to ensure that a switching service is provided by payment services providers. Steps must also be taken to ensure that information necessary to facilitate account switching must be provided free of charge by providers to consumers, and any fees for transferring payment services must be “reasonable” and in line with the actual costs to the payment service provider. Most of these requirements are already covered by the Central Bank Code of Conduct on Switching Accounts. 17 The third aim (access to services) aim is delivered, in the first instance, by a requirement that there may be no discrimination in applying for or accessing a payment account between consumers legally resident in the European Union on the grounds of nationality or place of residence. Additionally, all Member States must ensure that at least one payment service provider in their territory offers a payment account with basic features to consumers and that this is not offered by a provider with solely online banking facilities. Services on this account must be made available to consumers free of charge or for a reasonable fee. Conclusion In conclusion, to mention some other relevant measures in brief. The European Union (Protection of Consumers in respect of Timeshare, Long-Term Holiday Product, Resale and Exchange contracts (Amendment) Regulations 2014 (SI No 400 of 2014) came into effect in September 2014. In brief, these Regulations permit a consumer to terminate a long-term holiday product contract after receiving a request for a second instalment payment. Note that a long-term holiday contract is a contract of a duration of more than one year under which a consumer, for consideration, acquires primarily the right to obtain discounts or other benefits in respect of accommodation. While MiFID (Markets in Financial Instruments Directive) is not a consumer protection measure as such – its protective elements apply to retail clients (which is a broader category but which includes consumers), the measure has a strong consumer protection aspect so an awareness of forthcoming developments is useful. MiFID II (which comprises a Directive 2014/65and Regulation 600/2014) was adopted this year. MiFID II must be transposed by July 3 2016 and applied from Jan 3 2017. In brief, from a consumer (retail client) protection perspective, the main changes to be aware of in MiFID II are the new requirements introduced for firms when 18 providing investment advice –including whether the advice is provided on an independent basis and the basis on which the advice is formulated (issues which are now covered in CPC 2012); the strengthening of the suitability assessment requirements and the limitations to the execution only exemptions. Payment Services II. There has been ongoing work on the development of a new payment services directive (PSD II). The Commission published a proposal in this respect in 2013. The proposals are for a package of measures a new directive and a regulation. Among the main measures in the package from a consumer protection perspective are: a narrowing of the current exemption for digital content and the deletion of the current exemption for independent ATM services. 19