Consumer Law: the European Agenda

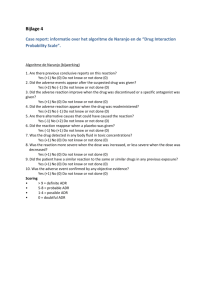

advertisement

Consumer Law: the European Agenda Consumer Law: Protection and Compliance UCC 11 December 2014 Ireland and Europe Shift to Europe 1980s- 1990s Return to endogenous – 2000s - European agenda Treaty 1957 – 5 references 1970s- 1990s – Legislation in context of Harmonisation/Market Integration Maastricht Treaty 1992: Specific Legislative Competence: Art. 153 (now Art. 169 TFEU) In order to promote the interests of consumers and to ensure a high level of consumer protection, the Union shall contribute to protecting the health, safety and economic interests of consumers, as well as to promoting their right to information, education and to organise themselves in order to safeguard their interest. Commission moves toward Maximum Harmonisation Member States fight-back? Current Agenda ADR as Alternative to Court Procedure European Regulation of ADR: current position Recommendation 98/257/EC and 2001/310/EC (not binding) Outline of principles: Independence Transparency Adversarial Effectiveness Legality Liberty to ensure that the decision taken may be binding on the consumer only if they are informed of its binding nature in advance Representation to ensure that the consumer has the possibility to be represented in the procedure by a third party if they wish. Fairness ADR Directive Directive 2013/11/EU on alternative dispute resolution for consumer disputes To be transposed by 9 July 2015 Application to Binding/non-binding ADR Application to Domestic/Cross-border ADR Two pronged approach Availability/Accessibility of ADR Procedural Requirements for ADR providers Availability Member States required to ensure that disputes covered by ADR Directive can be submitted to an ADR entity which complies with the requirements of the Directive. Accessibility Domestic and cross-border disputes But no mandatory participation by traders Some scope for refusal by ADR entities Procedural Requirements Impartiality: no conflict of interest Transparency: annual reports Terms of reference Effectiveness: Ease of access regardless of location No requirement for legal representation Free of charge or at moderate cost for consumers; Time limit of 90 days Fairness Enforcement Designation of competent authority Penalties for traders for noncompliance with information requirement ODR as a form of ADR Dispute Resolution which uses technology to resolve/help to resolve disputes between parties Technology: the ‘fourth party’ Consensus building Decision-making Interaction Can apply to disputes arising online/offline Particularly appropriate in B2C eCommerce ODR Regulation in Europe Provides for Establishment of European ODR platform to Complements ADR Directive ODR Regulation in Outline Public/Private mix Single Platform Web-interface to act as hub Linked to European Consumer Centres in Member States No submission fees for consumers Own language facility But ODR providers may charge ‘reasonable’ fee and may use other language Traders not required to participate but will have to provide information to consumers about platform Timeline for Implementation 9 Jan 2015: Testing of technical functionality/user friendliness (inc privacy requirements) ODR Regulation in force from 9 Jan 2016 except Provisions re relevant network points: from 9 July 2015 Provisions re establishment of databases etc from 8 July 2013 ODR Regulation in Operation: art. 9 Initial Stages in the Process Completion of electronic complaint form Transmit to respondent “without delay” + names of competent ADR entities Invite respondent to name ADR entity Obliged or prepared to use 10 day time limit ODR entity transmits complaint to named ADR entity Without delay ADR entity accepts/declines Without delay If ADR entity accepts 90 days to resolve Mortgages Directive Application (a) Credit agreements which are secured either by a mortgage or by another comparable security commonly used in a Member State on residential immovable property or secured by a right related to residential immovable property; and, (b) Credit agreements the purpose of which is to acquire or retain property rights in land or in an existing or projected building. Possible exemptions Buy-to-let mortgages; Credit agreements relating to credit granted to a restricted public under a statutory provision with a general interest purpose, free of interest or at lower borrowing rates than those available on the market Bridging loans; Credit agreements with non-profit mutual societies Basic Requirements Information Withdrawal/reflection Tying Credit-worthiness/suitability Advisory Services Early Repayment Arrears and Foreclosure Payment accounts Directive Aims: to facilitate comparability of bank account fees to facilitate switching between payment accounts; to provide access to basic payment accounts. Comparability of fees Standard terminology across Member States List of Main Services Switching Accounts A switching service must be provided by payment services providers. Access to Basic Payment Account At least one payment service provider per member state must offer a payment account with basic features to consumers at no or minimal cost and not solely online banking facilities